Latest Positions: Space Revolution, More Semis, HOOD, SEDG, PFE, and DALN

Here is Part 4 of the list of my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

- The Space Revolution

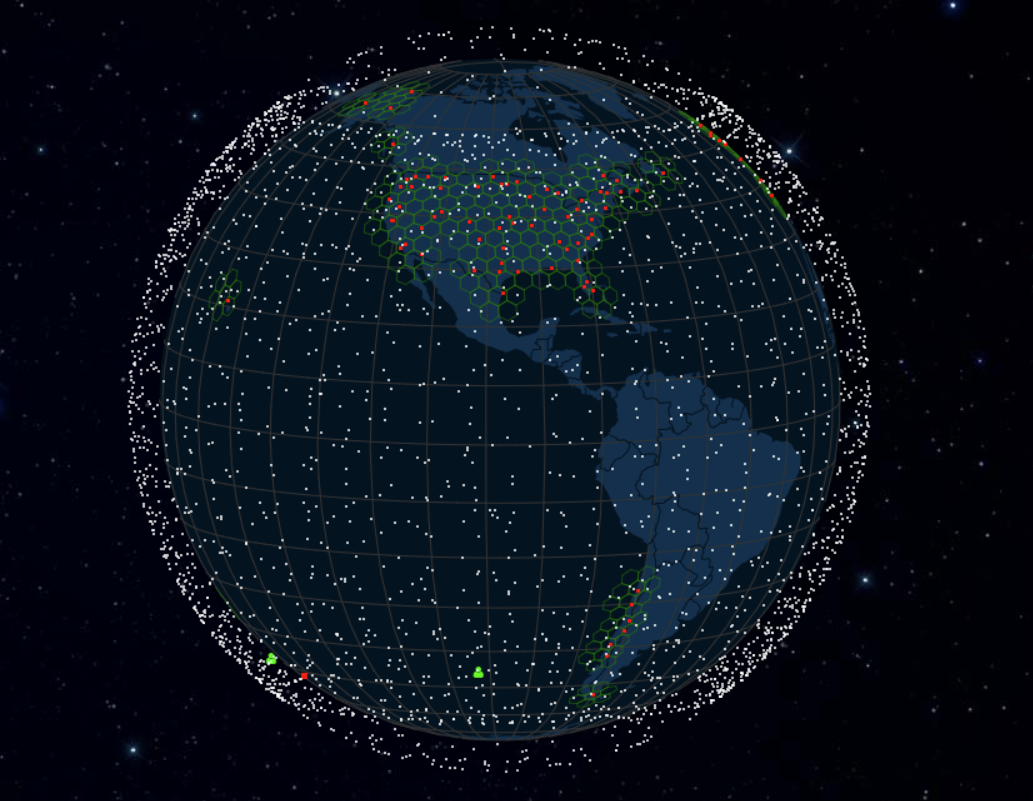

- SpaceX (9) — SpaceX continues its dominance of the Space Revolution and the already MASSIVE gap between SpaceX and the rest of the field continues to widen. SpaceX has completed nine launches thus far in November while most of its competitors cannot complete that many launches in a year. One of those nine launches was the second test of the Starship which flew for over eight minutes and was able to reach space after successfully completing stage separation. Success in our view. The next Starship will likely be ready to launch before Christmas but SpaceX will probably still be waiting on approval from the FAA at that point. Perhaps the most notable achievement this quarter was that we found out that SpaceX is now cash flow neutral. Starlink now has over 2 million subscribers serviced by its constellation of over 5,000 satellites. Below is a neat map we found which is a livestream of all of the Starlink satellites in orbit. Looking at SpaceX’s 5,000 satellites orbiting the Earth on this map illustrates SpaceX’s superiority and makes us wonder how any of the so-called “competition” for internet services like Amazon Kuiper, OneWeb, ViaSat, HughesNet, etc. will survive. SpaceX is still expected to spin off its Starlink division sometime next year although there is probably less of a rush to do so given the company is not burning cash anymore. Onward and Upward.

Source: https://satellitemap.space/

-

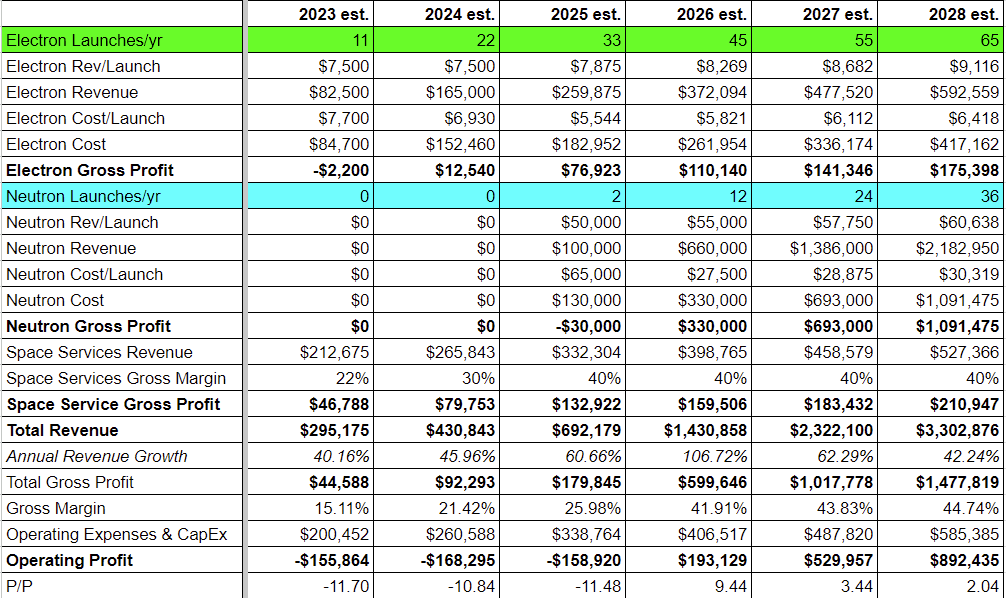

- RKLB Rocket Lab (6+) — Rocketlab had a major setback this quarter when one of its Electron launches exploded shortly after takeoff. This was Rocketlab’s first failure in over two years and after 20 successful launches in a row. Despite the failure, Rocketlab was able to quickly diagnose the issue and less than one month later it received FAA approval to begin launches again. We were frankly astonished that Rocketlab was able to get government approval this quickly and hats off to Peter Beck and team for pulling off what we thought could take 2-3 months minimum in only 25 days. That said, this failure definitely set Rocketlab back in its efforts to increase launch cadence and we have adjusted our financial model accordingly. We now model Rocketlab completing 11 Electron launches this year (down from 15) and 22 launches next year (down from 24). We also reduced the cadence growth significantly through 2028 including cutting the planned Neutron launches from 24 to 12 in 2026. As shown below, the company now has a 9.4 P/P in 2026 and it could get down to 2 P/P in 2028 if everything goes right for the company. This is an attractive valuation 5 years out but it mainly hinges on the success of Neutron, its next-generation rocket, which is much larger than its current rocket and will bring in $50 million per launch compared to $7.5 million for its current launches. From the conference call it sounds like Neutron development is going well but we think it is more likely than not that Rocketlab will have to raise cash to get Neutron deployed. But since Rocketlab is the only company in the US besides SpaceX (and one of the few in the world) that can regularly launch satellites into orbit, it should be able to raise cash on better terms than most startups. We trimmed some Rocketlab this year but are holding tight on a medium-sized position in it for now.

-

- GSAT Globalstar (7) — Globalstar is a very small position for us but we think this could be one of the only other space companies to make it to the other side. Globalstar’s legacy business is a constellation of 48 satellites that provide service for sat phones, asset tracking devices, and other IoT solutions. We are not terribly bullish on Globalstar’s legacy business but we bought the stock for essentially three reasons. First, the company recently hired a new CEO, Paul Jacobs, who was the CEO and Chairman of Qualcomm from 2009 to 2018 and is the son of Qualcomm co-founder Irwin Mark Jacobs. Paul Jacobs ran Qualcomm during one of the fastest-growing periods of the Smartphone Revolution and helped entrench the company as a near de facto standard for communications chips. Second, Globalstar is building a new constellation for Apple which Apple will use to enable iPhones to have emergency satellite connectivity. Apple is reimbursing Globalstar for 95% of the CapEx needed to build the constellation and also provided upfront funding to improve some of Globalstar’s ground stations. Third, Globalstar controls an important band of spectrum, known as Band n53 which operates at 2483.5 to 2495 MHz. This band of spectrum is unique because it can be used for both satellite-to-ground communications and terrestrial networks. Globalstar could potentially use this spectrum in conjunction with its satellites to build private internet networks with high bandwidth outside of the traditional cellular network. The company is working on several deals for this spectrum band but the details of which remain confidential. In short, Globalstar has multiple growth drivers, significant backing from the largest tech company in the world, and a new CEO with a proven track record. That said, the company faces competition from many space/communications companies including none other than SpaceX, who is also working on its own sat-to-cell communications and recently filed to use the same spectrum that Globalstar has controlled for decades. Thus, we are keeping Globalstar as a tiny position for now and would potentially add to our holdings once we learn more of the details of the potential deals for the company’s significant spectrum assets.

- More of the Semiconductor Revolution —

- TXN Texas Instruments (7) — We started buying Texas Instruments in October when the company was putting in fresh 52-week lows around $140. Founded in 1930, Texas Instruments is the oldest semiconductor company in the world (although it did not start out making semiconductors of course. Make sure to read The Great Semiconductor Shift for more history and analysis on TXN, and the next stock discussed below, STM). Texas Instruments makes analog chips that power everything from cars to phones to satellites, and the company has an extremely diverse product portfolio. Texas Instruments is a market share leader in its category and somehow has been able to fend off decades of competition and still maintain some of the highest gross margins in the industry at around 65%. Texas Instruments (or “Texan” as it is commonly referred to on the Street) trades at around 16 P/P currently and a 10 P/P five years out. Nobody on TV talks about Texan because it is the oldest and probably one of the most boring semiconductor stocks out there. That means now is probably a good time to start buying it. Texas Instruments is also investing in new fabs here in the US and recently broke ground on its newest plant in Utah. There are still many years of secular growth to come for Texan and ideally, we want to hold this one for the long term. We are sitting tight on our TXN common stock position for now.

- STM STMicroelectronics (7) — STMicroelectronics reported modest growth in Q3 which is impressive because much of the industry reported persistently high levels of inventory and declining sales last quarter. Like Texas Instruments, STM has a very diverse portfolio but it includes both analog and logic chips. Importantly, STM is a leader in silicon carbide (SiC) and gallium nitride (GaN) chips which (as we have explained many times) are much more efficient and powerful than traditional silicon chips for many applications. STM is also building new fabs around the world and counts both SpaceX and Tesla as major customers. Lastly, STM stock is outright cheap with an 8 P/P right now and 6 P/P five years out. We are mostly sitting tight on STM right now but still own a few in-the-money calls on it for December which we bought last month.

- The Fintech Revolution

- HOOD Robinhood Markets (7) — Robinhood reported a fine quarter but the stock got hit after the company said its stock-lending business had slowed down in October. The market hates a lot of fintech names right now and it feels like Robinhood has been left for dead even though the fundamentals are basically unchanged and the company is sitting on over $5 billion in net cash, giving it an enterprise value of just over $2 billion. Robinhood has $485 million of positive adjusted EBITDA (TTM) which means it is trading at just over 4x EV/EBITDA which is pretty cheap for a startup. We would have liked to seen more growth in AUM and users this quarter but in the grand scheme of things, Robinhood is still very early in its business lifecycle. The company is Revolutionizing a centuries-old business and is coming off of a period of outsized growth during the pandemic. Given the size of the market that Robinhood is going after — which is literally trillions of dollars in assets — we think Robinhood is still a great stock to own for the next 10,000 days. Robinhood is a medium-sized position for us and we are mainly holding tight on it for now.

- The Alternative Energy Revolution

- SEDG Solaredge (6+) — Here is what we wrote about Solaredge in our first quarter Latest Positions update which we sent out on April 21st when SEDG was at $319/share: “Solaredge and just about every other solar stock has been on fire for the last month. Why? Good question. It feels like solar is in its own bubble at the moment with many of these companies skyrocketing despite not being very profitable and with revenue growth likely to slow. While the IRA might boost some subsidies for solar, California (historically the largest solar market in the US) is set to cut its solar subsidies. Additionally, rising interest rates change the economics for these solar systems and there are likely many customers who would have installed solar panels on their house if they could have borrowed money at 3% but now cannot do it at 7%. We have been spending a lot of time researching these names and it is clear that this is a crowded field and we would rather be short than long most of the solar companies that are not called Solaredge. All of that said, it is clear that solar as a whole is a secularly growing industry and we want to continue to bet on the decentralization of power. But if 2022 taught us anything, we cannot pay unreasonable premiums for stocks just because they are growing rapidly.” Even though we knew that SEDG and every other solar stock was in a bubble earlier this year, we obviously did not anticipate that the stock would end up losing 75% of its value in 6 months (although that can and does happen often with even the best companies). The fact is we bought SEDG when it was at $14/share and it had been a great winner for us and we did not want to blow out of all of it back in April. All stocks are susceptible to being bubbled up and oversold and it is just too hard to try and time those exact tops and bottoms and that is the reason we trade using tranches. As mentioned in the above-quoted Latest Positions report, we were trimming SEDG and buying puts on most of the other solar stocks when we knew the stocks were in a bubble and that is our job as investors. If we sold 100% of our Apple, Meta, Tesla, or NVIDIA every time we thought it was overvalued, we would have missed out on most of the gains in those stocks. We have to find an investing strategy that is repeatable for the long term, and moving in and out of entire positions based on short-term price movements simply is not replicable. Solaredge makes a Revolutionary product that is one of the best in a Revolutionary industry and for that reason, we want to stick with it for now. That said, the solar sector is likely to remain in a slump as interest rates remain higher for longer so we are not rushing to buy more SEDG at this very moment. This is a smallish position for us and we will start to buy more if/when we see the underlying fundamentals for the solar industry start to turn around.

- Miscellaneous

- PFE Pfizer (7) — We recently picked up some call options on Pfizer as mentioned in last week’s trade alert. Most of us know Pfizer because it is a household name and it gained even more prominence because of its COVID vaccine. But the company makes a lot more than just COVID drugs. Here is a brief description of Pfizer’s product portfolio according to ChatGPT: “Pfizer, a global pharmaceutical leader, boasts a diverse and robust product portfolio, underpinned by a strong focus on innovation and research. Key areas include:

- Vaccines: Their portfolio is headlined by the COVID-19 vaccine, Comirnaty, developed in partnership with BioNTech. This vaccine has been a major revenue driver and a testament to Pfizer’s rapid response capabilities in vaccine development.

- Oncology: Pfizer has a strong presence in cancer treatment, with notable drugs like Ibrance (for breast cancer) and Xalkori (for lung cancer), demonstrating their commitment to addressing various complex oncologies.

- Internal Medicine: This segment includes Eliquis, a leading anticoagulant, and various cardiovascular and metabolic disorder treatments, showcasing Pfizer’s expertise in chronic disease management.

- Inflammation & Immunology: Drugs like Xeljanz for rheumatoid arthritis represent Pfizer’s strides in treating autoimmune diseases, a field of growing importance in pharmaceuticals.

- Rare Disease: Pfizer is also focusing on rare diseases, with treatments like Vyndaqel for ATTR-CM, reflecting their dedication to addressing less common but significant medical needs.

- Hospital Products: Their hospital portfolio, bolstered by the acquisition of Hospira, includes anti-infectives and sterile injectables, vital in healthcare settings.

- Consumer Healthcare: Though a joint venture with GlaxoSmithKline, Pfizer contributes to a range of over-the-counter products, enhancing their market presence beyond prescription medicines.”

The stock has come down big time as COVID vaccine and treatment product sales have fallen off a cliff. However, Pfizer has a great portfolio of other products that will likely generate secular single-digit growth for many years to come. Additionally, the company is working on a weight-loss drug to compete with Ozempic which could provide a near-term catalyst. The stock is already pretty cheap (16 P/P currently), pays a 5.5% dividend, and if the company can demonstrate any kind of success with its new drugs, the stock has lots of room to the upside. We are not making this a major position just yet but we like the risk/reward setup for Pfizer here using relatively long-dated call options near-the-money which have very low premiums right now.

- DALN DallasNews Corporation (7) — Not much has changed with DallasNews since we sent our original write up on the company back in September. The company did announce a voluntary severance program which was accepted by 58 employees. This cost the company $2.5 million but is expected to result in $3 million in annual cost savings. This is certainly a step in the right direction and we hope to see more of this from DallasNews going forward. We are meeting with the management team in Dallas during the first week in December and we will have more updates for you following that meeting.

- PFE Pfizer (7) — We recently picked up some call options on Pfizer as mentioned in last week’s trade alert. Most of us know Pfizer because it is a household name and it gained even more prominence because of its COVID vaccine. But the company makes a lot more than just COVID drugs. Here is a brief description of Pfizer’s product portfolio according to ChatGPT: “Pfizer, a global pharmaceutical leader, boasts a diverse and robust product portfolio, underpinned by a strong focus on innovation and research. Key areas include:

That wraps up our Latest Positions updates. We hope everyone had a great Thanksgiving with their friends and family and we will hit the ground running on Monday with a full week ahead. Rock on!