Latest Positions: WORK, PANW, SQ, NVDA, TSM, SEDG, FSLR, JD, BIDU

I just got scheduled to do a Fox Business hit to talk about the markets and earnings and what not today at around 2pm ET.

Here is a Part 2 of 3 of my latest personal portfolio positions and most of the hedge fund positions with updated commentary and ratings for each position. I’ll send out Part 3 this weekend.

The ratings for each stock go from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.” The positions that are bolded are those that I consider to be “core” holdings and am unlikely to ever sell out of them entirely.

Longs –

- (Cloud Revolution)

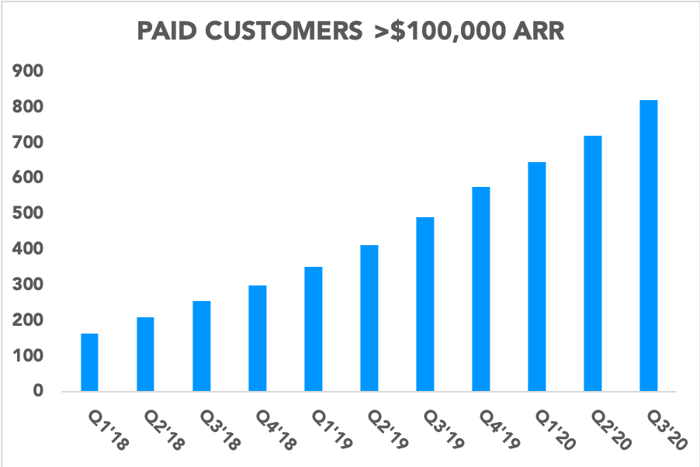

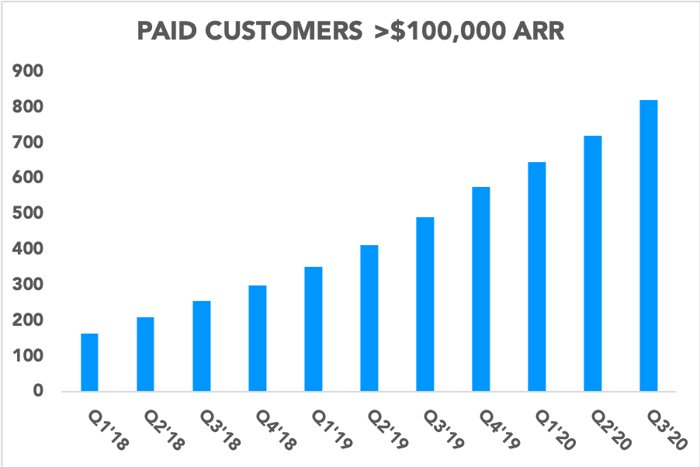

- WORK Slack (8) – Slack, unlike Uber, still can’t seem to get out from under of the Softbank-discount that the market has assigned to most stocks that Softbank is associated with. We’ll need to see a good earnings report for this company to show the market that Microsoft’s strong efforts to kill Slack aren’t working. The real bull case behind WORK (worst ticker ever) is actually the same as the bear case: The company has very few huge customers, with less than 1,000 companies spending more than $100,000 a month with the company. Slack added 5,000 paid customers during the prior quarter, and they now has 821 customers that generate over $100,000 in annual recurring revenue. The company also disclosed that it now has 50 customers that generate over $1 million in ARR, a new milestone of a metric. I expect both of these numbers to explode higher in coming quarters, and if they don’t that might be a sign to move on from this still very young company’s stock.

- Palo Alto Networks (7) – Goldman Sachs recently upgraded PANW on this base case, and it’s a similar bull case to the one you’ve heard me explain in the last few months, “we view product revenue weakness in the first fiscal quarter as a temporary issue and believe strong next-gen growth, exposure to emerging growth segments, contribution from acquisitions, and improving sales force productivity will drive better performance through the remainder of CY20. With some of the best profitable growth within our coverage universe, PANW currently trades at 17.7x EV/CY20 FCF, a several turn discount to Network Security peers. Additionally, as some begin to look forward to CY21, the stock is trading at 15.2x our FCF estimate compared to a 19.9x EV/FCF average for our coverage group”. Ie, the stock is cheap and I’d add that it’s still perhaps the most respected name in network security.

- SQ Square 7) – Just about the time I want to sell Square, in part because I’m starting to fall for the boy-that-Jack-Dorsey-is-out-there rhetoric, I see a people on Twitter posting charts showing how the most popular app downloaded for the last month has been Disney+ and I see Square’s Cash App still in a dominant place on the charts too. And it’s perhaps that app and it’s bitcoin-capabilities that keep me in Square. And on that note, you’ll see that the company received a patent for a new for a system that could let people holding different asset types transact in real time: “The present technology permits a first party to pay in any currency, while permitting the second party to be paid in any currency,” according to the application.” That is, people can pay in bitcoin and instantly get a dollar or vice versa. The patent suggests the system could be extended to add support for asset classes including securities, derivatives or loans. And so instead of selling Square, then I have a hard time not buying more and instead of being disappointed in Jack Dorsey, I’m impressed. So I stick with SQ.

- NVDA Nvidia (6) – Are we in a golden age for chips? I mean, Intel just reported a terrific quarter with strong guidance and increased dividend payments. I don’t know that I’d buy Nvidia afresh right now, at this valuation, at 20x next year’s earnings estimates for a stock growing its topline 10% per year. Here’s what I wrote when I first bought the stock three years ago near $30 per share: “Nvidia’s got to grow faster than single digits next year for this stock to work. But with the potential for 20-30% growth in the VR and Smart Car Revolution, I think the stock could double or triple from these current levels over the next five years. I’ll be watching this company’s technological platform and sales trends like a hawk in the next few quarters and will look to sell the stock if the company fails to catch serious traction in either VR or smart cars. For now, I am putting my toe in the water and buying a 1/3-sized tranche position of $NVDA common stock to get started. I would look to add another tranche if the stock drops below $30 and/or in the next few days or weeks if the markets tank and give us the chance to nibble on this name in a broader market downdraft.” The company has caught more traction in places other than VR and driverless cars over the years since, as its platforms have become leaders in driverless, cloud/data center, deep learning/AI, gaming, and other applications:

- TSM TSM (7) – Taiwan Semiconductor TSM finally pulled back a bit here, after a relentless rally for months on end. This remains my favorite play on the semiconductor industry, mainly because of it’s become a monopoly on 7nm and future smaller chips. No other company can do 7nm and TSM is already spending billions this year to move to 5nm and even 3nm chips. The company even makes the bigger chips that Tesla designed for its Full Self Driving computer. The chip basically is the computer and it’s a big chip and it uses older, larger designs than the latest 7nm technologies that TSM offers. Cars don’t need tiny chips. But Tesla still found that TSM was the best play to go get their chips custom made, which speaks to how good TSM’s service and reliability really are. There’s the chance there’s a sell-off in this stock if China pushes the envelope in Taiwan the way it has tried to do in Hong Kong.

- WORK Slack (8) – Slack, unlike Uber, still can’t seem to get out from under of the Softbank-discount that the market has assigned to most stocks that Softbank is associated with. We’ll need to see a good earnings report for this company to show the market that Microsoft’s strong efforts to kill Slack aren’t working. The real bull case behind WORK (worst ticker ever) is actually the same as the bear case: The company has very few huge customers, with less than 1,000 companies spending more than $100,000 a month with the company. Slack added 5,000 paid customers during the prior quarter, and they now has 821 customers that generate over $100,000 in annual recurring revenue. The company also disclosed that it now has 50 customers that generate over $1 million in ARR, a new milestone of a metric. I expect both of these numbers to explode higher in coming quarters, and if they don’t that might be a sign to move on from this still very young company’s stock.

- (Energy Revolution)

- SEDG SolarEdge (7) – What a run over the last three and a half years since we first bought this stock at $13 or so. It’s now almost a 10-bagger. I’ve trimmed this stock a little too much in hindsight. Regardless, Solar Edge’s leading solar chip technology is continuing to take share. I hold onto my core SEDG position, but, yeah, I think trimming some here might be a good idea.

- First Solar (7) – We all know that solar is the the best future solution for our energy needs. Wind isn’t it. FSLR trades at 15x next year’s earnings, but the topline is so volatile that the markets have a hard time believing this is a growth stock. I want to own the best solar companies in the world and that’s the main reason I own First Solar. I am going to go back and research all the solar stocks out there though, to make sure we’re not missing any good ones.

- (China Middle Class Revolution)

- JD JD.com (7) – JD is one of the best plays on the China Middle Revolution, but it’s perhaps not the best Chinese stock out there. Ten Cent owns some of the highest profile tech assets in China and I wonder if we should perhaps add it to this China Middle Class Revolution basket or even replace JD with it. That said, JD’s topline growth of 70% and valuation at about 30x next year’s earnings estimates make me want to stay in this stock. So I hold on.

- BIDU Baidu (6)– BIDU has finally made a nice move off its lows and we’re sitting on some decent gains here now. That said, this stock has been a laggard for us since we bought it last year when it was just so undervalued vs its balance sheet. BIDU is not as cheap as it was after this rally, but it’s still pretty darn cheap when you consider it’s strong balance sheet and investments.

I’ll send out Part 3 this weekend.