My Apple strategy now and some questions you should be asking yourself

Get TradingWithCody.com for only $58/month. For the holiday season, I’m offering another 30% off the $999 annual subscription price to TradingWithCody.com. Click here to take advantage of this rare offer. http://tradingwithcody.com/holiday-special/

$AAPL‘s market cap is within 1% of making it the first $700BB company in the history of the planet. I remember when $CSCO was worth $500BB back in the year 2000. $AAPL‘s value is more stable, but that doesn’t mean it won’t be worth less than $500BB itself again someday in a bear market. At any rate, I think $AAPL remains a must-own long-term, but I wouldn’t want to plow into it all at once. Slow and steady as she goes, as usual. I might decide to trim some Apple when it starts acting poorly rather than just doing so into this ongoing strength. Let you know if and when.

I am adding a second tranche of our Sonic short position here today. It’s up about 10% from my first tranche and it’s a tiny position, so I’ve still got some room to work with and I’d look at adding a third and final tranche in the next few weeks. It will still be a small position relative to my longs, which are much bigger than my shorts in addition to having more longs than shorts. My stock portfolio long and short weightings are partly a reflection of my overall continued bullishness. Now onto today’s report.

One of the most important lessons I’ve learned over the decades that I’ve been in the markets and on Wall Street is that we won’t ever know the answers of where the economy, society, the markets and just about anything else are headed. It’s hard enough to try to frame the questions themselves in an objective manner and even harder to predict the answers. So let’s go through some important questions that I’ve tried to frame in the most objective manner I can and to discuss some of the possible outcomes.

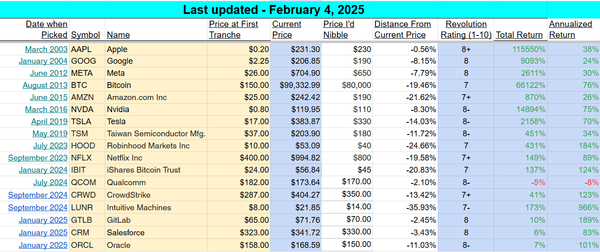

Do we chase stocks that we want to buy for the long-term as they keep going higher? The relentless rally brings its own set of issues for investors and traders with it. I try to have my cake and eat it too, by slowly scaling into stocks that I want to own for a very long time and then trimming and scaling into them over time as prices ebb and flow. I’ve got several new stocks I want to start scaling into as we head into year-end, and I’ll follow our playbook to do so.

Do we sit on our cash and wait for the next big crash? Not necessarily. Again, let’s try to have our cake and eat it too. That is, we’ve slowly raised our cash levels and reduced the overall number of stocks we own, but we’ll be opportunistic as always in trying to maximize our long-term gains while minimizing our risks and losses.

What if that crash doesn’t come for another two, three or four years? For the last five years, I’ve just not seen the catalysts for a market crash building like we saw in the collapse of badly managed dot-coms and telecom companies funded with easy money but without sustainable business models in 1999-2000 or the real estate bubble popping in 2007-2008 funded with easy money til it ran out. Oil and its collapse could be another spot of crashes as the billions invested in shale recovery could bring on an oversupply of energy creating a vicious cycle downward. If oil falls into the $60s, or especially in the $50s, there will be a lot of pain in east Texas and other shale boom areas. Will that pain spread? The oil/energy/shale bubble (if it turns out we are indeed living in one right now) is not the magnitude of the real estate bubble, which no sector of the economy could sustain its popping, but it could turn out a lot like the dot-com/tech bubble when it popped. And that would likely bring down the broader markets at least for year or two.

What if it doesn’t come for another decade? Put another way, what if the cycles of bubbles swinging to crashes that we’ve been dealing for the last two decades stabilizes into something a lot less volatile? What if markets stay sideways for the next ten years?

It’s happened before in the history of our modern stock markets, several times, actually. From 1905 – 1921 and again from 1937 – 1952 and again from 1966 – 1982. That’s when the markets truly become a stock picker’s market, because index-buying and broad stock portfolios will drastically underperform the fastest-growing companies in that kind of cycle. Heck in some sense, the Nasdaq’s been rangebound since 1999 to today.

Like I said earlier, I’ve got several new stocks I want to start scaling into and will be doing so into year-end, as I finish doing my homework on each of them. Stay tuned and stay vigilant and stay objective.