Market insights from Martin Zweig and the Anthony Scaramucci App

I’ve known Anthony Scaramucci, that guy that you’ve seen everywhere this week after he was named White House Communications Chief, for many years. And, yes, of course my company worked with Anthony long ago to create The IAm Anthony Scaramucci App for iPhone (https://goo.gl/w7ib7z) and Android (https://goo.gl/3KmGTJ)

Regardless of my relations and business dealing with people in the existing and prior White House(s), let’s be clear that I will never vote for any Republican or Democrat (I write in and/or vote for Independents) and that I am focused on being objective about the Republican Democrat Regime, its Federal Reserve — and how their policies affect our stock markets, economy and livelihoods.

And on that note, let’s talk more about the Fed and the cycles their interplay…

I’ve been re-reading Martin Zweig’s “Winning on Wall Street: How to Spot Market Trends Early, Which Stocks to Pick, When to Buy and Sell for Peak Profits and Minimum Risk” and it’s a fascinating look back at how the conventional wisdom about how the axiom of “Don’t Fight the Fed” has become conventional wisdom.

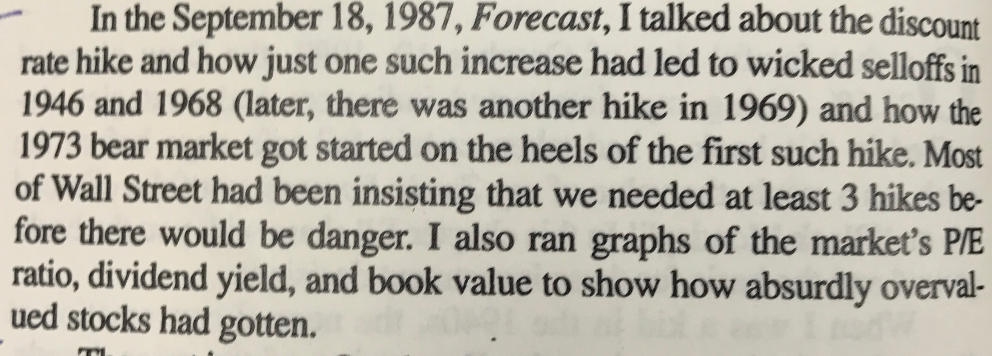

Zweig is (was?) famous for having bought puts for his newsletter and his fund before Black Monday 1987 when the DJIA crashed 22% in one day. And you’ll notice that the very first “reason” for this having turned bearish and buying the puts was that the conventional wisdom was it would take at least 3 rate hikes from the Fed before there would be danger but that “just one such increase has led to wicked selloffs in 1946 and 1968…

Most people who read this book seem to fascinate on this one theory that proved right — one time, in the 1987 story that Martin tells to start off his book — is that “It only takes one rate hike to cause a market crash, so don’t fight the Fed!”

Errr, or not. During the last three decades since Zweig’s Winning on Wall Street book has been published (and as I’ve explained for the last 20 years) that’s no longer been the case. Perhaps it’s a classic case of how on Wall Street whenever something gets to be “conventional wisdom” that it no longer works. Or maybe Zweig just got lucky in 1987 and we shouldn’t over-extrapolate anything out of that one data point.

But there are many more important lessons to be learned in the book about trading and investing successfully, as Zweig did over the years for his fund and newsletter subscribers. Here’s a couple more that are within two pages of the above quoted paragraph about the Fed that everyone seems to focus on.

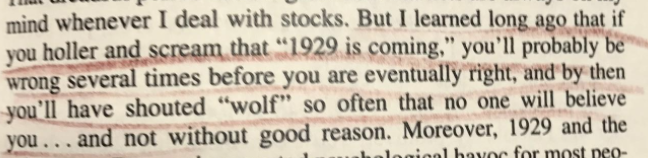

Long-time followers of mine have seen me chide what I call the “perma-bears” who kept screaming “1929 is coming” from 2002-2007 as the stock market went through the roof. And I’ve been chiding perma-bears for the last seven years of this Bubble-Blowing Bull Market that we’ve been riding.

You have to wonder why these perma-bears have missed (continue to miss?) the Bubble-Blowing Bull Market that has created so many profits for the rest of us these last few years. Maybe these guys use the wrong indicators. Maybe they just don’t wait for their indicators to turn. Maybe most traders, investors and pundits are second-guessing their compass.

You guys know that I keep saying I am looking for a downturn to get us more cautious and/or bearish, but that my analysis hasn’t indicated a turn.

And where have you dear subscribers been reading about me waiting patiently for the next great pitch and not just trading and buying stocks for any other reason.

Let’s continue to work the count, keep our positioning as our analysis indicates we should and look for the next great pitch or three coming our way.