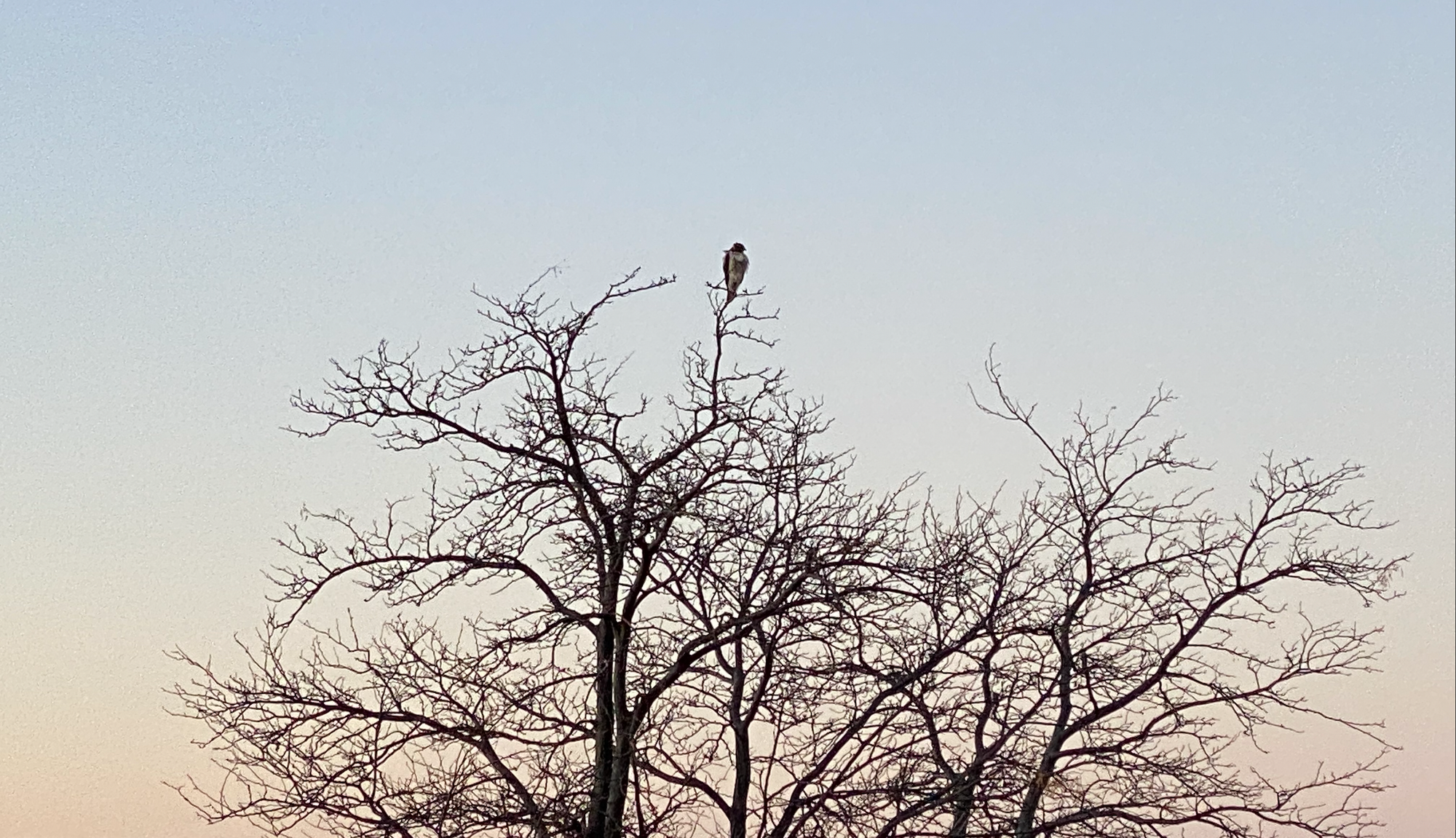

My Market Prediction, Kickers for Tesla, Trimming some U, A Stalking Hawk And More

Here’s the transcript from this week’s Live Q&A chat. Please note that I’m selling most of my U calls and even trimming some U common after it’s recent double from the recent lows.

Q. Cody, I see several respected market people including Morgan Stanley and JPM and the only market show I watch all think soon the markets will retest the lows of around S&P 3000. Generally because corporate earnings are coming down and are not yet reflected in stock prices. That could be a 20 to 25% reduction. Most then think the market does well later in 2023 and 24. I would appreciate your thoughts.

A. Feet to fire, my market prediction would probably go a bit like this: The markets are likely to pull back 5-10% from these current levels before year-end (too many people think seasonality and counter trend rallies will continue, IMHO). Early next year, we’ll likely get a big rally, taking the markets up 10-15% from those levels. Then, we get a slow grind lower for most of next year as the recession gets hairier.

Q. Hey Cody, do you ever pay attention to a company’s stock based compensation? There are several companies, for example like U that give 30% of revenue and 40% of gross profit to employees, or even more. That seems unreasonable. Ever see a database that compiles that info?

A. I do pay attention to that, in the way that I ignore that stuff and the accounting tricks that go around with it when I run these companies through my WiNR algo’s. U got to a level where it was trading at 10x 2026 or so profits in my spreadsheets when the stock was down in the low $20s and I sent out the Trade Alert that I was buying U call options. Now that the stock has doubled off of those levels, it’s expensive again, trading at 20x 2026 profits. Speaking of which, I’m cutting down my U exposure by getting rid of almost all of those call options and trimming a little bit of common too. Discipline.

Q. cody whats the best buy now??

A. TSLA at $160s looks good long-term. Most of our names have had a huge rally since I sent out the Trade Alerts that I was buying more of stuff. Right now, I’m not doing much buying at all. I like RKLB below $4 but it’s high risk. INTC still looks good long-term below $30 and especially if it drops back below $25 again. Most patient for now.

Q. Thoughts on tsla Meta Amzn RKLB. Long term sir. ?

A. I think that TSLA looks cheap whenever it is below $180 or so, just based on probable car/semi/cyber truck sales in 2025. If the company’s Dojo super computer becomes a viable competitor to Amazon’s Web Services, MSFT Azure, Google Cloud, etc, that could be a big unexpected new high margin business in 2025. The Tesla Humanoid Robot would be the same kind of un-modeled upside generator. Same thing with full autonomy if they ever figure it out. Amazon’s a bit of a utility-like stock at this point — it’s just so big already. RKLB, see my prior comments.

Q. With RKLB hovering around $4/share, where would you rate this stock? Would you be supportive of buying another tranche?

A. I shorted some RKLB December $4 puts in the hedge fund when it went below $4 the other day. If the stock stays below $4 I’ll probably just exercise them and accept the RKLB common stock. In other words, I’m a buyer below $4 but as always, remember that this is a high risk stock in a hard business.

Q. @Cody – Good Morning, Cody – Fidelity recently announced “Fidelity Crypto” to allow members to trade and secure Bitcoin & Ethereum. They promise “institution level security and services”. In your opinion, would this be a safer avenue to invest in crypto rather than one of the existing crypto exchanges or going with BITO or GBTC?

A. I generally trust Fidelity’s custodial and other services, so probably? I don’t know anything specifically about their new crypto products though.

Q. Early in 2021 you said you liked CRWD and most cybersecurity stocks, but not at the then ATHs. Thoughts on CRWD now that’s it’s been halved? A. I just searched for my prior CRWD commentary and here’s what I’d said back in March when the stock was double its current price: “Q. What do you think of CRWD and DDOG?

A. Great companies, very expensive valuations that could come down another 30-50% and then I’d be a buyer I do think.” That said, I came in early yesterday morning and ran CRWD through my WiNR Algorithm fundamental spreadsheet and, like a lot of companies, they just have too much annual operating expenses which makes the gross profits (I use hardcore numbers from the company’s actual financials and not the GAAP/non-GAAP stuff that the sellside analysts play with), even in 3-5 years, not high enough to make the stock cheap here yet. I was surprised that it didn’t come out better on the algo’s. But it is what it is. And while I still like the company, I’m probably not a buyer until it’s down another 30% or so, if it goes there.

Q. Thoughts on the recent OKTA & SNOW quarters and levels where you’d like them now?

A. Each quarter was fine, and probably better than the feared results. I’m a buyer of either of them if they get back to the lows at which we started these positions, which is 20% lower than these current levels I believe. Easy does it for now.

Q. Thoughts on Emerson (EMR) as another “re-US-shoring” play – kinda like ROK? Slightly better dividend, but less sexy?

A. Emerson’s just too big of a conglomerate for me. Anybody want to count the number of Emerson subsidiaries in this list? Gotta be over a 100, right?

Q. ENPH looks way overbought, thoughts on this company?

A. It’s been executing, but I prefer SEDG in the solar industry.

I leave you all with a shot of the hawk outside the house this morning as I left for work that might or might not be stalking the little puppy at our house.