Looking back, looking ahead: Where I’d buy more of all of our stocks

Trade this big move before it’s too late! Buy that breakout. Sell this breach. Buy that stock if it spikes above this level on high volume and set trailing stop losses. Short some volatility. Open a butterfly straddle. Brexit! Greek crisis! Look over there, that’s shiny!

How many traders, newsletter writers, pundits, retail investors, hedge fund managers, mutual fund managers and other people around the stock market spend their lives over-trading, listening to each panic each other out over obscure short-term global “crises” and otherwise just spin their wheels and fail to even match the market?

I asked Trading With Cody subscribers to answer a few questions about how they’ve done by subscribing to Trading With Cody and the results were pretty astounding. Several subscribers who have been with me since the beginning, nearly 7 years ago, reported their stock portfolios are up 200% or 300% or more.

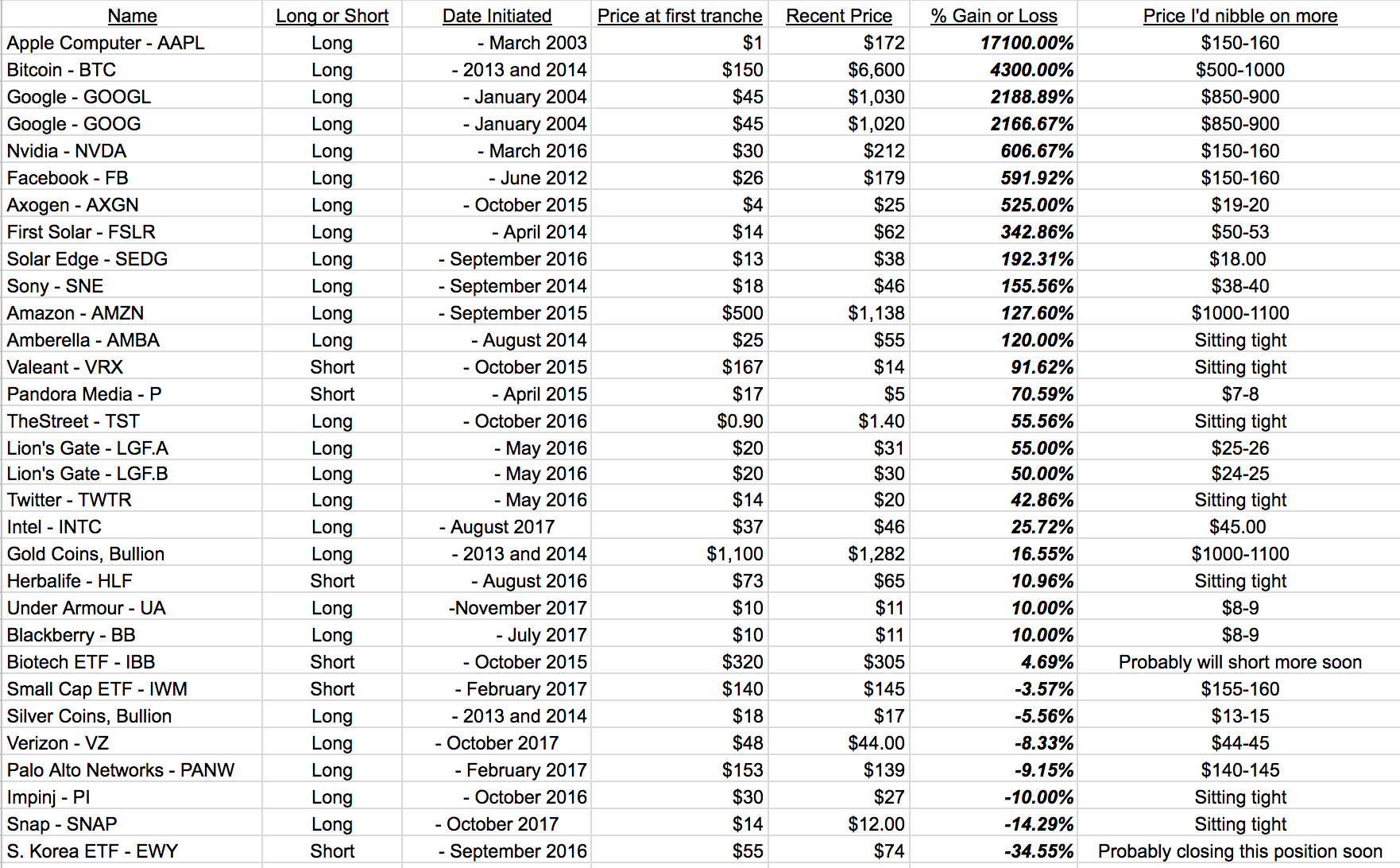

Some of the Revolution Investments that I’ve made in my professional career that I still hold in my portfolio, including those I’ve made over the last almost seven years since Trading With Cody launched:

| Name | Long or Short | Date Initiated | Price at first tranche | Recent Price | % Gain or Loss |

| Apple Computer – AAPL | Long | – March 2003 | $1 | $172 | 17100.00% |

| Bitcoin – BTC | Long | – 2013 and 2014 | $150 | $6,600 | 4300.00% |

| Google – GOOGL | Long | – January 2004 | $45 | $1,030 | 2188.89% |

| Google – GOOG | Long | – January 2004 | $45 | $1,020 | 2166.67% |

| Nvidia – NVDA | Long | – March 2016 | $30 | $212 | 606.67% |

| Facebook – FB | Long | – June 2012 | $26 | $179 | 591.92% |

| Axogen – AXGN | Long | – October 2015 | $4 | $25 | 525.00% |

| First Solar – FSLR | Long | – April 2014 | $14 | $62 | 342.86% |

| Solar Edge – SEDG | Long | – September 2016 | $13 | $38 | 192.31% |

| Sony – SNE | Long | – September 2014 | $18 | $46 | 155.56% |

| Amberella – AMBA | Long | – August 2014 | $25 | $55 | 120.00% |

| Amazon – AMZN | Long | – September 2015 | $500 | $1,138 | 127.60% |

| Valeant – VRX | Short | – October 2015 | $167 | $14 | 91.62% |

| Pandora Media – P | Short | – April 2015 | $17 | $5 | 70.59% |

Notice that the last two on the list are actually Revolution Investing short positions, meaning we bet that those stocks would crash.

The truth is that most investors don’t ever have even one or two stocks that go up 2000% and most retail traders/investors won’t even own one or two stocks that go up 500% in their lifetimes. And very few short sellers never have a stock that drops 90% after they short it.

We’re not most investors. 😉

That said, you guys know I make mistakes and I do my best to fix them quickly and learn from them when I do. But boy, have we had some huge winners that most investors can only dream of. Let’s not rest on laurels though!

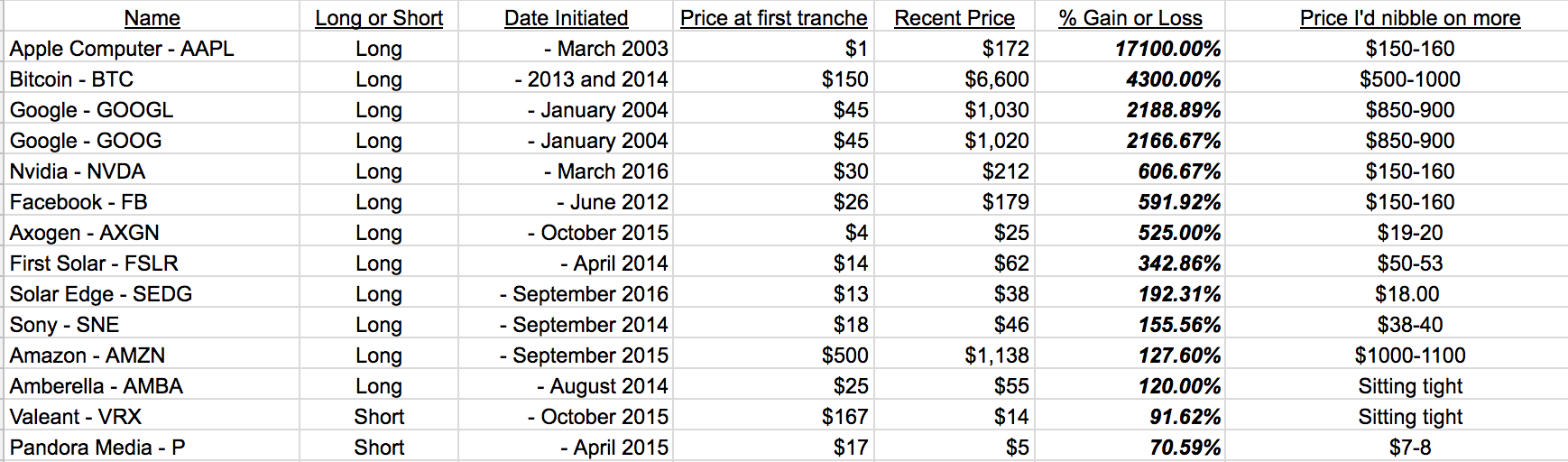

I’ve recently added a handful of new names that I think could go up big in coming years, including UA, Verizon and Intel. Here’s where I might nibble more on some of our other existing names.

| Name | Long or Short | Date Initiated | Price at first tranche | Recent Price | % Gain or Loss | Price I’d nibble on more |

| Apple Computer – AAPL | Long | – March 2003 | $1 | $172 | 17100.00% | $150-160 |

| Bitcoin – BTC | Long | – 2013 and 2014 | $150 | $6,600 | 4300.00% | $500-1000 |

| Google – GOOGL | Long | – January 2004 | $45 | $1,030 | 2188.89% | $850-900 |

| Google – GOOG | Long | – January 2004 | $45 | $1,020 | 2166.67% | $850-900 |

| Nvidia – NVDA | Long | – March 2016 | $30 | $212 | 606.67% | $150-160 |

| Facebook – FB | Long | – June 2012 | $26 | $179 | 591.92% | $150-160 |

| Axogen – AXGN | Long | – October 2015 | $4 | $25 | 525.00% | $19-20 |

| First Solar – FSLR | Long | – April 2014 | $14 | $62 | 342.86% | $50-53 |

| Solar Edge – SEDG | Long | – September 2016 | $13 | $38 | 192.31% | $18.00 |

| Sony – SNE | Long | – September 2014 | $18 | $46 | 155.56% | $38-40 |

| Amazon – AMZN | Long | – September 2015 | $500 | $1,138 | 127.60% | $1000-1100 |

| Amberella – AMBA | Long | – August 2014 | $25 | $55 | 120.00% | Sitting tight |

| Valeant – VRX | Short | – October 2015 | $167 | $14 | 91.62% | Sitting tight |

| Pandora Media – P | Short | – April 2015 | $17 | $5 | 70.59% | $7-8 |

| TheStreet – TST | Long | – October 2016 | $0.90 | $1.40 | 55.56% | Sitting tight |

| Lion’s Gate – LGF.A | Long | – May 2016 | $20 | $31 | 55.00% | $25-26 |

| Lion’s Gate – LGF.B | Long | – May 2016 | $20 | $30 | 50.00% | $24-25 |

| Twitter – TWTR | Long | – May 2016 | $14 | $20 | 42.86% | Sitting tight |

| Intel – INTC | Long | – August 2017 | $37 | $46 | 25.72% | $45.00 |

| Gold Coins, Bullion | Long | – 2013 and 2014 | $1,100 | $1,282 | 16.55% | $1000-1100 |

| Herbalife – HLF | Short | – August 2016 | $73 | $65 | 10.96% | Sitting tight |

| Under Armour – UA | Long | -November 2017 | $10 | $11 | 10.00% | $8-9 |

| Blackberry – BB | Long | – July 2017 | $10 | $11 | 10.00% | $8-9 |

| Biotech ETF – IBB | Short | – October 2015 | $320 | $305 | 4.69% | Probably will short more soon |

| Small Cap ETF – IWM | Short | – February 2017 | $140 | $145 | -3.57% | $155-160 |

| Silver Coins, Bullion | Long | – 2013 and 2014 | $18 | $17 | -5.56% | $13-15 |

| Verizon – VZ | Long | – October 2017 | $48 | $44.00 | -8.33% | $44-45 |

| Palo Alto Networks – PANW | Long | – February 2017 | $153 | $139 | -9.15% | $140-145 |

| Impinj – PI | Long | – October 2016 | $30 | $27 | -10.00% | Sitting tight |

| Snap – SNAP | Long | – October 2017 | $14 | $12.00 | -14.29% | Sitting tight |

| S. Korea ETF – EWY | Short | – September 2016 | $55 | $74 | -34.55% | Probably closing this position soon |

Now ALL that said, folks, let’s remember that we’ve got to stay flexible and even a bit cautious at this stage of the Bubble-Blowing Bull Market that we’ve been riding.

PS. I’m including screenshots of the above charts in case they aren’t easily read on your device.

Screenshot of the first chart:

Screenshot of the second chart: