Lessons From 1999: Full Markets and Economic Analysis

Valuations apparently don’t matter any more. Stocks only go up, right? Haha. Does anything but momentum matter from now on?

Yes, valuations still matter — or well, valuations will matter again some day, and perhaps soon. Momentum doesn’t last forever. Stocks do go down and sometimes they go down hard fast and they don’t come back for years if ever.

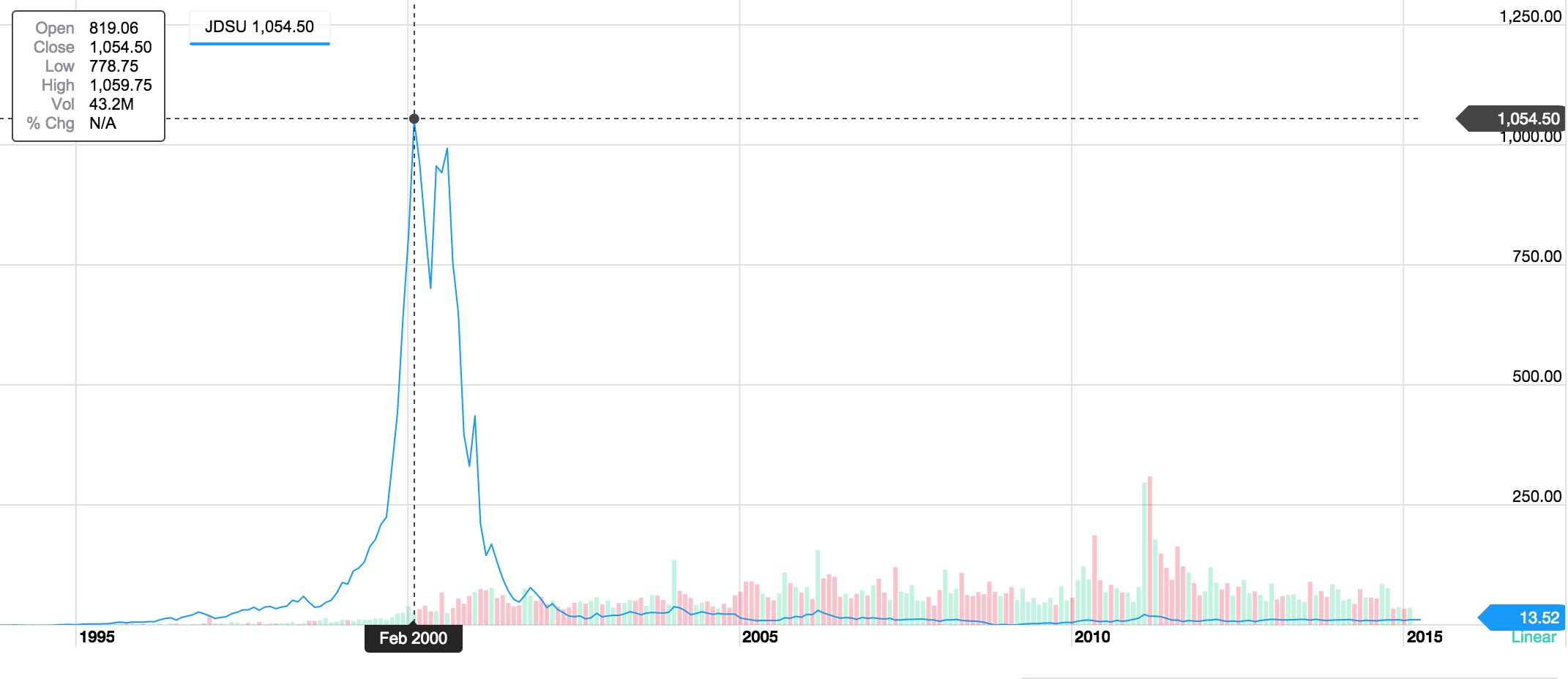

Remember when fiber optic component maker JDSU went up more than 10-fold in 1999 and early 2000 as the valuation topped $100 billion and the stock looked like it would never go back down because they had just taken out their two biggest competitor in all stock deals worth more than $60 billion (on paper, at least)? Does any of the following snippets from a CNN Money article published on July 20, 2000 sound like they could be written in 2020 instead of 1999 (bolded is mine)?

“In the largest ever merger of technology companies, optical networking firm JDS Uniphase Corp. Monday offered to buy rival fiber-optic components maker SDL Inc. for $41 billion in stock, an almost 50 percent premium over SDL’s closing stock price on Friday. JDS Uniphase just completed the $15 billion acquisition of E-Tek, its largest competitor. Adding SDL to its stable would give the company an 80 percent market share for some types of optical networking components, said SG Cowen analyst Drew Peck.

Both JDS Uniphase and SDL have very rapid revenue growth rates and sky-high valuation ratios. They have benefited from the booming construction of fiber optic networks necessitated by the seemingly insatiable demand for more Internet bandwidth.

SDL in May that it expects its revenue to be at least 140 percent higher in 2000 than it was in 1999. SDL had sales of $72 million in the first quarter ended March 31.

However, JDS Uniphase is buying the company at the top of its range. SDL’s current stock price is 11 times its 52-week low of $28-1/4. At its current market capitalization of $25 billion, SDL sells for more than 250 times what analysts expect it to earn for all of this year. Its trailing price-earnings ratio is an astronomical 568.

‘JDS Uniphase is taking a highly valued currency – its stock – and buying a great property with it,’ said money manager Michael Holland, chairman of Holland & Company in New York.

In a conference call, JDS Co-Chairman Jozef Straus emphasized that the deal will allow the combined company to address capacity constraints.

‘The Internet is taking over the work,’ Straus said. ‘Customers need higher levels of integration and complex products. By relocating resources we can produce more products that are in short supply.’

Each company is expected to produce sales and income higher than analyst expectations, said JDS chief financial officer Anthony Muller.

SDL has about 1,700 employees and generated revenue of $72 million in the first quarter ended March 31 [Cody’s note: putting it on track for maybe a total of $300 million in total revenue in 2000]. JDS Uniphase, which makes transmitters, amplifiers, couplers, filters and switches for fiber optic networks, has around 17,000 employees and generated sales of $395 million in its fiscal third quarter ended March 31 [Cody’s note: putting it on track for maybe a total of $1.8 billion in total revenue in calendar 2000]. Excluding merger-related charges and amortization of intangible assets, JDS Uniphase earned $85.8 million, or 11 cents per share, in the period.”

So let’s review. Companies around the world were scrambling to get more internet capacity because “the Internet is taking over the work” and the leading stocks in market were trading at almost 100x forward sales estimates (and in some cases, including the price at which SDL agreed to sell to JDSU in the year 2000 more than 100x forward sales estimates). Likewise, Yahoo was trading at about 100x its forward sales estimates when it was worth $120 billion at the peak in 1999 and early 2000. And the CFO at JDSU was claiming to investors and the media that as he made deals worth tens of billions of dollars that “each company is expected to produce sales and in come higher than analyst expectations” even as he had no visibility into the fact that the combined companies’ business would absolutely collapse in 2001 and 2002. By the end of 2002, JDSU was down 99.9% from its high just 500 days prior. You read that right — 99.9% losses for investors in JDSU, even as nothing really changed for the company’s outlook. Today, you can buy the remnants of JDSU (Viavi VIAV and Lumentum LITE) for 90% less than JDSU’s peak market cap.

For last ten years I’ve argued that the stock market, while in a Bubble-Blowing Bull Market, was not yet in an outright Bubble. I am becoming increasingly convinced that we closer to being in the Bubble Blowing Bull Market Blow-Off Toppish Action™. I’ve long expected The Top In The Market would likely come with a spiked “blow off” action of the kind we are seeing right now and that we saw back at the top in 2000 as JDSU was worth $100 billion trading at 100x sales.

These days we have companies like NKLA with no revenues being valued at tens of billions of dollars. You’ve got a used car dealer with an app, Carvana, being valued more highly than Ford. It’s a used car dealer with an app and it’s highly unlikely any of these used car dealers end up being worth the money the markets are currently thinking they are worth.

So let’s look at the positives and the negatives in the economy/market and find similar set ups from the past.

Positives:

- Trillions in stimulus from the Republicans and Democrats and in free money for giant banks and corporations from the Fed (this is sort of like the year 1999 when the Fed was cutting rates to unprecedented levels).

- Many companies will come out of Covid with lower expenses and higher profit margins (this is a lot like 1999/2000 when companies were adopting the “web” and learning that could make more money on the same amount of sales by leveraging technological innovations).

- Covid accelerated the transition to technology solutions which creates economic prosperity for companies that provide those technology solutions (there’s never been an event in our lifetimes that has caused so much acceleration of adopting technological advancements).

- Many new companies were launched in the last five months during the depths of the Coronavirus Crisis and many of those will be the next batch of Revolutionary companies to look out for (1999 was boom time, this part is more like 2002 or 2008 when there were many big companies founded).

Negatives:

- Small business crisis as millions of small businesses close their doors are are not coming back (there is no probably parallel for this dynamic in the history of the US except perhaps in the first couple years of the Great Depression).

- Unemployment is spiked and could be that way for months to come (maybe Great Depression-ish, but probably many of the lost jobs will indeed come back faster in coming months and quarters than they did in the 1930s).

- Deficit and debt for the US government are out of control and will be a Black Swan for the economy and stock market if rates were to rise in any meaningful way (real interest rates doubled in 1931 and stayed elevated in 1932 before starting to whipsaw for the rest of the decade).

- Real estate in major cities could be in trouble. (Then again, maybe companies won’t give up the extra space, maybe they just spread people out more creating more demand for real estate in the cities).

Two other notes:

- China’s standing in the world has taken a big hit and China’s stepping up aggression because of it. China in a war would be something the world’s not ready for. Taiwan comes to mind as a potential catalyst.

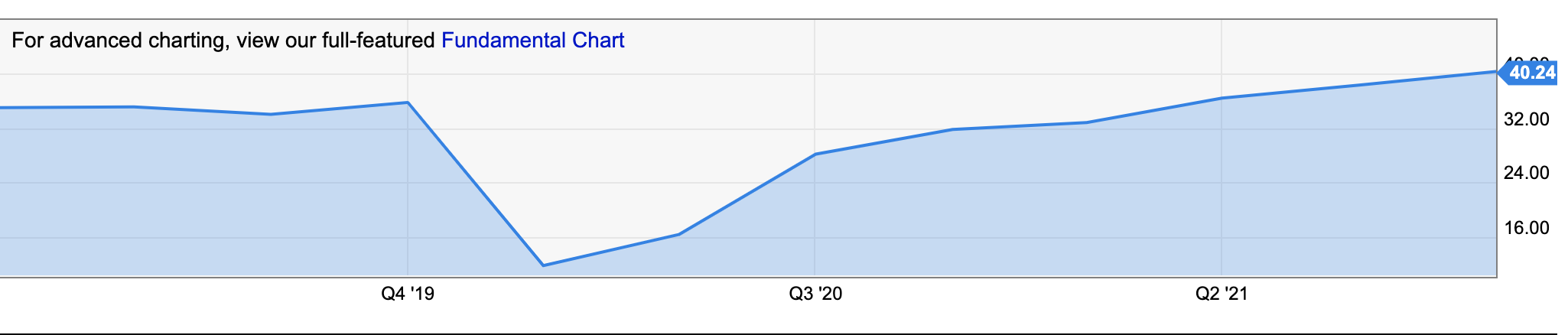

- Will S&P 500 companies earnings in 2021 be better or worse than they were in 2019? For now, expectations are that the second half of 2021 will actually be up slightly overall in 2021, which includes a 20% earnings growth for the second half of 2021 vs 2019.

So what’s the upshot of all this analysis here? Well, as usual, I’m mostly trying to lay out the way I’m seeing the risk/reward scenarios here. It’s not like I think we can time the exact top of the Bubble Blowing Bull Market Blow-Off Toppish Action™. But I don’t think it’s a good idea to load up on the momentum names with no regards for valuation and fundamentals either. And the lessons of yesteryears and past cycles are important here as we ride out long-held long positions and maybe add a few more hedges if/when the markets actually put in an official Bubble Blowing Bull Market Blow-Off Top™ (which we won’t know has been put in until months afterward, of course).

As for our names, our largest position, Tesla, is up 40% in a week to new all-time highs. It’s up 700% since we made it our largest position last summer. I’m thankful and happy about that, but I’m not chasing it. I even shorted a call or two today against some of my common stock to hedge this name a bit further here. Likewise, Crispr Therapeutics is hitting all-time highs here worth more than $7 billion now — on almost no revenue. Nothing wrong with trimming a little of this one if you haven’t yet. Solar Edge also hit new all-time highs this week, up to $230 a share from the $13 per share at which we were buying it four years ago. Put another way, SEDG was trading at 2x forward sales estimates when we bought it. Sales have gone up 200% since 2016 but the stock has gone up 1600% so the valuation is now stretched as its now trading at 10x forward sales estimates.

Investing and trading and building wealth for the long-term isn’t going to be all fun and games and high fives forever. Over the last decade and the decade before that too, we’ve repeatedly found the most Revolutionary Companies when they were selling cheap and we’ve repeatedly navigated the short-, mid- and long-term cycles in the markets with some success too. Throwing caution to the wind when the valuations are high and charts are parabolic is not in our playbook. Stick with the playbook for building long-term wealth safely, not the playbook for making fast money.

Let’s do this week’s Live Q&A Chat today at 2:30pm ET Thursday (tomorrow). Come directly to the TWC Chat Room or just email us your question to support@tradingwithcody.com.