Latest Positions: Semiconductors, Our Last Cloud Stock, And Meta

Here is Part 2 of the list of my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

- The Semiconductor Revolution

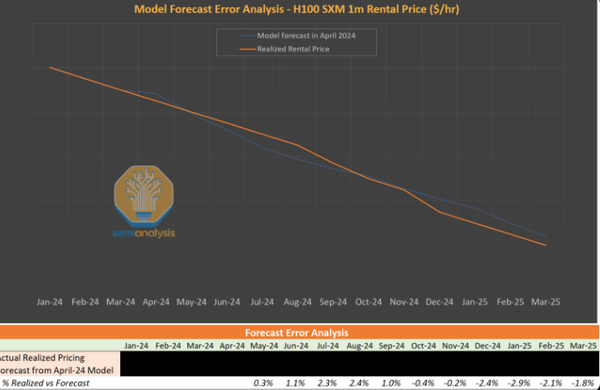

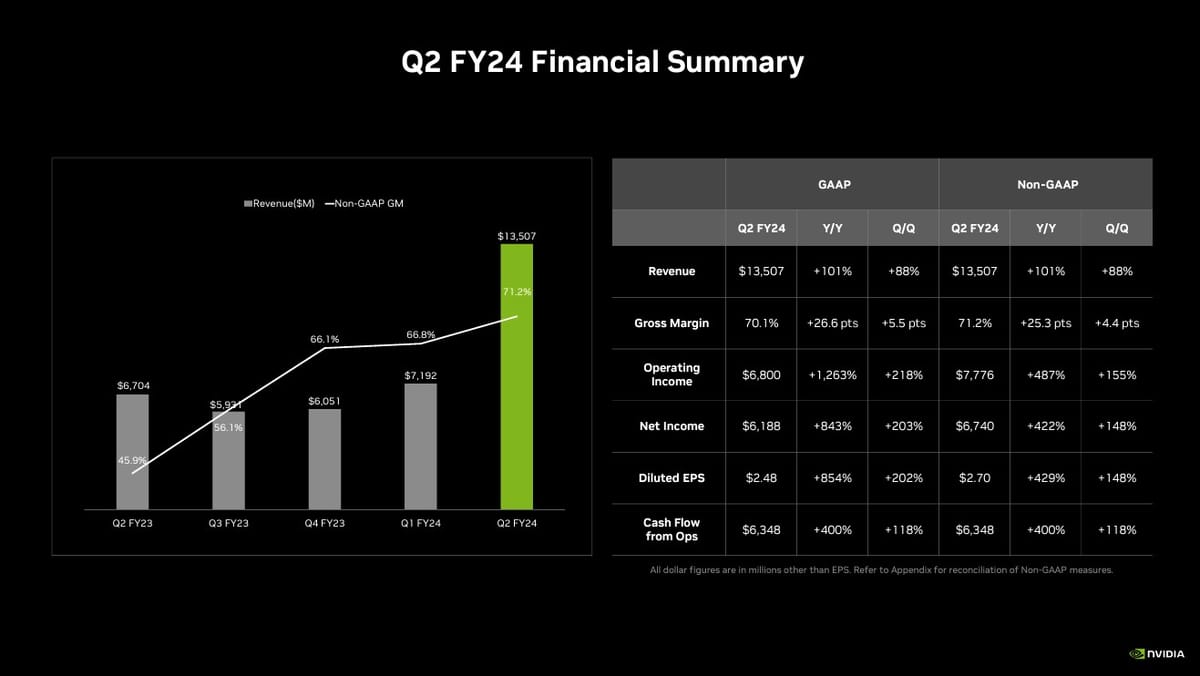

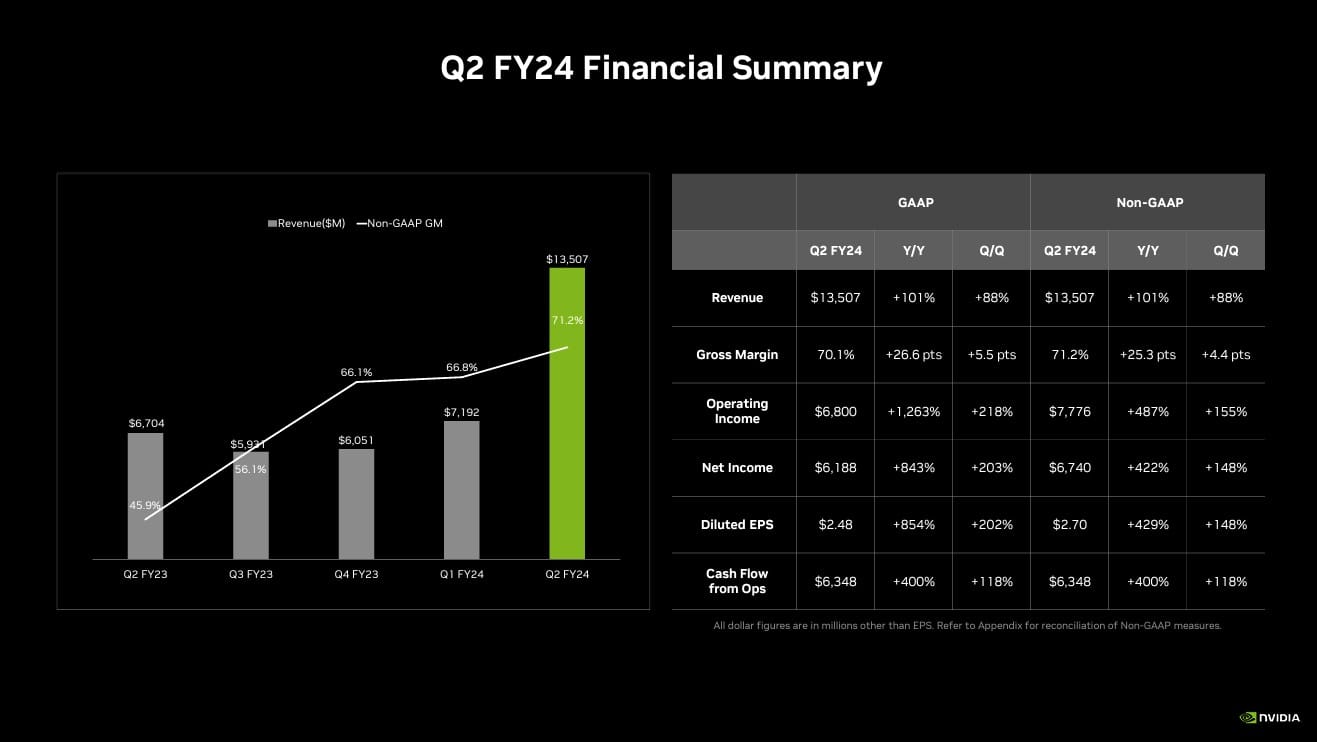

- NVDA Nvidia (7) – If there was ever a more overhyped quarter from a single company than Nvidia this last quarter, we are not sure what it is. What’s truly amazing though is that Nvidia actually turned in one of the most astounding quarters we have seen from a large-cap company in a long time, and the stock ended up selling off in the days that followed. It turned out to be one of the classic “Sell The News” trades. Still, Nvidia turned in impressive numbers that are worth repeating here: Revenues were up 101% YoY, beating analyst expectations by nearly 21%. Moreover, gross margins increased to 70.1% from 43.5% this time last year, leading to net income of roughly $6.2bb, up 843% from last year. On the earnings call, management stated that revenue growth is only constrained by the number of chips that its supplier, Taiwan Semiconductor (TSM), can build and that there is virtually unlimited demand for Nvidia’s H100 GPUs at present. While we are bullish on the AI Revolution, we remain concerned that the extremely high margins that Nvidia is earning on its AI chips right now will attract competitors and thereby erode margins for the company. Additionally, there is concern that demand could taper off if Nvidia’s customers who are spending $30-$40k per GPU are unable to turn around and earn a return on their investment. On the earnings call, Nvidia’s CFO explained that “large CSPs [Cloud Service Providers like AWS, Google, and MSFT Azure] are contributing a little bit more than 50% of our revenue within Q2. And the next largest category will be our consumer Internet companies [think Meta]. And then the last piece of that will be our enterprise and high performance computing.” We think that the big tech companies are much more likely to actually generate significant revenues and profits from AI than the hundreds of AI start-ups that popped up in the last 6 to 12 months. There is some risk that the estimated 20%-30% of NVDA’s data center revenue that is not coming from the CSPs, Meta, TSLA, etc. could be eliminated as the business models of most of those startups are not profitable yet. In fact, many AI startups that raised millions of dollars over the last 12 months are already laying off employees and slashing revenue projections as explained in this WSJ article this morning. All of that said, NVDA is still at the forefront of the AI Revolution and it will likely be a couple of years before they have any serious competition for GPUs.

-

- INTC Intel (6) – Intel is still in the midst of a “bet the company” transition as it moves toward a contract foundry model. The company had a decent quarter in Q2 after reporting the worst quarter in the company’s history in Q1 of this year. While foundry revenue was up 307% YoY, it is coming off of a tiny base and still only constituted 1.8% of Intel’s total revenue in the second quarter. While Nvidia CEO Jenson Huang did say that the test results from Intel’s fab were “good,” Intel still has not secured a major customer for its foundry business. In short, even if Intel can get its new fabs off the ground in time, it will be a while before the revenue contribution is meaningful for the company. Meanwhile, the existing fab companies like TSM, Global Foundries (GFS), Tower Semiconductor (TSEM), are seeing a slowdown in customer demand (more on that below). And since TSM is continuing to build more fabs as well (including in the US), we are just a little worried that once all of this new supply comes online, there may actually be a glut of production capacity and little to no growth in chip demand. Intel is also focusing on its AI products but those are struggling to garner any kind of traction. Intel’s Data Center and AI business unit saw a 15% revenue decline in Q2. If we can offer a football analogy in the spirit of NFL opening week just around the corner, we are probably in the 3rd quarter of the semiconductor fab/AI game(s) and Intel really needs to start moving the ball down the field if it wants to give itself a chance to win.

-

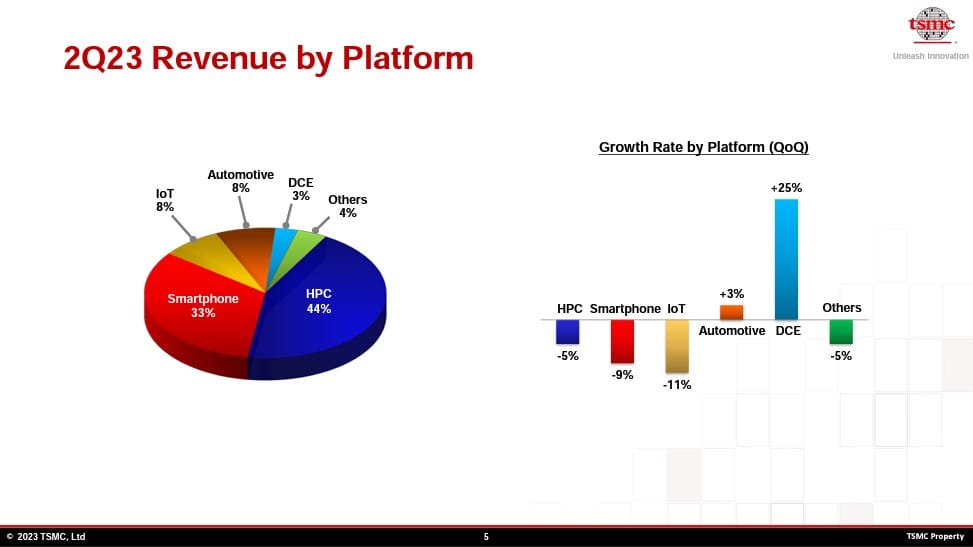

- TSM Taiwan Semiconductor (6+) – Taiwan Semiconductor’s revenue was down 10% and earnings were down 23% YoY in Q2 despite Nvidia’s meteoric rise in the same period. Perhaps most baffling, TSM’s high-performance computing (HPC) segment was down 5% YoY despite truly unprecedented demand from Nvidia. The only segments that were up this quarter were Automotive (up 3% YoY) and Direct Consumer Electronics (up 25% YoY) (DCE makes chips for smart TVs, User Interfaces, etc). It turns out that the historic demand for Nvidia chips was not enough to offset the declines TSM saw in the demand for smartphone chips and the other advanced chips it makes for companies like Apple, AMD, Qualcomm, Broadcom, etc. Semiconductor stocks have been on fire most of this year and we think that TSM is telling us that there is some weakness across the sector that is probably not yet priced into the stock prices of most of the fabless semis. TSM did say that it expects most of its growth for the next few years to come from HPC and is still planning on spending over $30bb this year on capital expenditures. We’ve been in this stock for years and from much lower levels because of TSMC’s monopoly status in the advanced semiconductor manufacturing business, we still want to own this stock for the long term but we won’t be looking to buy more unless we see a decent drop from here. We would be buyers of more around $85.

- The Cloud Revolution

- SNOW Snowflake (7+) – Most cloud stocks have been flat to down since the last time we did an update and Snowflake is no exception. At $155/share, the stock is now up only 14% on the year after pulling back from the $190 levels in June. We spend a lot of time looking at software and cloud stocks because they have some eye-popping revenue growth, but most of these companies are either unprofitable or barely profitable, despite having been around in many cases for 10+ years. We think there is a fundamental problem with a lot of the software companies that built business models around “growth at any cost” and are simply unable to continue to grow at these levels and rein in operating expenses at the same time. Concurrently with the new focus on profitability that came with 5%+ interest rates, we are seeing growth slowdowns within certain software sub-sectors like cybersecurity, for example. For those reasons, we are fairly cautious with respect to most software companies right now but Snowflake has a few redeeming characteristics that keep it in the portfolio. The company is still not cheap (fwd. P/E 155) but it will likely keep growing the topline at 30%+ per year for the next few years and is the best data warehousing/analytics company in the business. Moreover, Snowflake and Nvidia announced in June that they are working together to allow companies to build LLMs directly within the Snowflake Data Cloud. Simply put, companies can use the immense data already in their Snowflake accounts to train LLMs and make their own custom chatbots. One of the keys to building out successful LLMs is having enough of the right data to accurately train the model. Snowflake is uniquely positioned to capture this market since most major companies are already warehousing their data with Snowflake, and they can use their own data to create a purpose-built LLM utilizing the power of Nvidia’s chips. While the valuation is just short of outrageous, we are sticking with Snowflake as the only cloud/software company left in our basket because of its market dominance and good positioning for the AI Revolution. We would like to add to our SNOW when it gets to around $130.

- The Metaverse/AR/VR/Social Revolution

- META Meta (7-) – Meta has had a monster run this year, up 145% from $120 to $295. Maybe Meta should change its name one more time to “MONEY,” since the company is a lot more focused on profitability than the metaverse at this point. In Q2, Meta cranked out $9.3bb in operating profits on $32bb in revenue. Its net income grew 16% YoY and it actually grew Monthly Active People (MAPs) to a record 3.88bb from 3.65bb this time last year. As long-time readers know, we have owned Meta (formerly Facebook) since it crashed to $20 after coming public at $38/share. The company is extremely dominant at what it does and has thus far done a superb job at staving off competition from the once-feared TikTok. Facebook/Instragram “Reels” exceeded 200 billion views per day in the second quarter and the revenue run rate for this one product now exceeds $10bb annually compared to only $3bb last year. For comparison, TikTok is estimated to do somewhere between $8bb and $13bb in 2023 with its 1.6 billionish users. Both Meta and TikTok rely on AI to recommend content to viewers and also use AI to conduct even more targeted advertising to users. META is not wildly overpriced, trading at about 18 times next year’s EPS estimates, and is expected to grow the topline 13.8% and 12.7% in 2023 and 2024, respectively. We want to keep Meta as a core holding and add to it when that forward P/E gets closer to 15 or less like it did when we loaded up on it last December.

That’s it for today folks. Part III will be out tomorrow!