Latest Positions: Solar, China Middle Class, Trillion Dollar Club

Here is a Part 3 of 5 of the list my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The markets are steady again to finish out another week in what has been a historically strange year in the markets and the economy and in society.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- (Energy Revolution)

- SEDG SolarEdge (6+) – Solar is the future of energy. That’s why I’ve long invested in SEDG because it’s one of the best solar companies out there. That said, SEDG is a company that has only about 30% gross margins, is only going to grow single digits this year (might grow 20% topline next year) and is trading at like 70x next year’s earnings estimates and 8x next year’s sales estimates. I will continue to hold my SEDG steady but I have a hard time thinking it’s a great buy right now at these levels.

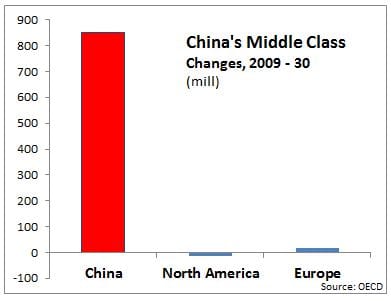

- (China Middle Class Revolution)

- JD JD.com (6) – China’s growing faster than the US this year and maybe next year too. Their middle class keeps adding millions of people each year and many of those people shop at some point at JD.com. JD’s gross margins are nothing to write home about at less than 25% but the growth here and dominance here is worth paying for. Trading at 40x next year’s sales estimates (and just about 1x sales estimates). China stocks, even one like the giant Alibaba BABA, are riskier than US-based stocks because they need government support from the Communists in charge and that requires graft and corruption and bad things. Remember a few weeks ago when the Communists in charge of China screwed up Alibaba’s Ant IPO because Alibaba Chairman Jack Ma had badmouthed some regulations the week prior? That’s a large part of why you have to be careful with stocks based in China. JD’s my favorite though, and I will hold it steady.

- JD JD.com (6) – China’s growing faster than the US this year and maybe next year too. Their middle class keeps adding millions of people each year and many of those people shop at some point at JD.com. JD’s gross margins are nothing to write home about at less than 25% but the growth here and dominance here is worth paying for. Trading at 40x next year’s sales estimates (and just about 1x sales estimates). China stocks, even one like the giant Alibaba BABA, are riskier than US-based stocks because they need government support from the Communists in charge and that requires graft and corruption and bad things. Remember a few weeks ago when the Communists in charge of China screwed up Alibaba’s Ant IPO because Alibaba Chairman Jack Ma had badmouthed some regulations the week prior? That’s a large part of why you have to be careful with stocks based in China. JD’s my favorite though, and I will hold it steady.

- (The Trillion Dollar Club)

- GOOG/GOOGL Google (7) – Google’s a great investment because the company runs illegal monopolies in many of its businesses. Google’s also constantly being targeted by politicians who pretend they someday might do something to stop Google’s monopolies. I think Google’s business model is terrible for the world and the consumers and any businesses not named Google at this point. But the dominance is real and not going anywhere. I’ve owned GOOG since the IPO and these are the same thoughts I had back then about why we should own GOOG.

- AAPL Apple (7) – I got my new MacBook Air that runs on non-Intel chips, based on an ARM Holdings (soon to be owned by Nvidia) design with no cooling fans. And it can actually run iPhone/iPad apps. And it lasts all day because the Arm chip is so much better than an Intel chip. It’s the first time that Apple’s actually done anything that leaps their computer systems ahead of the prior generations in decades. And then there’s the potential that hundreds of millions of people upgrade to the iPhone 12 or so as it adds 5G and other technologies that are at least a little better than the iPhone 9, 8, 7, and on down from there. That said, Apple’s trading at a historically high P/E right now of 30 and if the company doesn’t earn more than the $4-ish estimate next year, this stock is likely going back under $100 at some point in 2020. I’d rather buy than sell AAPL right now though, as the new computers are good enough that $5ish in Apple earnings is possible in 2020.

- AMZN Amazon (6+) – Amazon is the clearest winner in the work-from-home/shop-from-home/surf-from-home trend that The Coronavirus Crisis accelerated in. If I hear that “The Coronavirus Crisis these trends” that people on TV say every time I happen to have the channel on a business news network, I might sell everything and move to Botswana to become a hermit. Of course, I’d probably order some golf balls from Amazon while I’m there so they’d benefit anyway. Amazon’s stock is not cheap if you look at the P/E as the company always invests a lot of its revenues back in the business, but do you realize that Amazon will do almost half a trillion dollars next year and well over that amount in 2022.