Look back and look ahead: Full analysis on the economy and the market set-up

I came to Wall Street without a suit 22 years and 20 days ago. I had never owned a formal suit until I got to NYC when I bought a 60%-off Hugo Boss suit from the sale rack at Bloomingdales. I was a stockbroker’s assistant when Greenspan (whom I thought at time, incorrectly, was an actual Ayn Rand anti-central-control advocate) infamously made his “irrational exuberance” comments.

I was working at a telecom/dot-com incubator when the markets went into a telecom and dot-com bubble and then when it crashed and took hundreds of public companies to bankruptcy. I launched my tech hedge fund exactly two weeks before the Nasdaq bottomed in October 2002. I rode the Steady Betty Market into its top in 2007, when I closed my hedge fund and became a Fox Business TV anchor full-time. And there, I continued to predict and lived through the 2008 Financial Crisis and the Bailouts. In late 2010, I quit TV and went back to investing/trading my own money, launching TradingWithCody.com in early 2011 so I could write about what I was doing. And we’ve ridden this Bubble-Blowing Bull Market for the last seven or eight years now.

So I’ve seen ups and downs, bubbles and crashes, panics and euphoria, horrible predictions from permabears and horrible predictions from permabulls and I’ve seen thousands of wannabe traders (day traders, swing traders, cryptocurrency traders and so on) fail miserably and maybe a handful of people squeeze an often-very-hard living out of trading. I’ve seen thousands of people make millions of dollars by buying and holding stocks. I’ve seen very few money managers (his name is Warren Buffett) outperform the markets over the 2.2 decades I’ve been on Wall Street.

I know that 80% of Wall Street is marketing/selling/churning money out of the world’s pockets, 5-10% of Wall Street products are fraudulent and 10-15% is actually trying to deliver value for their customers. I remember in 2007 when I got set up on a soft blind date with a woman who was a derivatives trader at Goldman, Ivy League educated who told me when I asked her if she knew she the real estate crap she’d been peddling was garbage answered, “Yes, of course. But everybody was doing it and we made so much money. I pretty much had no choice.”

I’ve seen Republicans and Democrats in control of either or both chambers at the same time, come and go in the Presidential Office and I’ve read tens of thousands of pages of hundreds of actual laws/bills that they’ve passed in the last twenty years. (Every single law they’ve ever proposed on a Federal level was done at the behest of a giant corporation/industry that donated many millions to make that happen.) I’ve interviewed and hung out dozens of Senators and Congressmen and Governors and billionaires. I’m buddies with the likes of Anthony Scaramucci (former communications director for Trump), Chrystia Freeland (the Foreign Minister for Canada) who is at this moment trying to cut a deal with the Head of White House Economic Advisors, Larry Kudlow.

I’ve been around the block and I’ve seen the sausage being made by powerful people at every level all over this country. And I do my best to use all these experiences and connections in my Trading With Cody economic and market analysis. I’m not going to pretend that these same experiences and connections color my political viewpoints and why I’m so cynical about how I know the Republican Democrat Regime is never on the common man’s (or my own) side.

So thinking back over all my Wall Street/TV career, I’m trying to see if there’s anything I’m missing in my analysis right now.

Let’s review the set-up.

Near-term (say, over the next 3-6 months), the market set-up is all about headlines from The Great Trade War of the 21 Century and the wild swings/pain being caused in the currency markets and in many developing economies. We’re another six weeks out from the next earnings season, which will likely be another very strong one for most public companies, but which most analysts have long expected. And near-term, I’m bearish, as I think the sentiment is way too euphoric and greedy and bullish right now. So I’m expecting maybe a 5-7% pullback in September.

Mid-term (say, over the next year or so), corporate earnings are likely to continue to grow strongly as corporations legally avoid paying almost all taxes and continue to receive trillions in direct subsidies and trillions in indirect corporate welfare. But, there’s certainly a risk that all The Great Trade War of the 21 Century is already causing the unintended consequence that the US, China and every other nation’s global corporations are making adjustments to their supply chains and future plans. And we’re talking about trillions of dollars of economic activity in these supply chains and future plans which will have other unintended consequences. So maybe that’s where the biggest threat to the longer-term lies too.

Longer-term (say, over the next 3-5 years), the broader economy will likely see some significant disruptions to the status quo as those aforementioned unintended consequences ripple through the global system. Will they be positive for corporate earnings and/or the US worker? I think there’s a lot of risk that they won’t be. I am certainly comfortable predicting that any future laws passed by the Republican Democrat Regime on a Federal level will be done at the behest of a giant corporation/industry that donated many millions to make that happen so there will certainly be more firepower thrown at corporate earnings from a policy standpoint in future years. Then again, as we saw in 2001 and in 2008 when the markets crashed and the economy went recessionary, the Republican Democrat Regime policies continue to point towards more bubbles and crashes. So are we in a bubble and about to crash?

Want to know something funny? I just recalled writing that same question back several years ago. Here it is, from May 2011:

Shut up and buy the tech bubble – The Cody Word – MarketWatch – May 29, 2011

“Are we in a tech bubble already or not? Just because every bear you talk to and even the cover of the Economist say we are already in a huge tech bubble and every news paper article you read gives the obligatory ‘what some are calling signs of a bubble’ quote already right now in May 2011 doesn’t mean we are in a bubble. Indeed, if anything, all these bubble rumblings are probably indicators that we’re not in a bubble at all. At least not yet.”

Haha! Then again, let’s read more of my analysis from that report in 2011 (I’ll repost the article in its entirety at the bottom of this post):

“How many investors and traders and people at home missed out on huge fortunes because they were scared out of the burgeoning tech bubble when everybody was ‘warning’ them that ‘tech is already in a bubble’ back in 1995.

My analysis says that we need to ignore the people who think ‘tech is already in a bubble’ in 2011. Indeed, I expect we will look back in 2013 and 2014 and be thankful that we ignore the noise and tried to capitalize on the biggest marketplace in the history of the planet, the app/smartphone/tablet/cloud marketplace, when it was still early in the game.“

We were indeed thankful in 2013 and 2014 that we’d ignored the noise and invested early in the biggest marketplace in history. We’re even more thankful about it in 2018. Which leads me to another article I just found from 2011, when I wrote: “There’s indeed an entire burgeoning boom in the App Revolution as smartphone sales go from 100MM in 2009 to 400 million this year to 1 billion by 2017 or so. App downloads and cloud usage will grow exponentially on top of that. Don’t you think it’s time you got in front of that boom, especially if it can turn into an outright bubble, as it overshoots to the topside in coming quarters and years?“

Bold mine from 2018 real-time here. Let’s repeat that last phrase: “Especially if it can turn into an outright bubble, as it overshoots to the topside in coming quarters and years.”

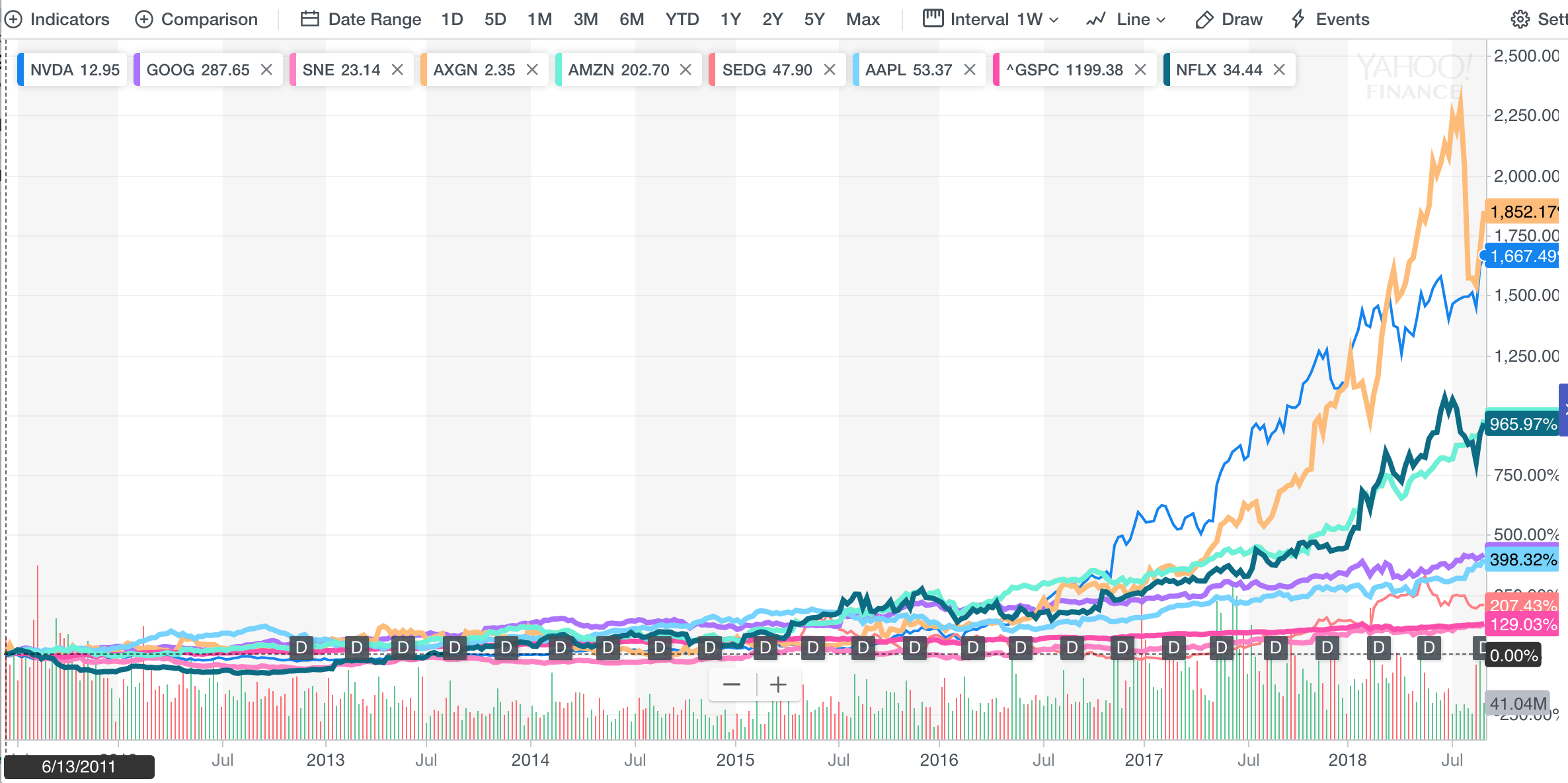

Now let’s look at these stocks’ moves since 2011 to see if they look like they might have “overshot to the upside” in the last couple years as I’d predicted they might:

There is now indeed here in 2018 a lot of straight up moves in the those stocks I was writing about in 2011 as potentially one day becoming Bubble Stocks.

Now one more thing I want to note about where we are in the cycle. Here’s a comment from the Trading With Cody Chat Room this morning:

“No offense to your guest Celente but he has been saying same stuff for 10 years. Listening to people like him is why I bought gold in 2008 instead of AMZN or AAPL. I think ultimately he is right but his timing has been awful. Question is, when house of cards comes crumbling down, how bad does it get? 1920s bad? When will our debt finally matter? 30 trillion? 50, 100?”

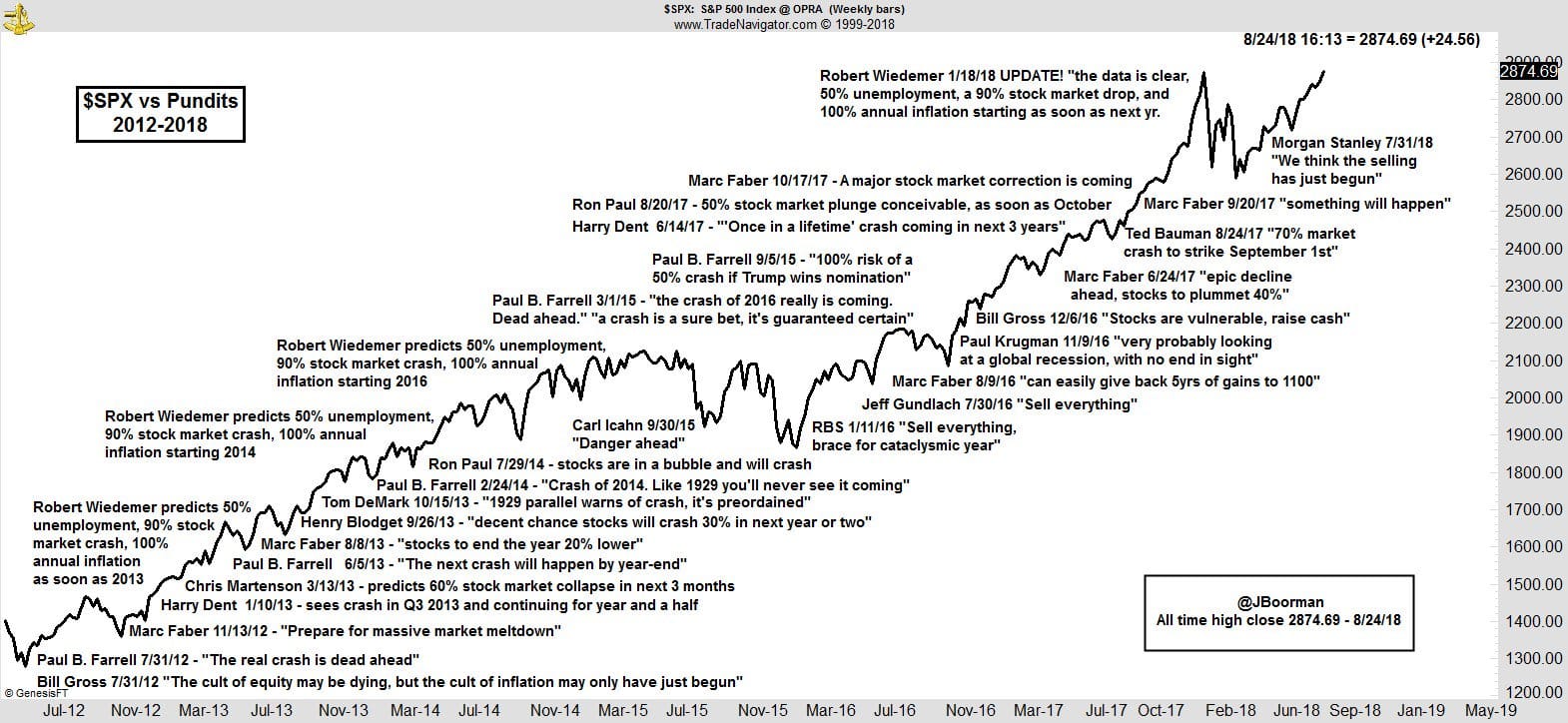

And here’s a screenshot of a bear-killing market chart that is making the rounds this week:

You certainly don’t get commentary and grave dancers on the permabears like this when the markets are at a bottom.

Now none of this analysis necessarily means that the Bubble-Blowing Bull Market is over right now. But what I also know is that we’re closer to the top than the bottom here. Long-time subscribers know that I pride myself on catching the broader economy and stock market turns before they happen. And I do think the risks to this Bubble-Blowing Bull Market are rising just as stocks are indeed going parabolic as I’d predicted they would seven years ago.

We don’t want to just sell everything or go short or freak ourselves out of our long-term holdings that have done so well for us over the years. And I know that new subscribers want some new Revolutionary ideas that could go up 500-1000%. But I also know that it’s getting harder to expect huge upside in the average and not-so average stock as prices, valuations, the economy cycle and the market cycle are all extended.

So be careful out there. But don’t freak out. I’m always working on new ideas, looking for amazing opportunities and I do think we’ll have some more huge homeruns over the next five years no matter what the broader market does.

And if you don’t own any of my Revolution Investing long-term Trading With Cody hard core stocks at all, I’d suggest starting slowly and buying maybe a 1/10th or 1/5th as much as you want to own in the highest rated names from the most recent Latest Positions. But I’d give yourself room to buy another tranche in a month or two and then nibble a little more in six months and/or three years and/or as the markets give us opportunities to do so with better risk/reward scenarios.

Shut up and buy the tech bubbleMay 26, 2011, 7:10 PM ET

By Cody Willard

To piggyback on my ideas, analysis and to find out exactly what options and stocks I’m buying and selling as I’m doing it in real-time, please check out TradingWithCody.com, where you also get all five of my investment books for free.

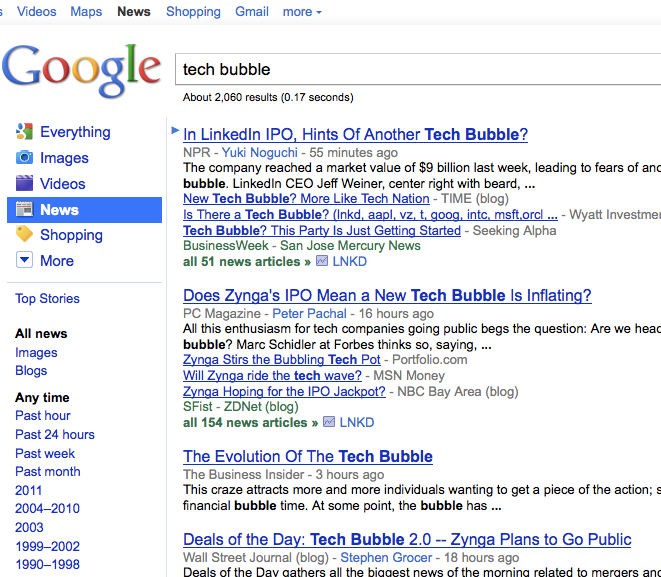

Are we in a tech bubble already or not? Just because every bear you talk to and even the cover of the Economist say we are already in a huge tech bubble and every news paper article you read gives the obligatory “what some are calling signs of a bubble” quote already right now in May 2011 doesn’t mean we are in a bubble. Indeed, if anything, all these bubble rumblings are probably indicators that we’re not in a bubble at all. At least not yet.

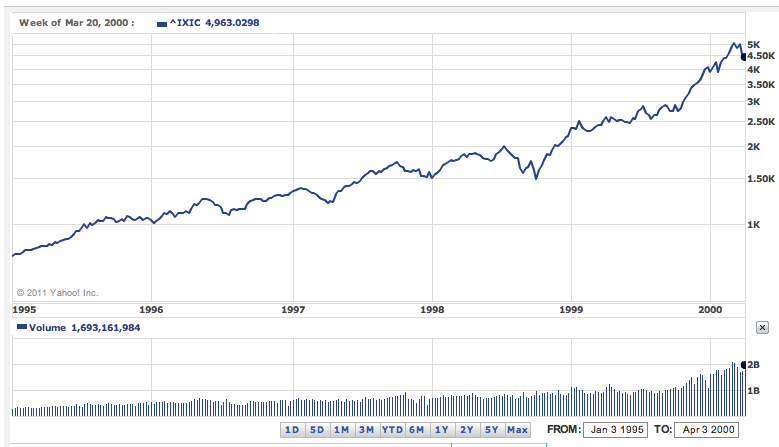

Let’s go back and look at the Great Telecom/Tech/DotCom Bubble of the 1990s for some history.

Even as far back as 1994 and especially in 1995 when Netscape first came public, most main stream analysis and media were wondering if tech was already in a bubble. Here’s a look at the frequency of news articles from 1994 to 1999 with both the words, “tech bubble”:

And here are a couple quotes from a few sample news articles talking about the “bubble” in 1995:

The tech-stock bubble Tampa Tribune – ProQuest Archiver – Aug 11, 1995 Don’t say there weren’t warnings that technology stocks were getting out of hand . The latest: the speculative frenzy over a company that helps us browse the …

Will Tech Fund Bubble Burst Soon? . Sunday Times-Sentinel – Google News Archive – Sep 17, 1995 Technology funds are showing some of the most powerful returns the industry has seen in years. If only we’d all been smart enough to know that in January. …

Yup, everybody was so smart and so smug saying that tech was already in a bubble as early as 1995. What happened to tech stocks from 1995 to 2000? The tech-heavy Nasdaq was up some 600% in the sixteen quarters from the end of 1995 to the end of 1999:

Eventually even the biggest bears got buried as they kept fighting that bubble or they eventually decided like everybody else that the trends were going to last forever.

There are currently 2060 recent articles that come up when you search Google News for the term “tech bubble”:

Now, where have you ever seen headlines like this before:

Does Zynga’s IPO Mean a New Tech Bubble Is Inflating? PC Magazine – Peter Pachal – 16 hours ago All this enthusiasm for tech companies going public begs the question: Are we in another tech bubble? Marc Schidler at Forbes thinks so, saying, …

The Evolution Of The Tech Bubble The Business Insider – 3 hours ago But I will introduce the general phases a new technology (paradigm) … At some point, the bubble has to burst. Things that go up must come back down. …

How many investors and traders and people at home missed out on huge fortunes because they were scared out of the burgeoning tech bubble when everybody was “warning” them that “tech is already in a bubble” back in 1995.

My analysis says that we need to ignore the people who think “tech is already in a bubble” in 2011. Indeed, I expect we will look back in 2013 and 2014 and be thankful that we ignore the noise and tried to capitalize on the biggest marketplace in the history of the planet, the app/smartphone/tablet/cloud marketplace, when it was still early in the game.

And again, even though we’ve had some huge homeruns betting on these revolutions already, the only guarantee I can give you is that I’ll remain focused and disciplined and that I’ll be doing everything I can to find us the best stocks and the best options to maximize our profits along the way.

If you’d like to find out how I’m building my own personal portfolio with eighteen long and short stocks, including what options I’m using, please check out TradingWithCody.com.

At time of publication, Willard, author of Revolution Investing and Trading With Cody, was net long Apple and Google though positions can change at any time. None of the information in this column constitutes a recommendation by Willard of any particular security or trading strategy is suitable for any specific person.