Mini Zebus, Oil Prediction, RIVN v. TSLA, ARM, And Much More

Here’s the transcript from this week’s live Q&A chat:

Q: If oil should fall to near $70, and inflation seems to be coming down some, shouldn’t the Fed stop raising or even cut rates in the coming months?

A. I think the Fed should and will stop raising rates for a while. Not sure they should cut rates for the next few years unless there’s a major financial crisis or something. 5-6% rates are normal for most healthy economies/societies.

Q. Your view on crude oil. Will it touch $110 or $60 first?

A. I think oil could trade in the $70s before year-end but maybe not go down all the way to $60. I think human nature and economic realities and greed will make most of the always corrupt OPEC+ member countries pump out more oil than they agreed to whenever oil gets close to or above $100 a barrel which would make $110 a barrel the likely high end of the range at best.

Q. Presently I don’t own Apple (AAPL), Micah Lamar suggests that this is a critical level and the next level down is $150/share. Would you buy here or wait?

A. Hmm, I’ll just riff on Apple (AAPL) here, and let’s see where we end up. Apple’s not had an innovative new hardware product since Steve Jobs passed and that’s a problem for a company that’s supposed to be innovative. Remember when Apple rolled out their Amazon Alexa knock-off product? Does anybody even use those Apple home devices these days? Apple Watch still can’t stay charged for more than 3 days at a time. The Apple Car has never seen the light of day (which is exactly what I told everybody would be the case for years by the way as I never thought Tim Apple (what Trump called Tim Cook) would ever be able to lead Apple to build a good computer car. Meanwhile, Apple’s valuation is still stretched here, certainly higher than I can historically remember it ever trading as its forward P/E is about 30 and for the first fifteen years I owned AAPL, it usually traded with a 10-15 P/E. A 15 P/E for its $6.59 earnings estimate for 2024 would put the stock below $100 per share! I’m not sure it’s going that low, but I do think it could give back some of these gains it’s had this year and could trade down to $150/share. On the other hand, Apple’s iPhone is still one of the most important consumer products ever to hit the market and is one of the few products that poor and rich people alike can use daily. I’m not terribly bullish or bearish on AAPL the stock right now but I’d be careful about buying any more than just a starter position if you don’t own it already. I’ve personally owned AAPL since March 2003 and still do.

Q: Sorry about my typing, watching my granddaughter.

A: All good, Derek. Grandkids are keys to happy living!

Q: Agree totally!

Q. I have added Alphabet Inc. (GOOG), but want to add more. Should I wait for a pullback or buy at this price?

A. Maybe consider buying 1/3 as much as you want to add now and then do more if it pulls back in the coming days and then more in a month.

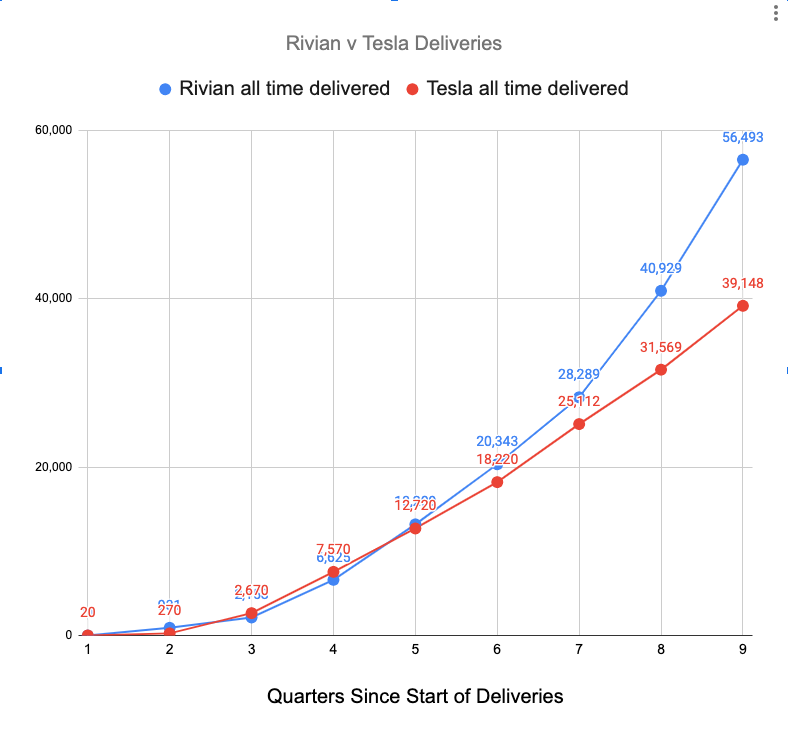

Q: Thoughts on this WSJ article about Rivian (RIVN) burning cash?

A: Thanks for the article. WSJ has never been a fan of Rivian (RIVN) or Tesla (TSLA), though WSJ is always willing to say good things about Ford (F) and General Motors (GM) who happen to advertise with Newscorp (WSJ’s parent company). That said, RIVN is burning a lot of cash as we have written about but is hitting/exceeding its production targets and is actually ahead of where TSLA was when it was at this point in its production life.

Q. Could Rivian (RIVN) be a binary stock like what Tesla (TSLA) was when it faced a make-it-or-break-it moment before the Model 3 took off? If RIVN is facing such a tough struggle manufacturing EVs, what do you say of General Motors (GM), Ford (F), and the rest of the legacy OEMs? Will one of the legacies buy RIVN?

A. The reason I got soooo wildly bullish on TSLA at $17-20 a share back in 2019 was because I bought the Tesla Model 3 for about $50,000 (the lowest-priced Model 3 back then was $35,000) and quickly found it to be the greatest value/purchase I’d made in years and I knew that middle-class people around with world could afford a Tesla Model 3 and that they would love the Tesla Model 3 as much as I did. I drove that Model 3 for three years, dinged the back panel, and then sold it for even more than I’d paid for it. Rivian’s trucks and SUVs are awesome but they cost $73,000 to $100,000+ or so and at those price levels, middle-class people around the world are NOT going to be buying Rivians. If Rivian can successfully roll out the new, smaller truck and SUVs they’re planning on for $30-$50,000 they might very well become The Next Tesla and the stock could go to $100/share in three to five years. At the current $23 price that RIVN is currently trading at, the market cap is $20.5 billion, or about 1/2 of one GM and almost half of one Ford F. I don’t think GM or F can afford to buy Rivian. I think GM might not make it another three to five years and I think Ford will struggle but will survive. I’m long GM puts and have been for most of the last few months although I did sell some GM puts when it hit new 52-week lows today. Rivian could get hit in the next few weeks if Tesla announces that the Cybertruck prices are a lot lower than Rivian’s truck price so we added some Rivian puts today to hedge it a bit. We also have sold about 20% or more of our Rivian since it got to the mid $20s as noted in prior write-ups. Tesla is tough to compete against.

Q. Any update to your comments regarding Solaredge (SEDG)? Really looking ugly the last couple of weeks. Short-term and long-term prospects?

A. We bought a little Solaredge (SEDG) for the hedge fund earlier this week but are not making a big bet on it right now. I first bought and sent out a Trade Alert about this stock at $14 a share and I have just been sitting on those shares in my personal account still. Short-term is a tough setup for all solar companies, as I’ve been explaining all year, partly because borrowing money at 8% interest rates to put solar panels on your house or business vs. 0% interest rates is not economical. Long-term, solar and nuclear are the best Energy Revolutions to bet on.

Q: I believe that NuScale Energy (SMR) is a subsidiary of Fluor (FLR), that has been moving up. Is SMR worth buying?

A: Fluor spun out NuScale (SMR) and remains its largest shareholder. We still have a good-sized position in SMR and are not necessarily adding any more here, but if you do not own any you might consider buying some now.

Q. Ran across a very interesting job posting by Microsoft that relates to your SMR position I think. “Principal Program Manager Nuclear Technology: ‘The next major wave of computing is being born, as the Microsoft Cloud turns the world’s most advanced AI models into a new computing platform,’ said Satya Nadella, chairman and chief executive officer of Microsoft. ‘We are committed to helping our customers use our platforms and tools to do more with less today and innovate for the future in the new era of AI.’ We’re looking for a Principal Program Manager, Nuclear Technology, who will be responsible for maturing and implementing a global Small Modular Reactor (SMR) and microreactor energy strategy. This senior position is tasked with leading the technical assessment for the integration of SMR and microreactors to power the data centers that the Microsoft Cloud and AI reside on. They will maintain a clear and adaptable roadmap for the technology’s integration, diligently select and manage technology partners and solutions, and constantly evaluate the business implications of progress and implementation. The ideal candidate will have experience in the energy industry and a deep understanding of nuclear technologies and regulatory affairs. This role will also be responsible for research and developing other precommercial energy technologies. You will be working with people from many different teams and backgrounds requiring an open mindset. You must be able to identify and partner with other groups to achieve joint or complementary goals. A proven track record of successfully managing projects, driving contractual improvements through service agreements and lower cost are skillsets needed to be demonstrated, resulting in measurable impact to be successful in this role. In alignment with our Microsoft values, we are committed to cultivating an inclusive work environment for all employees to positively impact our culture every day.” It seems like there is an emerging trend of data centers being turned into either their own microgrids and/or being built closer to where energy material is generated for the twofold purpose of lower transport emissions (green) and cheaper operating costs. I work for a cybersecurity company, Palo Alto Networks, so I’m always very interested in your thoughts on that industry. Thanks as always for the great recommendations and thought-provoking articles.

A. Thanks for the kind words. There has definitely been an uptick in interest in Small Modular Reactors for anything that has large energy needs, including data centers and crypto mining centers. It’s still To Be Determined who wins in the SMR industry.

Q. I am upside down on Blade Air Mobility (BLDE) and MP Materials (MP) should I add or hold? I remember holding Skillz (SKLZ) & Fubotv (FUBO) for big losses.

A. I can only tell you what I’m doing with them — we bought more BLDE this morning but it’s still a smallish position. We have had MP in the penalty box for a while and are mostly sitting tight with it for now. MP is still up from where I first sent out the Trade Alert when I was buying it at $14 a share.

Q. Didn’t you have buys on MP $40+? Wouldn’t this make your cost basis higher? What is the best way for us to keep up the dollar cost averages?

A. I did have some buys on MP at higher levels than $14, I was just saying that it was indeed up since when we first bought it. I think I’m sitting on a loss on MP overall right now.

Q. Hoping all is well with you. Just read your AI note and was thinking that you probably are looking at Arm Holdings PLC (ARM), although you did not mention it. As you well know, Nvidia (NVDA) negotiated to acquire ARM for $40 billion from Softbank, in a deal that was strongly opposed by many of the tech big boys, Qualcomm (QCOM), Intel (INTC), and Microsoft (MSFT), among the most prominent ones, so ARM has to be doing something interesting and with high strategic value that I can only surmise because it’s above my pay grade. I don’t buy IPOs and would not go near anything that Softbank is selling, but if its market value eventually goes below Nvidia’s purchase price of $40 billion (now it is about $60 billion), it may become interesting. What do you think?

A. I think there are two problems with ARM here that will probably keep me away from it. 1) The company depends on smartphones for most of its revenues and smartphone penetration has become saturated and smartphone sales are now mostly cyclical. 2) RISC-V is a competing open-source technology that was used by the one and only Tesla (TSLA) to design their new Dojo Supercomputer chips, the D1. If RISC-V is good enough for the best tech companies like Tesla to use to design their new chips, I don’t see why others won’t be using RISC-V for free in lieu of paying ARM royalties.

Q. In yesterday’s writeup I see that you were buying Instacart (CART). Is that a trade alert?

A. Yes, consider it a Trade Alert that we started slowly building a long position in CART this week.

Q. Are there any possible shorts in the housing sector? With 30-year mortgages at 7.5% or whatever it is, one would think housing would fall. On the other hand, with no one selling homes maybe there is still demand for new homes?

A. Yes, higher rates should make the average house get sold at a lower level than it was sold at when rates were 2%. And yes, on the other hand, nobody who bought a house when rates were at 2-5% wants to sell their house now and the giant corporations that were loading up on houses during Covid are still mostly sitting tight on them. So there’s very little supply. All of which creates too many cross currents for me to make a bet shorting home builders.

I leave you all with a picture of our two baby miniature zebu cows that Bryce and I took on the way back to the office from lunch today. I’ve taken to calling one “Freckles” and the other one “Bambi”.