My Buffett Stocks, Starlink Vs The World, Markets Commentary, And MUCH More

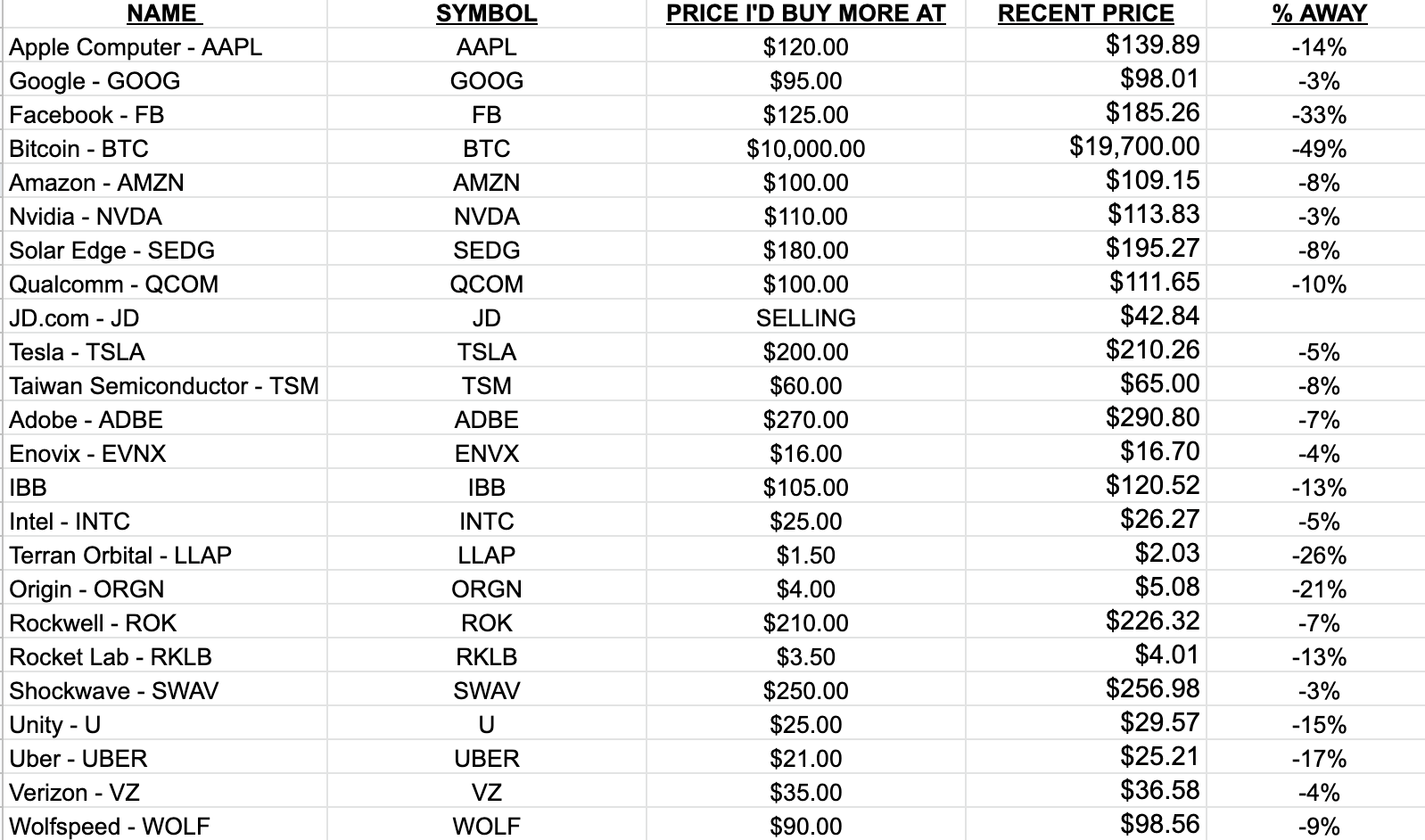

I had a few typos on that recent “Where I’d Buy More” spreadsheet because I was rushing it out to get to an appointment that day and I apologize. I have people who offer to edit my posts before I send them out but by the time I write these things up, I want to get it out to you as fast as possible, especially if it’s when the markets are open. Anyway, some of the stocks hit the levels I’d buy more at the very next day after I sent out that post I think, although this week has become a blur by now as the gyrations intraday and day-to-day have been exhausting for a hedge fund manager.

| NAME | SYMBOL | PRICE I’D BUY MORE AT | RECENT PRICE | % AWAY | |

| Apple Computer – AAPL | AAPL | $120.00 | $139.89 | -14% | |

| Google – GOOG | GOOG | $95.00 | $98.01 | -3% | |

| Facebook – FB | FB | $125.00 | $185.26 | -33% | |

| Bitcoin – BTC | BTC | $10,000.00 | $19,700.00 | -49% | |

| Amazon – AMZN | AMZN | $100.00 | $109.15 | -8% | |

| Nvidia – NVDA | NVDA | $110.00 | $113.83 | -3% | |

| Solar Edge – SEDG | SEDG | $180.00 | $195.27 | -8% | |

| Qualcomm – QCOM | QCOM | $100.00 | $111.65 | -10% | |

| JD.com – JD | JD | SELLING | $42.84 | ||

| Tesla – TSLA | TSLA | $200.00 | $210.26 | -5% | |

| Taiwan Semi – TSM | TSM | $60.00 | $65.00 | -8% | |

| Adobe – ADBE | ADBE | $270.00 | $290.80 | -7% | |

| Enovix – EVNX | ENVX | $16.00 | $16.70 | -4% | |

| IBB | IBB | $105.00 | $120.52 | -13% | |

| Intel – INTC | INTC | $25.00 | $26.27 | -5% | |

| Terran Orbital – LLAP | LLAP | $1.50 | $2.03 | -26% | |

| Origin – ORGN | ORGN | $4.00 | $5.08 | -21% | |

| Rockwell – ROK | ROK | $210.00 | $226.32 | -7% | |

| Rocket Lab – RKLB | RKLB | $3.50 | $4.01 | -13% | |

| Shockwave – SWAV | SWAV | $250.00 | $256.98 | -3% | |

| Unity – U | U | $25.00 | $29.57 | -15% | |

| Uber – UBER | UBER | $21.00 | $25.21 | -17% | |

| Verizon – VZ | VZ | $35.00 | $36.58 | -4% | |

| Wolfspeed – WOLF | WOLF | $90.00 | $98.56 | -9% |

And here’s the transcript from this week’s Livestream Q&A Chat. If you prefer you can watch a replay of the video on Youtube clicking here. I’d like to thank Cabana Crypto, who has been a subscriber and/or reader of mine for about 20 years and whom I’m just now getting to know better and am glad I’m doing so. (By the way, I haven’t edited the transcript at all, sorry.)

Cabana Crypto:

Hey, what’s going on everybody? We have a Live Trading with Cody AMA today. This is going to be a lot of fun because there’s a lot of questions to go through. Mr. Cody Willard, how are you doing?

Cody Willard:

I’m doing fantastic and I appreciate you not only getting this put together technologically but hosting it, Cabana Crypto.

Cabana Crypto:

Yeah, it’s fun. So, I enjoy this, I’m used to doing it, and I guess for the audience, just real quick, we are working out some kinks for… this is on the SKTLs channel and we have some exciting things content-wise coming up. I think we’re doing a question or AMA just specifically SKTLs in a couple of weeks, so we wanted to get as many TWC subs over here and get the word out, at the same time get used to this format.

Cody Willard:

Yeah, exactly. And that’s why we’re not on Zoom, which is when we’ve done video live streams for Trade with Cody Chat in the past we’ve used Zoom and maybe we’ll do that again, but we wanted to test out everything and do… This is a SKTLs YouTube channel, I will mention the SKTL’s, S-K-T-L Crypto Space Debris Cleaning Cryptocurrency, if you’re not familiar with it, in case you just happen to be tuning in here at this moment or you’re a new sub or whatever. But go to S-K-T-L-S.com to learn more about the cryptocurrency that myself and a bunch of Trading with Cody subscribers helped build, create. And it’s not a security, its sole purpose is to clean up space debris and to make people rich if you’re an early adopter and you get into it. But no promises and no guarantees and most cryptos I will mention once again, are headed to zero at this moment. Cabana, let’s hop in and do some Trading with Cody stuff.

Cabana Crypto:

That’s right, that’s right, let’s do it. Let me do one more housekeeping item. Do like and subscribe to this channel if you haven’t already because then you’ll be notified of future shows on the SKTLs channel here. So, we have a bunch of questions from the Trading with Cody chatroom. I’ve tried to group them and…

Cody Willard:

Yeah. Cabana-

Cabana Crypto:

Yeah?

Cody Willard:

… before we hop in, markets have been complete crap.

Cabana Crypto:

Yes.

Cody Willard:

And so everyone… You know, I don’t know if the first question you were going to hop on there is, “What’s going on with the markets?” But let’s hit that real quick, a broad one and I’ll give it a two minute answer as best I can, a TV sound-bite interview. There you go. Ooh, very fancy. See, this is why I’m excited not to be using Zoom. Very cool, I feel like I’m on TV.

Cabana Crypto:

That’s the 200 and the 40 just some… I guess the 40… I guess a single…

Cody Willard:

And what is that, a five… eight year chart, a long-term chart.

Cabana Crypto:

Yeah. I mean we can go-

Cody Willard:

Well, I mean that… It’s actually…

Cabana Crypto:

… way out.

Cody Willard:

When you pulled that up, that long of a term of a chart up because… Scoot up, let’s get the last year. Well let’s get to the crunch time. Things have been ugly here and gotten really ugly accelerating on the downside near term. But when you scale back, if you would, now go ahead and go back to that eight year because I thought that was instructive. That’s the problem. You know, you scale out it all over several years, much less decades and the markets have… are still hockey sticky looking. We finally come down onto these averages. People like to draw lines on charts and… or use moving averages to try to smooth out what the charts look like. I don’t get much value out of drawing lines on charts and as longtime subscribers are Trading With Cody know the worst looking chart is the one I like the best.

If everyone really hates it and every technician is out of it and every sentiment person has sold it then… Then you got to have the fundamentals, that’s the problem. So really… and that’s the problem with the markets here is you sort of step back and you look at the markets and from just a pure valuation perspective, they’re very expensive. We’re probably going in a recession and if not even a recession, earnings are probably not going to be growing much this year if at all. Probably need to take a little bit off the earnings estimates we call the S&P 500. And if you take 10 or 20% off of that, you’re talking less than $200 in earnings across those 500 companies per share. And you do the math on it, 15 multiple puts you at 3000. The market’s 3,600 right now, so it’s a 20% potential downplay.

I talked about this in Trading With Cody the other day and it just is what it is. I can’t be excited on that kind of a market multiple in general. The flip side though is twofold. Number one, I cannot bring up a single topic about the market that includes a bear thesis. I can’t tell you a bear case that you haven’t already heard that you don’t know. Everybody on the planet knows that there’s a war in Ukraine and that energy is… got a real crisis in Europe. Everybody in the world knows that interest rates have shot through the roof and that mortgages are a lot more expensive now than they were six months ago, much less a year ago. Everybody knows everything about the bear case right now. You can’t come up… Can you… Cabana?

Cabana Crypto:

Yo.

Cody Willard:

Can you name one reason for stocks to go higher? Probably not, right? I mean…

Cabana Crypto:

Not in this environment.

Cody Willard:

No. I mean that’s my point. Okay, well that’s a lot of help right here. I’m drawing… Cabana, circle down there at the very end of your chart where we’re running in after this huge downswing over the last… Yeah. No, just right there at the little… Yeah, right there, at the little spot where they’re meeting. Good they’re… Everybody knows it now, that’s what’s in the market. I have no edge being short or bearish at this moment. I did a great reset for my Trading with Cody subscribers last March, last February, darn near at the exact top of innovation stocks and revolution investing stocks and the crazy bubbles of bubbles and crypto and everything else. We didn’t sell everything, we sold… I don’t know, we probably took a third of the portfolio off and we’ve been cautious ever since. We’ve tried to sneak in and buy on some of these down nasty turns in the last year and then we end up selling those same names. I try to buy a new name, lose 20%, we get out. Now it’s down to 80%.

I mean it’s… it has been nasty in innovation, in anything that’s not energy, frankly. And that’s when eventually though we’re here, like we’re here where everybody sees it. So you have no edge selling right now, you have no edge shorting right now. I don’t know if we want to load up yet. Put it this way, if we’re in a nine inning downturn, we’re probably in the seventh inning somewhere. I think someone on TV said that today, I liked that analogy. So, I don’t know if we’re at the top of the seventh or the bottom of the seventh or what, but we’re getting closer to the end of this, not the beginning of it. My humble opinion. We’ve been cautious for a long time and I am slowly but surely starting to put money to work on the long sign. I’ve been covering a lot of shorts in the hedge fund and sold a lot of puts and…

Cabana Crypto:

I think if everybody knew magically that the Fed would just ease up and just calm down tomorrow, we’d have a entirely different story. But that’s the big unknown. And it’s like they are so dead set against inflation trying to stamp it out. They don’t care. It seems like a scorched earth policy really in the market… the market has been that way.

Cody Willard:

You highlight something I should have mentioned. There’s a… What I was trying to get to earlier is that… forget the markets, just go find great companies at great valuations right now because they do exist. You’re not buying up there. Go to the top of our bubble. You’re not buying the blow off top at the top of the biggest asset bubble bowing bull market in the history of the planet. You’re not buying at the top now. I don’t think this is the exact bottom. I think we’ve got a little bit more to go, but I’d rather start buying now, especially if you did some selling earlier. And in the grand scheme of things, you… it’s…

The only reason you get to buy great companies at great valuations at times like this is because nobody knows what the Fed’s going to do. And the other thing you hit on there, Cabana that… let’s just hit on real quick and then get to these questions, is it’s crazy that I spend my entire lifetime trying to learn how to invest and now I have to… it’s dependent upon some bureaucrat… unelected bureaucrats from Harvard who are worth $50 million or more. Some of them like the Chairman Powell guy, like with… this is what I have to do for a living, sit around gamifying their gamification. So, I mean it’s all… And that’s what obviously… the great promise of crypto, that we don’t… we’re not beholden to the bureaucrats or even elected officials for our currencies. Anyway, let’s get into the Q&A.

Cabana Crypto:

Well, of… I guess one that kind of fits right along with this one from Kayanks16, “How do you feel about Jamie Dimon’s comments about equity markets?” I guess you kind of spoke on a lot of it. “More bearish sentiment that’s already priced in?” So, you kind of…

Cody Willard:

Yeah, that’s… Look, I think Jamie Dimon is a crook who should have gone to jail in 2008 and I’ve said that on Fox Business and CNBC and every other channel I’ve ever been on, and I will say it here. And now I’m like, ‘What the hell do I care what some schmuck who runs a too big to fail bureaucratic bank, that owns the Federal Reserve, literally…’ I mean, who cares? I don’t care about Jamie Dimon’s comments other than he’s… The only thing I will also mention is Jamie Dimon is always speaking out of the other side of his mouth. He is never purely speaking to you from what he thinks is the truth, he has an ulterior motive in saying whatever he says, so yeah.

Cabana Crypto:

That’s that. Moving on. And also for those watching, feel free to put questions in the chat, in the YouTube chat there. I know we already have one. We’ve also grabbed a lot of these from the Trading With Cody chatroom. Harper2016. “Hey Cody, if building positions to hold for the next five to 10 years, what sector would you be most excited about averaging into right now? And in that sector what category jumps out?”

Cody Willard:

Space without a doubt is where it’s all at. I mean, look, this time last year in September there was 77 satellites launched and four astronauts. This year, in September, 247 satellites and eight astronauts. Now I don’t know if the economy is going… I think we’re in a recession already, I’ve been saying that for a few months. Silicon Valley is probably in a depression, it could get worse. But regardless, space is growing, it is a secular growth story. The economy, other… If we go into a great depression, the United States loses its dominance as the world power… dominating power, all bets are off. But other than those kind of scenarios, space is a secular growing growth industry. There will be trillions of dollars generated in the space industry five years from today, multi trillions of dollars generated in the space industry 10 years from today. There is no other industry out there that has that kind of upside, total addressable market, total growth from where it’s coming from right now.

Mentioning this market being maybe seventh inning, the Space revolution is like the second pitch of the first batter in the first inning. And there’s hardly any publicly traded companies that you can invest in yet that are good in the space industry. I’m sure a lot of space industry companies… in the public markets. The best ones are SpaceX in the… but they’re private. Best ones are private market or SpaceX, Relativity, Blue Origin, Axiom. I’ve invested in three of four of those already in the private markets. In the public markets, Rocket Lab is my favorite publicly traded space company, it got down… it came out with a sell rating on it today by Credit Suisse. It’s a 100-page report, apparently. I’ve been trying to get my hands on it. I’ve got several friends, hedge fund friends and I’ve got prime brokers, and nobody’s got access to Credit Suisse reports, but I’d love to get my hands on that report, eventually I will. At any rate, yeah, there you go, with the $3 price target.

Again, I don’t know who this analyst is, I don’t care what he thinks about Rocket Lab. I know the company, I’ve been following space now for two years, in-depth investing in it, and I think the CEO is great. Rocket Lab has performed, they are launching into space. They had better revenues and guidance last quarter, the quarter before that too. I mean they’re delivering, they’re executing, and… That said, space is hard and Rocket Lab is a very speculative stock. So if you do buy it, know that it’s not as good as SpaceX.

Cabana Crypto:

As the chart would indicate, very speculative.

Cody Willard:

And even the stock price, right?

Cabana Crypto:

Yeah.

Cody Willard:

I mean it’s four bucks here so it’s a speculative stock. But I do… I like space best of all. Right now there… Artificial intelligence would be another place I would actually start looking with valuations, having done what they’ve done, AI stocks are down 60, 70, 80, 90%. There’s some crappy AI stocks. AI, the symbol itself I’ve shorted in the past, I would not buy that one. C3, AI is the company for the foreseeable. Anyway. But AI is another sector I would look into, and even meta, the Metaverse Unity and Meta I think are cheap; they’ve been demolished, and Unity is not cheap yet, believe it or not, but Meta sure is.

Cabana Crypto:

You did add a little Unity I saw recently.

Cody Willard:

Last week I think, yeah.

Cabana Crypto:

I was a little surprised by that, but [inaudible 00:16:18].

Cody Willard:

I’m a little… probably a little early. 25 is really where you probably… 20 would be a great place to start loading up on it. It’s a small position for me both personally and in the hedge fund, especially after it’s been down so much I haven’t added until now. It’s been a while.

Cabana Crypto:

Onward. jspan10, “what is your feet to fire guess on mortgage/treasury rates in the next year?” Thank you.

Cody Willard:

Feet to fire, we’re peaking on rates. I don’t know that we’re going much lower anytime soon, okay. So, feet to fire I guess, the average 30-year mortgage rate was 3%. Three in change a year ago, today 7, 7% in change. A year from now, 5.5, 6%, 5%. Let’s call it 5 to 6%.

Cabana Crypto:

All right. And a couple more, just more general market questions. These kind of go together. JG, “It seems this huge bull market we had for decades is ending. Do you think that we are now into a pattern? We have seen from 67-82 a wide range with no progress?” And Woody kind of piggybacked on that, “It feels like we could be staring down a 70s barrel where we have stagnant growth for a decade and the real-returns are brutal. Is that why we need to stay with revolutionary stocks?”

Cody Willard:

Amen. So, on all of that, these are… it sounds like people have probably been reading Trading With Cody for the last year or so because it was when I did the great reset last year that I started declaring eventually by the end of last year, fully declared, the end of the bubble blowing bull market. We had a blow-off top in the semiconductors in, was it December, November… December last year? And that’s when I fully waved the flag that the bubble blowing bull market had… was going through a blow-off top and it was over, and so… To rephrase that first question, it’s not ending, it’s over. The bubble blowing bull market, the entire paradigm that we lived in for certainly the last 15 years, and you might even… Broader… more broadly speaking.

Cabana Crypto:

More broadly?

Cody Willard:

Yes. I fixed it before I screwed it up. I sort of like the broader. Broadly speaking it’s been 30 or 40, 50 years probably since the mid 80s, let’s call it 40 years, that we have had a bubble blowing bull market based upon ever declining interest rates. And the fact that the Federal Reserve in the United States had unlimited firepower because of our reserve currency status and the fact that we are always the cleanest shirt in the global financial laundry, and so there’s always demand, endless demand around the globe for US assets and US dollars.

But that’s sort of over, I don’t know about the very… I mean we’re still the cleanest shirt, the United States is still the dominant place, we’re still the best regulation system for all of our faults, it still is a lot better here to… that you can trust your financial companies and your stocks and the valuate… the numbers those companies report better than you can in any other country. And so those things have sort of worked together, that we had this endless Fed put that the Fed could cut rates at any financial crisis or any stock market collapse and get things back up. And clearly with the Fed right now scrambling in the midst of either a near recession or an ongoing recession, this would be the time. Markets have crashed, valuations are down, this is normally the time that the Fed would do… Every other time in my career for 40 years… every other time we were in this situation, the Fed cut, riding to the rescue.

And now they do not have that ammunition, they do not have that bullet, that bullet is… They’re trying, they’re putting bullets in their…they’re stocking ammunition right now by getting rates up to somewhere a natural place, so if… Natural rates are probably around 4% for treasuries for the government to borrow money, that’s about where they’ve gotten. And the Federal Reserve’s lower than that, but treasury itself and the Fed’s going there, we’re rounding errors after that next raise, that 4% is where… So, the cost of capital for the United States government, that’s probably about natural, that’s about the right place. So, if the Fed does want to start inflating another bubble blowing bull market six months from now or a year from now, even sooner from now, I don’t know, they now are… they’ve got a little bit of ammunition being built into the system finally again. But that paradigm that we just had of just… almost full confidence that the Fed would bail out and try to blow up… would create new bubble blowing bull markets anytime there was a downturn.

On YouTube I used to do… I mean on Fox Business they… some of these commercials and skits are on YouTube. On Fox Business I used to do… In late 2007, early 2008, I thought the world… and most people, most [inaudible 00:22:23] were like, “We’re probably going in a recession.” And the Fed was like, “We’re going to have to cut rights” and everybody will be on tv, “We got to do something to stop the recession. Oh, my God, it’s going to be a recession that stocks might go down.” And at the time it… I called it a refreshion, “We need refreshions. They’re not recessions, they’re refreshions. They allow things to get refreshed, you wash out the excesses, you let shitty companies go bankrupt, you don’t keep zombie banks around, you don’t misallocate taxpayer capital endlessly. Well, that’s what we need, a recession will be fine.”

We’re here. We need crypto to wash out, we need Google and Metabook and Apple-face and all of them to cut some jobs. They have… they don’t need 200,000 employees. And it’s just… I’m sorry, like I… from a humanitarian perspective, I don’t want anyone to lose their job, but I… I mean I’m just… Realistically, there’s too many people working at those companies and this got… all this stuff has to just sort of play out, we need it, we need excesses washed out. So, it’ll be fine, we’ll get through it, we need this. It’ll actually be so much better if we could just have one great washout recession and maybe the Fed has no choice but to finally let us do one. And I’ll buy everything in sight if we get this amazing washout and like literally if… we’ve got… it’s probably got to happen. You’re going to have 300 specs in one day declared bankrupt… 30 specs in one day declare bankruptcy in six months or something. And that’s the day markets will be just… I mean panicked, everyone on TV’s going to be scared, and then we buy it.

Cabana Crypto:

So, you’ve mentioned say 3 to 5% would really kind of peak your interest, how about… what about these guys calling for like S&P 3000, do you think we get down that far? I mean that’s another 20-ish in the area of 20%. That would be quite-

Cody Willard:

Well, I think we’ll get…

Cabana Crypto:

… a shock from where we’re…

Cody Willard:

I think we will hit S&P 3000, but let’s say… I think at some time after we hit S&P 4000 and after we hit S&P 3300, and after we’ve hit the… S&P 3600… And that’s what I was talking about earlier.

Cabana Crypto:

A stair… step down.

Cody Willard:

In my mind it’s sort of a framework of a grind lower market, but it’s not going to be 10 or 20 years. We’re living in Kurzweil, 21st century instant money flow, instant information flow, everything happens faster now than it did in the 60s or in the 70s or in the 80s, and it’s just exponentially cycling faster. So, we’ll get through this, but it’s probably a year or two. And my best guess, instead of it being 10 or 15 years, it’s a year or two. And then yeah, if we get to 3000 on the S&P 500 it wouldn’t shock me, but it’s not going to be…I don’t… I think you’d be… make a mistake if you just sat around… Number one, I think you… if you’re a long-term investor and all you do is buy indexes, don’t change. Like whatever, you’re just doing your thing, don’t stop. Money cost, average down, buy some now, buy someone that keeps going down, do your thing but if you’re… And if you’re investing in great revolutionary companies I can’t time the bottom either. I don’t know that Rocket Lab will go down to 3 even if the S&P 500 goes to 3000. I don’t know if Adobe goes to… down 20%, even if the S&P goes down 20%. Some stocks are bottoming right now; they have already bottomed.

Cabana Crypto:

I like it. A stock picker’s market, if you will, and perfect for the service that you offer.

Cody Willard:

It just so happens that it actually [inaudible 00:26:36]-

Cabana Crypto:

There you go.

Cody Willard:

… like trading with cody.com to… And by the way, in all seriousness, Cabana, you’ve been reading me for 20 years. I don’t know… This is the first time we’ve done anything like this together. You and I got on the phone for the first time at some point a few months ago, right, but you’ve been a long time… like you know my analysis and that’s what I… What I’m trying to get to is, look, I don’t have any silver bullets. We have had some amazing home runs, Cabana got into crypto reading me in 2013 and we got tactful.

Cabana Crypto:

Years after that, but yeah. But you were responsible

Cody Willard:

I’ll just mention some stuff in a minute maybe about that. But the point being, I don’t have any silver bullets, but I will tell you that you get my frank, honest, hardworking analysis and it will be different than anything else you’re reading. Sort of like this commentary so far has been, I hope.

Cabana Crypto:

Yeah, if you’re enjoying this, viewers out there, let us know in the comments, and/or comment.

Cody Willard:

And if you made it, let me know. I don’t care, I’m [inaudible 00:27:37].

Cabana Crypto:

That’s right. A couple… actually, a few questions on Verizon. I’ll just read them both because I think they’re asking the same thing. buck20, “What are your takes…” Let’s do this one first, “What’s your rating on Verizon? I know you’ve mentioned it may not be long term holding, so I’m curious what your gut is” and that was also kind of piggybacked, “What are your takes on Verizon’s huge amount of debt in a raising interest environment as well as losing customers and losing advantage and network coverage to other providers?”

Cody Willard:

Yeah, look, I… Verizon would be the only network operator, whether we’re talking cable or… Give me one second. Of all the times, someone’s at the door.

Cabana Crypto:

And this one also goes to Rohit Kumar, “Why do you like Verizon?” So, we’re all talking the same thing there. Yeah.

Cody Willard:

Verizon is the only network operator I would want to touch at all.

Cabana Crypto:

Would you touch it if it didn’t have a very nice yielding [inaudible 00:28:44]?

Cody Willard:

That’s on… Look and that’s part… that’s really… What got me into it is looking at that 7% dividend and seeing that the bonds themselves are only paying 5.5 % dividend. It makes me feel very confident that the dividend can easily be covered for at least the next year or two. I don’t know about five years from now. But yeah, just looking at Verizon and knowing I can get a 7%… And look, I mean if the Verizon bonds are going 5,5.5% yield and the treasuries right now are 4, 4.5% yield, I mean you’re basically saying that Verizon’s almost as money good as the treasuries, and that’s not true. But that’s an indication of just how safe that dividend for even the common stockholder is.

In general, I’m short, I’ve been short, some cable companies, cable stock companies, I would not want to buy any network operator that controls wireless or cable spec or cable networks because Starlink… I am a Starlink customer. This particular network at my office is not Starlink because I’m in town, but just outside of town I’m in the edge of civilization out there, on the edge of this town. You can go 270 degrees and walk 100 miles and there’s like eight lights that you might cross. There’s like two ranch houses and a little village, and… So point being, I’m a happy Starlink customer. We were… we’ve never had good internet and now we have 30 to 100 megabit every time we check, it’s amazing. [inaudible 00:30:32]

Cabana Crypto:

I’ve been on the wait list for a year and a half, I think I live close to too many people, so…

Cody Willard:

Yeah, I like… Try the Starling.

Cabana Crypto:

Yeah.

Cody Willard:

You might still be able to get in.

Cabana Crypto:

Oh, I’m on the wait list, it’s just they delayed me. That was the last email I had from them. Let’s see. Let’s move over to Qualcomm. “How will the potential China ban impact Qualcomm? How much will a potential recession impact Qualcomm’s business?”

Cody Willard:

Potential China ban? Look, all of this stuff’s getting priced in. I mean, Qualcomm’s probably still going to be selling chips in China three years from now. If they’re not… our world’s… I don’t know where the market is either. It’d be scary, scary times if that’s the sort of… Qualcomm’s not selling AI chips to China, which is what I think really the government wants to be concerned about. Recession will absolutely hit Qualcomm. Hey, will you go… just go to Yahoo Finance, if you would, pull up QCOM and then go to analyst estimates.

Cabana Crypto:

Oh, okay. Well, yeah, keep speaking. You caught me off-guard there. So

Cody Willard:

So, Qualcomm’s… At this point… I mean you can see in the chart there, Qualcomm hit almost 200. It’s dropped down almost 50% from its recent high. You see that straight green line from… at the very end? That was the blow off top in semiconductors that I was talking about. That was my cell signal and my declaration of the end of the bubble right there. That was the last hurrah. We’ve clearly come way down past that. Qualcomm at this level is trading at less than 10 times earnings. I’m going to say it’s like six or seven at this point. Get the analysis right there if you would. Yes. So 13 bucks are in earnings next year. And again, this is classic, this is a great example of what we were talking about earlier with the analyst estimates for next year… are probably too high.

Analysts are still expecting Qualcomm to grow 6% sales growth next year. And they expect earnings to grow from this year, 1254 to 13 next year. I don’t know if Qualcomm’s going to grow next year. So call it 12 bucks, call it 10 bucks. Okay, it’s 10 times earnings, eight times earnings. I have a spreadsheet that I run that I call my PP ratio. I was trying to be funny, you’re supposed to laugh. Thank you. PP get it? PP?

Cabana Crypto:

PP.

Cody Willard:

Sorry. My eight year old daughter was here when I named it and we thought it was hilarious.

Qualcomm on my sheet… running out sheet. How many… I’m a sheet splitter, I split sheets. I’m the best darn PP sheet splitter that ever PP has sheet. Qualcomm trading at seven times my five year out number and profits, not earnings, which is a little harder to even get to, so that’s a low number. And my profits number, I do not give them credit for their employee stock buyback shenanigans. I just look at pure revenues, gross margins and operating expense. And then I have a formula that I’ve plugged into my thing that I’ve written that extrapolates the top line, whatever you put in, and then it takes for growth of expenses, a fraction of that top line growth exponentially in the years ahead. And at any rate, I get to seven times earnings for Qualcomm five years out, look man, that’s where I want to buy something like that.

Cabana Crypto:

Nice. sk, “I like this format. You should do more Q&A through YouTube. Well Mr. Cody is a very busy man, but if-

Cody Willard:

Well, on a… I’d have to [inaudible 00:35:13]-

Cabana Crypto:

… the demand is there.

Cody Willard:

…to assist quite like this, but yes, maybe we’ll do this. Thank you, sk.

Cabana Crypto:

This is pretty cool. I mean as a sub myself, I think you just get more content in the hour, but I realize that sometimes you got to be at your desk and answer questions on the keyboard.

Cody Willard:

Well, and I’ll tell you, I did a questionnaire to Trading With Cody subs a year ago and I was like, “”What’s your favorite thing? And a lot of them were like, “Yeah, the normal Q&A chat.” And 2% of the people were like, “Yeah, I like the video chat.” So, very few people picked that as their favorite thing, so maybe I misinterpreted what that meant. I’ll start doing it more often. Keep going, Cabana.

Cabana Crypto:

Maybe COVID had something to do with that and got people more connected to YouTube and they’re used to watching content or listening to it. I do a lot of that, especially in replay. I’ll listen to a stream at 1.5x, and yeah, it’s a great way to consume. “I want to ask” I believe this is Provention Bio hooking up with Sanofi, “I wondered why they would invest unless they knew something? Your thoughts?” I also saw you put out an update on that as well.

Cody Willard:

I did, I sold Proverb today, I just took the profits. I run into this a lot. I keep coming back and trying to invest in biotech. I’ve done this for 10 years, 15 years, and I… most of the time end up feeling like I do not have an edge. I feel like I’m… you know that old saying when you’re at the poker table and if you don’t know who the sucker is, you’re the sucker, I feel like that investing in biotech most of the time. So, this nice little home run we just had on Proverb, not with… I call it Proverb, it’s Providence, but symbol… Like you look at these symbols all day, every day. I’ve been short, “Ride Sally, Ride” for two years, maybe a year. A long time I’ve been short, “Ride Sally, Ride.” You know what the… Ride, R-I-D-E, Lordstown Motors. I don’t know, I literally could never remember the name Lordstown, I just call it “Ride Sally, Ride” and I hate that song. It’s the worst thing, I’ll be sitting there and get that thing stuck in my head just because I looked at the quotes.

Cabana Crypto:

There you go.

Cody Willard:

Anyway, I sold the Proverb, because I feel like I don’t really have enough of an edge. Move on.

Cabana Crypto:

Okay. Well, I… I just wanted a quick follow up on that one.

Cody Willard:

Sure.

Cabana Crypto:

That seemed to me like a home-run/lottery ticket. So, I think… what, did you catch a double on it? But if they do get, say these approvals, I mean it could be one of these crazy biotech things, but you just don’t know.

Cody Willard:

It can be, I just…

Cabana Crypto:

You just don’t have that edge.

Cody Willard:

When I’m investing in space, there is nobody that knows more… Well, actually, Dan Geraci, the chairman of the Planetary Society through our SKTL weekly volunteers call, he knows more about investing in space than I will ever know. But other than Dan, I’m pretty confident I can go in most… any room and I know more about investing in space and what the revolution is going to look like and how I think it might play out. 10 years ago, I knew more about the app revolution and the platform for smartphones and why I didn’t like Google… Microsoft or Blackberry’s platforms. You would remember this, Cabana, and why I liked Apple and Google. Because I got… Nobody knew more about investing in platforms than I did.

25 years ago, DSL, fiber optics, telecom, nobody knew more. I could… do you know what I mean? So, I felt like I had an advantage. When I talk about Providence, I get nervous. I get nervous. There’s someone else in this room knows more about Providence and Biotech than I do, and I don’t want to be the guy at the table that didn’t know he was the sucker.

Cabana Crypto:

Got it. Onto the WOLF. “What’s the rationale… buka20 asks, “What’s the rationale investing in WOLF? It’s not profitable, it never was, the company failed to cash on the LED revolution. Thank you.”

Cody Willard:

Will you pull up a Wolfspeed.com page?

Cabana Crypto:

Oh, okay. The actual website?

Cody Willard:

Yeah. And this is instructive, actually. Sometimes you get so bogged down looking at the numbers, looking at the valuations, looking at the stuff on Yahoo Finance or Bloomberg or whatever it is that you go and get the numbers, and then you go look at the stock chart and then you get obsessed with that. Stop. Go look at the website, go look what this company’s doing. Scroll down a little bit. Keep going, keep going. Products. So, they’re doing chips in a different way, they’re not silicon based, it’s an entirely new approach, it’s revolutionary. I do not know if Wolfspeed will actually end up revolutionizing every market that they’re going to try to revolutionize. But I think the risk reward scenario is looking promising enough at this stage, and they’re getting enough end markets penetrated and enough new customers that I go, “Three or five years, this thing could be much bigger than it is right now. 10 years, it could be different… could be an Nvidia kind of thing.” That would be… Let’s reign it in a little [inaudible 00:40:59].

Cabana Crypto:

A home run of home runs there. But okay, yeah,

Cody Willard:

Yeah, let’s reign it in, Poncho. But it’s… Cabana, do you recall that at Trading With Cody we did actually recommend Nvidia in this same kind of concept? I said, “Look, go to their website and you’ll see that they’re doing, A…” This is four or five years ago, the stocks at $7 a split adjusted at the time. And I was like, “Look, they’re in all the right markets. AI, driverless.” I don’t know, I had four or different markets that I was like… “And I don’t know if they’re going to make it, I’m not sure they’re actually going to dominate all these markets. In fact, I don’t think they will.” That’s what I said at the time. But the risk reward scenario was looking pretty darn positive.

WOLF is too expensive right now. I would love to buy it at 60, 50; it’s still 106 guys, so I’m not the only one who recognized the potential of the revolution, and that’s why it’s a little expensive here. It’s a very small position for me still. I would love for it to drop. I hate to say this, I’d love for it to drop 20%, 30% so I could really get serious about it.

Cabana Crypto:

Onward to some crypto. Have you seen all the recent HNT mumblings? Very negative/borderline scammy, hard to sift through the noise. I was curious if you’ve still been digging into Helium at all and what you think.

Cody Willard:

Yeah. Actually, I haven’t been as deep in the woods on Helium as I probably should be. I own some Helium, I even have a little bit of equity in the company that created Helium itself, not just the token. I’m worried about crypto and Helium’s a crypto, so I can’t really differentiate. The SKTL, S-K-T-L crypto that I created and helped… I didn’t create it, but I helped create, that I helped found that we… I’m a part of the volunteers team, was purposely built from the ground up to have no founder’s tokens, to make sure we’re not a security, to do only a positive thing, to be completely transparent.

And other than Bitcoin, there’s really no other crypto that’s like that, and so Helium has some problems. The SCC can come knocking on any of these guys and Helium’s included in that, and if they… they’re the door that gets knocked on and/or if they’ve done anything nefarious at all then fuck them anyway. I’ve got no time or patience for things working out for people who are stealing money from… and lying and cheating. So, I don’t know. I’m worried about crypto in general and Helium’s part of it, and I regret having recommended it or put any money in it, so…

Cabana Crypto:

Yeah. I just wanted to ask you a general one on crypto. Are you more cautious on that because of potential regulation or it has so much air that you think could come out of it, or a combination of both perhaps?

Cody Willard:

I’d say 80-20. It’s 80 the air, and 20… The SCC, the regulators, the Federal Reserve, all regulators, they typically show up after something went wrong and then they pretend that they’re going to fix it for the future. And that’s sort of what you’re seeing the SCC starting to do where they’re like, “Hey, Kim Kardashian, you need to pay a tiny little fine and then I can go on the… I’m the head of the SCC, Gary Gensler, and I can go on CNBC today and make an appearance and talk about Kim and also warn people that the Biden administration, just like the Trump administration is serious about protecting your money, blah, blah, blah.” Look, if and when Helium goes to zero, then those guys end up getting a knock from the SCC. That’ll probably be the way this crap works, right? The SCC will show up and be the final nail in the coffin, but the fraudulent silly stupidness of most cryptos is still… got… how did you phrase it, needs to come out?

Cabana Crypto:

Just has a lot of air that…

Cody Willard:

A lot of air.

Cabana Crypto:

Yeah, and has yet to come out of that balloon as opposed to perhaps stocks which might not have as much.

Cody Willard:

Agreed. That’s a great… good point. I’m getting more and more bullish about stocks and I’m not getting at all bullish about crypto yet. I’ve got a long way before I get bullish about crypto other than SKTL. And I still own Bitcoin, I’ve owned Bitcoin for nine years now and I’m not going to sell what I’ve got left in my personal account. I don’t have any in the hedge fund at this moment, I’m not short of any Ethereum in the hedge fund anymore. I’m out of all my crypto stuff in the hedge fund right now. I still own a little bit of crypto stuff in the personal account. I own a pretty decent amount of Bitcoin and I’ve been buying SKTLs. I mean, I do buy… Even just last week, I buy like 20 or 50 bucks or 100 bucks of SKTL on PancakeSwap here and there. I’ve ended up with tens of thousands of dollars worth of SKTL tokens at this point-

Cabana Crypto:

I’ve bought all of those in the past month or so.

Cody Willard:

… that as long as there’s two [inaudible 00:46:42], two sets. What did you say?

Cabana Crypto:

I was like, I’ve bought all of those three SKTLs, Bitcoin and Ethereum in the past month or so, just in case. And I think we have further to go down, but at the same time, Bitcoin is at its old top from years ago, same thing with Ethereum. If it doesn’t make a new low and go to triple digits like an Ethereum, then I don’t want to be sitting there being like, “Oh, man, I should have bought some.” A little taste. A little taste.

Cody Willard:

I feel like that about Adobe, I feel like that about Verizon right now. I don’t feel like that about… I have Bitcoin… At 10 or 12,000. I’ll start getting that inclination. I don’t know that there’s a price at which I’ll get excited about Ethereum again. I’m going to have to…

Cabana Crypto:

I’m way more excited about Ethereum than Bitcoin. But that’s another conversation.

Cody Willard:

Another conversation entirely. We’ll have to do that sometime. We’ve got another five minutes or so. We’ve run… I’d like to…

Cabana Crypto:

Oh, all right. Quickly, quickly. Housekeeping.

Cody Willard:

I say… No, we do an hour, don’t we? I forgot. We’ve got 10 more minutes.

Cabana Crypto:

All right, here we go. Just real quick, housekeeping. You mentioned a bigger space article a week or two ago, is that still in the works?

Cody Willard:

Yeah, we were just hitting on some of that, right? I want to talk about this secular growth nature of space versus the cyclical growth nature of even artificial intelligence more so than space. Any other sector out there? Smartphones, cyclical; apps, cyclical. Most things in the world right now; chips, cyclical; but space not cyclical. It’s secular growth as long as there’s not a depression.

Cabana Crypto:

All right, we got about four questions we’re going to try to run through. Straight from the YouTube chat, Rohit Kumar, “Meta is dirt. Could TikTok be banned by the Biden administration?”

Cody Willard:

I doubt it, but it surprises me that I doubt it. In my mind it’s… The only way that TikTok doesn’t get banned, I mean, I’m not going to call it the Biden administration, it’s a Republican Democrat regime. The powers that are in… up there and how they think they can maintain their power is how I’ll phrase it. They do what their corporate masters tell them to do, and TikTok is a giant corporate master, but it’s not in the US anymore. So, because of its China ownership, I mean, I really do think in six months or a year, it’d be… Number one, they need to… the government needs to ban TikTok. It is owned by the Chinese communist repressive, incredibly intrusive, technologically speaking government. I do not want the Chinese government… I’m scared about saying what I just said on YouTube, that’s how scared I am of the Chinese tracking software out there.

And you guys are like, “Well, let me invite the Chinese Communist into my 12 year old daughter’s cell phone. Let me put it on my smartphone. Hey, daddy, you want to follow it? Your granddaughter’s doing on that TikTok… let’s put that thing on your iPad.” Yeah, let the communists track you on that. You guys are sitting here worried about the NSA, the CIA, and the Patriot Act, but you’re going to let the commies, the Chinese communists who are focused all, even… not explicitly, they don’t even hide the fact that they are trying to track everything everyone is doing. And the Republican Democrat regime will fucking show up after they finally figure out that it’s too late. Oh my God. Yes. They need to go in and band TikTok now, but they’re not going to do it. I didn’t… yet. It’ll happen. I don’t know what the lever is, I don’t make that happen. They need to, they will, and the day that happens… I don’t know if they will, they need to. I’d say it’s an 80% chance they will in the next two years ban TikTok, not Biden, or the Republican Democrat regime.

Cabana Crypto:

I mean, right now, that’s likely why Facebook is just getting hit so hard is the worries that TikTok’s just eating away at Instagram and like when’s the actual metaverse going to happen? I know they released their new headset but it’s like, “Okay, cool. Are people really going to buy in droves a $1,600 device?”

Cody Willard:

No. See, that headset doesn’t get us where we’re trying to get yet, right? You’ve got to get that mainstream… Look, it’s got to get to this. That’s where the metaverse… that’s what the headset’s got to look like. And we’re three years, four years from this being the metaverse headset, and so… and it’s got to cost $200, $400, $500 max. And we’re years from that, so… but yeah. No, I think what you might have been getting at is the fact of the matter is, if and when they banned TikTok, even somewhere in Europe, if some relatively responsible government were to do it, say in Holland or, I don’t know, make up a middle of… at least some community. Like in Hamburg, Germany, they’re going to ban TikTok.

Cabana Crypto:

The military power of Luxembourg.

Cody Willard:

Thank you.

Cabana Crypto:

Yes.

Cody Willard:

Perfect. Anyway, point being that the metaverse… the stock, meta stock would be up 20% that day. If it’s two years away, the stock metaverse can be at 110 before that day gets here. But yeah, man, I don’t know. Shall I tell you how I really feel about TikTok now?

Cabana Crypto:

Got it. Onward. Got a couple more left. Not so revolutionary, but “If I was comfy with a 4.2% return over the next six to 12 months and wanted to buy the US six month or one year treasury, what’s the best/easiest way to do that and lock in that return? Any suggestions?”

Cody Willard:

It’s a great question and I’m not the right guy to answer that. I run a hedge fund and I invest my own money. I will say I am personally… my wife and I just last week were sitting down at dinner one night and I was talking about, “It’s risk-free at 4.2% right now, six months.” Like you can give… you literally lend the government that… The government that just lent you a mortgage… I don’t have a mortgage, but if you did just get a mortgage at 3%, now you can go lend that money back to the government at 4.5%, so it’s pretty awesome. Bad business model for the tax taxpayer, but if you’re the consumer on that end of the deal, it’s a better deal. Absolutely. But I don’t know the right answer. I wish I had… My wife and I both were like, “I’m going to have to look into buying… How do you…? What would be the best way for me to buy those treasuries?” And so I have the same question. I’m sorry I can’t answer it well.

Cabana Crypto:

All right. And the last one/two, but-

Cody Willard:

We’ll do two, let’s do them.

Cabana Crypto:

… they’re pretty intertwined. Let’s see. “I don’t see Uber or Rocket Lab as to where you’d buy more.” I think that might have been in the recent update.

Cody Willard:

I forgot to put them in the list. Yeah. And it also had a couple of typos in the list. Look, I had to be home for lunch with Lincoln, my eight year old for some random thing, today of all day, and then I was like, “Oh, crap. I need to get this out right quick before lunch.” And then I sent it and then I was driving home reading it. I’m in the middle of nowhere, I’m not going to wreck, okay. I’m like… I mean, I might hit a bunny, but…

Cabana Crypto:

Coyote, perhaps

Cody Willard:

Rattlesnake.

Cabana Crypto:

Oh, okay. Armadillo?

Cody Willard:

And I was like, “Ah, crap.” It still said Meta… FB, not… and it’s got BTC for big… I’ve got to fix that. I’ll resend it tomorrow or something. Uber, I would buy more. I bought more yesterday, so in the hedge fund at least, 24-ish.

Cabana Crypto:

This was the last follow-up to that. “How do you feel about Uber given today’s…”

Cody Willard:

Well, let me answer Rocket Lab. I would buy here below 4, 3.50 $3. I get real aggressive. Please.

Cabana Crypto:

“How do you feel…” This is the last follow up. “How do you feel about UBER given the news about the Labor Department’s Gig Economy proposal? Does this change the thesis at all?” I thought this was kind of already out there. I don’t know.

Cody Willard:

Yeah, so-

Cabana Crypto:

It’s been out there, it’s just…

Cody Willard:

… that’s identical to how I felt yesterday. I was like, “If this is new news and you’re selling it, I’ll buy that from you. I’ll take that, I’ll buy that news.” I don’t know. It’s not good for Uber, it is good for the people who would… It’s an interesting debate though. I will say, you can talk to Uber drivers and they’re on the fence about it. Some of them want to actually be employees and get healthcare, for example, and some of the benefits that you get as an employee, certainly if you’re a union shop. But others are sort of like, “Look, just leave me alone, let me do my own thing.” As always, I’d air on the side of freedom, whatever that might be. Even what the site of freedom might be a debate on that one. So, I don’t know. I don’t really think it changes much for Uber. I think the Uber Eats, the Uber logistics, Uber cabbing is secular growth for… still to come.

Cabana Crypto:

All right.

Cody Willard:

Let’s see if I got any emails real quick from-

Cabana Crypto:

Oh, go ahead.

Cody Willard:

… today’s Trading with Cody. Here’s a couple. Cody, are getting close to sharing a spreadsheet that lays… Oh, I did that. And he was like, “Hey, will you do…”

Cabana Crypto:

I have it right here?

Cody Willard:

Thanks. Don’t show it, because that’s… we’re out in public right now.

Cabana Crypto:

That’s right. Semi-public, but yeah.

Cody Willard:

Well, you know. We’re not in the confines of Trading With Cody at this moment.

Cabana Crypto:

The chat room. Yeah.

Cody Willard:

The chat room. Cody, have you looked into energy plays like P-T-H-R-F-B-T-U-A-R? No, I did not, and I will not. New energy, yes. Like I’ve owned SolarEdge since 12 or 10 or something, I don’t know, and I still own it and I’m not selling it. It’s my revolutionary energy play. I would love to buy some more solar stocks at some point. I just covered my solar short. I’ve been… I’ve owned puts on the tan in the hedge fund for a while. I sold all of those literally today. Yeah. But no, oil stocks, liquid, natural gas, it’s a secularly declining industry forever. As long as there’s less and less to get to, then maybe prices can go higher and higher. But some days someone’s going to come out with a much better solar battery thing that is going to be in order or 10 of magnitude better than what we use right now, and energy… carbon energy is fucked long term.

Cabana Crypto:

Yeah. Simply put. Let’s see…

Cody Willard:

I have other questions. Wait, let me see. [inaudible 00:59:07], next.

Cabana Crypto:

Oh, good. I’ve got two quick ones here.

Cody Willard:

Next. Go ahead. These were different.

Cabana Crypto:

Just the quick one, “Out of all your stocks, which one could Buffet buy?” I mean he owns Apple, but I guess aside from Apple, do you see a buffet play in the revolutionary portfolio?

Cody Willard:

Unity. That was a joke. You thought it was funny too. That would be funny, actually. It would be funny. Like everybody would be like, “Okay, Warren Buffet, it needs to stop now.”

Cabana Crypto:

Helium. Yeah.

Cody Willard:

Rocket Lab is just not exactly what Warren would ever do. Okay, let’s just look at them. Adobe is cheap enough for Google… I mean for Buffet, Google’s cheap enough for Buffet, Intel’s cheap enough for Buffet, Meta is cheap enough for Buffet, Qualcomm’s cheap enough for Buffet, Verizon’s cheap enough for Buffet. How many was that, five or six?

Cabana Crypto:

Yeah. Yeah.

Cody Willard:

So, those ones are possible Buffet names. They are outright… It’s just a matter of him deciding, he thinks that’s where he should put his money instead of Cheniere or Railroad or whatever he’s… what’s the energy one? It’s not Cheniere. What’s that energy company he’s got 30%? Occidental.

Cabana Crypto:

Petroleum, yeah.

Cody Willard:

I think that’s the one. So yeah.

Cabana Crypto:

That’s it.

Cody Willard:

I mean it’s just a matter of him deciding that he wants to put 2% of his 30% of cash into one of those. Google would be the easiest one for him because of its sheer market cap. He could buy… put 5… he could own 5% of Google and that’d be $120 billion. No, $60 billion. So he’s not going to buy $60 billion of Google, but he could buy $10 or $20 billion and not even move the needle on Google. If he wants to go buy Adobe or… Do you know what’s crazy? Adobe’s market cap is 30% more than Intel right now.

Cabana Crypto:

Yeah, that’s nuts.

Cody Willard:

I mean, he could go buy Intel. “Buffet, where you at, boy, come on, help me out. Throw a sucker a bone, man.”

Cabana Crypto:

He’s up yonder in Nebraska, so… All right, last… This is just a fun one, so any guesses for the CPI tomorrow? And based upon your guess, where do we go? Because it’s actually… it’s a pretty… we’re at a pivotal point in the chart. We’re at the 200 day, we’re kind of like at a double bottom, which we don’t think holds any guesses on CPI and where we go.

Cody Willard:

Let me ask you something, Cabana.

Cabana Crypto:

Yo.

Cody Willard:

Have you heard anyone say that CPI is going to come in cold?

Cabana Crypto:

I have my estimates here, nothing below 8, 8 to 8.3.

Cody Willard:

But have you heard anybody on TV or anything? Have you heard any buzz? Will I just be another pundit who’s going? “Yeah, man, I think it’s going to come in low and the margin’s going to be up 4% tomorrow.” I actually don’t think anyone’s got the guts to say that right now, but me. At this very moment, everyone’s pull… the bulls are deferring to the bears on tv. If you ask this question on tv, there is nobody who’s got the guts to be like, “All right, man, that shit’s coming in around 4 or 5% tomorrow. The market’s going to be up, dollars be up 1000 tomorrow.

Cabana Crypto:

I’d take like a mid-7. That’d be a huge win, right?

Cody Willard:

Mid-7 ain’t going to…

Cabana Crypto:

I know. Yeah.

Cody Willard:

I actually don’t think so. Mid-7 mark it’s going to be like, “No, it’s still horrible.”

Cabana Crypto:

Oh, really? Okay.

Cody Willard:

Yeah, you got to get below 7. You got to get below 7 for the market to think it’s okay and you really need to have a 5-handle on it for the market to go relieve.

Cabana Crypto:

Ultimately, yeah. But…

Cody Willard:

No, I think tomorrow, literally. I’m answering the question. If you… I guess I’m not answering the question, I’m putting the theory out of what will happen if… such and such. Look, I do think it’s got to be below 6% handle to get the market moving tomorrow up. If it’s 7 or 8, I think the market will probably actually be slightly down, and if it’s 9 or 10, 11%, I mean, it’ll be down 500 [inaudible 01:03:55].

Cabana Crypto:

Stocks are getting a lot cheaper.

Cody Willard:

If you want to fit to fire, I’ll say, yeah, I think we’re coming in at 5.5. I’m not even joking, I actually think we’ll come in at 5.5 tomorrow.

Cabana Crypto:

There you go. If that’s true, you saw it here on the SKTLs YouTube channel.

Cody Willard:

That’s right. So, look, Cabana, is that your handle on YouTube, CabanaCrypto?

Cabana Crypto:

Yeah, YouTube and Twitter. Yeah.

Cody Willard:

So, let’s give a little promo here. If you are on… if you enjoyed today’s show, please check out CabanaCrypto elsewhere on YouTube and/or Twitter.

Cabana Crypto:

I talk a lot of…

Cody Willard:

I’m @CodyWillard on YouTube… I mean on Twitter, it’s just @CodyWillard and also have the TradingWithCody handle on YouTube, but I don’t tweet on it. People just put out… my employee puts out when I publish stuff on there, but it’s @TradingWithCody. And, of course, follow us on SKTLs, if you haven’t yet. My daughter’s going to love this. “I can subscribe.” That’s what my daughter… and then she finishes her own-

Cabana Crypto:

There you go.

Cody Willard:

… video show. “Like and subscribe.” Like and subscribe for SKTLs.

Cabana Crypto:

And there we go. I mean, we’ve… we’re close to… It could be… by tonight we could have doubled our subscribers on this channel. So, we’re above…

Cody Willard:

I would think we’ve got to be over 100 by tonight. If I don’t get us over 100 I’ll go Tweet on it. And if I don’t get us over 100 then I’m hitting my head on Times Square tomorrow. Speaking… I’ll leave you with this, you see your Times Square background right there?

Cabana Crypto:

Yes.

Cody Willard:

Right there, above the Yahoo thing. Can you move my face… Right there below Chevrolet. My face is [inaudible 01:05:35] there.

Cabana Crypto:

Hold on.

Cody Willard:

I used to walk…

Cabana Crypto:

I don’t know if I could do that, actually.

Cody Willard:

I used to walk from my show. It doesn’t matter, forget it. I used to walk from my show… My building… I guess you can’t even see the building I used to work out of, but the Fox headquarters, and then I’d walk to the subway and it was pretty awesome. I’d be walking to the subway… You still there, Cabana?

Cabana Crypto:

Yeah, I was just trying to see if we could… See this is working out the kinks-

Cody Willard:

Exactly.

Cabana Crypto:

… trying to see what kind screen real estate we could get there. And

Cody Willard:

And anyway, right there underneath Chevrolet, I used to see myself. There would be a commercial for my show and I’d always be like, “I’m living the dream. I came all the way to New York and now my face is in Times Square” but it was also that moment where I went, “And I’m not even happy. Fuck.” So, that’s why I quit. Peace, love and happiness, man. It’s fun doing YouTube videos. I would not want to have the pleasure of doing that [inaudible 01:06:33].

Cabana Crypto:

So, if you like this or hate it, comment away, let us know and see if that survey a couple years ago was accurate or not, or if opinions have changed. So, we will see you. And the SKTLs stream is in two Tuesdays, I believe the 25th, but…

Cody Willard:

October 25th, 8:00 PM Eastern, Cabana Crypto and I will be back on this channel for our first SKTLs space conversation.

Cabana Crypto:

There we go. All right, thank you everybody for watching.

Cody Willard:

Thank you so much everyone, I really appreciate you doing this.

Cabana Crypto:

Oh, you’re welcome. It was absolutely fun. I totally loved it. And we’ll see everybody next time. Cheers.

Cody Willard:

No worries, thank…