Latest Positions: Content, Genes, Social

Here is a Part 4 of 5 of the list my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The concerns about England’s mutated Coronavirus is probably not the only reason the markets are struggling today. Might be a slow grind lower into year end. Patience, caution, discipline — these things are key, especially in a market that might be going through a Bubble-Blowing Bull Market Blow Off Top™ phase right now.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- (The Content Revolution)

- NFLX Netflix (6+) – Netflix Revolutionized the way we consume TV and movies and the company’s relentless growth in spending to create new content while keeping prices way below what a cable subscription costs has enabled the company to create a product that is almost a must-have for most people who live in the middle or wealthy classes around the world. Topline growth for Netflix has started to slow a little bit, but the company’s turned the corner, at least temporarily, on profits for now, and the P/E actually exists in a relatively normal price at about 50x next year’s earnings. I think NFLX stock is probably, like much of the market, looking to pause or even consolidate for a while here, but I continue to hold the shares I have steady as the company continues to execute.

- SPOT Spotify (6+) – Podcasts have become so important to Spotify that I sometimes wonder if the company should consider changing their name to Podify and their stock symbol to POD. Since making a couple relatively inexpensive podcast acquisitions a couple years ago, Spotify overtook longtime podcast leader Apple in the second quarter, according to recent estimates from MIDiA Research. The company shared that The Joe Rogan Experience and The Michelle Obama Podcast, two of Spotify’s most prominent exclusives, were among the top five most popular podcasts globally this year. The company is paying a lot of money to Joe and Michelle but the gross margins over time will increase in podcasts significantly while the gross margins for the old music streaming business remain steady at a lowish rate in the 20%s. Subscriber churn rates continue to drop and that means more people are staying with Spotify for longer and that also helps cash flow and gross margins. The company isn’t profitable, but is trading at 5.5x next year’s sales estimates and I’m holding it steady for now.

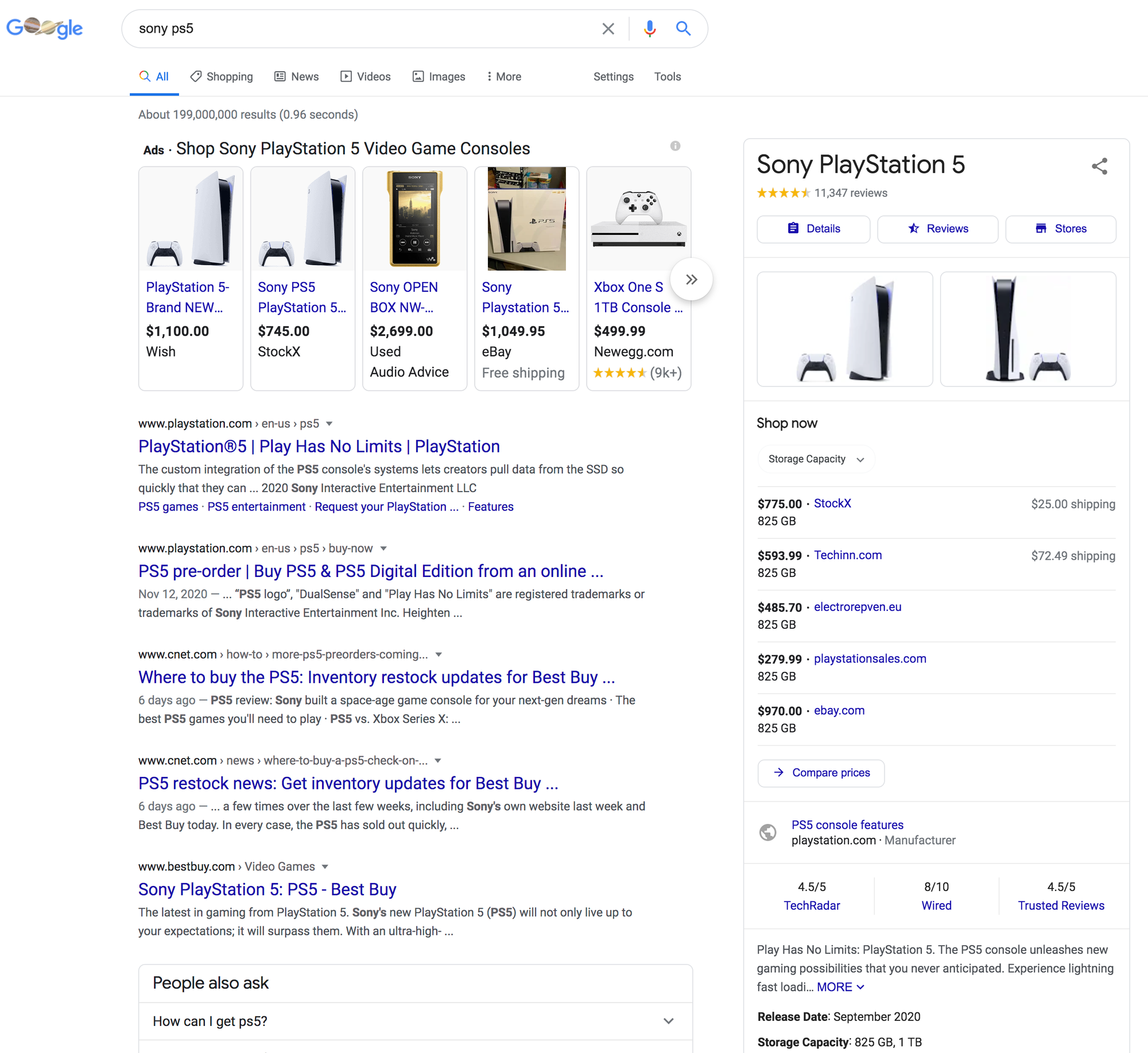

- Sony (7) – The problem with Sony here is that the topline growth is supposed to slow down to 5% next year from this year’s low teen growth. The good thing about the set up for the stock here is that I don’t think Sony’s going to see only 5% growth next year because estimates for the PS5 and related services are probably too low given how strong the demand for PS5 appears to be so far heading into this holiday season where no kid who wants a PS5 can get it in any reasonable manner.

Trading at “just” 20x next year’s earnings estimates, which are probably too low, means that SNE is one of the few relatively cheap stocks in the market. Then again, Sony’s gross margins are never going to be very good and being based in the always-struggling-to-grow-its-economy Japan means the stock deserves to trade at a discount to its US-based peers.

- (Genetics Revolution)

- CRSP Crispr Technologies (6+) – What the heck is going on with this stock and this stock market? Another vertical straight up move in another one of our stocks that we’ve added.

Name Symbol Long or Short Date Initiated Price at first tranche Recent Price % Gain or Loss Years held Annualized gain Crispr – CRSP CRSP Long April 2020 $39.00 $167.71 330.03% 0.5 1749.22% And while I love making money and seeing many of our stocks go straight up, it’s not normal to have stocks go up 1800% annualized. And CRSP has gone from being cheap, trading at about 2x its cash balance when we bought it to something less cheap now at 11x its cash balance. The company has hardly any revenues this year or next year, but the ramp up could be huge if they deliver on what looks like very promising ways of helping save lives using gene based medicines. “CRISPR (/ˈkrɪspər/) (clustered regularly interspaced short palindromic repeats) is a family of DNA sequences found in the genomes of prokaryotic organisms such as bacteria and archaea. These sequences are derived from DNA fragments of bacteriophages that had previously infected the prokaryote.”

- CRSP Crispr Technologies (6+) – What the heck is going on with this stock and this stock market? Another vertical straight up move in another one of our stocks that we’ve added.

- (Social Revolution) –

- FB Facebook (6+) – Back in March, when the economy had collapsed and the stock market was about to, I’d done some back of the envelop numbers for Facebook in 2020. I’d assumed that small businesses would actually spend less in 2020 on Facebook than they did in 2019 and that maybe big corporations might too. I’d come up with a low estimate of maybe $5 potential earnings for FB and I’d thought at the time that FB could end up trading at like 30x that number, so maybe at $150 per share. But, instead of freaking out or panicky and selling the stock, I actually figured that we should look past the lowest potential earnings for 2020 and instead I nibbled some FB when it was below $150 as noted in “Don’t doubt the USA or mankind’s ability to prosper”. Topline growth is supposed to reaccelerate next year from the 18% number this year to the mid 20%s and I think earnings estimates for next year might be too low if FB can pull off that kind of growth because expenses are not likely to continue to ramp as quickly as Wall Street has become accustomed to the last few years at Facebook.

- TWTR Twitter (6+) – As I always explain: “Twitter’s a de facto standard in our society. It’s amazing how little revenue and market cap this company has generated vs its outsized impact on our society. Twitter can do better and that’s actually partly why I think there’s still so much upside in this name over the next three years. They will do better creating revenue streams and higher margins and growing the business fundamentals and I don’t think there’s a big a threat to Twitter’s de facto status as there is for Facebook or Instagram in years ahead.” The problem with TWTR’s stock here is that its almost the opposite set up as the aforementioned set up in SNE. That is, Wall Street expects Twitter’s topline growth to accelerate this year from 5% or less to the mid-20%s for next year. I expect that Twitter can indeed get back on the growth train like that, but I’d rather Wall Street not be on board the same train already. Easy does it here for Twitter right now after this huge move its made of late.

- SNAP Snap (6+) – Here’s what I wrote about Snap three years ago when we bought the stock at $6 per share: “Getting crushed along with the markets this week is a stock that’s probably the most hated tech stock in the world at this moment. Snap. And sometimes, it’s when at stock is at its most hated that it’s actually the best time to start a position in a name. Let’s do some of my proprietary fundamental analysis on SNAP. The company is growing revenues about close to 40% per year this year and next, seeing sales go from $1.15 billion to about $1.6 billion. Cash has decreased from about $2.2 billion to $1.5 billion over the last year. But the company is far from profitable and while the CEO Evan Spiegel sent out an internal note this week that included his goal to make Snap profitable in 2019, no analysts are modeling profitability for next year into the numbers, as earnings are expected to go from a loss of 56 cents per share this year to a loss of 42 cents per share next year.” Let’s update those numbers now that the stock has gone from $6 to $52 while we’ve owned it: “Going parabolic along with the markets this week is a stock that’s probably one of the most loved tech stocks in the world at this moment. Snap. And sometimes, it’s when at stock is at its most loved that it’s actually the best time to trim a position in a name. Let’s do some of my proprietary fundamental analysis on SNAP. The company is growing revenues about close to 40% per year this year and next, seeing sales go from $2.5 billion to about $3.5 billion. Cash has increased from about $2 billion to $2.7 billion over the last year. The company is about to turn profitable and analysts are modeling profitability for next year into the numbers, as earnings are expected to go from a loss of 9 cents per share this year to a profit of 22 cents per share next year.”

- PINS Pinterest (7) –Pinterest is perhaps the only bastion of friendliness left on the Internet. That’s perhaps the single best reason to stick with this stock, I suppose. The stock is trading at 100x next year’s earnings and at almost 20x next year’s revenue estimates. I love the 70% plus gross margins at PINS, but the stock has gone from very cheap when we bought it in March at $13 to quite expensive now.