Latest Positions Part 3: P/E Ratios Matter Too

For this week’s Live Q&A Chat, tomorrow at noon ET, we’ll use Zoom video. Here are the details to join.

https://us02web.zoom.us/j/89076435567?pwd=c1VEelN1dDhra2pKc3Z0T2NCaitjZz09

Meeting ID: 890 7643 5567

Password: 449982

One tap mobile:

+12532158782,,89076435567#,,1#,449982#

Here is a Part 3 of 5 of the list my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

We are definitely seeing a pause in the big Nasdaq stocks this week and Netflix’s after hours miss has the potential to exacerbate that tomorrow. Be cool, don’t be greedy right now.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- (Energy Revolution)

- SEDG SolarEdge (6+) – Big move to all-time highs in our ol’ SEDG and I’m just mostly sitting tight. It’s the best solar company I can find to invest in and frankly, I think some of the other solar companies look like better shorts than longs. Solar Edge’s revenue growth rate is supposed to accelerate from the single digits this year to 20% next year. That’s good to see, but on the other hand, when a stock chart is as parabolic as this one is, that means a lot of high expectations are being priced into the stock already. The stock is trading at about 4x next year’s sales estimates and at 30x next year’s earnings. That’s on the high end of a fair valuation for this company. I think this is a long-term Revolution core holding, but that doesn’t mean I want to load up on it just now.

- (China Middle Class Revolution)

- JD JD.com (6) – JD hit all-time highs earlier this week. Meanwhile, this is a company that’s growing 20% per year and is likely to keep doing just that in years ahead. Trading at 60x next year’s earnings estimates after having more than doubled since we turned from bear to bull and went from short to long this stock in a rare move for me. I’m thinking the valuation here looks stretched too, as there could and should probably be a Chinese-based company discount in years ahead vs US-based stocks.

- (The Trillion Dollar-ish Club)

- GOOG/GOOGL Google (7) – I couldn’t believe it the other day when I saw this article in the WSJ this week coming literally 15 years since I first wrote about how Google could end up in big trouble if they feature YouTube videos over other website’s similar videos. Here’s a link to an article I wrote five years ago called: A Decade Of Google Analysis, which featured ten years of analysis from yours truly, including links and articles and quotes, etc. I could update it with an article called “15 Years Of Google Analysis” now. Anyway, in March, what seems like fifteen years ago, I’d written: “The companies that enable remote work will also benefit from this remote work trend. That means Amazon Web Services, Google Cloud and Microsoft Azure…I’m nibbling on AMZN and GOOG and opening a new position in MSFT. In fact, I would expect people to spend even more time than ever on social networks out of boredom if nothing else…I’m nibbling on FB, TWTR and opening a new position in PINS. People staying at home and not going to concerts and sporting events is going to drive people to play more video games. The video game platform industry is a global duopoly — Sony Playstation and Microsoft XBox…I’m adding to SNE and as mentioned above, I’m buying MSFT too. I also nibbled on some more AMD (server chips will be in big demand to make these remote workers work). And of course, people will be spending more time at home streaming TV and movies instead of going to the movie theaters. I’m nibbling on more ROKU and NFLX.” Wow, I was really bullish and excited about buying stocks at that moment, wasn’t I? Really, doesn’t that seem like forever ago? Each and every one of those stocks are up big since then and I guess I did my job. Anyway, I’ve been analyzing and owning Google for fifteen years now and it’s still a long-term hold that we sometimes get a chance to buy on the cheap and probably will get that chance again soon if I had to guess.

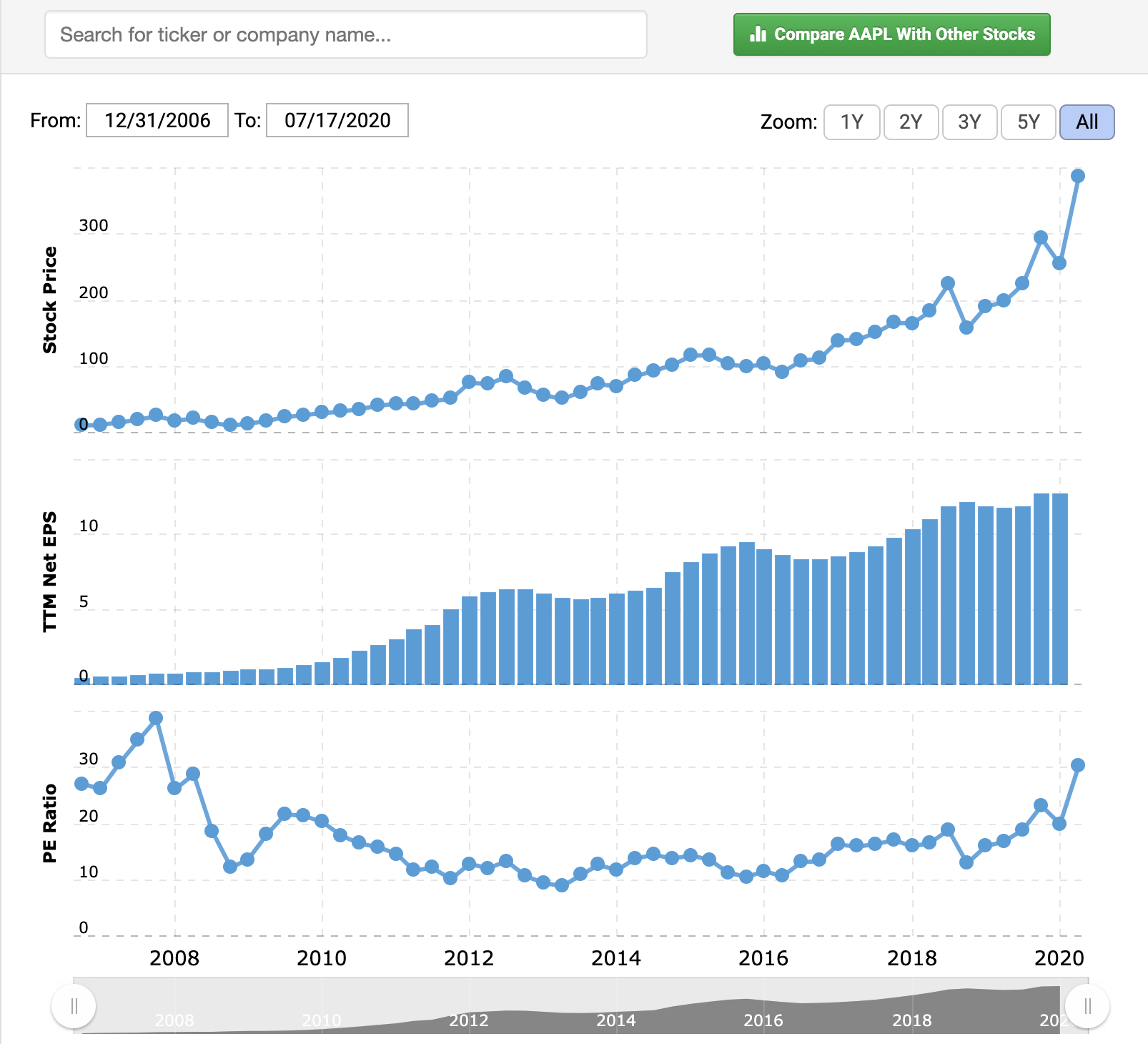

- AAPL Apple (6) – I’m afraid that there’s a lot of money/traders/investors hiding in Apple right now because “it’s safe”. Here’s something I wrote last March when AAPL was less than half today’s price: “Apple‘s one of the best plays on 5G and nobody realizes it yet. In 2021, there will be enough 5G penetration along with the new apps and feature sets and services that 5G penetration will spawn that we’ll finally see a major upgrade cycle hit for the iPhone. Hundreds of millions of people will upgrade to the new 5G smartphones in 2021 and 2022 and Apple‘s going to make a bunch of money on that. In the meantime, I’d buy more every time it gets hit by 5-10%.” I’d rewrite that today as: “Apple‘s one of the best plays on 5G and EVERYBODY realizes it NOW. IN 2022, there will be enough 5G penetration along with the new apps and feature sets and services that 5G penetration will spawn that we’ll finally see a major upgrade cycle hit for the iPhone. Hundreds of millions of people will upgrade to the new 5G smartphones in 2021 and 2022 and Apple‘s going to make a bunch of money on that. In the meantime, I’d TRIM more every time it RALLIES 5-10%.” Apple is trading at more than 30x this year’s earnings estimates and 25x next year’s earnings estimates — when I say that stocks seem richly valued to me, it’s because I don’t remember the last time Apple traded at this high of a P/E multiple and indeed, according to this chart I just pulled up, it looks like Apple’s P/E ratio is as high as it’s been since 2008 right before it crashed along with most of the rest of the stock market in the Financial Crisis:

- AMZN Amazon (7) – I’m a trimmer of Amazon here too even as I’ve long loved Amazon for the very reasons I remain long a core position in the name today and despite the fact that Amazon’s still primed to benefit in many ways in during the ongoing Coronavirus Crisis and even in the post-Covid world. Last time I’d written: “Amazon’s revenue estimates for 2020, unlike most of the other companies out there, are likely too low.” But now analysts might have caught up with where Amazon’s revenues are likely tracking this year and that means, along with the stock having gotten so vertical before its recent pullback this week, there’s a lot of good news priced into this stock here. I’m staying long this long-held Revolutionary name that we owned long before it was worth trillions, but let’s not think it’s all roses from here.

Parts 4 and 5 to come.