Latest Positions: The Content, Space, Defense and Genetics Revolutions

Here is a Part 4 of 5 of the list my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

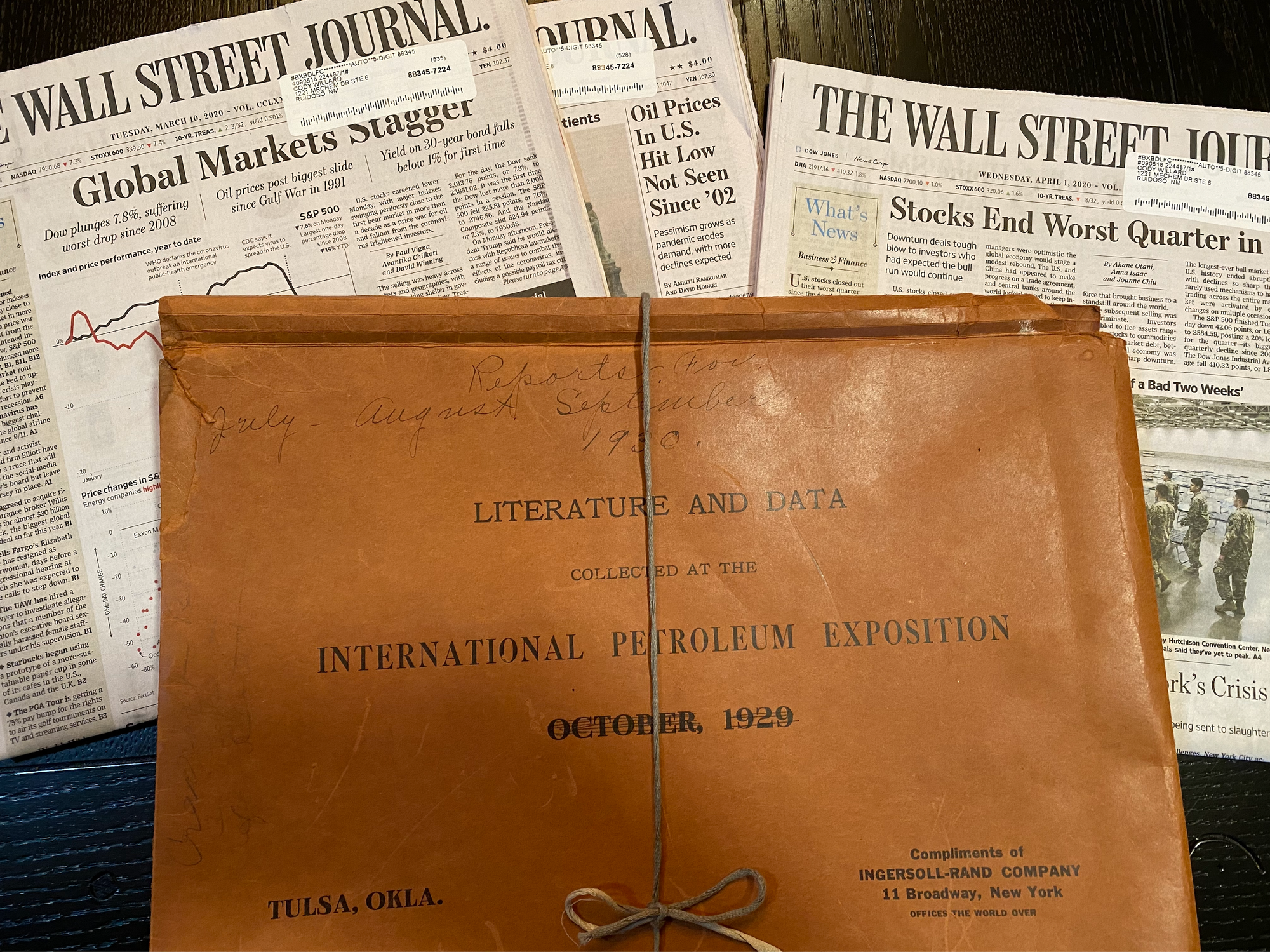

Tonight I start with this picture of a folder that my great-grandfather used to keep stamps in. My mom just found it and gave it to me today. Notice the date that he marked out at some point, the infamous October 1929. I googled the International Petroleum Exposition and this is what I found. Oil was at $1.50 per barrel in 1929, on its way to $60 cents over the next couple years as the Great Depression took hold. The world moves much faster these days than it did back then, money moves instantly, it’s a global world. But the lessons of the past are never a bad thing and it sure is cool that I have this folder in my office now.

A day seems like a week in this market and while we’re on lock down. A week seems like a month. A month seems like a year. And that’s partly because stocks have made moves that should take years to happen. But we live in a strange time and money moves instantly.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- (The Content Revolution)

-

- NFLX Netflix (6) – It’s admirable how Netflix keeps going all-in on new content, spending tens of billions of dollars to create extremely high quality programming for every taste and language all over the globe. At some point if the company just slows spending and keeps becoming the dominant TV content platform, it could kick off tens of billions of dollars in cash per year in a few years. That’s still the bet here, but as usual since I’d bought this stock when it was trashed back in September at $260, I’ve been trimming it lately, including today as it hit new all-time highs.

- DIS Disney (6) – If Disney+ were its own company, I could see it being worth a hell of a lot more than it is probably worth inside of the Disney crowd. Disney+ as its own standalone business has incredible margins and incredible growth prospects in front of it. However, I don’t know that it would be worth as much as Netflix because Netflix is on every remote control TV, it’s on every … Its critical mass is worth a lot. It’s much larger in total number of hours that you can consume of content at Netflix, is worth a lot. Back to Disney, like we mentioned though, Disney+ is just a small part of its overall company. Those other sectors that the company operates in are in trouble though. If Disney Cruise was its own company, it would be down 90% and going bankrupt just like Carnival and the other airline companies are. Disney theme parks and hotels would be down 50, 60, 75% like Marriott and all the hotels are. So Disney+ already keeping a lot of value in that Disney stock, which is “only down” 35%. The market’s recognized that there’s values in Disney+ and keeping Disney higher than it would’ve otherwise have been. I’d made DIS a pretty big position, but have taken some losses on part of that position as I’ve trimmed this name down too.

- (The Space Revolution)

- SPCE Virgin Galactic (6) – Nothing’s changed except their access to capital. We six months ago would look at that and be like, look, there’s going to be so much money coming into the space revolution in the next three, four, five, 10 years that Virgin Galactic’s going to have their bucket out in front of some of that. They’re going to get some of it. They will be funding their business to the point where if they actually pull any of it off, it’s going to become a virtual self-funding profitable enterprise. I’m not sure we’re there anymore. Access to capital’s not going to be as easy as it was on the other side of this if things don’t get better quickly, and that’s what you’re betting on if you’re going to buy Virgin Galactic, that things are going to get better, they’ll continue to have access to capital, in a year or two, things will be fine. The stock, like I’ve said all along, could be a tenbagger if they figure out supersonic shipping, to send things from China to the U.S. in an hour on these subspace ships. I still own it, but like everything else, I trimmed it. You guys know I was trimming it $20 and $30 up to $40, and I’ve not bought much back. I did buy a little bit back at some point and I bought some back even the other day, like when it got below $10, I think. But I’ve trimmed that already. I’ve got a core position, and if you don’t own any or don’t feel like you own much, then maybe yeah, add a little. But know that there’s more risk in SPCE than there was, even with the stock having come down from $30 or $40, and of course, the stock’s up from $8, where we bought it, so whatever. This is yet another one I’ve trimmed down a bit and I’m in no rush to add it back.

- (Defensive names)

- CPB Campbell’s (6) – Campbell’s has been a pretty steady stock for us, as it’s risen from $30ish where we bought it at the lows to now $50 a share. The company is another one that benefits from the Coronavirus Crisis trends that it’s a part of as people are stocking up on canned goods like good ol’ Campbell’s Soup. The stock did have a wild ride during the Coronavirus Crisis as it spiked to nearly $60 and then crashed to nearly $40 before settling back here at $50 again. Let’s see how long it lasts, but at the current valuation, this isn’t a stock I’m thrilled about. I’ll hold my smallish core position here steady out of discipline though.

- GLD Gold ETF (7) – Gold’s been on fire for most of this year, but remarkably, it had a mini-crash of its own in March and bottomed exactly at the same time the stock market did. I suppose that underscores the power of the Fed’s printing press when they kicked it on into overdrive with new trillions of dollars at about the same day that the markets bottomed. I’ve long explained that I think gold could go to $5,000 or $10,000 an ounce in my lifetime and part of that theory is that the Fed will have a hard time putting its dollar printing genies back into the bottle in my lifetime.

- (Genetics Revolution)

- CRSP Crispr Technologies (7) – I’m still learning about what this company does, and it’s often best to start at the company’s own website and then drill down from there. Here’s how they describe what they do: “At CRISPR Therapeutics, we are focused on developing transformative gene-based medicines for serious human diseases. We are rapidly translating our specific, efficient and versatile CRISPR/Cas9 gene-editing platform into therapies to treat hemoglobinopathies, cancer, diabetes and other diseasesOur multi-disciplinary team of world-class researchers and drug developers works every day to translate our CRISPR/Cas9 technology into breakthrough human therapeutics. Our lead program targeting the blood diseases β-thalassemia and sickle cell disease has entered clinical testing, as has our first allogeneic CAR-T program targeting B-cell malignancies. We are also advancing additional blood stem cell, immuno-oncology, regenerative medicine and in vivo programs towards the clinic.”

So this is some pretty cutting edge stuff and something we should be careful about betting on because we are not trained experts in this field. That said, this company has a billion dollars in cash on the balance sheet and when we bought the stock it was valued at just over $2 billion. That does mean that the market is valuing this business at a couple billion dollars which means if they don’t get some successful products out in the market place in the next year or two, the stock will be in trouble because they are burning cash in the meantime. The stock has run 25% in the two weeks since we started buying it and I’m not going to plow into a huge position right here, but will build it up discplined-like over time.

- CRSP Crispr Technologies (7) – I’m still learning about what this company does, and it’s often best to start at the company’s own website and then drill down from there. Here’s how they describe what they do: “At CRISPR Therapeutics, we are focused on developing transformative gene-based medicines for serious human diseases. We are rapidly translating our specific, efficient and versatile CRISPR/Cas9 gene-editing platform into therapies to treat hemoglobinopathies, cancer, diabetes and other diseasesOur multi-disciplinary team of world-class researchers and drug developers works every day to translate our CRISPR/Cas9 technology into breakthrough human therapeutics. Our lead program targeting the blood diseases β-thalassemia and sickle cell disease has entered clinical testing, as has our first allogeneic CAR-T program targeting B-cell malignancies. We are also advancing additional blood stem cell, immuno-oncology, regenerative medicine and in vivo programs towards the clinic.”