Latest positions (new format gives even greater detail than ever)

This type of action is not normal, though it feels like it right now.

- 5% intraday dislocations in ETFs,

- 5% intraday dislocations in precious metals,

- 2-3% intraday moves in stock markets around the world.

- a huge spike in rates and sell-off in Treasurys

- a US Federal Reserve bank’s inability to deliver gold as promised to its rightful owners in Germany

- Sovereign debt crises, bank bailouts and bail-ins and 0% interest rates from the Fed and so on…

Here’s a deep thought for you — if the Treasurys are losing their place as a “Safe haven”, then can the dollar retain its place as a “Safe currency”? Methinks gold and silver are likely to become the perceived “Safe store of value” if things don’t get back to somewhat more stable in the market places very soon.

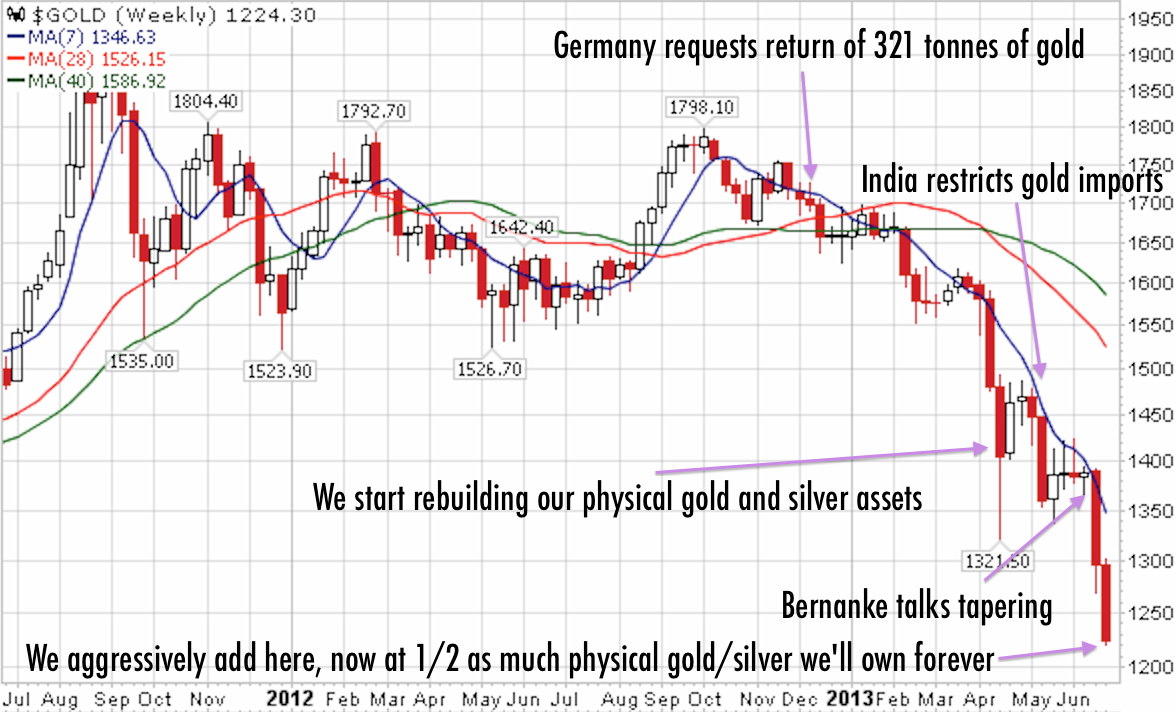

For some reason this gold chart I spent hours making for us didn’t go out in yesterday’s column in the blast email to you subscribers and I wanted to make sure you got it today.

On a similar note, I’ve had over 100,000 people read my latest column about gold and silver on Marketwatch and over 250 comments to boot. There’s definitely a huge build up of emotion and interest in gold and silver here amongst the investor demographic. Interesting times we economize in, eh?

Anyway, here’s a list of my latest positions in approximate notional order from largest to smallest. In the never-ending quest to provide the best service I can to you guys (and to help keep my own sanity), I’ve broken the Longs side of the list down even further into refined categories.

I give each stock a current rating from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment” (there will never be a 10 rating, because there is no such thing as a perfect investment, of course). Anyway, here’s the list:

Longs –

- Forever assets and other permanent holdings –

- Media and other private investment/business holdings (9+ because betting on yourself and running a biz is always a best bet)

- Real estate, including land and the ranch I live on in NM (7)

- Physical silver bullion & coins (9)

- Physical gold bullion & coins (9)

- BitCoin (6)

- Primary stock exposure portfolio

- Sandisk (7)

- Intel (8)

- First Solar (7)

- Google (7)

- Facebook (8)

- FutureFuel (7)

- Apple (8)

- Juniper (7)

- Amazon (7)

- Lindsay (8)

- Ciena (7)

- Nvidia (7)

- Marvell (6)

- Stock baskets and short-term flips

- Long-term social basket

- Zynga (8)

- LinkedIn (6)

- Long-term 3-D printing basket

- XONE (7)

- SSYS (7)

- DDD (6)

- Autodesk (6)

- Bankruptcy technical flip

- XIDEQ (6)

- Short-term metal ETF flips

- GDX (9)

- GLD (7)

- SLV (8)

- Long-term social basket

Shorts –

- Welfare bank basket

- MS (8)

- GS (8)

- JPM (8)

- LPS (9)

- Samsung/South Korea basket

- EWY (7)

- Bet on interest rates rising

- IEF (8)

- Other shorts

- CSTR (7)

- Apollo (7)

- Dollar Tree (7)

- IBM (8)