Latest Positions: Crowded Semiconductors, Enterprise Software, and META

Source: ABC News.

How about that Starship launch today? That was absolutely incredible. Seeing that gigantic rocket lift off and travel so high in the atmosphere was truly inspiring. As you all know, the fact that this thing did not blow up on the launch pad was a huge success by SpaceX standards. And I feel like there was a little life breathed into the whole Space Revolution today which needed a win badly after the pain/disasters it has seen with VORB, ULA, Astra, Virgin Galactic, etc. here lately. Sometimes as long-term investors, it is easy to forget about just how revolutionary some of these companies are when we do not see any results in the near term. I am confident that SpaceX and Starship will truly change the world(s) we and our children and grandchildren will someday live in for the better and what we saw today was a HUGE step in the right direction.

Without further ado, here is a Part 2 of the list my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

- The Semiconductor Revolution

- NVDA Nvidia (6+) – Let’s start out by saying that semis might be one of the more crowded sectors right now and NVDA has led the way higher all year long. With a $638bb market cap, NVDA is the sixth most valuable company in the US at the moment, behind only AAPL, MSFT, GOOG, AMZN, and BRK. And trading at roughly 62x 2024 earnings estimates, the stock is not cheap. While NVDA has never been a cheap stock, just look at how much higher the P/E is compared to NVDA’s historical P/E over the last four years:

There is no doubt that NVDA is probably the best-positioned chipmaker for the AI revolution, but that doesn’t mean that we should go chasing this stock right here either. While we want to position our money in front of the AI revolution, there are probably better ways to do that than buying NVDA right here. It will take many years of growth and earnings to support the present valuation and we think we will get the chance to add to our NVDA at lower prices at some point. There is just too much hype around this stock right now and given the relative weakness in the global chip market right now but we would maybe buy more around $200.

There is no doubt that NVDA is probably the best-positioned chipmaker for the AI revolution, but that doesn’t mean that we should go chasing this stock right here either. While we want to position our money in front of the AI revolution, there are probably better ways to do that than buying NVDA right here. It will take many years of growth and earnings to support the present valuation and we think we will get the chance to add to our NVDA at lower prices at some point. There is just too much hype around this stock right now and given the relative weakness in the global chip market right now but we would maybe buy more around $200. - QCOM Qualcomm (7) – On the other side of the semiconductor-P/E spectrum is Qualcomm. Qualcomm is relatively cheap, trading at about 12.5x 2023 earnings estimates, and is at the lower end of its historical P/E range:

However, topline growth will be basically flat over the next two years as analysts are predicting revenue to decline 14% in 2023 and then increase 13.3% in 2024. While Qualcomm’s Snapdragon chip remains the de facto standard communications chip for nearly every smartphone, the CEO is anticipating that QCOM will no longer make chips for Apple starting in 2024. This leaves QCOM in a precarious position because historically nearly all of the company’s revenue has come from the sale of phone chips. Accordingly, the company has been focused on diversifying its product line in recent years. Specifically, it has made a big push toward becoming a leading provider of communications chips for cars and other connectable devices in the IoT market. But even though QCOM has not lost AAPL as a customer yet, its growth in the smartphone market is already declining. While the automotive market is growing rapidly, the IoT segment only grew 7% year over year in Q1’23. Given the rapid growth in the IoT market as a whole, it is somewhat disappointing that QCOM is not growing that segment of its business more than 7% annually. It will take a substantial increase in the automotive and IoT segments to offset the expected decline in the smartphone market over the next 2-3 years. If QCOM’s shift toward automotive and IoT works out, the company will likely start growing topline revenue again and command a higher multiple. There is no doubt that QCOM’s tech is the best in the business and more and more devices will eventually be connected to the internet using Snapdragon chipsets. However, losing AAPL as a customer will likely be a big headwind over the next couple of years and QCOM will have to excel at growing its auto and IoT business, or its revenue will likely decline. That said, the risk to the downside may not be that significant since the stock is only trading at a roughly 12x multiple, and the revenue decline may be priced in at this point. Buying QCOM here is really a bet on the best technology that will continue to be the best option for any object (phone, car, camera, sensors, etc.) that needs mobile connectivity.

However, topline growth will be basically flat over the next two years as analysts are predicting revenue to decline 14% in 2023 and then increase 13.3% in 2024. While Qualcomm’s Snapdragon chip remains the de facto standard communications chip for nearly every smartphone, the CEO is anticipating that QCOM will no longer make chips for Apple starting in 2024. This leaves QCOM in a precarious position because historically nearly all of the company’s revenue has come from the sale of phone chips. Accordingly, the company has been focused on diversifying its product line in recent years. Specifically, it has made a big push toward becoming a leading provider of communications chips for cars and other connectable devices in the IoT market. But even though QCOM has not lost AAPL as a customer yet, its growth in the smartphone market is already declining. While the automotive market is growing rapidly, the IoT segment only grew 7% year over year in Q1’23. Given the rapid growth in the IoT market as a whole, it is somewhat disappointing that QCOM is not growing that segment of its business more than 7% annually. It will take a substantial increase in the automotive and IoT segments to offset the expected decline in the smartphone market over the next 2-3 years. If QCOM’s shift toward automotive and IoT works out, the company will likely start growing topline revenue again and command a higher multiple. There is no doubt that QCOM’s tech is the best in the business and more and more devices will eventually be connected to the internet using Snapdragon chipsets. However, losing AAPL as a customer will likely be a big headwind over the next couple of years and QCOM will have to excel at growing its auto and IoT business, or its revenue will likely decline. That said, the risk to the downside may not be that significant since the stock is only trading at a roughly 12x multiple, and the revenue decline may be priced in at this point. Buying QCOM here is really a bet on the best technology that will continue to be the best option for any object (phone, car, camera, sensors, etc.) that needs mobile connectivity. - TSM Taiwan Semiconductor (7) – TSM reported last night with EPS coming in slightly higher than estimates and revenue slightly below estimates. The stock reportedly popped today because of TSM’s comment that they expect to keep CapEx high for 2023, which also caused the chipmaking-equipment suppliers like ASML, AMAT, and LRCX to pop. TSM’s revenue declined significantly from last year as the demand for chips has remained soft because of stubbornly high inventory levels. That said, TSM thinks that this is the bottom of the cycle for chips and is expecting demand to strengthen in the second half of the year. We have doubts about whether that materializes as we do not expect a surge in chip demand given our macro outlook. However, TSMC is basically the only company on the planet with the capability to manufacture advanced semiconductors needed to support AI/ChatGPT, EVs, iPhones, Supercomputers, etc, and this company are poised to continue to return to growth as we eventually come out of the chip inventory glut that the industry is still working through. Obviously, TSM will also benefit from the ever-increasing demand for NVDA GPUs which power ChatGPT, and unlike NVDA, TSM is not trading at a ridiculous valuation (currently at about 16x 2023 estimates). Thus, if you are looking to get more money in front of the AI revolution, TSM is probably the better buy here over NVDA.

- INTC Intel (8) – Intel has had a pretty big move up since hitting $25 in early March. Intel is still in a transition period as it shifts focus toward its Database/AI and foundry businesses and less towards the personal computing side of things. Obviously, the PC business has and may continue to struggle, and it is possible that total revenue for Intel will be down in 2023 and the company may even end up losing money this year. Intel’s last quarter was pretty bad and the market is pricing in further deterioration of Intel’s main business lines. But Intel is potentially starting to turn around its Datacenter/AI business as it noted in its AI day last month. Intel explained that they are seeing more demand for their CPUs to aid with AI inference. Here is Intel’s response to the question of whether GPU’s are “inherently superior for deep learning”: “No. Today, Intel® Xeon® processors are being used for deep learning without GPU support. GPUs have been opportunistically applied to deep learning, but GPU architecture is not uniquely advantageous for AI. And as AI continues to evolve, both deep learning and machine learning will need highly scalable architectures. Intel® architecture can support larger models and offer consistency from edge to cloud. These processors can run most AI workloads, and particularly excel at recommendation systems, recurrent neural networks (RNNs), reinforcement learning, graph neural networks (GNNs), and classical machine learning.” Intel reports next Thursday and if there is any indication that the AI/Datacenter business is returning to growth, the stock is likely going much higher from here.

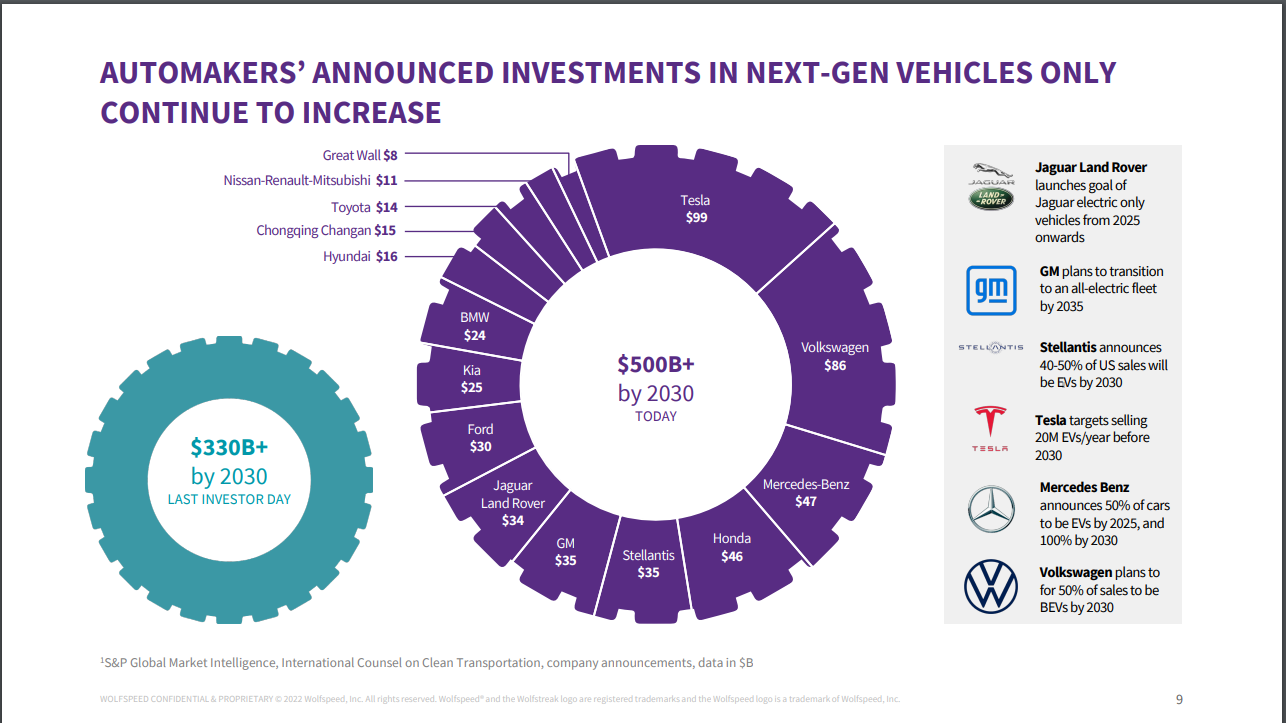

- Wolfspeed (8) – Wolfspeed has really struggled since Tesla announced at their last investor day that their next-generation vehicle will not use Silicon Carbide (SiC) chips, which Wolfspeed manufactures. Prior to this announcement, most EV companies were using SiC chips to power their vehicles. According to Electronic Design, this is because SiC chips have “higher system-level efficiency, owing to the greater power density, lower power loss, higher operating frequency, and increased temperature operation. This translates into a higher driving range on a single charge, smaller battery sizes for traction inverters, and faster charging time for on-board chargers (OBCs).” If Tesla is able to build EVs with a high range and fast charging times without SiC chips, then that will hurt Wolfspeed to some extent. Still, many of the dozens of other EV makers likely will not have the technological wherewithal to develop their own form of semiconductor that can achieve the same level of performance as a SiC chip. And just look at the chart below showing the announced investments from other car companies which are making investments in EVs. Those other car companies will all be producing cars which will likely include SiC semiconductors. Earnings come out next Wednesday and we think the stock could go higher if the company demonstrates good execution on the production side and continued sales growth.

- NVDA Nvidia (6+) – Let’s start out by saying that semis might be one of the more crowded sectors right now and NVDA has led the way higher all year long. With a $638bb market cap, NVDA is the sixth most valuable company in the US at the moment, behind only AAPL, MSFT, GOOG, AMZN, and BRK. And trading at roughly 62x 2024 earnings estimates, the stock is not cheap. While NVDA has never been a cheap stock, just look at how much higher the P/E is compared to NVDA’s historical P/E over the last four years:

- The Cloud Revolution

- SNOW Snowflake (6+) – Snowflake is one of the fastest-growing companies in the portfolio at the moment with analysts expecting near 40% growth in 2023. SNOW has built an enterprise software program that allows companies of all shapes and sizes to aggregate and analyze their data from across the major cloud providers like AWS, Azure, Google, etc. According to ChatGPT, “Snowflake is designed to work across different cloud hosting services, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). This cross-cloud compatibility is one of Snowflake’s key features, as it allows customers to leverage the platform’s capabilities regardless of their preferred cloud provider. By providing a cloud-agnostic data warehousing solution, Snowflake enables businesses to avoid vendor lock-in and maintain flexibility in their cloud infrastructure strategy. This flexibility can be particularly valuable for organizations with multi-cloud deployments or those that wish to switch between cloud providers in the future. Note that while Snowflake is compatible with major cloud providers like AWS, Azure, and GCP, it doesn’t currently support Oracle Cloud.” The risk with many of the enterprise software names right now is that they could see a big slowdown in sales as most corporations and businesses are in belt-tightening mode and may not be willing to pay for the Nth software program that their employees are asking for. Additionally, a lot of these companies have been running with huge OpEx and will run out of cash quickly if they see a modest slowdown in growth. We have been spending a lot of time analyzing these enterprise software names lately and it is always astounding just how many companies and products are out there. Many of these programs, such as Sprout’s social media software, are silly and really do not provide much value to their customers and in a few years, some of these low value-add software programs could be simply eliminated by in-house programs built by the companies themselves using AI/ChatGPT. That said, we think there are also some names that are truly creating revolutionary products that companies cannot live without and which eliminate overhead and costs and these companies may even be beneficiaries of corporate cost-cutting. We should have some new longs and shorts in the enterprise software space for you all soon.

- The AR/VR/Social Revolution

- META Metaverse (7) – Meta has returned to glory in the eyes of Wall Street and is hands down one of the best-performing stocks of 2023. The company was a screaming buy last December when we bought more of the stock at around $100/share. But now at 20x ’23 earnings estimates with only 4% revenue growth, we are not so sure that it is still a buy at $213. The idea of the metaverse has almost completely fallen out of favor with most consumers and businesses, including META itself, which is now shifting away from the idea of wearing a clunky headset over your face for extended periods of time. Now the company is just trying to cut costs and increase profitability which is great but that cannot come at the expense of long-term growth. While Facebook, Instagram, and Whatsapp are not going anywhere any time soon, those businesses are not necessarily growth businesses anymore and the markets are essentially treating META like a value stock. In some ways, it feels like META lost its soul when it sort of abandoned the social media focus and then it tried to pivot to the metaverse and then that didn’t work either so now they are a _____ company? As you all know, we have been long META since it hit $20 after the IPO but we trimmed it some lately as the stock has rallied over $200. We do not doubt that Zuckerburg will come up with some great ideas to keep the company growing, but the near-term focus on cost cutting will eventually lose its luster and the next thing you know Wall Street will hate this stock again. Not to mention the global advertising market has already shown a lot of weakness and there is probably risk to the downside if META doesn’t cut costs enough to please Wall Street this next quarter and/or the revenue flatlines. We would be cautious into the call next Wednesaday and would encourage you to trim some META if you haven’t done so already.

That’s it for today folks. Part III will be out tomorrow. Also, let’s do this week like Q&A chat at 1:00 pm EDT. Talk soon!