Latest Positions: The Space Revolution, HOOD, BLDE, and UPWK

Here is a Part 4 of the list of my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

- Longs –

- The Space Revolution –

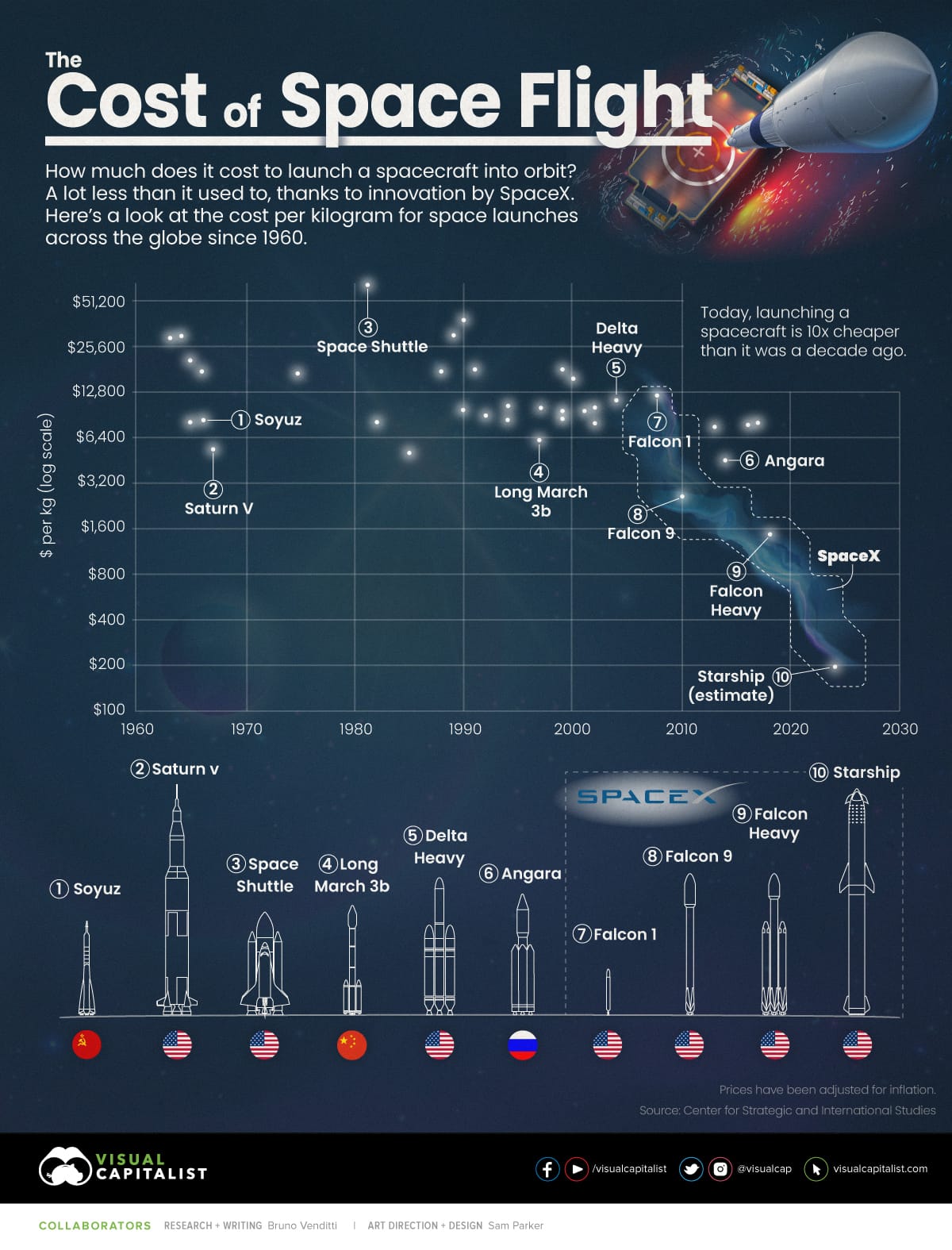

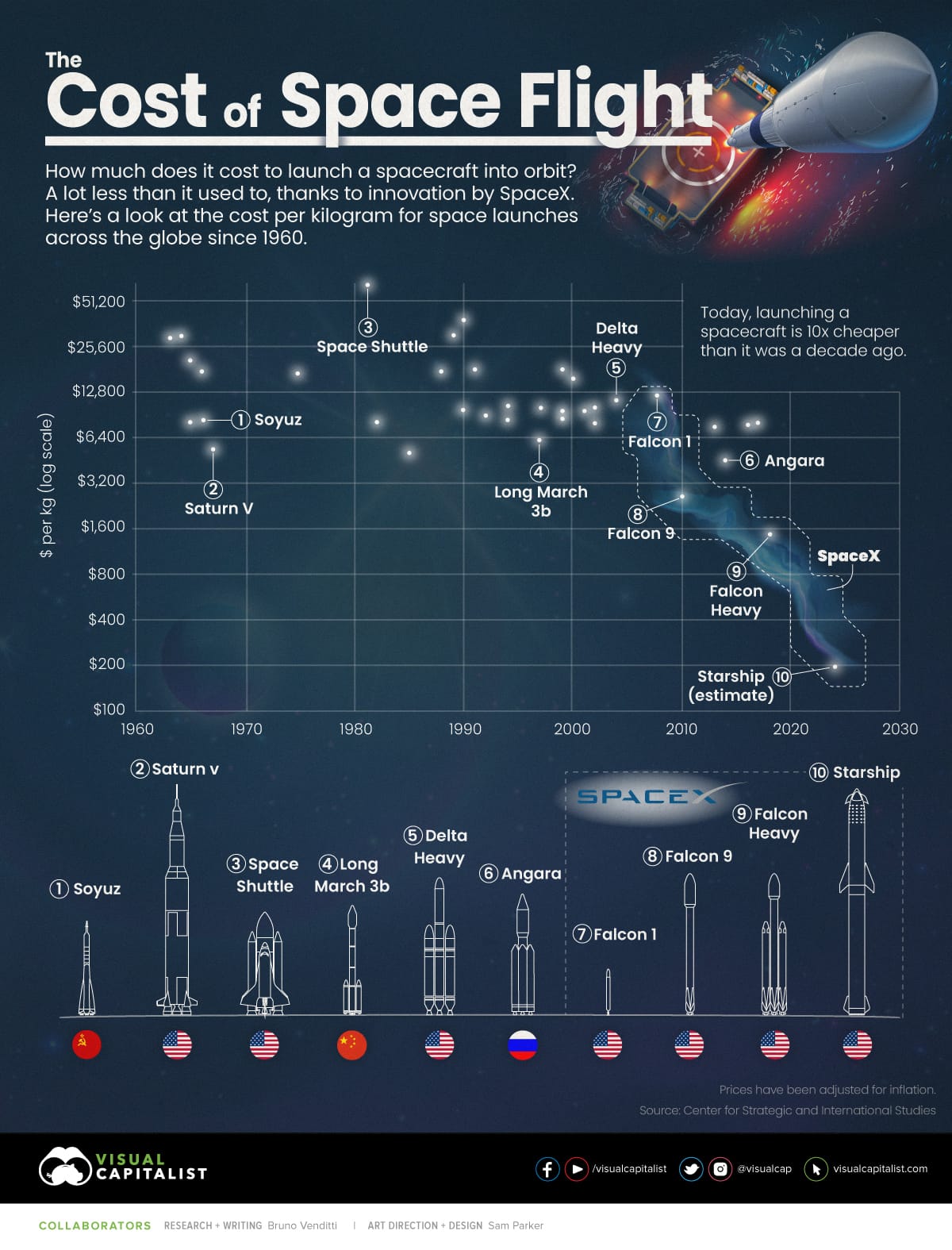

- SpaceX (8+) – As of yesterday, SpaceX completed its 60th launch of the year, well on its way to hitting its goal of completing 90 launches in 2023. We spend a lot of time working on the Space Revolution because we think it is one of the most obvious multi-trillion dollar economies to be developed over the next decade or so. In almost every conversation we have with someone in the industry, we end up talking about SpaceX at some point. Love it or hate it, SpaceX is single-handedly enabling much of the growth that we are seeing in the space industry today because it has lowered the cost of launch by several orders of magnitude from where it was only a few years ago. The costs of launch will potentially go down another order of magnitude once Starship is fully ramped. Starlink is also doing well, having reached 1.5 million subscribers in May of this year and probably getting close to 3 million subscribers now. We recently got a glimpse into SpaceX’s finances when the WSJ reported in August the company generated $55 million in profit on $1.5 billion in revenue during the first quarter of 2023. In 2022, total revenues doubled to $4.6 billion with total expenses reaching $5.2 billion, up from $3.3 billion the year earlier. We purchased more SpaceX for the hedge fund earlier this year and we are hopeful that we’ll get to see a Starlink spinoff IPO in the next year or so given the success of the business thus far.

- The Space Revolution –

Image Source: Visual Capitalist.

-

-

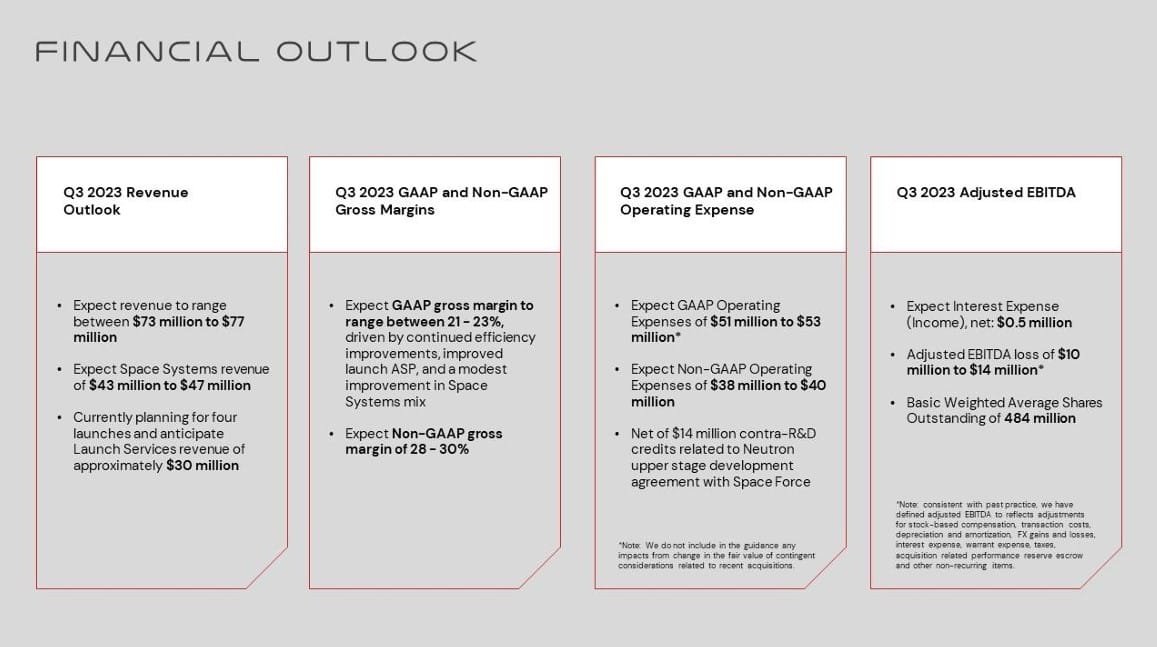

- RKLB Rocket Lab (7) – Rocket Lab is essentially the last Space SPAC standing. Unlike almost every other space company that came public during the 2020-2021 bubble, Rocket Lab is executing its approach and completing launches at an ever-increasing cadence. We recently caught up with our friends at the Rocket Lab IR department and we are always pleased to hear about the exciting things happening at the company. Rocket Lab is continuing to pick up business from several failed launch companies (Virgin Orbit (VRBO), Astra, etc.) in addition to developing new business lines like its recently announced hypersonics business. The company also took advantage of the VRBO bankruptcy when it agreed to purchase, for pennies on the dollar, VRBO’s 144,000 sqft. manufacturing facility which is located only 15 minutes from Rocket Lab’s HQ in Long Beach, CA. Rocket Lab is on track to complete its targeted 15 launches this year and is also working hard to get its next-generation mid-size rocket, Neutron, online by the end of 2025. Lastly, Rocket Lab’s space systems division continues to grow between 10-20% per year and is in the midst of building out a constellation of satellites for Globalstar (GSAT) which will enable GSAT to provide emergency SOS service to iPhones via its contract with Apple. In short, Rocket Lab continues to stand out as one of the only public space companies that can actually deliver on its promises and complete missions to space on a regular basis. We bought this stock initially too high, but we loaded up on the stock when it got below $4 earlier this year and have mainly been sitting tight as the stock has rallied to above $6 recently.

-

-

- The Fintech Revolution –

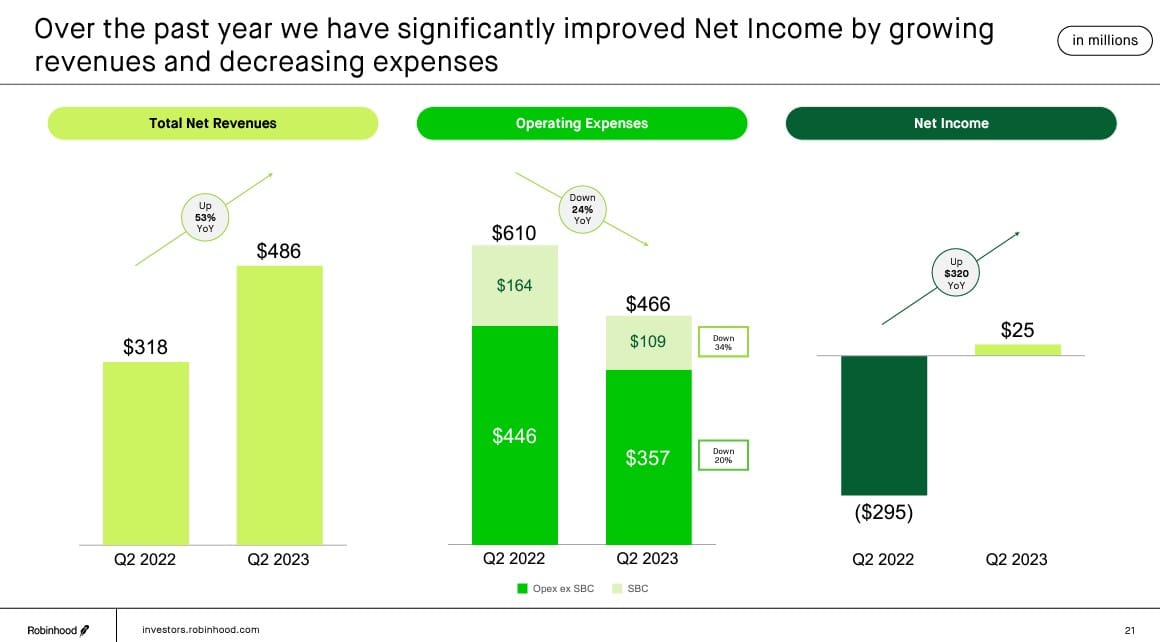

- HOOD Robinhood Markets (8) – In case you missed it, we recently did a deep dive on Robinhood wherein we discussed its potential to become a Revolutionary Financial SuperApp. We started buying Robinhood back on July 6 when the stock was around $10.50/share. Since then, the company turned in its first-ever quarter of GAAP profitability in Q2 thanks to decreasing operating expenses, rising interest income, and stabilizing transactional revenue. We got the chance to meet with the investor relations team after the results were out and we were very impressed with what we heard. The company continues to develop new products/innovations at a rapid pace, including recently upping the IRA match to 3% from 1%. Robinhood also acquired a credit card startup and the company is excited about its opportunities in credit. We expect Robinhood to continue to bolt on new features (like the credit card) that will drive incremental revenue growth from its existing customer base. Robinhood also continues to grow its users. In Q2, monthly active users (MAUs) dropped 1mm from Q1 levels but management explained that it was attributable to lower activity levels and not users actually leaving the platform. Net funded accounts (which is a better measure of unique users on the platform) still grew by 310,000 YoY to a record 23.2 million accounts. Robinhood also announced just today that it agreed to purchase 55,273,469 shares of its own stock for $10.96 per share (or just over $600mm in the aggregate) from the court handling Sam Bankman-Fried’s bankruptcy. That comes out to about 6% of the total shares outstanding. It is nice to see a company buy back a large percentage of its stock when it is closer to its lows rather than try to do a secondary in a desperate attempt to raise cash as we have seen so many poorly run companies do lately. We are still really excited about Robinhood and are buyers when it gets a $10 handle.

- The Fintech Revolution –

-

- The Air Mobility Revolution –

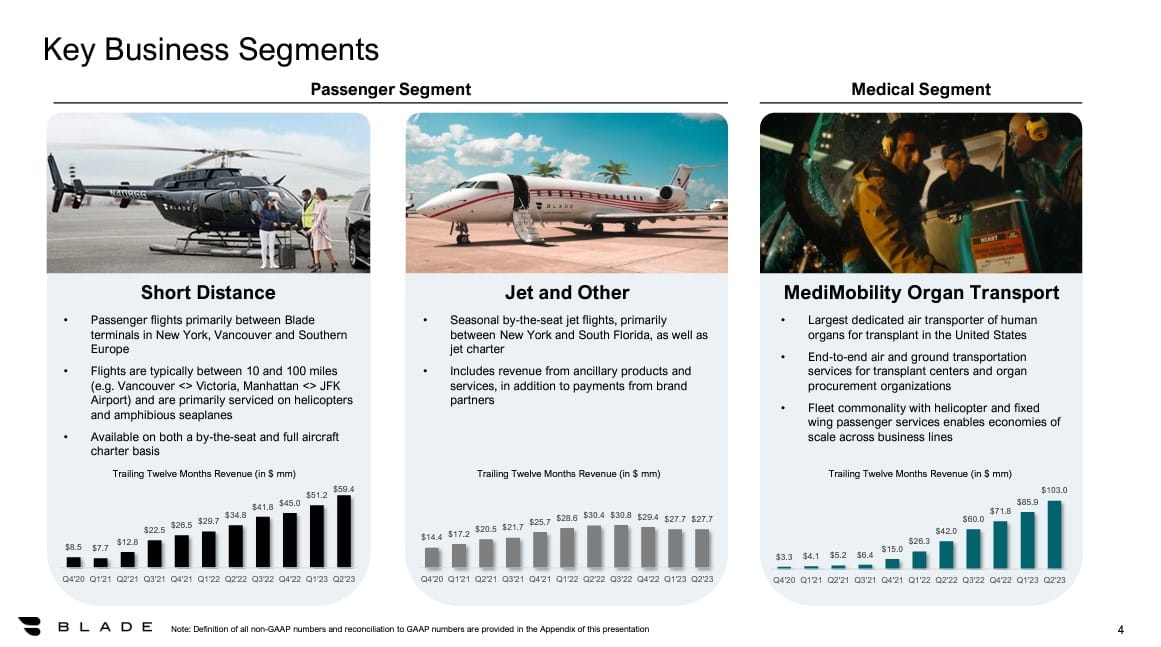

- BLDE Blade Air Mobility (7+) – Blade’s stock has been under pressure lately and we continue to build up this position on down days. We published an in-depth analysis on Blade on August 8. Like many other unprofitable small caps, Blade’s stock has been punished as many investors are opting to invest their capital risk-free and earn 5% in treasuries rather than speculate on growth companies. As we mentioned in the write-up, Blade is still in its early stages and this should be considered a venture-capital-like bet. With a market cap of only $236mm, there is a lot of upside here if Blade can accelerate growth and/or achieve profitability quicker than expected. The company’s Q2 results were impressive with revenue up 71% YoY, flight margins up to 17% from 14%, and corporate expenses down 12% YoY. Blade expects to have meaningful positive EBITDA in 2023. The company’s organ transport business grew 99% YoY and its airport business grew 65% YoY. We think management’s focus on profitability and steady growth is the right approach. We are buyers of the stock right here but there could be more near-term pain so be sure and use tranches rather than loading up all at once.

- The Air Mobility Revolution –

-

-

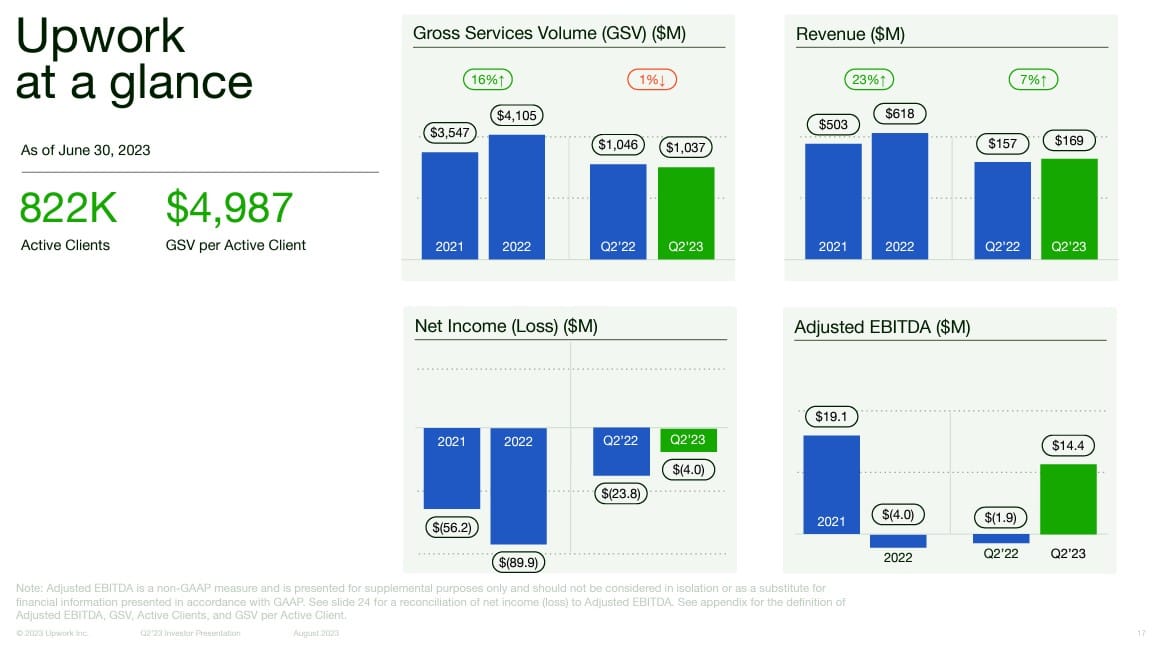

- UPWK Upwork (6+) – Upwork has had a monster move (up 44%) since reporting second-quarter earnings on August 2. The company had a nice profit beat (reported $0.10 EPS v $0 expected). Upwork had been basically left for dead when we sent out a Trade Alert that we were buying it below $8 on June 1. This is what we were writing about the company back then: “We bought UPWK after both it and its competitor FVRR had been beaten up because the market thought AI would ultimately replace the need for most freelancers (writers, content creators, programmers, etc.). But the more we play with ChatGPT and Bard, the more frustrated we have gotten. It has thus far been unable to successfully write code for the programs we want, so we have UPWK to hire freelancers to help us with AI programming. We should also mention that both ChatGPT and Bard have repeatedly given us straight-up false information and made-up facts. With that in mind, we think ChatGPT and Bard may actually increase the demand for freelance programmers and the like to help people like us actually utilize AI in our business. We like UPWK because it has reached critical mass of both clients and freelancers, and has a fairly attractive valuation.” It turns out that ChatGPT actually did drive increased demand for AI-related freelancers. On the Q2 conference call, the Upwork CEO explained that “Outstanding growth in this category [AI] of work continued in the second quarter, as AI was the fastest-growing category on Upwork in the first half of 2023. In fact, generative AI job posts on our platform were up more than 10x while related searches were up more than 15x when comparing the second quarter of 2023 to the fourth quarter of 2022.” With the stock now up over 86% from where we started buying it, we are simply holding tight. While we like the long-term fundamentals of the company, it is not quite Revolutionary and it has serious competition from Fiverr (FVRR) and others online work platfroms. We are also a little concerned that corporate cost-cutting could put a lid on revenue growth for the next couple of years. We trimmed some Upwork when it got above $15 and we would look to add to it if it got back to below $10.

-

That wraps up our latest positions. We want to wish you a very happy and safe Labor Day weekend! Don’t forget, I will be speaking at the Ingenuity Venture Fund Investor Symposium in Albuquerque on September 26-28. You can learn more or sign up here.