Morning notes plus Zika Virus analysis and playbook

Employment and jobs numbers come in about as expected — some strength but not really strong. I think most data points and analysis point to the Fed still going back and cutting rates and/or creating new forms of QE this year and I don’t find that set -up very bullish.

LinkedIn ($LNKD) and Tableau Software ($DATA) reported earnings last and their stocks are both down 30-40% today, and are down 50% plus from their highs last week.

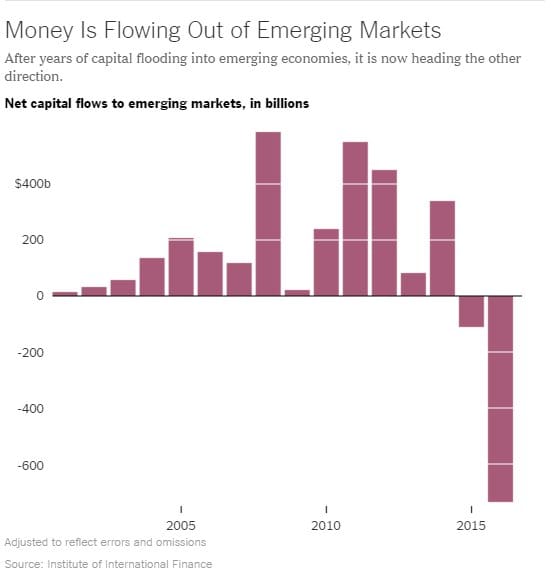

You guys know that I’ve always said we should mostly avoid emerging markets and anything non-US-based in our investments. And you know that for the last few months I’ve been pointing out how it’s increasingly likely that the emerging markets (and larger commodity-based economies) are likely in huge trouble this year. This trend is an example of “Reflexivity” as the capital flows to emerging markets are about to impact the economy as much as the economy is impacting capital flows to emerging markets:

I’ll have an updated Cody’s Latest Positions report out for you later today, but in the meantime, let’s talk about the Zika virus and its potential to impact the markets and economy.

The Zika Virus outbreak is starting to have the potential to impact travel and other economy, especially in Central and South America and the Carribean.

Here’s the best must-know snapshot about the Zika virus that I’ve seen. Zika Q&A: What to know about the mosquito virus. And from that article, here’s what bothers me most about Zika:

“Zika was first detected in Brazil in May. Researchers suspect the virus may have arrived in South America during the 2014 World Cup Games that drew millions of fans to Brazil. Zika usually causes no symptoms, which could explain why the first cases of illness weren’t reported the country until the following year.

Brazil’s hosting of the Games could give mosquitoes a chance to infect people from around the world. Public health officials in Rio de Janeiro downplay the risk, saying there will be fewer mosquitoes when the sporting event opens during the cool month of August. City workers are already destroying mosquito-breeding grounds.”

I’m a bit embarrassed to admit that my favorite game that I’ve ever played on my smartphone is called “Plague Inc.” It’s a bit of a sick game because you play as a virus or plague or other plague and your mission to overcome mankind’s efforts to destroy you. You win the game when every last one of the 7 billion humans on the planet are dead. Early on in each game, you get the chance to see a 500% or more gain in the humans you’ve infected when the Olympics are held despite concerns about the break out.

Now I’m not going to make any real world conclusions about Zika and how the Olympics in Brazil this summer could help spread the disease from a smartphone video game. But the fact that the WHO and CDC are worried about it while the market looks past the current Zika breakout — well, it’s something we should have on our radar as yet another potential Black Swan for this market and economy.

Frankly, it bothers me that Zika’s not dominating the headlines the way that Ebola did when there was that break out last year. Recall some of my writings from back then when I was buying stocks into a 5% Ebola panic stock market sell-off:

“If the reason the market is selling off the last 5% or so is because of #Ebola concerns, then I expect a bounce back to new highs relatively quickly.”

The stock markets have been weak all thoughout 2016, but I don’t think that weakness is from Zika concerns. You find a total of a handful of mentions of the Zika outbreak on WSJ.com, Marketwatch.com and USAToday.com, none of which talk about it as a potential catalyst for market sell-offs or economic impact. Zika’s not life threatening in most cases, but its ability to do irreparable harm through birth defects is scary. And scary too is that fact that there’s no easy way to test for the disease and no treatment or vaccine for it.

There are a few Zika plays in the stock market such as $XON Intrexon and $INO Inovio. I wouldn’t want to try to invest on hopes that one of those companies creates a viable Zika treatment. I’m not in favor of trying to buy a biotech based on a disease breakout, as they often crash later as evidenced by the Ebola plays that spiked back last year. As I’d mentioned back in October 3, 2014:

“Tekmira TKMR does have options available and if you’re a risk-taker kind of reader, I thought I might flag the TKMR puts dated out six months or more and with strike prices around $20-24 or so.

Prayers to all affected by the ebola outbreak, and I hope this thing gets contained asap globally and in the US. Ebola should be on our radar as a possible Black Swan. But I don’t think TKMR‘s huge move here is going to work out well for new shareholders.”

Tekmera was at $29 when I wrote that. Today? It’s changed its name and it symbol, but the stock sits at $3.

A few other notes about what to look for if the Zika break out escalates further and the markets do take a hit from Zika fear.

Oil – Zika concerns, would start impacting people’s travel plans. If they can choose not to travel, they won’t. It’s possible that oil won’t be able to rally until Zika is contained globally. It’s possible oil could take another big hit if Zika starts dominating the headlines and market discussions.

Gold – Gold would quickly become a safe haven again, and it would have a Zika-premium. I own my physical gold coins and bullion that I bought a few years and plan on holding it pretty much forever.

If gold goes to $1400 or more, they will print money and be fine and the stocks will go higher. If not, they could be in big trouble. Gold miners and the $GDX, with gold at $1150, are a pure leveraged bet on the direction of gold from here. If gold goes to $1100 there will be a wave gold miner bankruptcies in the next year or two. If gold goes to $1300 and stays there or higher, gold miner stock and $GDX could pop another 50-100% in the next year or two.