Navigating The Stock Market Twilight Zone/Purgatory

“It’s two a.m., The fear has gone, I’m, sittin’ here waitin’, The gun still warm,

Maybe my connection is tired of takin’ chances,

Yeah there’s a storm on the loose, sirens in my head, I’m wrapped up in silence, all circuits are dead,

I cannot decode, my whole life spins into a frenzy, Help I’m steppin’ into the twilight zone,

The place is a madhouse, Feels like being cloned,

My beacon’s been moved under moon and star, Where am I to go, now that I’ve gone too far?,

Help I’m steppin’ into the twilight zone.” -Twilight Zone by Golden Earring

First things first, we will do chat this week today at 3:00pm ET in the TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com.

This market is a bit in a post-earnings Twilight Zone/Purgatory. After spending most of the last five years or so seeing most stocks trade in tandem with whatever the broader market’s directions were, this year has been much more of a stock-picker’s market with good stocks performing well and most bad stocks getting hit hard.

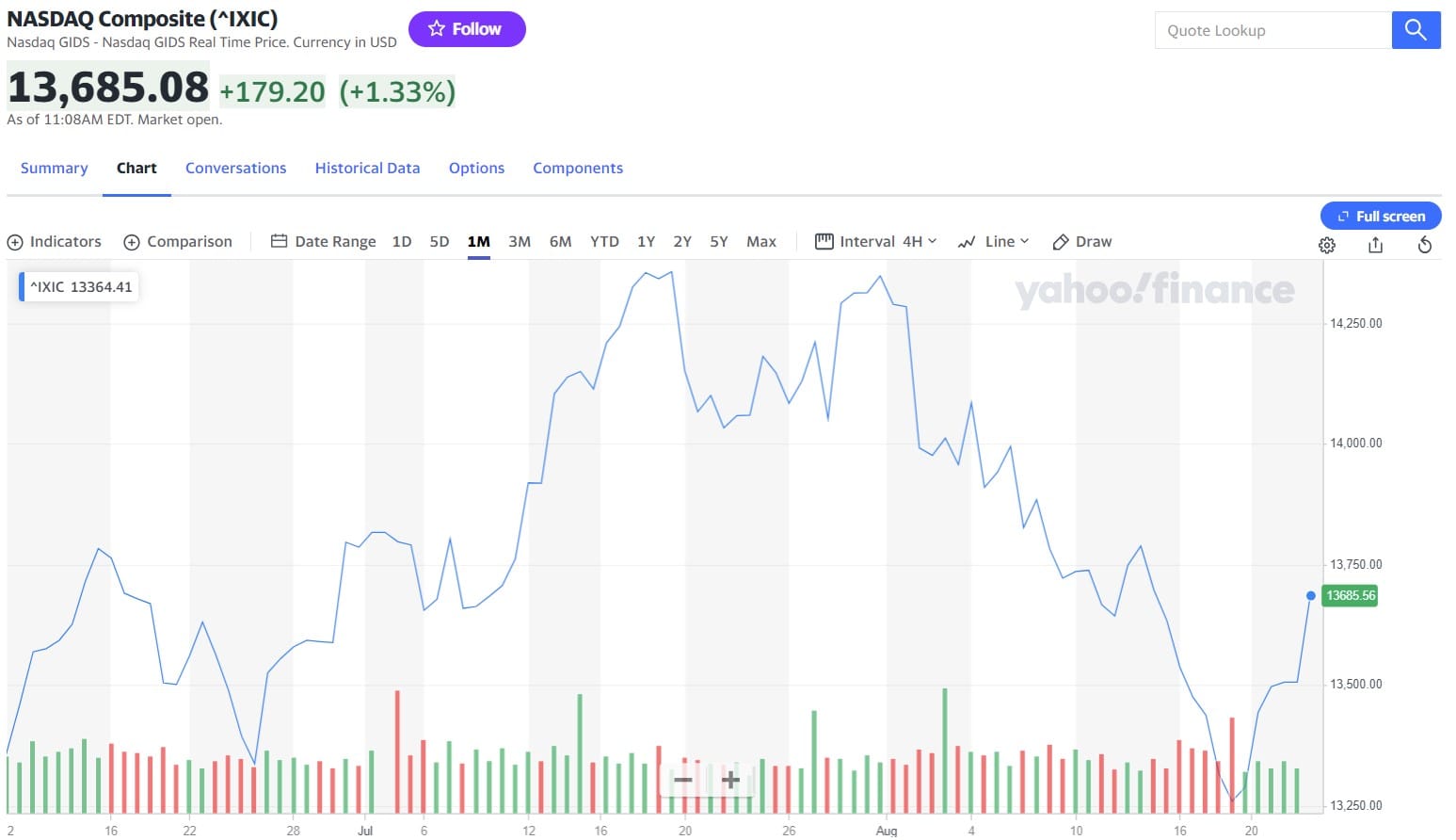

Meanwhile, the Nasdaq is currently down about 5% from its July highs after quickly rebounding nearly 4% in the last four trading sessions.

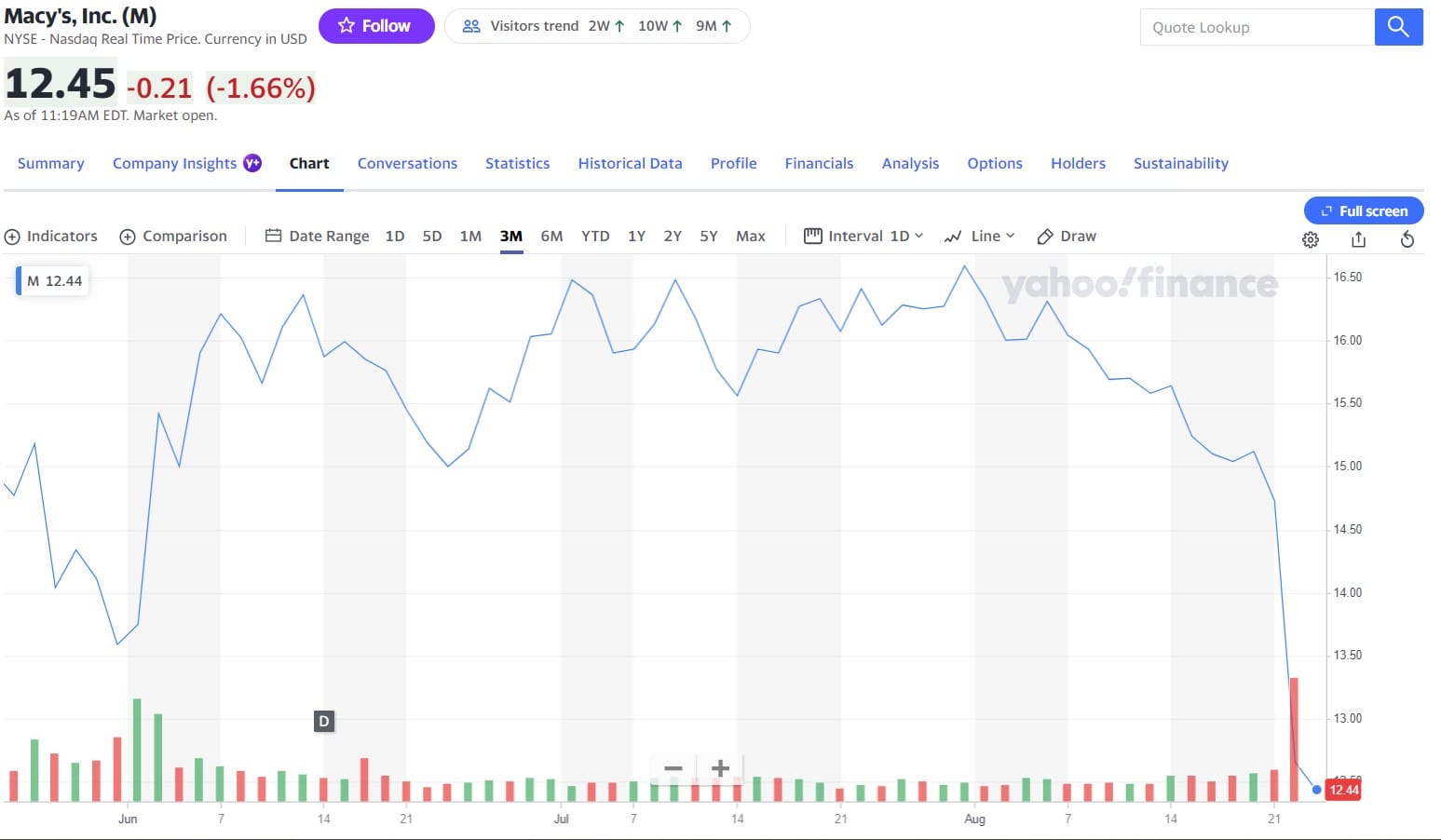

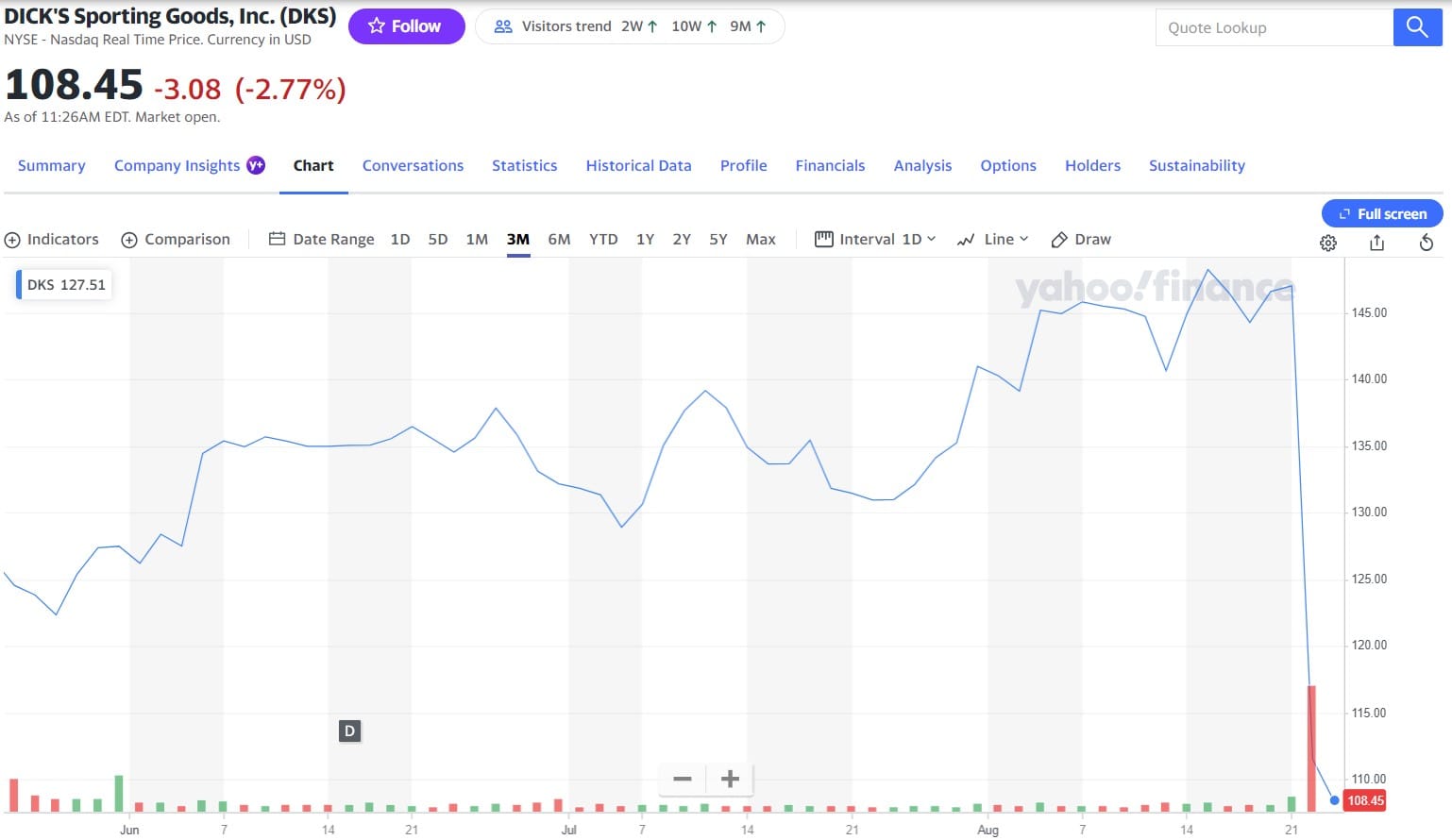

Underneath the surface, a lot of the tech stocks that were down 30%+ in one month have now popped back up 10-20%. But a lot of other stocks are still at or near their 52-week lows, including major retailers like Macy’s (M) and Dick’s Sporting Goods (DKS) which have absolutely collapsed recently:

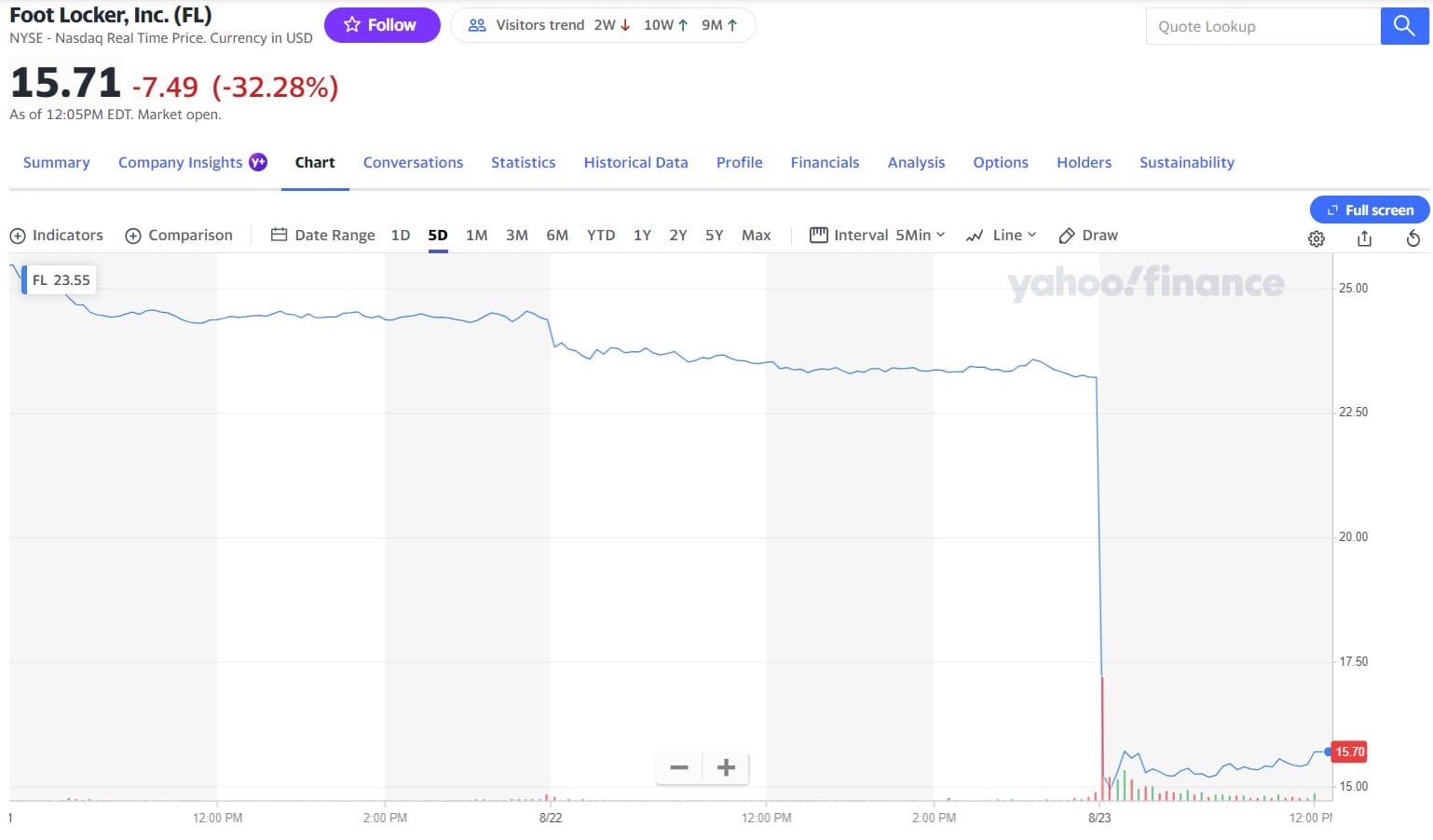

Foot Locker (FL) reported last night and lost a third of its value today, which was already at a 52-week low yesterday:

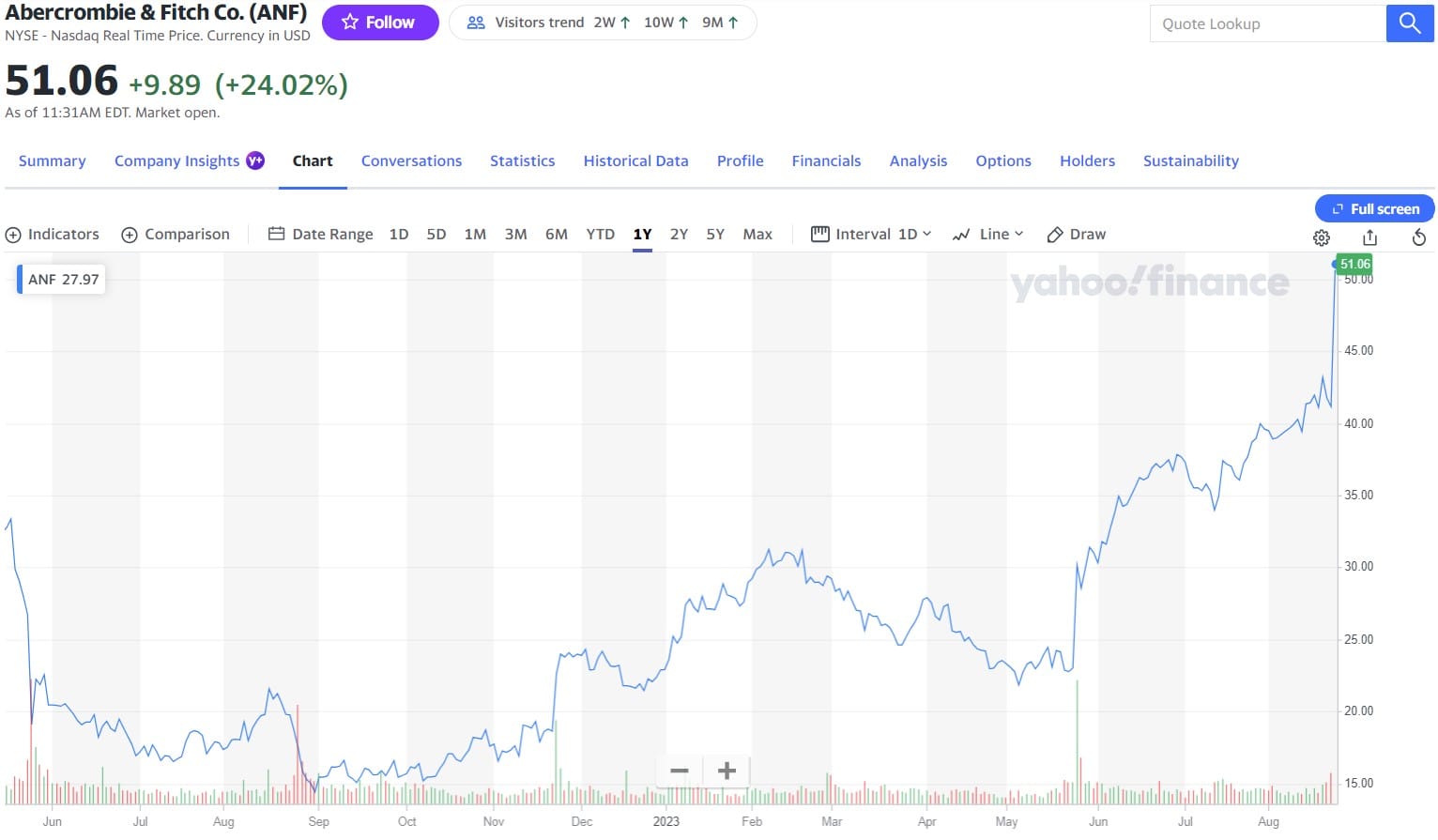

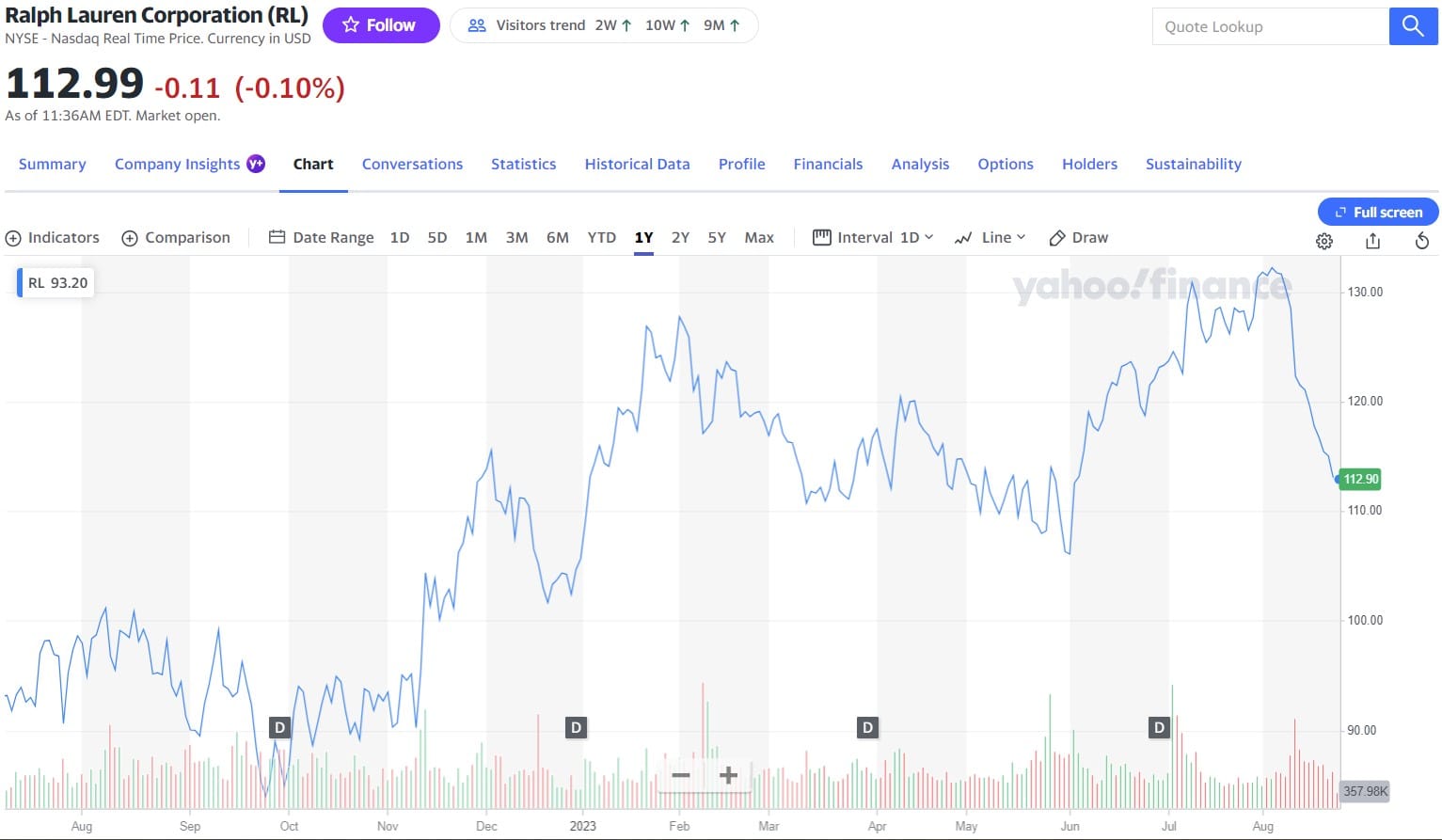

On the other hand, some of the major retail brands have been doing pretty great, like Ralph Lauren (RL) and Abercrombie & Fitch Co. (ANF):

This market probably has a lot of investors confused, to say the least. A lot of strategies that might have worked for nearly 30 years during the bubble/mini-crash cycles have led to underperformance this year. Whether it be momentum, macro, sector-focused, or “buy the dip” strategies, traders and investors who have tried to follow these kinds of playbooks have struggled in 2023. People got so used to nearly all stocks moving in tandem that many of them are feeling lost when a multitude of stocks in the same industry are putting in 52-week highs and 52-week lows at the same time.

We have been saying all year that this is a stock-pickers market. We can get rewarded handsomely when we do our homework and trust our analysis. Most analysts and commentators on TV are obsessed with predicting market moves and/or the next recession, but that is nearly irrelevant in this market. Regardless of what the economy and the indices do over the next six months to one year, you can bet that there will be a lot of stocks doing really well and a lot of stocks doing really poorly. The nasty moves in stocks that we have come to expect when the economy goes into a recession are happening right before our eyes in many large-cap and small-cap names that are at 52-week lows. On the other hand again, the moves that happen when we are in a bubble are also happening right now as many stocks are at 52-week highs. When we get this kind of setup, we want to make sure we spend even more time reading, researching, and analyzing so we are prepared when the right pitch is thrown our way. Preparation is key so that we can swing at the big pitches when they look attractive, as we did last week in the Trade Alerts that we sent out in which we were covering many of our shorts and layering into some longs and call options.

After this recent pop, we’re doing a little bit of trimming on some of those calls including SHOP for example, but are not making any major moves right now and we are certainly not forcing any new trades at this moment. Don’t let the movement of any given stock or index make you doubt your analysis. Don’t let the fear of missing out (FOMO) suck you into buying a stock just because it popped 5% one day. This market is extremely harsh on stocks that don’t deliver (as the moves in DKS, M, FL, and others show) and as you saw throughout the last month or so, upside momentum can turn to downside ugliness in even great stocks after they get overbought and too many investors/traders feel complacent.

Sometimes the hardest “trade” to make is deciding to sit tight. We have had a handful of bad trades this year (Tower Semi (TSEM) and Wolfspeed (WOLF) for example), but we have had some very strong performance overall in large part because we have stuck with the stocks that we have high conviction in and we haven’t been sucked into the stocks that we don’t believe in. We will continue to always do our homework and ensure that we have a firm grasp of the risk/reward setup before we put our hard-earned capital to work in this market.

Let’s stay hooked. Let’s not be complacent. Let’s not let ourselves get lost in the madhouse that is the Twilight Zone.

All eyes on Nvidia (NVDA) which reports earnings tonight. We still don’t own NVDA in the hedge fund (although it is a forever position in the personal account) and there is so much interest/hype around this earnings report that we think the most likely scenario is the stock has a muted reaction to the report. Feet-to-fire, I think we’ll see NVDA up or down less than 3% tomorrow no matter what they say on the report tonight.

I also want to let you all know that I will be speaking at the Ingenuity Venture Fund Investor Symposium in Albuquerque on September 26-28. You can learn more or sign up here.

As a reminder, we will do chat today at at 3:00pm ET in the TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com.