Latest Positions: QCOM, NVDA, ENVX, WOLF, UBER, ORGN

Here’s what the S&P 500 has done over the last 8 days since I started out the Latest Positions updates (the white arrows are where I sent out each one):

That chart shows a market that was up big for a few minutes one day and then got demolished and taken to new lows. The volatility in that chart looks more like something you’d see over a month’s or three months’ time frame than a one week (plus a day) time frame. The fact is that I got a little bullish again today. First time in a while I could feel some fear in the markets. Not sure the sell-off is over of course. But I did do some nibbling in the hedge fund today including in Amazon and in a couple names as highlighted below.

By the way, Amaris is doing well and was in her usual joyous, hilarious, fun mood yesterday and this morning when I left.

Here is a Part 4 of 4 of the list my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

- The Semiconductor Revolution

- QCOM Qualcomm (7+) – Semiconductor stocks have been trading wildly all year. Up, down, mostly down, then up big, then down more, then down again, then up, then down and down again. Innovation that makes chips get ever more functional, smaller and cheaper to help drive secular demand for the chips that make the world’s electronics run smartly and stay connected are what it’s all about in this industry. Qualcomm’s Snapdragon and other chips are well positioned for long-term growth of 10% or so. With this stock trading at 10x next year’s earnings, it’s pretty cheap but we’ve seen it cheaper on a P/E basis before so it’s not a no-brainer buy just yet. Below $100 and I’d get aggressive in buying this name again.

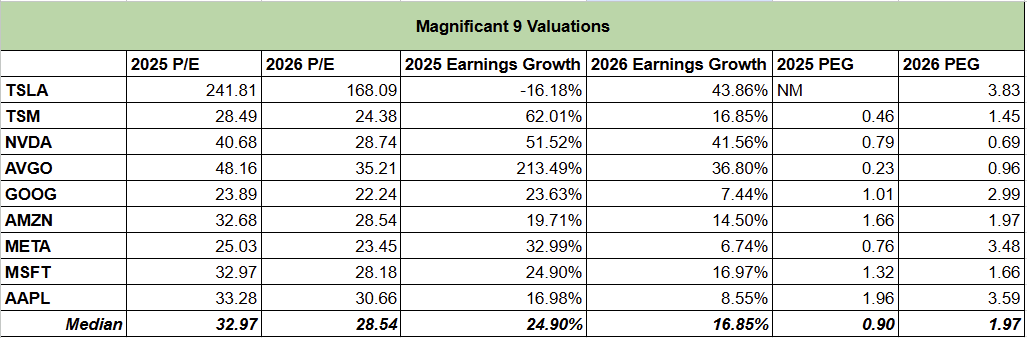

- NVDA Nvidia (7-) – The markets are paying $165 per share for $4 per share in earnings for NVDA while QCOM is trading at $120 for $12 per share in earnings. That’s largely because Nvidia’s chips are the most cutting edge AI and neural network chips that are sold into the broader markets (Tesla, Google, Amazon and others might be designing chips that are approaching Nvidia’s capabilities, at least in narrow applications and/or for proprietary AI/Neural needs. ChatGPT, which I’ve been using a lot lately in my articles and analysis, at least for trying to understand it how it might be utilized in coming years, is a good example of a system that needs lots of Nvidia’s best chips. I’d rather buy this near the $110 level that I’ve highlighted a few weeks ago and that it recently did hit before spiking back up. It might trade back there again before this cycle is over (but it might not!).

- TSM Taiwan Semiconductor (7) – In the last few Latest Positions, I’ve written about how TSM is in such demand: “Everybody needs TSM to make more chips. I mean, car companies, stereo companies, TV companies, computer companies, smartphone companies, tractor companies, refrigerator companies, tool companies, etc. I mean everybody. And that’s a great position to be in, especially if your competitors are going to continue to struggle to catch up with your technological advantage and experience.” My recent Where I’d Buy More list said that I’d like to buy more of this one around $60 which it did recently get near and that’s still where I’d be looking to buy more although it might not drop quite that far now that Buffett’s been buying this one.

- INTC Intel (8) – Intel’s been trading as bad as any other semiconductor stock but I like better than the others for three reasons: They might be taking marketshare from AMD. They are cheap and have a good dividend. They are building factories in the US to become the dominant western semiconductor force in the world.

- Enovix (8-) – Tiny and/or more efficient batteries to power all the mobile things that need semiconductors or otherwise need electricity. That’s what the bet is here. That said, this is a start up and has a long way to go to deliver big revenues from these products that they’re developing and starting to sell. We have to consider this one a venture capital kind of bet with high risk and high potential long-term rewards. I’m a buyer near $10.

- Wolfspeed (8-) – Here’s how they describe themselves on whatever SEC filing Yahoo! Finance is pulling their data from: “Wolfspeed offers silicon carbide (SiC) and GaN materials, including silicon carbide bare wafers, epitaxial wafers, and GaN epitaxial layers on silicon carbide wafers to manufacture products for RF, power, and other applications. The company also provides power devices, such as silicon carbide Schottky diodes, metal oxide semiconductor field effect transistors (MOSFETs), and power modules for customers and distributors to use in applications, including electric vehicles comprising charging infrastructure, server power supplies, solar inverters, uninterruptible power supplies, industrial power supplies, and other applications.” Remember a few weeks ago when I sent out the information and analysis about silicon carbide that I gleaned from ChatGPT? I was putting it to the test to see if it could teach me more about this nascent industry and it did. Re-read that post if you want to learn more about SiC. Anyway, this is another high risk venture capital-like investment so be careful. I do like this name near $70 or below.

- Other Names

- UBER Uber (7+) – I expect that in three years, UBER will earn $2 to $3 per share and the stock could be double or triple if it works out. As I’ve said for the few months, I’m a buyer of more UBER near $25 and it’s here now and I did nibble some for the hedge fund today.

- ORGN Origin Materials (7+) – Still need to consider this one a Venture Capital-type investment and give it some room while this market is hating on unprofitable start ups like this. For a while I’ve been saying that, I’d be a buyer closer to $5 and it’s here now but I haven’t nibbled any yet. I might do some this week in the hedge fund.