Latest Positions: Yes, there are new 10-baggers are out there

Here is a list of my latest positions with updated commentary and ratings for each position.

This morning in the chat, everybody was like “Cody, any new buys coming soon?!” and “Cody we need another Axogen at $4!” And our new subscribers are always asking me if we’ll be able to find new names that go up like our old names have.

I think it’s important to remind you guys how hard it is to find 10-baggers, much less having a portfolio full of stocks that have gone up 2x, 5x, 10x or 180x like we do. And I’m constantly trying to find the next one. But think of it this way — do you have any idea how many times from 2012-2017 I analyzed Under Armour, for example. There are dozens of mentions of of UA while the stock was at $30, $40 or $50 per share on TradingWithCody.com when I’d answer questions about UA thusly, “UA is a stealth play on wearables and other tech revolutions but I don’t like the risk/reward set up.” Well, eventually UA fell to $10 a share and guess what — that was the opportunity. I have a handful of stocks that I want to buy and several new names that I think could turn into some big investments for us. But I have to let the markets, the prices, the valuations, the cycles and, most of all, the analysis drive my buying decisions.

So I remind you guys all the time about the importance of sitting, of not forcing trades, of not being greedy. There are going to be lots of great opportunities to buy stocks that go up 2x, 5x, 10x and maybe even another 180-bagger or so.

I assure you I am always on the lookout for our next great Revolution Investment and I’ve got quite a few that I’m working on that I think sure can be. Onto the Latest Positions then.

I’ve broken the list into Longs and Shorts. And from there, I’ve broken down each list into refined categories in order from the largest positions within each category to the smallest. I also give each stock a current rating from 1 to 10, 1 being “Get out of this position now!” and 10 being “Sell the farm, I’ve found a perfect investment.”

Longs –

- Forever assets and other permanent holdings –

- Media and other private investment/business holdings (9+ because betting on yourself and running a business is always a best bet)

- Real estate, including the office I work out of, some land and the ranch I live on in NM (8)

- Physical gold bullion & coins (8)

- Primary stock exposure portfolio

- AMZN Amazon (8) – Amazon’s a juggernaut, positioning itself strategically to benefit from so many trends, from The Voice Revolution, Driverless/Drone Delivery, Robotics, Distribution, Advertising, The Voice Revolution and The Voice Revolution. Alexa’s really a big deal as I’ve been saying for three or four years now I suppose. Speaking of which, here’s a few articles I suggest reviewing for more on Amazon strategy and why I think it could eventually, in another ten years, be a, yes, Amazon as a $4 trillion company. See also: Peak Swipe: Why Alexa is Apple’s greatest threat and Amazon vs Google.

- AAPL Apple (7) – I’ve been thinking a lot lately about how Apple whether or not Apple is still truly a Revolutionary Investment. The answer is yes, because the iOS platform, the Mac and the whole Apple ecosystem remains vibrant and growing. On the other hand, Apple has pretty much ceded The Voice Revolution to Amazon Alexa/Echo and Google Assistant. Apple Siri is a bad joke at this point and the developer community has fully embraced Alexa and Assistant. Investment-wise, Apple is relatively safe for now, with the hundreds of billions of dollars in dividends buybacks and what not coming from the one place that Apple is definitely innovative these days — finances!

- FB Facebook (7) – I’m so sick of Facebook. But they also own their best competitor, Instagram. And Snapchat should change its name to FootShooter, since that’s all they ever do. Twitter’s back in the game and will be a force in social media/news/celebrity for decades to come. But the social media industry has become a full-fledges duopoly or maybe an oligopoly with few competitors in the industry at critical mass. As I keep explaining in regards to the the EU and the US governments and other governments around the world that have created new regulations for social media companies : All that means is there will be few if any new social media type networks and apps that can afford to comply with those new regulations. Facebook (and Twitter) is now free to roll up or kill any and all remaining competitors. In the previous Latest Positions when Facebook was at $165 and getting killed over the new regulations, “Counter to everyone’s logic, I’m actually raising my rating on Facebook back up to a 7 in large part because of the increased regulatory environment.” The stock’s now back above $205, and I’d leaving it at a 7 rating.

- GOOG/GOOGL Google (7) – Rinse and repeat: Android, search, Android, ads, Android, driverless, Android, iOT, Android, AI, Android and Google Assistant are good reasons to hold onto this stock. To be clear, I’m not sure I’d own Google any more if they didn’t own Android. That’s how key Android is for Google’s long-term prospects. That said, Android is probably going to make this company worth a few trillion dollars in my lifetime if they don’t screw it up.

- NVDA Nvidia (7) – Nvidia’s stock has spent a few months here around the $250 range and is no longer outright overbought. But it is still quite overvalued and overloved. The company’s got to show some serious revenue growth to catch up to the valuation here but with growth drivers and dominance in AI, Driverless cars, Highest-end servers, virtual reality and other major Revolutions of the next five to ten years, I do expect the growth to be here. We bought this stock when it was around $30 two years ago and I’ve trimmed it a few times over the last couple years, but I’m holding my remaining shares steady for now.

- AXGN Axogen (6) – I’m worried this stock has some near-term downside and/or range-bound trading ahead of it for the next few months or so. If only because the stock hasn’t stopped going up in the two and a half years since we bought it. Then again, it is quite possible the company gets acquired by a bigger player in the medical equipment/science field, and that’s probably helping the valuation be propped up here. (More exciting than Axogen at this moment is the fact that I’ve got a new name from the same hand-transplant surgeon source who turned me onto Axogen that I’m doing homework on right now.)

- SEDG SolarEdge (8) – Long-term, I expect solar is one of the most efficient and safest ways to power our society. And SolarEdge’s technological advantage of taking analog solar cells and turning them into digital solar cells is a Revolution in the industry. Shorter-term, the sector’s stocks are often driven by whims and reports of tariffs, non-tariffs, regulations, de-regulations and other headlines. I’d trimmed some SolarEdge near its highs before it got hit recently and I’m likely to buy those shares back if and when the stock gets hit on those types of headlines again.

- SNE Sony (7) – I like Sony as a contrarian tech Revolution play. Nobody thought the company would ever get turned around when we first bought it a few years ago in the teens. Nowadays, Sony’s image sensor business, their content business (My wife and took our four year old daughter, Lyncoln to watch Hotel Transylvania last night…Dracula was struggling to get his Sony smartphone to understand his requests — I was surprised Sony didn’t mock Siri for that part instead.), Playstation itself plus the cable-replacement app Playstation Vue, are all doing well and remain good reasons to own this stock.

- TWTR Twitter (8) – President Trump and so many other politicians have fully jumped on the Twitter platform. More impressive is the growth of teens that I see on the Twitter platform. Longer-term, I want to own this de facto standard platform.

- INTC Intel (8) – I don’t own Intel because of their server business, or their current CEO, or the business as it is right now. I own it because Intel‘s made some big bets on internet of things and driverless, and some very revolutionary things, technology trends, that they’re trying to get in front of, and maybe dominate. And if they can pull that off, the stock will double, maybe triple. Some of those things could be real, very big growth drivers. But in the meantime, Intel can bounce around for a little while after this recent run. Looking out two or five years, stock could be at $100, $150 or more.

- UA Under Armour (8) – UA has pulled back about 10% from its recent highs, but it’s still about double from where we bought it a few months ago. UA is a stealth wearables play — I expect the company has some really cool technology to roll out in the next year or two. And good ol’ clothing/shoes sales have rebounded, inventories appear healthy and their could be nice upside ahead if the revenue growth kicks in.

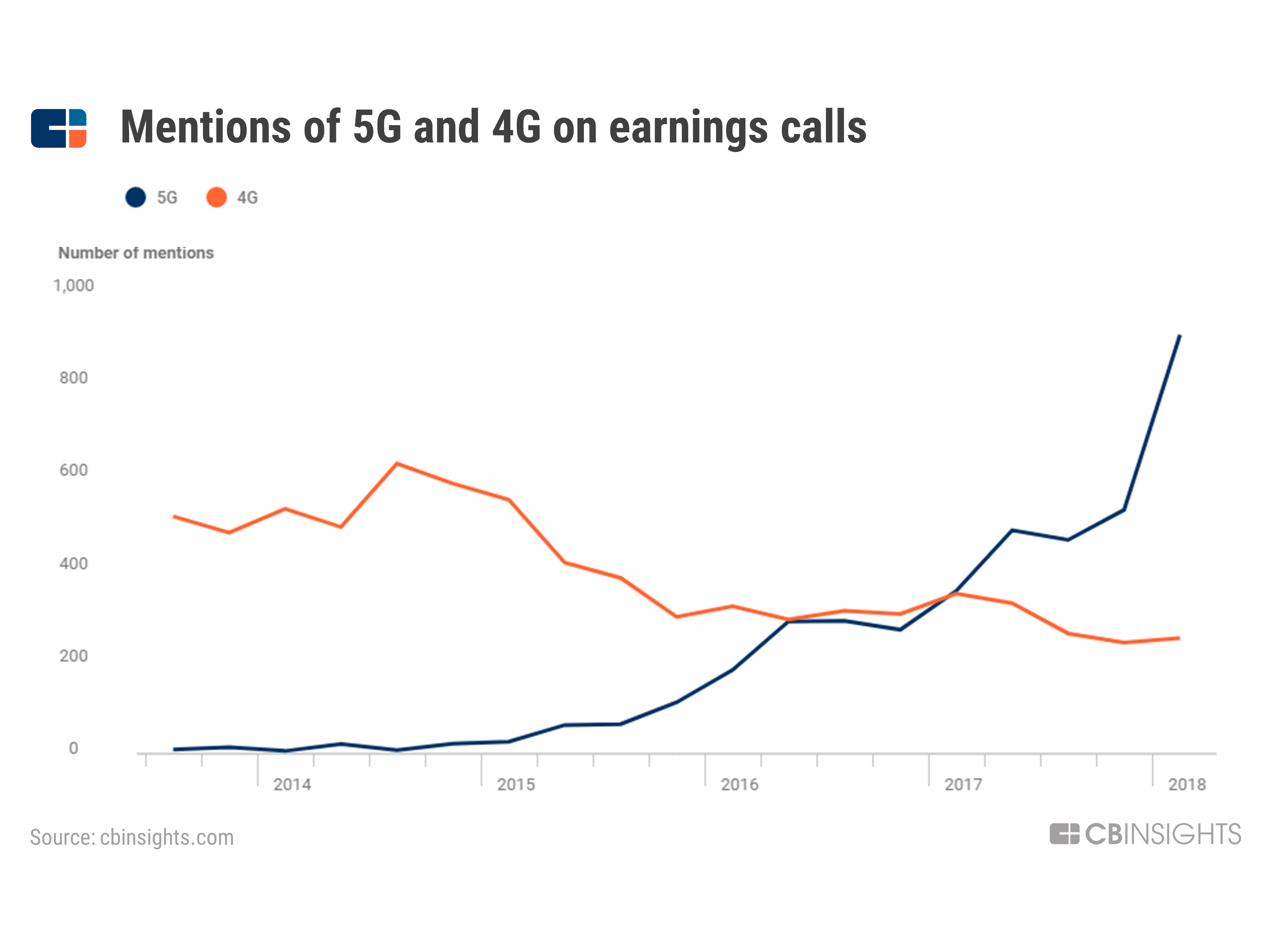

- VZ Verizon (9) – If Verizon can stay focused on 5G and not overspend billions of dollars trying to become a content company, there’s a good chance this stock can run to $100 or $150 in the next three to five years. The 5% dividend is a good reason to hold it anyway. Here’s an interesting chart that underscores the growth in 5G that’s coming down the pike:

- Palo Alto Networks (8) –I can’t get my Weather Channel app to work anymore. Weather Channel was bought by IBM a couple years ago. Used to be that IBM was the gold-standard of technology. You couldn’t get fired using “Big Blue.” Now IBM sucks. Point is, that Palo Alto Networks is the “Big Blue” of network security. This is a boring, fast growing, high-recurring revenue, high-margin business in big demand in this crypto / hacking / privacy -shaken world.

- TST The Street (6) – TST has been on fire lately and we’re now up 150% plus on the position. The Street just sold one of their subsidiaries, RateWatch, to S&P for $33.5 million bucks. The Street is going to walk away with $32 million cash out of this too. Now TST, this is small cap stock, guys. Don’t run out and buy the stock right now. Don’t go crazy. You’ll move it. When I sent out a Trade Alert a year ago about buying TST, the entire market cap of the company was just $30 million. The company had $35 million or so of cash in their checking account. The stock market was saying that The Street would never come back. They’ve come back and I don’t think this come back is over.

- FSLR First Solar (6) – First Solar’s having a rough 2018 and revenues are supposed to shrink this year. But in 2019, the company is looking to grow the topline 25-30%. That’s the make or break for this stock. And while Solar Edge has a technology advantage to help separate it from its competitors, First Solar doesn’t have that same kind of edge. I’ve been making a lot of calls around the industry and the company to get a better feel for what’s going on at First Solar as I am considering selling my First Solar stock and moving on.

- CALX Calix (7) – Some nice move recently in this name, but remember that Calix is a binary bet — the stock can go up 10-fold if they win traction at a reasonable price at Verizon and the other major carriers. If we don’t see some wins translating to real revenue growth in the next couple quarters, I’ll probably move on from this name.

- WDC Western Digital (8) – Pricing might be weak this quarter for storage. Western Digital is still my smallest long and I’d likely buy more if the stock will get hit near-term into the $60s or so, as I think demand for storage and supply of data storage isn’t inline for the next five years or driverless/AI/servers/app growth.

- Primary short portfolio

- S&P 500 SPY ETF (6) – Our hedges served their purpose, I suppose, as they helped keep the portfolio hedged a bit at the highs. I’m likely to nibble a few more puts in coming days or weeks when markets rally.

- DJIA DIA ETF (6) – See SPY write up above.

- Nasdaq 100 QQQ ETF (7) – See SPY write up above.

- P Pandora (8) – Pandora’s had a bounce as Wall Street analysts are drinking the kool-aid that the company is pouring. I’m not. I’m holding this short steady as I continue to think Pandora can’t sustain its business against the likes of Amazon, Google, Spotify, Apple, YouTube and other music streaming services.

- IWM Small cap ETF (6) – See SPY write up above.

- Biotech ETF IBB (7) – I’m still planning to add to my Biotech IBB short sometime soon.

- EWY SouthKorean ETF (6) – South Korea’s stock market has been volatile recently and I’m still likely to finally just cut my losses on this hedge too.

- Cryptocurrencies/tokens

- Bitcoin (6) – I’ve owned bitcoin for years and have sold most of my bitcoins but still hold some. I think there’s more near-term crash ahead for bitcoin and most any cryptocurrency but that bitcoin could be a survivor/thriver long-term.

- Stellar Lumens (6) – I just started buying Stellar Lumens recently and I’m likely to nibble a few more soon even though I think there’s more near-term crash ahead for Stellar Lumens and most any cryptocurrency but that bitcoin could be a survivor/thriver long-term.

- Ethereum (6) – See Stellar Lumens write up above.

- Ripple (6) – See Stellar Lumens write up above.

Remember: I wouldn’t rush into a full position all at once in any of these stocks or any other position you’ll ever buy. Patience and allowing the market and time to work to your advantage by buying in tranches is key. Maybe 1/3 or 1/5 of whatever you might consider to be a “full position” in any particular stock. And I wouldn’t ever have more than 5-15% of your portfolio in any one stock position at any given time. The younger you are and/or the higher the trajectory of your career income, the more concentrated and risk-taking you can be with weighting in your portfolio. But spread your purchases and your risk out over time and over a several positions no matter your age or risk-averse level.

Scaling into a position using an approach of buying 1/3 or 1/5 tranches over time is how I build my personal portfolio positions, but there’s no scientific way to go about investing and trading. Sometimes you have to pay up for the latest tranche but I try to be patient and wait for a temporary sell-off to add to the existing position.

** NOTE FOR NEW SUBSCRIBERS:

If you’re new to TradingWithCody or if you’ve been a subscriber for a while but haven’t acted on much of my strategies yet and/or if you haven’t been in the markets, but you’re sick of getting 0% on your CDs, Treasuries, savings, checking, etc while the markets have been continually hitting all-time highs this year, what should you do now?

Before you ever make any trade, step back and catch your breath before moving any money anywhere. Rank your positions and your whole portfolio and make sure you’re not about to make any emotional moves with your money.

If you haven’t yet read “Everything You Need to Know About Investing” then spend a couple hours doing so, please. It’s a quick read but chock-full of important ideas, concepts and strategies that amateurs and pros alike should understand.

Then, take a look at my own personal portfolio’s Latest Positions and slowly start to scale into some of the ones you like best and/or the ones I have rated highest right now. I’d look to start scaling into a few of the many stocks in the Latest Positions that are at all-time highs along with a couple that we’ve recently featured in our Trade Alerts that I’ve personally been scaling into.

You can find an archive of Trade Alerts here.