Latest Positions: Valuations, Valuations, Valuations

Do you realize that “ignore” and “ignorance” have the same root? From French ignorer or Latin ignorare ‘not know, ignore’, from in- ‘not’ + gno-, a base meaning ‘know’. You can’t ignore reality or you end up ignorant. Ps. Covid is real.

Here is a Part 2 of 5 of the list my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position, including another Trade Alert.

I’m selling DIS. It’s been our only stock that hasn’t made us money this year, which is quite an amazing thing to type, because we have almost 30 stocks in the portfolio. 97% hit rate, ain’t bad. That said, I still think Disney+ is going to be a major money maker for DIS, but I’m uncomfortable with all the theme parks and cruise line revenues that come with what really should be Disney’s only business of content creation and intellectual property control. I’m increasingly worried that the markets have a vacuum lower coming at some point this year and I’d rather have some more cash than DIS stock at this moment. I of course reserve the right to revisit DIS in coming weeks and months.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- (Cloud Revolution)

- ZM Zoom (6+) – Let’s play the relative valuation game with ZM, which is currently being valued in the stock market at nearly $80 billion. I wish the company would do a secondary offering right now to raise some money while they can at this kind of valuation since they could raise $4 billion with a 5% dilution. The company will triple their revenues this year as the Coronavirus Crisis has forced the world to work from home, from $600 in 2019 to $1.8 billion in 2020, which is a large reason the stock has gone parabolic this year. Then again, the growth is likely to slow to 30-40% next year, which is a large reason as to why I’m a bit worried about ZM’s valuation right now, trading at 30x+ next year’s revenue estimates. Zoom’s market cap is about half of ORCL’s market cap — and Oracle has $40 billion in revenue and Oracle will earn 10-15x more than Zoom next year. Zoom is worth 25% more than VMWare even as VMW will do $12 billion in sales this year. Be careful, but I’m holding onto a small position in ZM as I like the long-term model.

- WORK Slack (7) – The main bullish argument for WORK is the same as it has been since we started — and it’s actually the same argument the bears/shorts use as to why they hate WORK. Only about 20% of Slack’s customers are paying anything at all and the major enterprise customers are just starting to pay. Slack is still adding thousands of new customers per quarter and that means there are three ways to grow its business from here — getting existing paying customers to pay more; getting existing customers to start paying at all; and to get new paying customers. Microsoft Teams is still trying kill Slack and I still don’t think they can because people like me can’s stand Microsoft products and don’t want to join its ecosystem if they don’t have to.

- DOCU Docusign (6+) – Docusign is a noun and a verb and when a company’s name becomes synonymous with something we all do, it usually ends up being a good investment. See Google or Xerox back in the day. That said, Docusign isn’t going to get the 200% growth this year that Zoom got and the company is currently being valued at $38 billion or 50% more than Ford. The market is valuing Docusign at 20x next year’s revenues, which I suppose is about appropriate in relation to Zoom’s 30x next year’s revenue valuation. I have about the same amount in DOCU and ZM and I have a little bit more WORK then either of these two at this point. I’m holding the remaining shares steady.

- SQ Square (6+) – In the prior Latest Positions update, I wrote: “Square’s estimates for this year are off the table. Revenues, whatever the growth they thought it was going to be, are not going to be there. And so it’s tough to get a sense of the company’s valuation for now because of that. If you look at Square on a valuation basis over the next year or maybe even 2021, it looks pretty expensive. If you look out three or five years and you assume that the world gets back to normalish, then Square is cheap right here. If the Cash App can keep growing and actually benefit from the Coronavirus Crisis trends then that would obviously make the valuation compelling here. Your risk-reward analysis has shifted though, because it used to be you were betting on Square beating the competition, having a better platform, easier technology, critical mass. Now you’re betting on an economic outcome that is not guaranteed.” I’m not sure that’s quite as true as I thought it would be. The markets are looking past the economic troubles and the small business collapses in the US right now. I’m not sure the market won’t decide that the risks to next year’s estimates for SQ are big enough to try to price some downside potential into the stock over the next few weeks. This is a name that we bought more of at the bottom and the stock has tripled since and I’ve trimmed some of my exposure. I’m mostly sitting tight on the shares I still have now.

- NVDA Nvidia (6+) – Do you realize that we are up more than 1200% on our NVDA position since I first added it to my personal portfolio four years ago? Do you realize that NVDA is worth as much as TSLA even though these days nobody seems to be paying much attention to NVDA? Tesla will actually generate twice as much in revenue this year than Nvidia will do, but Nvidia has more than double the gross margins on that revenue that Tesla does. Trading at 20x this year’s sales estimates at this point, it’s helpful to remember that this stock was trading at 4x revenues when I bought it. You can see why I’m growing uncomfortable with the valuations here. We’d bought more NVDA in March and I’ve trimmed this name down some too and am hold the remainder steady for now.

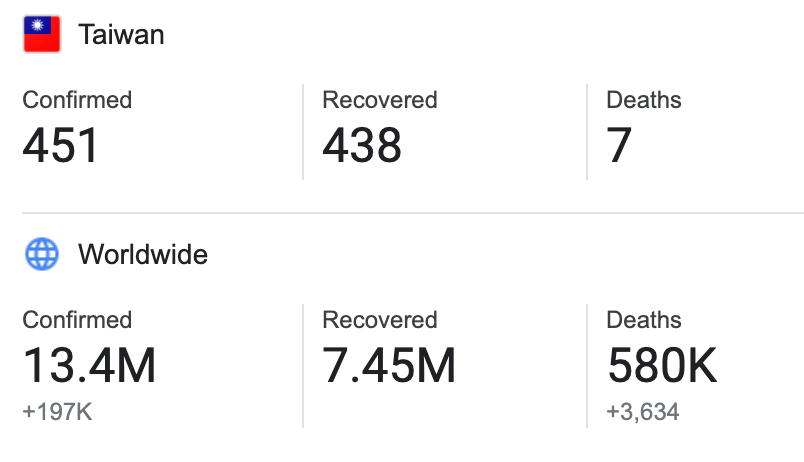

- TSM Taiwan Semiconductor (7) – In the previous Latest Positions update, I wrote: “Either Taiwan in completely under-reporting their official Covid-19 cases, or the country has remarkably remained relatively free of the virus. Likewise, Taiwan Semiconductor appears to be running its factories and even reported that March revenues totaled $3.78 billion, marking a 43% rise from a year ago and a 22% increase from February. This under-reported fact is perhaps one of the biggest reasons behind the big bounce off the bottom in the chip stocks, many of which are TSM customers. I’m just holding this core holding steady for now.” Taiwan’s ability to avoid the Coronavirus Crisis is still a remarkable feat:

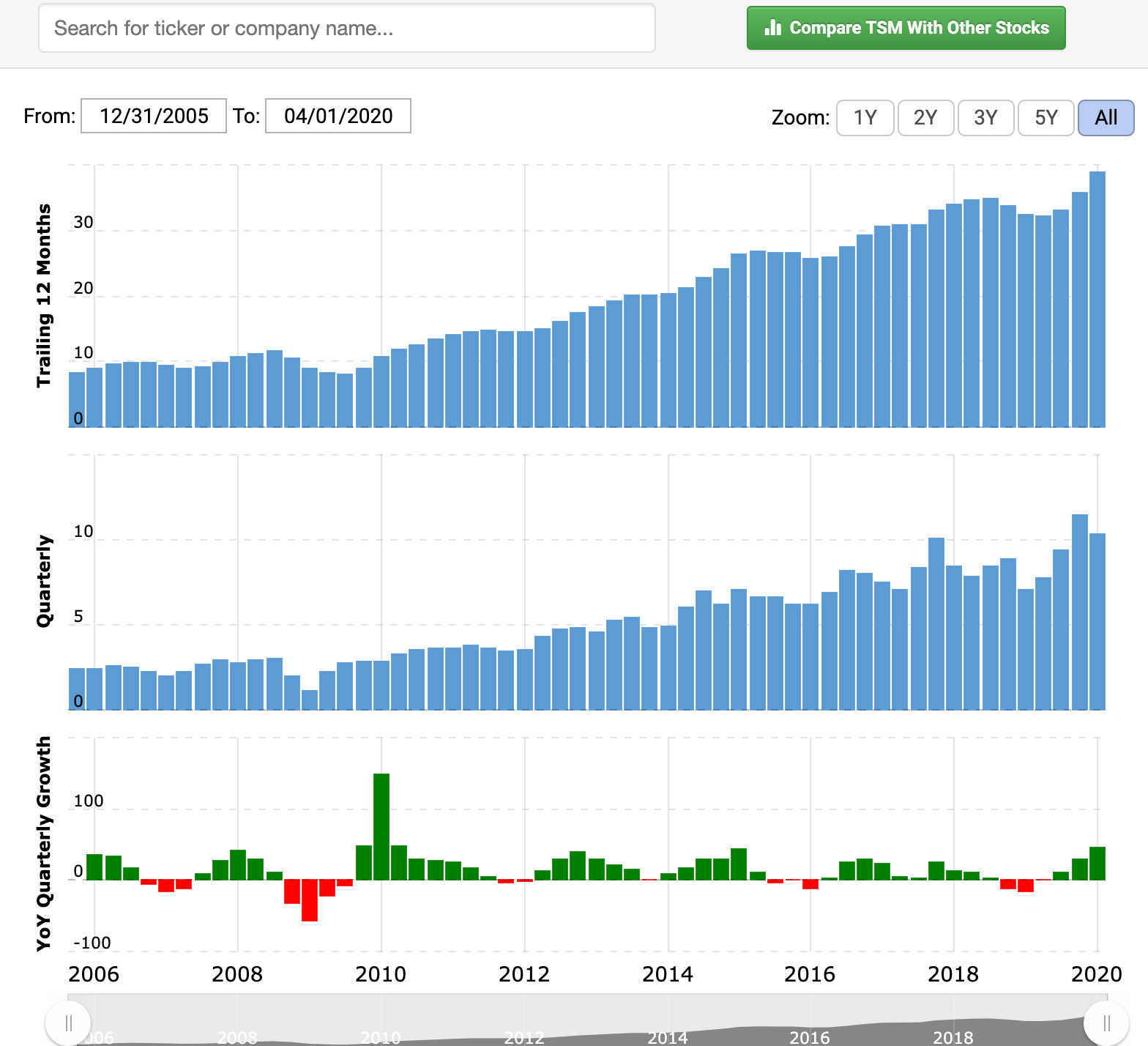

Put another way, Taiwan, which is right next to China unlike, say, the US, has apparently lost only .00003% of its population to Covid-19. If the entire world had that kind of a death rate, there would only have been about 2000 people who would have died from Covid-19 instead of hundreds of thousands. Taiwan is also dealing with China aggression but it’s not going to be as easy for China to clamp down in Taiwan as it was for them in Hong Kong. Perhaps geopolitical risks are the biggest risks to our TSM investment because the dominance in technology that TSM has and keep expanding makes this a very attractive long-term Revolution investment. I expect there are more years ahead with growth like TSM has had in years past:

Put another way, Taiwan, which is right next to China unlike, say, the US, has apparently lost only .00003% of its population to Covid-19. If the entire world had that kind of a death rate, there would only have been about 2000 people who would have died from Covid-19 instead of hundreds of thousands. Taiwan is also dealing with China aggression but it’s not going to be as easy for China to clamp down in Taiwan as it was for them in Hong Kong. Perhaps geopolitical risks are the biggest risks to our TSM investment because the dominance in technology that TSM has and keep expanding makes this a very attractive long-term Revolution investment. I expect there are more years ahead with growth like TSM has had in years past:

For comparison purposes to NVDA, TSM has smaller gross margins of about 50% and is trading at 8x this year’s sales estimates and “just” 22x this year’s earnings estimates. I have more a little more exposure in TSM than NVDA and am holding both mostly steady for now.