Latest Positions: Our Magnificent Seven Stocks, Reshoring, and Bitcoin

Here is Part 3 of the list of my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

- Our Magnificent 7 Stocks – Is it FANG, FANNG, or the Magnificent 7? Doesn’t matter. This group includes Apple (AAPL), Microsoft (MSFT), Meta (META), Alphabet (GOOG), NVIDIA (NVDA), Amazon (AMZN), and Tesla (TSLA). We have owned each of these stocks (excluding Microsoft) for many years, from AAPL at 20 cents in 2003 to Google at $2 on the day of its IPO and NVDA at $7 a share seven years ago. Despite being so commonly grouped together by the mainstream media, each of these companies are very different from one another. They each have very different products and services, different fundamentals, different management, different valuations, and so on. Let’s stay objective and make sure that we evaluate each company on its merits, rather than its stock price. (p.s. we updated our analysis of TSLA and NVDA in Part I and Part II of our Latest Positions reports, respectively).

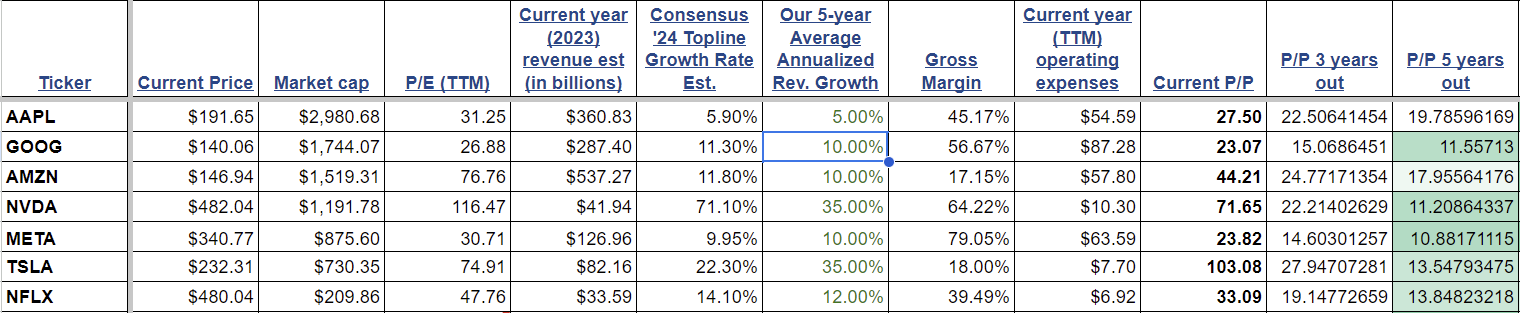

- AAPL Apple (6) — At the top of this update we’ve included a screenshot of a portion of our spreadsheet that we use to analyze stocks. Using assumptions regarding growth rates of revenue and expenses, we project what the price/profits (P/P) ratio will be in 3 and 5 years for each company. Ideally, we want to see single-digit or low double-digit P/Ps five years out. In the above table, we’ve shown the projected P/P ratios for our Mag 7 stocks, and Apple is clearly the outlier here. With a five-year P/P ratio of nearly 20, it far exceeds the average P/P of 13.2 for the remainder of the group. We are modeling Apple growing revenue at about 5% per year for the next five years (more or less in line with consensus), and we have a hard time seeing Apple growing much faster than that without rolling out some Revolutionary new products/services. Even if we use a 10% annualized sales growth rate, Apple still comes in with a 14.5 P/P five years out which is not cheap. It goes without saying that Apple has the best product/services ecosystem in the world but that doesn’t necessarily mean the company should trade at 30x earnings when it has single-digit revenue growth. That said, Apple has yet to roll out any sort of meaningful AI offering and that could certainly be a catalyst for the stock. But unlike Google, Amazon, and Microsoft, Apple does not have a major enterprise cloud services business with the massive data centers needed to run generative AI. So unless there is a major change in Apple’s strategy, we’re not sure that Apple is going to be rushing in to build a large language model (LLM) or some other form of AI to compete directly with the others. The more likely result is that Apple builds AI into its devices but it’s not clear yet what that will look like and whether it could even be a revenue driver for the company. We are holding tight with our small Apple position in the hedge fund and personal accounts.

- GOOG/GOOGL Alphabet (7+) — Google sold off pretty sharply (about 11%) after its Q3 earnings report because its cloud growth was not quite as fast as the Street was expecting. We sent out a Trade Alert indicating that we were buying $127 and $131 calls on Google and not even a month later the stock is back to $140. As seen in our table above, Google is one of the more reasonably valued stocks in the Mag 7 (23 P/P currently, 11.5 P/P five years out) and we think we have modeled the growth fairly conservatively (10% annualized). That said, Google is about $10 from its all-time high and now would not be a bad time to trim a little if you have not done so already. While Google might be a step behind OpenAI with its current LLM (“Bard”), the company’s upcoming Gemini AI is probably going to leapfrog even OpenAI’s offerings. Google also has a lot of other growth/profit drivers that make us continue to really like this stock. YouTube revenue returned to growth last quarter and despite fears that ChatGPT would destroy the company’s near monopoly on Search, thus far the LLM has not really made a dent. Google is one of the best-positioned companies to integrate AI across its ecosystem because all of Google’s apps and services are cloud-based (unlike Microsoft, which is still in the process of shifting to cloud-based productivity apps). At Google, AI won’t be just its own app like ChatGPT, it will be integrated into every app offered by Google. With this AI running in the background, workers will become more efficient and productive all the time without having to think about using AI to help them become more efficient and productive. We sold all of our calls on Google which we bought earlier this month and are mostly sitting tight with our common position for now.

- AMZN Amazon (7-) — Amazon has had a great run since reporting earnings and is now up over 71% for the year. The company reported a big beat in earnings and notably its Amazon Web Services (AWS) sales grew 12% year over year. With the rise of ChatGPT — which runs exclusively on Microsoft’s Azure cloud service — analysts were concerned that Microsoft was seriously cutting into AWS’s cloud market share. To be clear, Microsoft and Google are both growing their cloud services at about twice the rate of AWS. However, AWS still commands roughly 32% of the market with Azure at 23% and Google Cloud Platform (GCP) at 10%. In September, Amazon announced that it was investing $4 billion in AI startup Anthropic which operates a ChatGPT competitor known as Claude. Only two weeks later, Google announced that it was investing $2 billion in Anthropic. We think a large part of the incentive for Google and Amazon to invest in Anthropic is so that Anthropic will train and run its LLMs on AWS and GCP. Generative AI requires immense computing power for both training and inference, and that translates into massive sales for the public cloud providers. We expect this AI/cloud/data center arms race between Microsoft, Google, and Amazon will continue for the next couple of years and it seems unlikely that this will be a winner-take-all scenario. Rather, it seems likely that each of the hyperscalers will benefit immensely as more and more workloads shift to the cloud from devices driven by the advances generative AI. Beyond its cloud business, Amazon has an advantage in that is using AI to benefit its retail business by increasing advertising ROI and product recommendations for consumers. Like Google, Amazon has several major growth drivers that will carry the company for the next few years. Amazon is more expensive on a P/P basis (18 P/P five years out) then the most of the rest of the cohort and we have trimmed it down following this big run. We would look to pick up more Amazon if it got back to the $120 range.

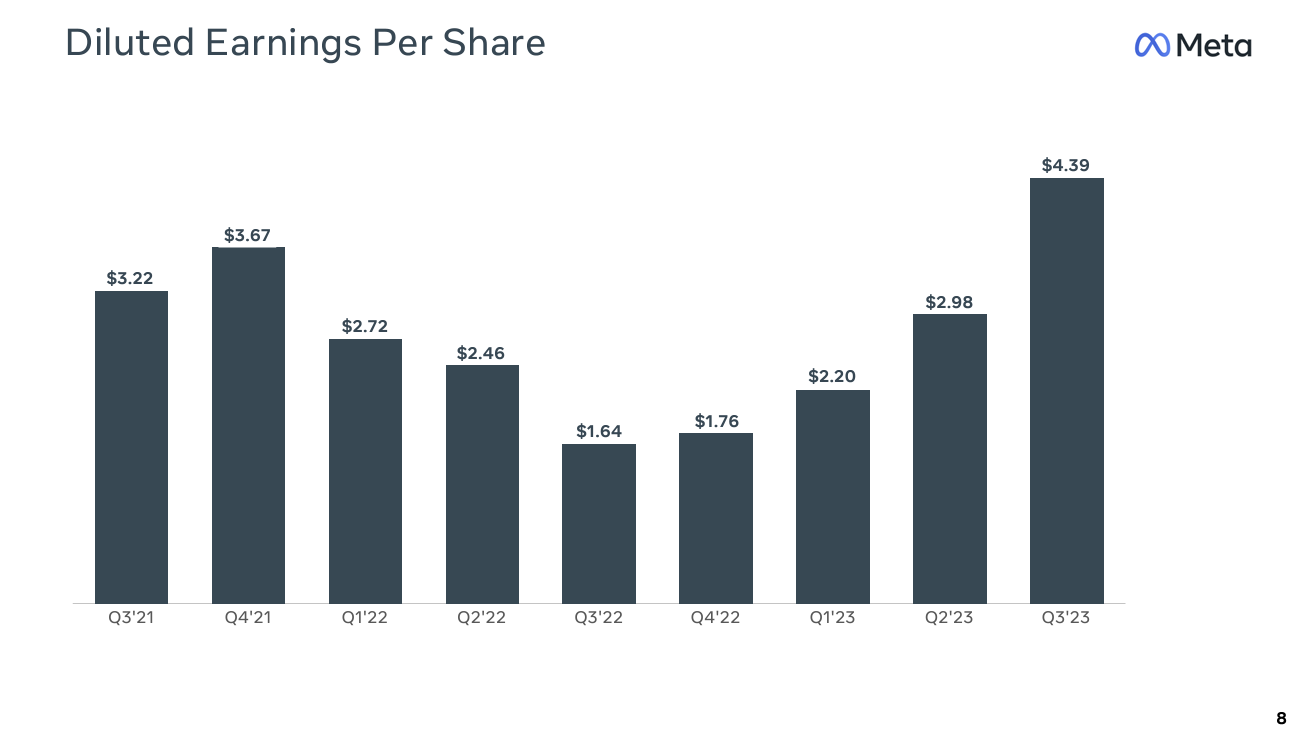

- META Meta (7+) — Meta is the best-performing Mag 7 stock this year (up 174% YTD) after NVIDIA (up 238% YTD). Turns out that Mark Zuckerberg wasn’t lying when he said 2023 would be Meta’s “year of efficiency.” Meta turned in its most profitable quarter in three years in Q3 with 40% operating margins and was still able to grow revenue 23% year over year. Meta owns the two largest social networks by far and also by far the profitable social media platforms on the planet and continues to dominate online advertising. Advertising on Meta’s family of apps already presents one of the best ROIs for advertisers and now the company is using AI to further improve its ad targeting. The genius of the Meta platform is that its users create the content that goes on the social network for free while readily divulging critically important information about themselves like preferences, interests, skills, likes/dislikes, and even personal beliefs and opinions, that most platforms never have access to. Even Google, for all of its strengths in data collection and advertising, does not know nearly as much about you as Facebook or Instagram. Meta also has the benefit of more powerful network effects and switching costs that makes it extremely hard for any other platform to seriously compete with it given its massive user base. Meta appears to have successfully fended off the TikTok threat and it seems ever more likely that the US Government will end up banning TikTok in the coming years. Meta is also fairly cheap on a P/P basis (11 P/P five years out). We have trimmed some Meta given its recent run but we still really like the stock for the long term and are mostly holding tight for now.

-

- NFLX Netflix (7) — Netflix became the forgotten member of the Mag 7 earlier this year as investors worried about the writers/actors strike and the overall dismal performance of most of the streaming companies like Disney (DIS), Paramount (PARA), and Warner Bros Discovery (WBD) which, unlike Netflix, are all losing money on their streaming businesses. We sent out a Trade Alert before Netflix reported earnings in October that we were picking up some call options on NFLX when the stock was at $355. Netflix reported nice beats on the top and bottom line and it was like the market all of a sudden realized that not all streaming businesses suck. Netflix stock is up over 35% in nearly a straight line since the earnings report and it remains a decent-sized position for us. The company is still growing subscribers and has proven itself as an excellent operator in the streaming world. The company does an amazing job at pivoting when needed to accommodate customer demand, demonstrated most recently by its ad-supported tier. Netflix is not terribly cheap (13.5 five-year P/P) but it (and potentially Disney) may prove to be the only truly successful streaming company in the long term. We are mostly holding tight on our common position now.

- The Reshoring/Automation Revolution —

- ROK Rockwell Automation (7) — Rockwell’s stock (as with many other industrial companies) has underperformed the broader markets recently as rising interest rates have curbed the growth in domestic factory buildouts. The company reported a great quarter with sales rising over 20% year over year. However, Rockwell slightly lowered its full-year sales estimate for 2024 given the interest rate headwinds and analysts now expect Rockwell’s sales to grow only 3.2% in 2024. All of the fundamentals supporting the Reshoring/Automation Revolutions are still in place and we think these are long-term trends that will continue for decades to come. Companies continue to make investments in American manufacturing in order to better control their supply chains and those new factories will all be automated to the maximum extent possible in order to reduce labor costs. Rockwell designs and manufactures some of the best automation software and hardware in the industry and we expect it will be a great stock to own for the next 10,000 days. That does not mean that it might not face continued near-term headwinds given some of the challenges with the economy right now. We are sitting tight on our ROK stock for now.

- The Crypto Revolution —

- BTC Bitcoin (7-) — Bitcoin has been on a wild ride. Bitcoin’s rally has been largely fueled by speculation around the government potentially approving a bitcoin ETF from Blackrock or other fund managers. On the other hand, the DOJ and SEC continue to crack down on crypto and just yesterday Binance founder and CEO, “CZ,” pleaded guilty to violating a range of federal anti-money-laundering laws. CZ was forced to step down and Binance has agreed to pay $4.3 billion in fines to the government. It is unclear whether Binance even has the capital to pay these fines and we will see whether Binance even exists this time next year. As I’ve said for years now, 99.9% of the cryptos which popped up during the bubble are fraudulent, silly, or scams and frankly, the government was derelict in its duty to protect the public by allowing all of these cryptos to come public in what seems to be clear violations of securities laws. Only after the public has lost billions of dollars in crypto is the government starting to enforce the law. Sigh. By picking and choosing when to enforce certain laws, the government is open to corruption and playing favorites. Coinbase (COIN) is now essentially the last crypto exchange standing (other than Robinhood (HOOD)) and the government has leveled many of the same allegations against Coinbase that it did against Binance. We still think that all currency roads lead to bitcoin but that doesn’t mean that any other cryptocurrency survives this mess. We trimmed some ProShares Bitcoin Strategy ETF (BITO) into this most recent rally after buying more early this year when it was near $14/share.

That’s it for now. Part IV will be out on Friday. Happy Thanksgiving to all!