Latest Positions: The Trillion Dollar Club, Energy Revolution, and Reshoring Revolution

Here is a Part 3 of the list of my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

- Longs –

- The Trillion Dollar Club –

- AAPL Apple (6-) – What can we say about Apple that hasn’t been written this year? Back twenty years ago, fifteen years ago, ten years ago when I used to pound the table on this stock, nobody cared about it. Now it is the largest public company in the world and its earnings every quarter are some of the most anticipated and widely analyzed on Wall Street. Since we last wrote, Apple introduced its first new product line in nine years with the Vision Pro. I am frankly a little disappointed with the Vision Pro and its battery dongle and $3500 price tag and I have doubts whether revenue from the product will move the needle much at Apple. Apple is still a core holding for us but it is also still expensive, as we mentioned in the last write-up: “With a $2.6tt market cap, the company is now trading at roughly 28x 2023 earnings estimates and revenue is expected to decline 1.5% over that same period. AAPL is now only 18% away from its all-time high of $182 set back in January of 2022.” Apple was at $165 when we wrote that and has since blown through its all-time high, running to $198 (with its market cap topping $3tt) before dropping back to $188 currently. Apple’s Q2 results were in line with Street expectations and the stock sold off a bit following the release. Revenue was down 1.4% YoY and earnings were up 2.3%. Apple is now trading at 31x 2023 earnings estimates and 28x 2024 estimates. Feet to fire, I think Apple and some of the other mega-cap tech stocks will trade flat to down for the next couple of years while earnings eventually catch up with the stock prices. With the risk-free rate offering a 5% yield and Apple having little to no growth for now, it would make sense that Apple trades closer to a 15-18 fwd P/E (which would give us a 6.7% earnings yield) rather than a 31 P/E. That said, it is still an amazing company and it has the potential to grow substantially again if it rolls out new Revolutionary products/services.

- The Trillion Dollar Club –

-

-

- GOOG/GOOGL Alphabet (7-) – After working with and spending a lot more time on ChatGPT, talking with one of Google’s AI gurus, and seeing what the company has been able to do with its own AI offerings, we have decided that Google was one of the best-positioned companies to successfully market and monetize AI. While ChatGPT is probably somewhat of a threat, we have a lot more confidence in Google’s ability to innovate and develop AI products that people will love and use than we do in Microsoft/OpenAI’s ability to do the same. Moreover, we think Google will be able to integrate AI into its existing platform seamlessly, quickly, and effectively, something we are not really expecting from Microsoft. Trading at 20x next year’s earnings estimates, Google is not necessarily cheap but it is relatively better priced than most of the other mega-cap tech names (AAPL 28x, MSFT 26x, AMZN 44x). Analysts think that Google will grow revenue by 10-11% for the next two years and there is probably room to the upside in those numbers if Google’s AI offerings (including its new $30/month enterprise AI product) get some traction. In Q2, we also saw Google’s YouTube revenue grow over 4% YoY after declining for the last few quarters, which was one of the reasons that we were worried about the stock earlier this year. We bought back some Google in the hedge fund at the beginning of July when it was about $120 and might add more if it gets back to those levels.

- AMZN Amazon (7-) – The Amazon print came in a lot better than expected after the company reported on its Q1 earnings call that it had seen a huge drop off in cloud demand in April following the banking crisis in March. It turns out that those fears were overblown and Amazon turned in good numbers in Q2, with revenue up nearly 11% YoY. In addition to the cloud business stabilizing, retail consumption also continued to be surprisingly strong, with Amazon reporting its best Prime Day in company history. Across two days in July, Amazon reported $12.7 billion in online sales, a 6.1% jump from last year. Although Amazon has done really well this year, we have seen a lot of weakness in traditional retailers like Foot Locker (FL), Dicks Sporting Goods (DKS), Macy’s (M), and Dollar General (DG), just to name a few. There is a massive divergence in the performance across retailers and retail brands right now, with many stocks in the same industry hitting 52-week lows and 52-week highs at the same time. We would not be surprised to see some of the weakness in retail spread to some of the companies like Walmart and Amazon that have thus far been largely immune to the pain. Amazon’s stock is up 64% this year, outperforming the Nasdaq by a whopping 22%. We would like to see the stock pullback to the $110 level before buying more.

-

-

- The Energy Revolution –

- SEDG Solaredge (6+) – Remember what we were writing back in April when Solaredge was at $320/share? “Solaredge and just about every other solar stock has been on fire for the last month. Why? Good question. It feels like solar is in its own bubble at the moment with many of these companies skyrocketing despite not being very profitable and with revenue growth likely to slow. While the IRA might boost some subsidies for solar, California (historically the largest solar market in the US) is set to cut its solar subsidies. Additionally, rising interest rates change the economics for these solar systems and there are likely many customers who would have installed solar panels on their house if they could have borrowed money at 3% but now cannot do it at 7%. We have been spending a lot of time researching these names and it is clear that this is a crowded field and we would rather be short than long most of the solar companies that are not called Solaredge. All of that said, it is clear that solar as a whole is a secularly growing industry and we want to continue to bet on the decentralization of power. But if 2022 taught us anything, we cannot pay unreasonable premiums for stocks just because they are growing rapidly. We trimmed some SEDG the other day and would buy more if this stock ever gets back to the $200 range.” Cody back here in real time. Turns out that the entire solar sector was indeed in a real bubble earlier this year, with SEDG down about 50% from where we were trimming it when we sent out that update. Meanwhile, Enphase (ENPH) is down about even more, and the entire Invesco Solar ETF (TAN) is down about 25% (comparison chart below). We nibbled on some SEDG two weeks ago but haven’t made it much of a position since we sold it down in April. We are still believers in the long-term bull case for Solaredge as we want to bet on the continued decentralization of energy, but the demand headwinds resulting from 5%+ interest rates are not going away anytime soon. If the stock really gets beat up from here, we might add to our position around $150.

- The Energy Revolution –

-

-

- SMR NuScale Power (7+) – NuScale’s stock has been under pressure lately along with almost every utility-related or alternative-energy-related stock. As we mentioned a few weeks back, a lot of the major electric utilities are putting in multi-year lows every day. With higher interest rates likely here to stay, those utility companies become less profitable because of their extremely high debt loads and inability to quickly pass along those cost increases to ratepayers. We recently had the chance to catch up with the IR team at NuScale and feel confident that the company is executing on its strategy. NuScale is signing more customers and it recently began production of its first castings. Additionally, the US Government recently announced a $275mm commitment to help the country of Romania install NuScale SMRs. NuScale now has two customers and is on track to sign three more customers before the end of this year. We do think NuScale could still be a ten-bagger (or more), but this challenging utility/energy environment is probably going to continue being a drag on the stock. Remember, this is a venture-capital-like bet. As we have said since the original write-up, the near term could be painful for the stock as the company will not be generating meaningful revenue or profits for the next year or so. However, if NuScale can start successfully building and deploying its SMRs, the addressable market is huge and it could be doing a $10-$20bb in revenue pretty quickly.

- The Reshoring/Automation Revolution –

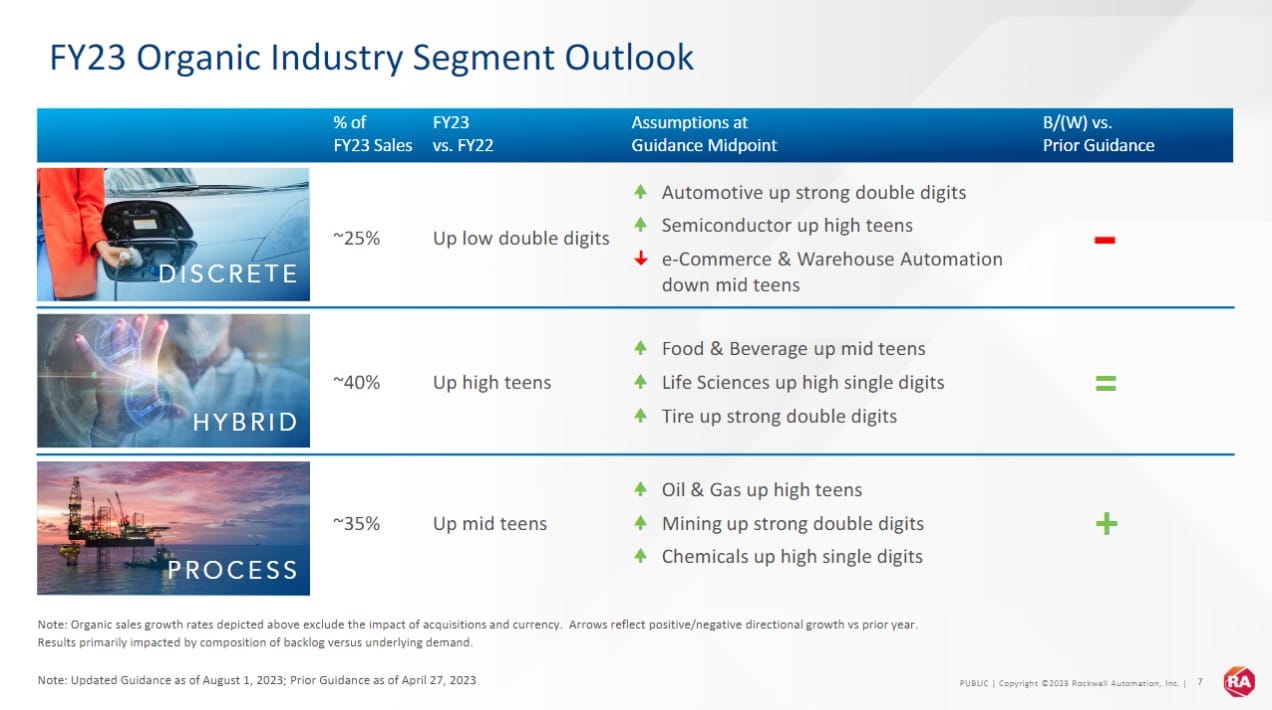

- ROK Rockwell Automation (7) – Rockwell has been a great stock for us as is at the vanguard of both the Reshoring and Automation Revolutions, which is why we initially bought it. According to Morgan Stanley, there has been $686bb in cumulative mega project ($1bb+) announcements since the start of 2021 (see image below). This trend will likely continue as attitudes toward China and much of Southeast Asia have really soured in the last few years. The importance of having a secure and effective supply chain has never been more prominent. But to make manufacturing in the US/Europe cost-effective, these companies need to automate their systems so that labor costs are minimized. Rockwell makes the equipment and software that powers automation for companies building these factories and process facilities (think refineries, water treatment plants, etc.). When we last wrote about Rockwell, we mentioned that “Analysts are only predicting ~4% revenue growth this year and if the company is able to beat those numbers (as we expect) we think the stock is likely higher from here.” Rockwell did turn in a faster-revenue-growth quarter in Q2 with sales and EPS both up over 13% YoY. Additionally, as we had been expecting, Rockwell upped its full-year revenue growth guidance range to 14%-16%. Because of how much we believe in the Reshoring and Automation Revolutions, we have been looking for other stocks in this area. However, we continually come back to Rockwell because most of the other companies in this sector are over-diversified conglomerates and not good pure plays. With Rockwell’s stock currently trading at around 23x 2024 earnings estimates, we would probably wait for the stock to get closer to $280 before buying more.

-

-

-

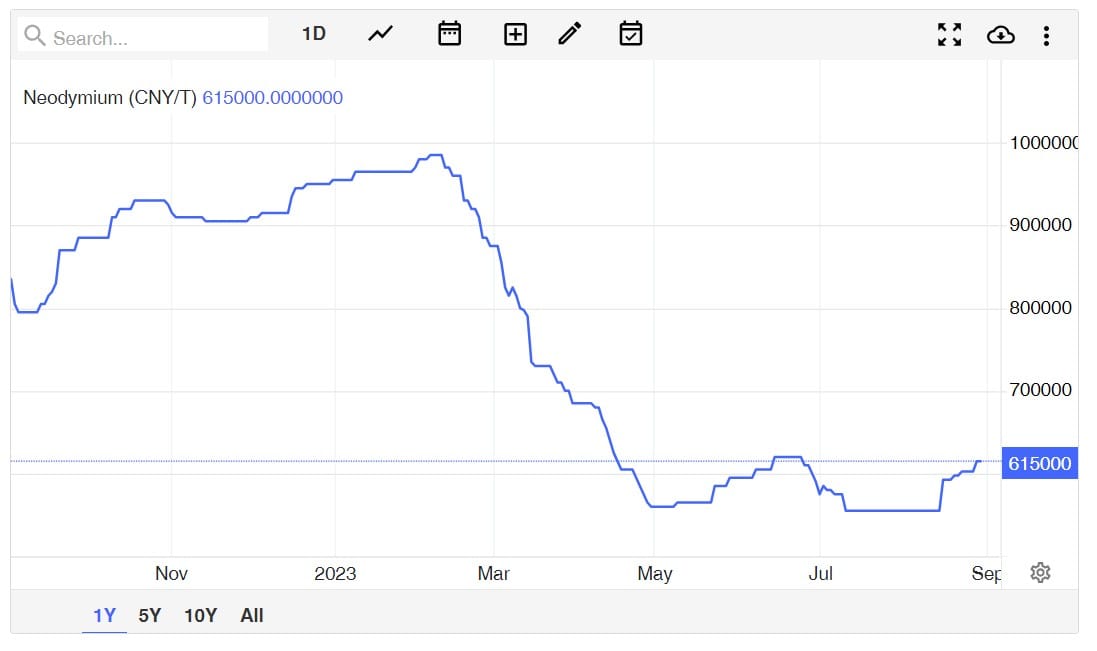

- MP MP Materials (7) – MP’s stock is still feeling the effect of the big pullback we have seen in rare earth element (REE) prices. Here is a chart of what Neodymium-Praseodymium (NdPr), MP’s main product, has done year to date (see image below). We wrote recently that “MP is still a commodity company and its revenue/earnings will be affected by changes in the price of its main product, Neodymium-Praseodymium (NdPr).” That is still true, and unfortunately, a lot of companies (incl. TSLA) are trying to design products that don’t require rare earth minerals due to their high cost. That has probably hurt the near-term price of NdPr. However, we think that long term, the demand for rare earth minerals will continue to grow as it is needed to power everything from electric motors and wind turbines to laser-guided missiles and jet airplanes. REEs make electric motors extremely more efficient and most companies not named Tesla will probably continue to rely on rare earth magnets as they strive for increased EV range and speed. And unlike almost every other mining company, MP is focusing on vertically integrating so that they will be producing their own magnets within the next two years. Most importantly, MP’s management has done an amazing job of executing their plan for the company amidst both good and bad NdPr pricing environments and this most recent quarter was further proof of that. Despite the recent NdPR price drop, the company was still able to beat both top and bottom line estimates for the quarter (chart below). The company also finished commissioning of its Stage II production facilities which will allow them to start selling to customers outside of China. For some additional reading, here is a good article written by a Harvard Business School professor discussing MP’s reshoring business model.

- MP MP Materials (7) – MP’s stock is still feeling the effect of the big pullback we have seen in rare earth element (REE) prices. Here is a chart of what Neodymium-Praseodymium (NdPr), MP’s main product, has done year to date (see image below). We wrote recently that “MP is still a commodity company and its revenue/earnings will be affected by changes in the price of its main product, Neodymium-Praseodymium (NdPr).” That is still true, and unfortunately, a lot of companies (incl. TSLA) are trying to design products that don’t require rare earth minerals due to their high cost. That has probably hurt the near-term price of NdPr. However, we think that long term, the demand for rare earth minerals will continue to grow as it is needed to power everything from electric motors and wind turbines to laser-guided missiles and jet airplanes. REEs make electric motors extremely more efficient and most companies not named Tesla will probably continue to rely on rare earth magnets as they strive for increased EV range and speed. And unlike almost every other mining company, MP is focusing on vertically integrating so that they will be producing their own magnets within the next two years. Most importantly, MP’s management has done an amazing job of executing their plan for the company amidst both good and bad NdPr pricing environments and this most recent quarter was further proof of that. Despite the recent NdPR price drop, the company was still able to beat both top and bottom line estimates for the quarter (chart below). The company also finished commissioning of its Stage II production facilities which will allow them to start selling to customers outside of China. For some additional reading, here is a good article written by a Harvard Business School professor discussing MP’s reshoring business model.

-

That’s it for today folks! Stay tuned for Part IV of the latest positions.