Market notes, must-reads, trading ideas and deep thought of the day.

Somber mood out there this morning as the markets open down big. Portugal bank Espirito Santo gets suspended and freaking out the world. On Monday I turned short-term bear writing “Path of least resistance has now turned downward.” So it goes for now. The response from Marketwatch readers on these news round ups I’ve been doing lately has been so good, I’m going to try to do these more often. Here’s part of what every investor and trader should be thinking about into the weekend.

Best trade to make for the rest of the summer – If (IF) you’d bought GDX and shorted QQQ at the moment I wrote that comment two days ago, you’d not only have made big money, you’d also be one of the bravest traders in the world. I often write that the toughest trade is often the right one, and that was a classic example. Frankly, I’m almost sick to my stomach this morning for not having made the trade myself when I wrote that. I could have at least thrown a Scutify Sentiment Vote at the trade. All that said, I think this trade is just barely started playing out and I’m likely to still put some version of it on soon.

Fed plans to end taper in October: minutes – Does Fed tapering matter? Imagine you’d been flooding your fields with excess water for five years straight and its all swampy and there’s places that have washed out completely and other places that are drying out. And then you announce to your crop that you’re going to stop flooding your fields with excess water for at least a few hours a day, but that for all intents and purposes you will continue flooding the fields. Taper is a distraction. The fields are flooded and there’s no drying them out without a complete revaluation of gold. Make sense? Who cares about tapering. The damage to the economy and our currency is already done. Gold will show that over the next few decades whether they taper this week or next month or stop all QE entirely tomorrow.

InvenSense likely won designs across Apple product lines – Invensense INVN and Synaptics SYNA have had almost identical returns for shareholders since INVN came public 2.5 years ago. Both are still good Revolution Investing plays, I think. I own Invensense and plan to for a long time as it’s a great play on the Wearables, Robotics and Drone Revolutions.

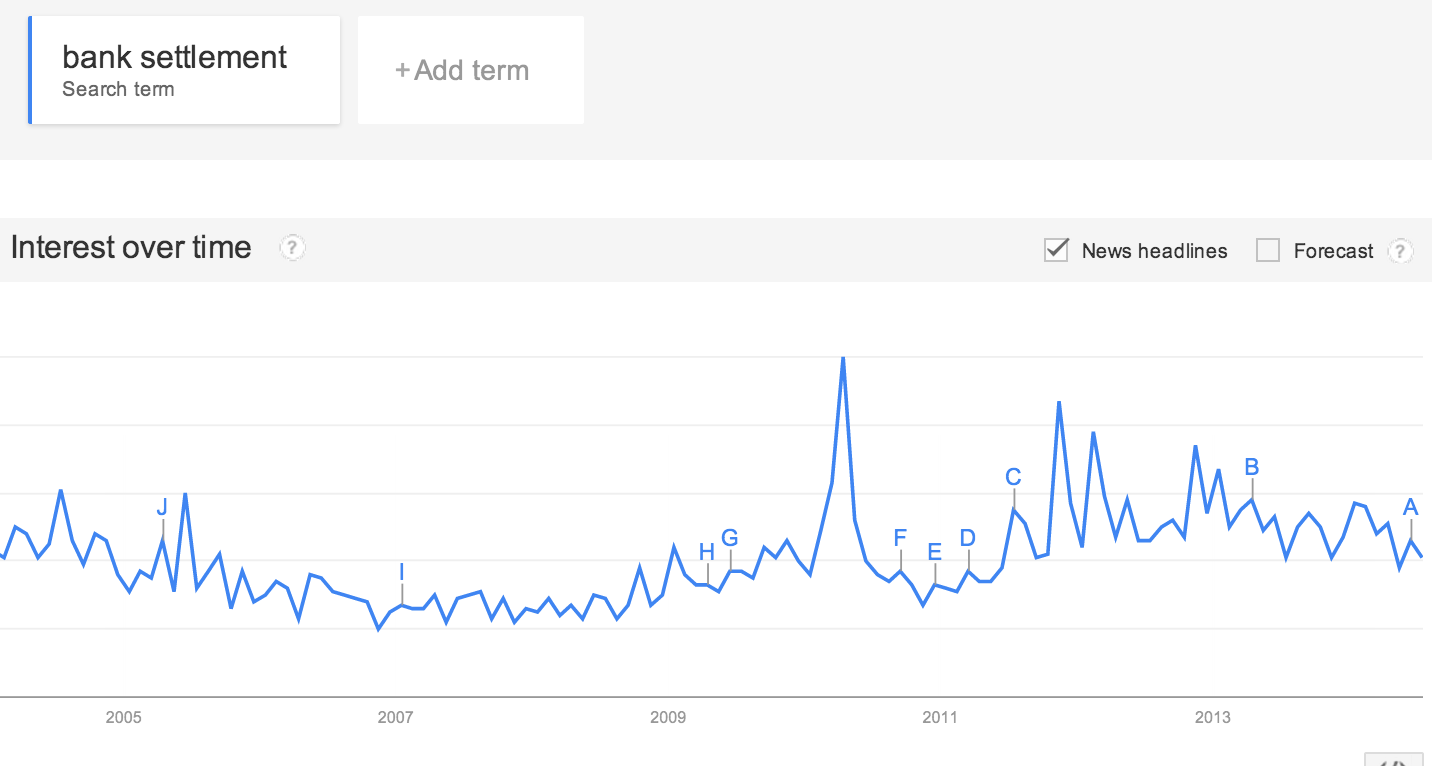

Citigroup said to be near $7-billion mortgage settlement – Citigroup C is paying a $7BB fine. Citigroup will get $70BB in welfare implicit and explicit this month, just like they get every month via 0% rates etc. If Citigroup destroys their entire balance sheet paying out billion dollar bonuses this year and next, well, what’s going to happen is they will get something like $1TT in direct welfare that year and then will pay $100BB in fines over the new few years after that. Rinse, repeat til the collapse comes, if you keep voting in Republican/Democrat Regimers.

Deep Thought of the Day: Just because everybody finally recognizes something, doesn’t mean we should become contrarians right now just for the sake of being contrarian. Sometimes you should be a contrarian to the contrarian.