New book – 100 Stocks for the Clean Tech Revolution

Click here if you would like a PDF version of 100 Stocks for the Clean Technology Revolution

I coined the term “Flip It” many years ago, and it essentially is all about being contrarian and objective in your analysis of everything. One of the most important and profitable aspects of “Flipping It” is being willing and able to buy companies in sectors when they are truly hated. And likewise, to short companies in sectors when they are truly loved.

Long-time subscribers and readers of mine will recall that I wrote a series of newsletters and articles about how “Alternative Energy Is Doomed” back when government-backed, subsidized and completely unprofitable Clean and Green companies were coming public and trading at astronomical valuations. Indeed, we added Aone and other Clean Tech companies to the short side of the Revolution Investing portfolio and didn’t cover it until it was close to a dollar, at which time I still declared it to be headed to bankruptcy. AONE’s asset were just bought out of bankruptcy and shareholders got absolutely nothing.

Over the couple months, I’ve seen a bunch of random headlines, articles and analysis that now declare…wait for it…”Alternative Energy Is Dead.” It’s not quite my titles, but you get the point — now is the time to “Flip It” when it comes to green energy. I’m no Warren Buffett fan, but you know about his legendary guts in buying contarian/hated sectors and guess what. The Oracle of Omaha is lately investing in Clean Tech.

I’ve got a stock research team that is the best in the business. Believe it or not, everybody who works for me right now, and most of my past employees too, have been long-time subscribers and readers of my services who reached out to me looking for an opportunity. We went to work on the entire Clean Tech Revolution Sector looking for investments, trades and even some short ideas still, especially near-term shorts. The Clean Tech Revolution Sector is indeed now consolidating at pennies on the dollar for both assets and entire companies. The survivors of this consolidation will likely see some huge gains for investors from these levels in years ahead.

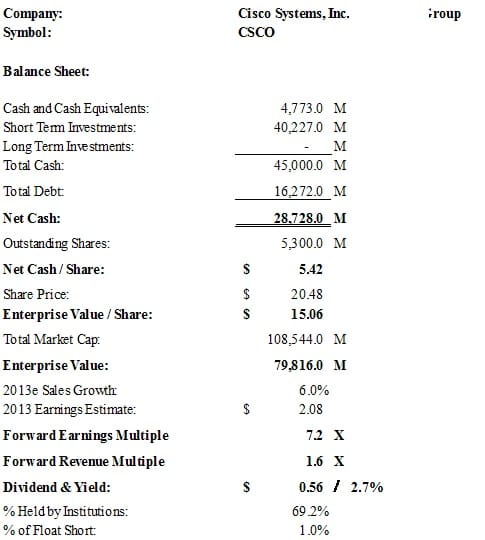

The set-up right now for Clean Tech is probably a lot like it was for Telecom/Dot-com Tech back in about 2002. The Great Tech Bubble had popped in 2000 and most every dot-com and telecom stock was trading at a small fraction of where it had been just two years earlier. Cisco was at $8 a share. Apple was at $10. Amazon is up 10-fold since 2002. Google couldn’t even consider coming public despite generating billions of dollars in revenues.

The companies that survived that crash truly became great investments for those willing to dive in after the crash. Indeed, I launched a tech hedge fun in October 2002 for the explicit reason of buying up tech stocks in the carnage.

I’m never planning on running other people’s money again in such a manner, but if I were starting a hedge fund today, I’d sure be looking to figure out what companies will survive and then thrive and which are still doomed.

We’ve broken the book into a dozen sub-categories:

- Solar

- Wind

- Biofuels and Biomass

- Energy Storage and Batteries

- Utilities, Utility Suppliers and Smart Grid Suppliers

- Electric and Natural Gas Vehicles and Alternative Transportation

- Nuclear

- Pollution Control

- Energy Efficiency and LED Lighting

- Other, including HydroElectric, Hydrogen, Geothermal and Ocean Power

At the beginning of each category we give an overview of the sub-sector – including important trends and forecasts for global implementation. Then we provide our traditional Enterprise Value (EV) analysis for each company reviewed and rate the stock on a scale of 1 to 10 – 1 being a perfect short and 10 being a perfect long (note, there are no 1’s or 10’s because there are no perfect investments). Also, note that a rating of a “5” means we’re neutral on the stock for now, but it’s in our list because the company is on the cusp of doing something—making it big or falling apart. We want to keep an eye on those “5s” even if we don’t buy or short them today.

Finally, we’ve also included an Appendix at the end of the book ranking all 100 companies by their Revolution Investing Score; within the score categories (all “7s” for example) the companies are ranked alphabetically. The CleanTech sector they’re in is also listed here.

If you’re serious about being a contrarian investor and trying to find the same kinds of gains I found when I first bought Apple for my hedge fund investors and subscribers back at $7 a share, this is the book for you.

Introduction

“CleanTech” has become a dirty word in investment circles over the past year or two, with stocks in sub-sectors like solar, wind and biofuels (i.e. ethanol)—just to name a few—getting hammered. Billions of dollars of equity cap has been lost and this has left a very bad taste in the mouths of many once-enthusiastic investors.

We’ve always been fans of contrarian indicators, however, and if you consider:

1) Governments world-wide are still hell-bent on reducing their reliance on fossil fuels and the Middle East;

2) Extreme weather events are becoming more frequent, lending credence to the notion that global warming is a real phenomenon;

3) Global population continues to grow at a potentially unsustainable pace;

4) It just FEELS GOOD to be “green”;

then you have to acknowledge that the pendulum is likely to swing back the other way at some point, bringing many of these beaten down issues back into the limelight—and making a lot of money for investors willing to commit a portion of their portfolio to some speculative names.

Make no mistake, a LOT of the former high-flyers in the CleanTech arena simply won’t make it in their current configuration—the recent Chapter 11 filing by A123 and the subsequent auction of its assets is a perfect example. But what is also worthy of note here is that there was a lot of interest in the company’s electric vehicle battery technology and there were several suitors chomping at the bit to buy its assets. In the end, it seems clear that A123’s problems were due primarily to its balance sheet and its life cycle stage when the Great Recession hit—not a lack of interest in its product portfolio. There are other CleanTech companies trading today with out-of-whack balance sheets—and these will make for good short candidates.

We’ve spent some time studying the potential and the pitfalls of this admittedly broad category, and in this book we present our best 100 Stocks for the Clean Technology rEvolution—that’s a Revolution that’s Evolving. Some are long ideas, some we’d label speculative long and some are clear short candidates. Government meddling—or lack thereof—will continue to be a risk factor for investors, but President Obama talks about clean energy alternatives every chance he gets, and his victory probably bodes well for the sector. The ongoing trade disputes with China have also had a measurable impact on several CleanTech sub-sectors, but in the long run, the trend toward cleaner, greener energy can’t be denied.

Introduction – Solar

After years of being the “brightest star” in CleanTech investing, it’s safe to say that solar, otherwise known as “photovoltaic, (PV)” has become one of the most beaten down of the sub-sectors we examined—and for good reason. Government-backed Chinese producers of solar equipment have flooded global markets over the past two years, leading to a supply glut and dramatically lower ASPs (Average Selling Price) for solar equipment. The price of solar panels has fallen from a peak of around $4/watt to less than $1/watt. The Department of Commerce took action in October to impose tariffs and anti-dumping duties on Chinese companies exporting solar equipment to the U.S., but the damage has already been done—witness the high profile flameout of Solyndra.

Also, solar is generally considered an alternative to marginal sources of electrical energy like coal and natural gas, and financing has been based on an assumption of flat or increasing energy prices. The advent of hydraulic natural gas fracturing (fracking) has turned that assumption upside down, at least for now.

And then there are financially strapped governments (at the national level across Europe and the U.S., as well as for U.S. states and cities), which have been forced to scale back their plans or extend their timelines for investment in and ultimately reliance upon solar energy as an alternative to carbon-based fuels.

As a result, many of the publicly traded solar companies have seen their top lines fall precipitously over a relatively short amount of time, collapsing both net income and share price. For some that downslide has reversed in recent weeks, but for others this downward spiral probably isn’t over. Long run, however, the upside for solar remains substantial. Let’s take a moment to consider a few factors that will impact the outlook for deployment and use of solar energy:

- China has publicly stated plans to generate 21 GW (gigawatts) of solar power by 2015;

- India’s National Solar Mission has established solar energy generation targets through 2022; in the first phase India aims to commission 1000MW of grid-connected solar power projects by 2013;

- Australia hopes to generate 20% of its electricity via solar by 2020;

- The European Union countries have also set a 20% target for renewable energy as the source of its electricity consumption by 2020.

At the end of the day, governments are still supremely interested in developing alternative sources of power like solar, and we think we’ve found some winners in the group.

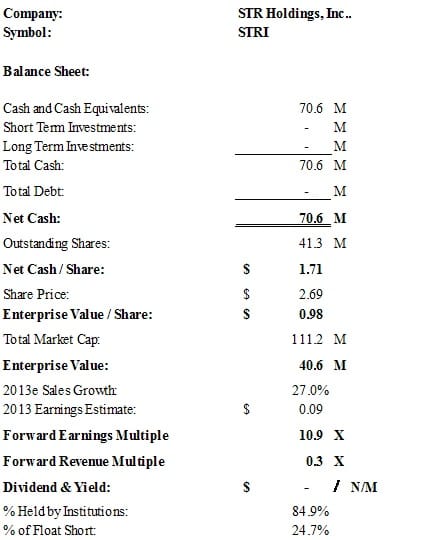

STR Holdings, Inc., together with its subsidiaries, designs, develops, manufactures, and sells encapsulants for the solar industry worldwide. Its encapsulants protect the embedded semiconductor circuits of solar panels.

The company sells its products to crystalline silicon and thin-film solar module manufacturers like First Solar Inc. (FSLR), and SunPower Corporation (SPWR) and has seen its revenue plummet along with that of the manufacturers. The volatile Euro, a reduction in European solar subsidies and falling crystalline silicon prices are also of concern.

STR Holdings’ balance sheet remains solid, despite the sales decline; at the end of the third quarter 2012, STR had $70 million in cash on the books, or about $1.71 per share, implying just $0.98 per share in enterprise value. STR’s cash burn has been modest as it has cut costs along with sales declines; it seems likely that its cash balance is high enough to help it survive the current environment—unless it’s several years before solar sales rebound—and the stock is cheap. We’re betting on STR to make it.

Revolution Investing Rating: 6/10

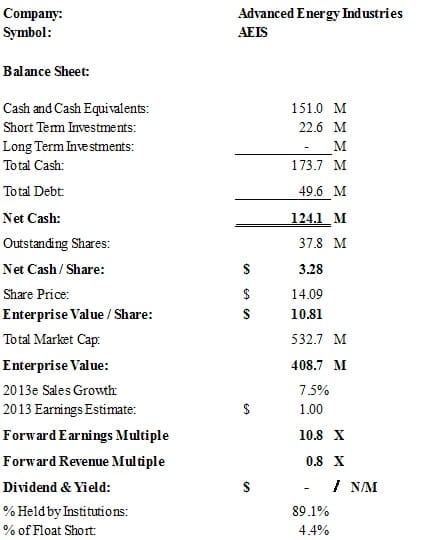

Advanced Energy is a global leader in reliable power conversion solutions used in thin-film plasma manufacturing processes and solar energy generation.

Advanced Energy participates in the solar industry via inverters, where it has good market share and has shown solid growth in recent quarters. But it also has heavy exposure to the ailing semiconductor capital equipment industry. Its most recent quarter showed a decline in revenue, although the declines were not as severe as for some of its competitors, and the top line did improve sequentially. The company has a healthy balance sheet and recently announced a $25 million share buyback program, on the back of a $75 million buyback in 2011. On a valuation basis the stock is less expensive than many in the solar sector.

Revolution Investing Rating: 6/10

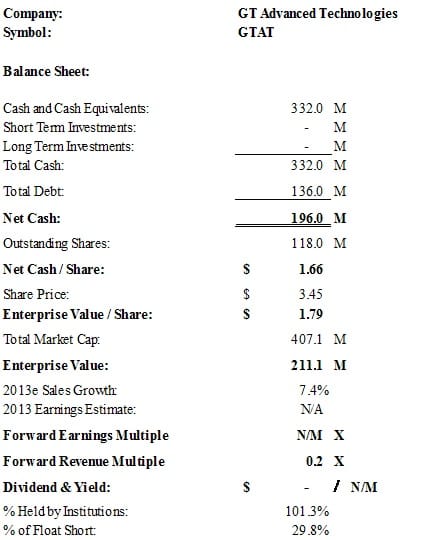

GT Advanced Technologies Inc. provides polysilicon production technology and crystalline ingot growth systems, and related photovoltaic (PV) manufacturing services for the solar industry worldwide. It also offers sapphire growth systems and material for the light emitting diode (LED) and other specialty markets.

GTAT makes the bulk of its money in solar, though management says that 45% of its business will come from the sapphire-based LED business in calendar year 2012 (GTAT’s fiscal year ends in March). The stock got hammered in October after it warned that it would miss guidance for third quarter revenue and said that it was going to lay off 25% of its work force. Two things work in favor of GTAT, however, when compared with most of the solar stocks. First, it has $1.66/ share of net cash on the balance sheet, or about half of its share price. Second, it priced $205 million in 3% convertible senior notes (due 2017) in late September. Both the 3% yield as well as the $7.71/share conversion rate indicate that bond investors must have been comfortable with the company’s prospects. Proceeds will be used to “diversify beyond the struggling solar industry,” which may mean strategic acquisitions are being considered.

GTAT is struggling today, but its balance sheet is healthy and the LED market has considerable upside. It trades for about 0.3x forward revenue, and the heavy short interest could make for a nice pop on any good news over the next few months. Speculative long.

Revolution Investing Rating: 6/10

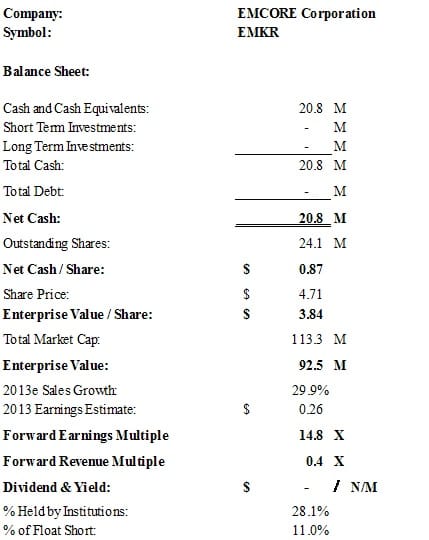

EMCORE Corporation, together with its subsidiaries, provides compound semiconductor-based products for the broadband, fiber optics, satellite, and solar power markets. The company operates in two segments, Fiber Optics and Photovoltaics.

In addition to its solar industry exposure, EMCORE was hit hard by the flooding in Thailand a year ago, but recently the company reported that its production capacity has recovered. The floods affected inventory and production operations for a contract supplier, impacting product lines serving the telecommunications and cable TV markets. Management indicated that it would reach pre-flood production levels on all its continuing product lines by October 2012, and that it expected increased shipments as a result for its fiber optics segment in the quarters to come.

EMCORE’s exposure to the fiber optic market helps to insulate it against the weak solar sector, and its balance sheet is clean. In October, EMCORE placed $8.3 million worth of shares, or 1.59 million shares at $5.46 per share. The amount of stock offered was increased after investors expressed strong demand. At 14.8x forward earnings, it’s not cheap, but on the other hand, revenue is forecast to grow by 30% in 2013.

Revolution Investing Rating: 6/10

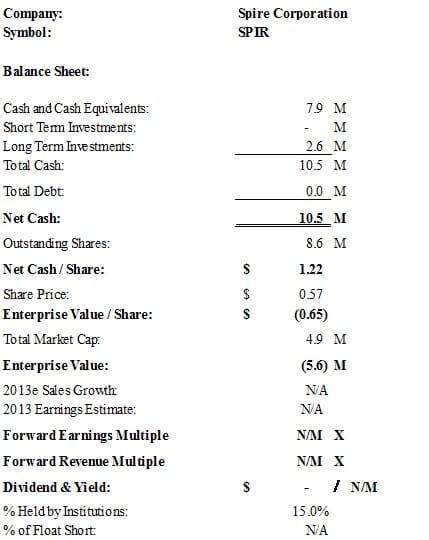

Spire Corporation is a global solar company providing capital equipment and turn-key production lines to manufacture PV modules.

The company’s revenue in the first half of 2012 was less than half of its 2011 levels, but at around $0.57 per share, Spire is trading for less than cash on the books. Management has said, “Based on recent industry marketing forecasts, we expect the PV equipment market to begin to recover in late 2013 then potentially increasing in global demand extending through at least 2016. As this happens, we believe that we are positioned to capitalize on equipment re-tooling, the growth of regional PV module manufacturing and PV module supply chain transactions. During this quarter, we successfully introduced and delivered our first Spi-Sun SimulatorTM 5600SLP and anticipate sales of this new system to increase as module manufacturers replace older equipment, address measurement needs of high efficiency module technology and expand production.”

That recovery may or may not happen in time for Spire, but at its current price we’re inclined to look at the stock as an option on the recovery of the solar industry. Highly speculative long.

Revolution Investing Rating: 6/10

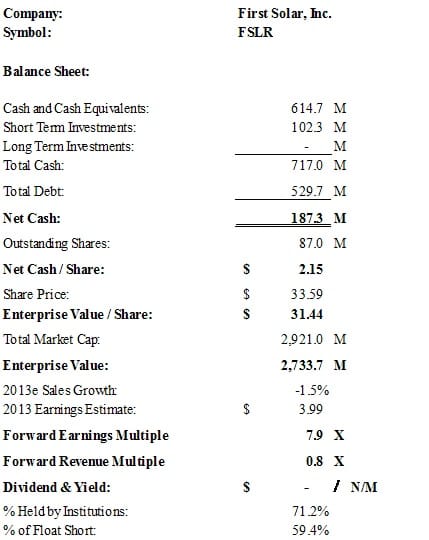

First Solar engages in the design, manufacture, and sale of solar modules using a thin-film semiconductor technology in the United States and internationally.

First Solar was hit hard by the contraction in solar panel sales in recent years, but thanks to its large-scale production capabilities it is has shown success in winning large scale power generation projects. This type of project accounted for 70% of revenue in the second quarter, when FSLR beat analyst expectations and raised earnings and revenue guidance. Well-known utilities such as Berkshire Hathaway’s MidAmerican Energy subsidiary and Exelon Corporation have purchased solar system power generation projects from First Solar and the company also inked recent deals in Australia and India. On the down side, there have been concerns about the quality of First Solar’s panels and the risk of fire hazard, and its third quarter earnings and guidance were disappointing and lower, respectively. Some of its ongoing projects were also hurt by Superstorm Sandy, which accounted for some of the reduced guidance for 4Q12. The shares have recently gained nearly 40% since last fall’s lows, but on a valuation basis, remain relatively cheap.

Revolution Investing Rating: 3/10

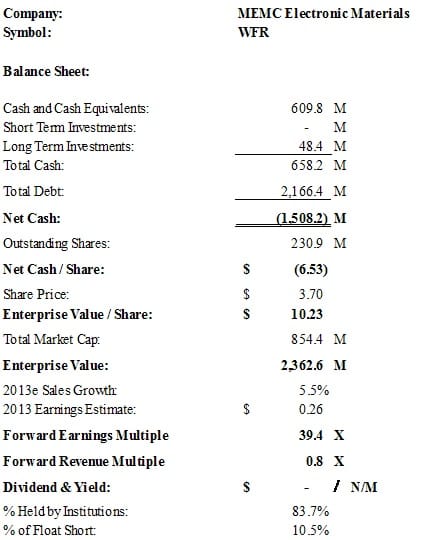

MEMC Electronic Materials, Inc. engages in the development, manufacture, and sale of silicon wafers for the semiconductor industry worldwide. The company operates in two segments, Semiconductor Materials and Solar Energy.

MEMC has undertaken a restructuring over the past year and reported revenue and earnings that handily beat analyst expectations for 3Q12. That said, the company did not provide revenue or earnings guidance for the fourth quarter “in light of the current uncertainty in the semiconductor and solar markets.” Its solar system subsidiary, SunEdison, has done well winning projects to build solar energy plants, including a recent $250 million contract for a South African plant, and the company says it has 2.9 Gigawatts of solar plant projects in its pipeline, down only slightly from a year ago. On the other hand, its solar wafer business has faltered and in September Conergy AG, a German solar manufacturer that is restructuring its operations, cancelled a $600 million supply agreement for polysilicon wafers. The agreement was supposed to run through 2018.

MEMC has more than $2 billion in long-term obligations and the shares are expensive based on projected 2013 earnings. Furthermore, the stock has surged more than 60% in the past two months. Short.

Revolution Investing Rating: 3/10

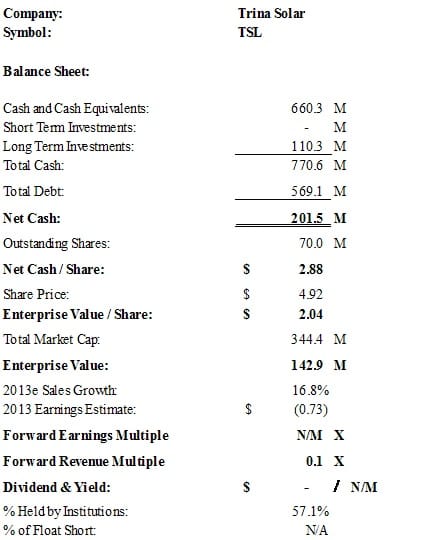

Trina Solar Limited, an integrated solar-power products manufacturer, engages in the design, development, manufacture, and sale of photovoltaic (PV) modules worldwide.

Trina Solar is a Chinese company and it was specifically named in the Commerce Department’s ruling last month related to Chinese “dumping” of solar products: Trina’s crystalline silicon photovoltaic cells will be subject to duties of 16% and anti-dumping duties of 18% on the value of Trina Solar imports. Bottom line, Trina’s going to find it tougher to sell its products in the U.S., although third party sourcing may help it get around some of the tariffs.

Based on its latest available financial data, Trina Solar’s enterprise is currently valued at about $2 per share, or about $143 million—this for a company with about $1.5 billion in sales. Trina may also be well positioned to benefit as the Chinese government moves forward with its aggressive solar plans. Net net, however, we don’t really like to invest in a Chinese company where the recently imposed U.S. duties could impact its performance in the U.S., and similar action may also be taken by European governments in the near future. Furthermore, the share price has risen by 33% in the past two months. Avoid.

Revolution Investing Rating: 3/10

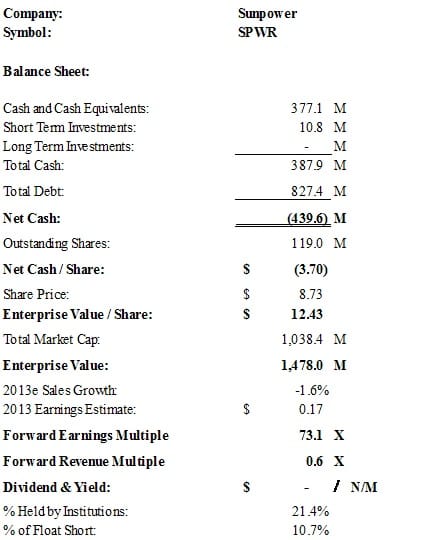

SunPower Corporation, an integrated solar products and services company, designs, manufactures, and delivers solar electric systems for residential, commercial, and utility-scale power plant customers worldwide. It operates in two segments, Utility and Power Plants, and Residential and Commercial.

Sunpower disappointed investors in the third quarter as weakness in Europe dragged down its results, and in October the company announced that it was reducing its workforce by approximately 15% and idling a number of its manufacturing lines in the Philippines. The company says it is working toward reducing its cost per watt for solar panels to an industry leading $0.75, but at this early stage in its restructuring, and given that continued European weakness will likely lower forward earnings estimates, SPWR looks expensive.

Revolution Investing Rating: 3/10

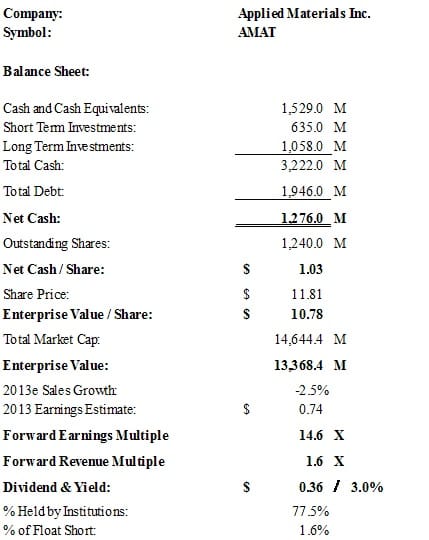

Applied Materials, Inc. provides manufacturing equipment, services, and software to the semiconductor, flat panel display, solar photovoltaic (PV), and related industries worldwide.

Applied Materials makes the equipment that makes chips, and chips—whether for PCs or solar equipment—are not in high demand these days. The company announced earlier this year it would cut 9% of its workforce, or about 1,000 jobs, but it is unlikely that these cuts will put profitability back on track in the near term. Intel is one of Applied Materials largest customers, and it’s been in its own world of hurt recently—it isn’t likely to place big new manufacturing equipment orders. On a valuation basis, and given these dynamics, Applied Materials looks expensive at 14.6x next-year’s earnings.

Revolution Investing Rating: 3/10

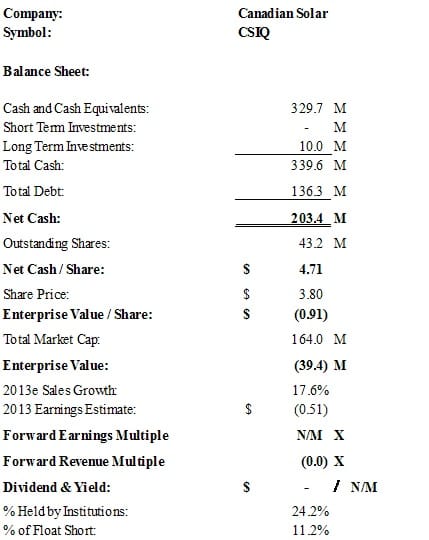

Canadian Solar Inc., together with its subsidiaries, engages in the design, development, manufacture, and sale of solar power products in Canada and internationally. Its manufacturing assets are predominantly in China.

Canadian Solar is in trouble on two fronts: first, geographically, the majority of its revenue comes from Europe, followed by North America. Ongoing economic woes in these regions and low ASPs will continue to hurt Canadian Solar’s revenue prospects. Second, it makes a good deal of its equipment in China, subjecting it to the recently imposed anti-dumping duties in the U.S. But it only sells about 15% of its products in Asia, so it doesn’t have as much to gain from aggressive Chinese solar deployment plans as its Chinese competitors.

On a strict valuation basis, you are paying less for the stock right now than there is cash on the books—getting the underlying business for free. But through the first half of this year the company lost about $50 million, and analysts have been reducing their forecasts for 2013—from negative to even more negative. It’s too early in the eventual solar industry recovery to buy Canadian Solar.

Revolution Investing Rating: 3/10

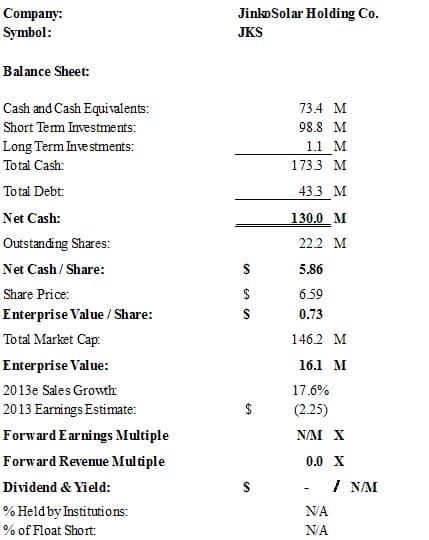

JinkoSolar Holding Co., Ltd., together with its subsidiaries, engages in designing, developing, producing, and marketing photovoltaic products in the People’s Republic of China and internationally.

Jinko’s enterprise value is next to nothing based on its current stock price and the most recently available financial statements—but that doesn’t mean you’re getting a good deal. First, Jinko is Chinese and was specifically named in the Department of Commerce’s final determination of anti-dumping duties and countervailing duties. This could impair sales in 2013 and beyond, although it’s possible Jinko will generate substantial revenue growth in China in coming years.

But revenue of more than $1 billion in 2013 is not expected by analysts to translate into a profit—in fact, it’s expected to lose more than $2 per share next year, after losing nearly $10 per share over the trailing 12 months. Negative outlook.

Revolution Investing Rating: 2/10

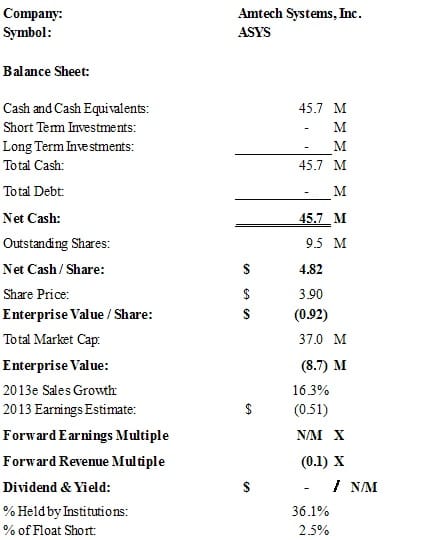

Amtech Systems, Inc., through its subsidiaries, engages in the design, assembly, sale, and installation of capital equipment and related consumables used in the manufacture of wafers, primarily for the solar and semiconductor industries.

Here’s another one that sells manufacturing equipment for the solar and semiconductor industries, and it’s also another one that’s selling for less than cash on the books—and also with reason. In late October, Amtech announced “preliminary revenue of $81.5 million in fiscal 2012, including $10.9 million for the fiscal fourth quarter ended September 30, 2012.” In other words, fiscal fourth quarter revenue came in at less than half of the $20-$25 million it had generated in the first three quarters—which were in turn well below the $60 million in sales posted in the September 2011 quarter. The press release in October also said, “Amtech expects to incur a significant loss for the quarter ended September 30, 2012.” The company has been working on restructuring all year, and said that it is developing additional plans, which will be outlined in its year-end conference call in late November. Bottom line? This one just keeps getting uglier and that cash on the books isn’t likely to last for too many more quarters of “restructuring.”

Revolution Investing Rating: 2/10

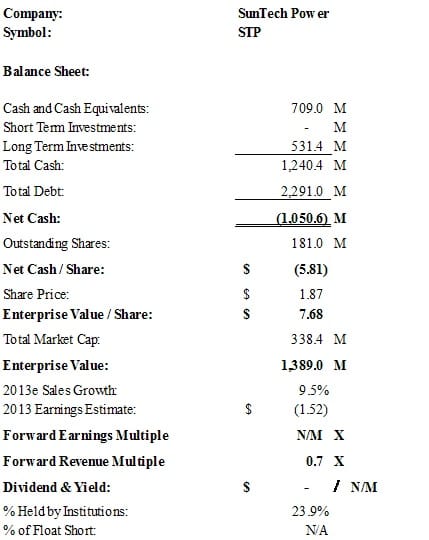

Suntech Power Holdings Co., Ltd., a solar energy company, engages in the design, development, manufacture, and marketing of photovoltaic (PV) products. It is based in Wuxi, the Peoples Republic of China.

Suntech was named in the Dept. of Commerce’s ruling on Chinese solar products, and is facing a 15% tariff to counter Chinese government subsidies as well as a nearly 32% anti-dumping duty. Ouch. It also has more than $2 billion in debt and revenue in the second quarter was $471 million, according to initial, unaudited figures presented in a press release. Actual financial statements from the June quarter have not been released because “In July, Suntech announced that it is conducting an investigation into a security interest the Company received in connection with its investment in Global Solar Fund, S.C.A., Sicar. Suntech is currently assessing the potential impact of the GSF investigation and its dispute with a supplier on its consolidated financial statements and is not in a position to provide additional financial data at this time. The Company intends to publish its consolidated financial statements once the financial assessment is complete later in 2012 and will continue to inform investors of any material developments in a timely manner.” Considering 2011 revenue was more than $3.1 billion, or an average of nearly $800 million per quarter, it’s clear the company is suffering. Sell, sell, sell!

Revolution Investing Rating: 2/10

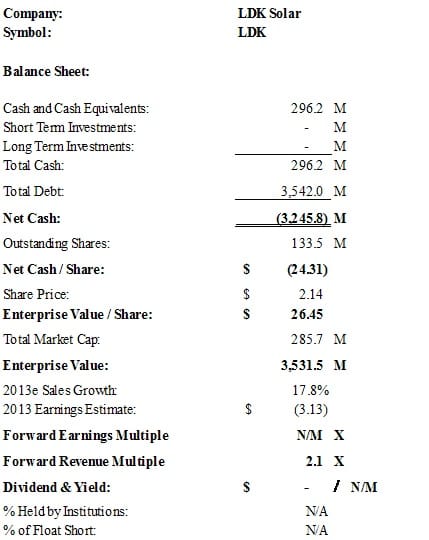

LDK Solar Co., Ltd., together with its subsidiaries, engages in the design, development, manufacture, and marketing of photovoltaic (PV) products; and development of power plant projects. The company is based in Xinyu City, the Peoples Republic of China.

LDK was trading for around $0.70 per share in October but has spiked to more than $2 per share recently—even though it sold stock to a new (partially state owned) Chinese investor for just $0.86 in November. The company is dramatically overleveraged, and its losses are still growing, despite restructuring efforts and a new CEO. The company recently lost a solar wafer supply agreement with Sumitomo, for which it will receive a termination fee of $33 million—a drop in the bucket next to $3.5 billion in debt. The company has nothing but substantial losses on the horizon—and its recent stock price jump presents an excellent short opportunity.

Revolution Investing Rating: 2/10

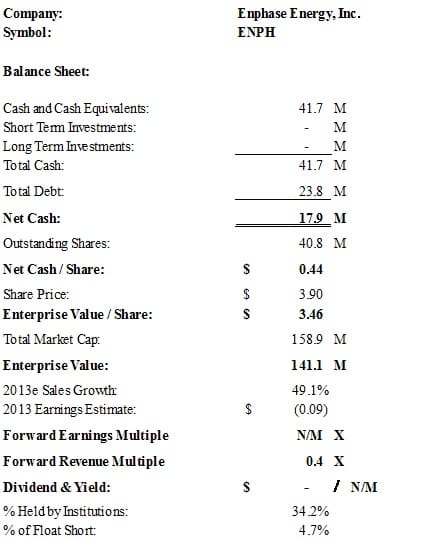

Enphase Energy, Inc. designs, develops, and sells microinverter systems for residential and commercial solar system owners. Inverters are used to convert the DC power of a solar system into the AC power of the grid, or vice versa.

Enphase has experienced slowing growth in recent quarters and offered guidance of lower revenue in the fourth quarter than it posted in 3Q12. Analyst estimates of $350+ million next year now seem wildly optimistic, as the company’s run-rate top line is between $55-$60 million and competition in the microinverter space is growing. Cash burn is high and the company has announced that it will be tapping more credit in the near term. Furthermore, the newly announced sanctions against under-priced Chinese solar panels could stall overall panel sales, which will make it even more difficult for Enphase to grow its sales. Finally, where Siemens had been considered a potential buyer of Enphase in the past, the electronics giant recently announced it is exiting the solar business, making it unlikely that Enphase will be acquired. Short opportunity.

Introduction – Wind

Wind power is one of the most prevalent forms of alternative energy in the world, accounting for an estimated 2%+ of the world’s energy supply. That figure is predicted to hit 8% by 2018. Wind power is actually a form of solar power, since wind is the movement of air molecules from high pressure to low pressure, which is caused by the sun. The sun unevenly heats the surface of the earth, creating a massive variety of air pressures in different geographical locations.

One of the biggest attractions of wind is the fact that it is free once the equipment is installed; there are no further costs apart from maintenance and upkeep of the turbines. On the down side, wind turbines emit a great deal of noise and also, if the wind isn’t blowing, they aren’t generating any power. This can create problems for utilities which need to provide customers with a constant stream of power. Generally, analysts foresee difficulty in their models when more than 20% of U.S. energy comes from wind farms.

Wind power’s output is measured in watts, and can often be quoted in kilowatts, megawatts, and gigawatts. As a reference point, one gigawatt of energy is equal to one billion watts. According to a 2007 report form the U.S. Energy Information Administration, the average home uses 11,232 kilowatt hours of energy on an annual basis, though estimates vary. This means that one gigawatt is enough energy to power roughly 90,000 homes for a year, and the current 239 gigawatts throughout the world is enough to power roughly 21.5 million homes globally.

China is the world’s top producer of wind power (63 GWs in 2011), followed by the U.S. (47 GW) and Germany (29 GW). India, Canada and most of the other major European countries round out the top ten. The price of wind energy production is affected by weather conditions, government subsidies, the pricing of crude oil and natural gas as an alternative and the cost of rare earth metals used in making wind turbines. China is responsible for 90% of the world’s supply of rare earth metals.

The potential for growth in wind energy is great. A paper published in the science journal Proceedings of the National Academy of Sciences (PNAS) estimates the total global wind energy potential to be about 40 times current worldwide consumption of electricity. The U.S. Energy Information Administration predicts that worldwide demand for non-fossil fuel sources, such as solar and wind, will increase 22% over the next five years and 85% over the next 25 yeares.

The United States constructed more than 2,150 megawatts (MW) worth of new wind power in 2011, and over the last four years, the U.S. has been responsible for 35% of the world’s new capacity. This growth in wind generation is second only to the growth in new natural gas generation, but it is more than nuclear and coal growth combined. Overall, scientists estimate that the U.S. has a total generation potential of 145,500,000 MW worth of both on- and offshore wind energy. Emerging markets like Brazil and India have also embraced wind and China continues to deploy substantial wind capacity.

Like solar, the wind energy industry has been highly dependent on government subsidies, and Chinese “dumping” and industry-wide overcapacity has impacted pricing. The Commerce Department has placed provisional duties on Chinese companies accused of selling below cost in the U.S. Perhaps more importantly, in the U.S. the Production Tax Credit (PTC) for wind energy is set to expire at the end of 2013. Congress renewed the credit as part of the fiscal cliff deal in early January, but only for one year. The PTC has been in place for most of the past two decades, but given the federal budget crisis, remains vulnerable after this year. That said, some in the industry believe wind it approaching the point where it won’t be dependent upon the PTC. The long-term potential for wind energy generation remains great and the industry is ripe for consolidation, which could be a boon for investors in the strongest companies.

Revolution Investing Rating: 7/10

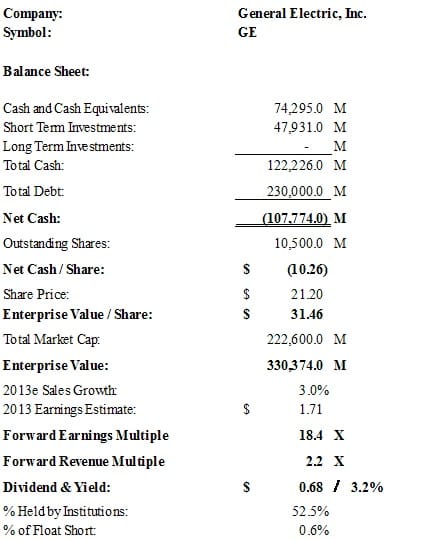

General Electric Company operates as a technology and financial services company worldwide. The company’s Energy Infrastructure segment offers wind turbines; gas and steam turbines and generators; integrated gasification combined cycle systems; aircraft engine derivatives; nuclear reactors, fuel, and support services; oil and gas extraction and mining motors and control systems; aftermarket services; water treatment solutions; power conversion infrastructure technology and services; and integrated electrical equipment and systems.

GE is one of the two largest wind turbine manufacturers worldwide, and is also well diversified. Its 3.2% dividend is nice and it’s surely one of the safer ways to play the long-term potential of wind energy generation. At 18.4x forward earnings, however, and with just 3% sales growth forecast for 2013, the stock isn’t super cheap.

Revolution Investing Rating: 5/10

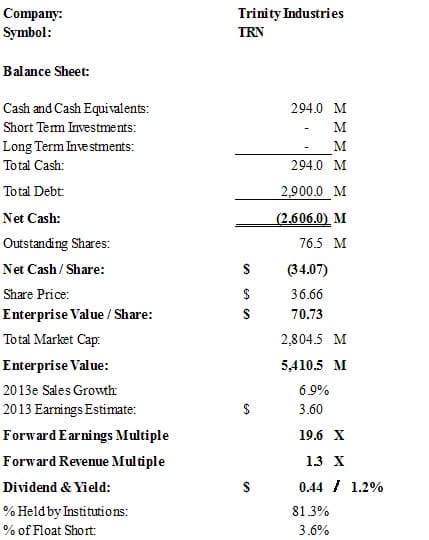

Trinity Industries, Inc. provides products and services to the industrial, energy, transportation, and construction sectors primarily in the United States, Canada, Mexico, the United Kingdom, Singapore, and Sweden. The company’s Rail Group manufactures and sells railcars. Its Energy division makes structural wind tower and tank containers.

Trinity has been enjoying strong growth in its inland barge, rail and energy equipment units. In the latest quarter the company’s revenue grew 19% and the company is investing for increased capacity going forward. The company has a fair amount of debt, but it’s not leveraged beyond its ability to service the debt. There’s a small dividend, but the shares have been on a run. At nearly 20x earnings, we’d hold off on this one for now.

Revolution Investing Rating: 5/10

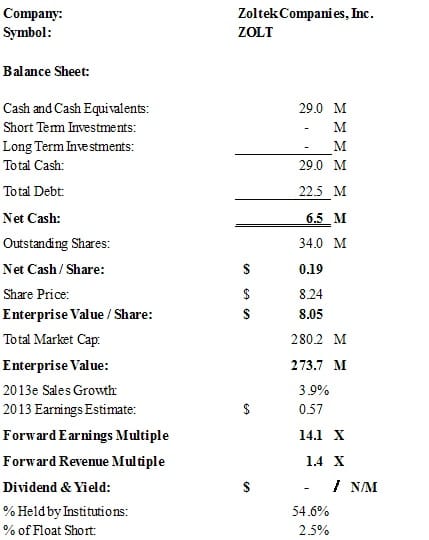

Zoltek Companies, Inc., through its subsidiaries, develops, manufactures, and markets carbon fibers and technical fibers primarily in Europe, the United States, and Asia.

Carbon fiber is used in wind turbine blades to reduce their weight and allow them to spin faster. Recently, management indicated that “Wind turbine applications continue to represent our biggest near-term opportunity” and added that they expect the trend to accelerate with the development of off-shore wind farms. Off-shore turbines have longer blades which require carbon fiber. The company’s revenue and earnings have shown growth over the past year, following two years of losses. Zoltek has also won a $3.7 million grant from the U.S. Dept. of Energy for advanced carbon fiber research.

Revolution Investing Rating: 5/10

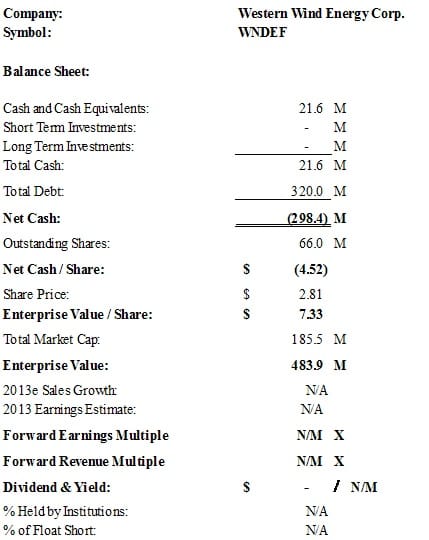

Western Wind is a vertically integrated renewable energy production company that owns and operates wind and solar generation facilities with 165 net MW of rated capacity in production, in California and Arizona. Western Wind further owns substantial development assets for both solar and wind energy in the U.S.

Western Wind owns and operates three wind energy generation facilities in California, and one fully integrated combined wind and solar energy generation facility in Arizona. The three operating wind generation facilities in California are comprised of the 120MW Windstar, the 4.5MW Windridge facilities in Tehachapi, and the 30MW Mesa wind generation facility near Palm Springs. The facility in Arizona is the Company’s 10.5MW Kingman integrated solar and wind facility. The Company is further developing wind and solar energy projects in California, Arizona, and Puerto Rico.

Western Wind is in the process of selling the company and said in late October that a number of bidders had moved to the second stage of due diligence. It’s possible that investors might get upwards of $3/share in a sale and the share price has been steadily moving higher. A $3 per share buyout leaves some room for upside, but at the current price, it’s only about 7%.—probably not enough to warrant the downside risk of no sale or a lower priced sale.

Revolution Investing Rating: 5/10

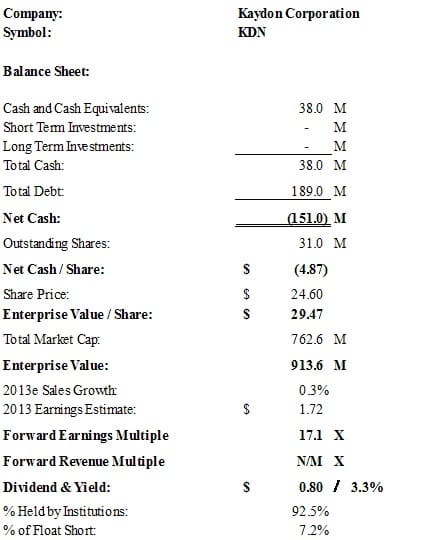

Kaydon Corporation engages in the design, manufacture, and sale of custom engineered, performance-critical products in the United States, Germany, and internationally.

Kaydon’s ball bearings are used in wind turbine production. The company announced a restructuring in October whereby it will close one of its production facilities devoted to the wind sector and take a roughly $50 million (largely non-cash) writedown. Earlier this year Kaydon declared a special $10.50 one time dividend, and the stock hasn’t recovered since. Management said the uncertainty surrounding the PTC as well as weak global economies led to the restructuring. With flat revenue, the 17.1x multiple looks high, but on the other hand its dividend yield is 3.3% and there has been insider buying this year. Until the restructuring is completed and we see some evidence that other sectors can pick up where wind has fallen off, we’d be hesitant to buy the shares. Neutral.

Revolution Investing Rating: 4/10

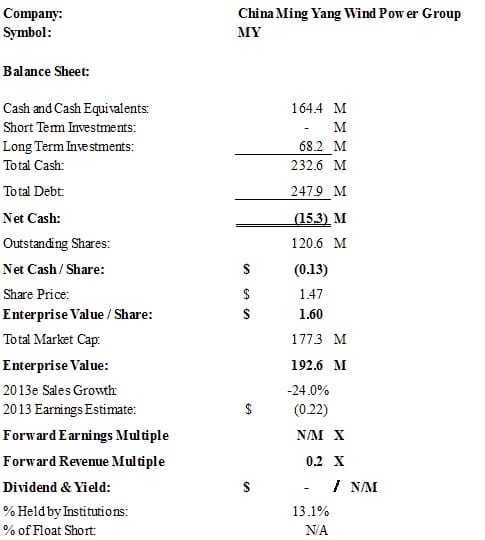

China Ming Yang Wind Power Group Limited designs, manufactures, sells, and services megawatt-class wind turbines in China.

Ming Yang has seen its run-revenue decline by nearly 50% since its peak in 2011, but the company has recently announced a number of strategic partnerships to develop off-shore wind farms in southern China, as on-shore projects there have slowed. European companies like Vestas and Siemens have historically dominated in off-short wind projects, but the Chinese government is placing increasing focus on off-shore projects and Ming Yang will likely need to capture that growth in order to turn its fortunes around. The company also hopes to expand its growth internationally, although current anti-Chinese tariffs in the U.S. will impact growth in this country. The shares are cheap assuming the company can turn its revenue trend around, and its balance sheet is relatively clean, but the stock is unlikely to climb before a demonstrated reversal in its declining revenue.

Revolution Investing Rating: 3/10

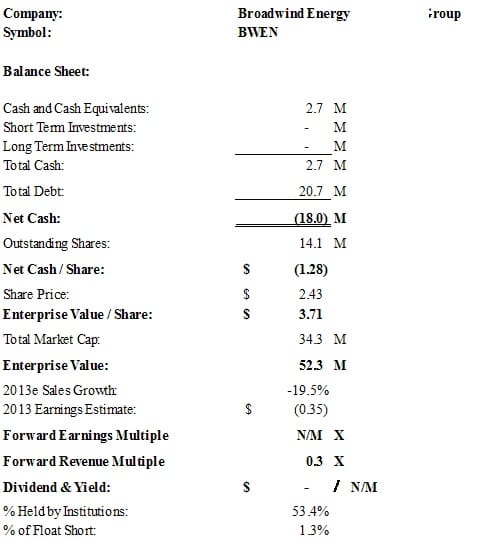

Broadwind Energy, Inc. provides products and services to the energy, mining, and infrastructure sector customers, primarily in the United States. The company’s Towers and Weldments segment manufactures towers designed for two megawatt and larger wind turbines.

Broadwind has been working to reduce its dependence on the wind industry, although it believes it is benefitting to some degree by the fact that some of its competitors are leaving the sector in the face of regulatory uncertainty and slow global economies. The company has closed its European office and recently closed on a new $20 million credit facility recently which it used to refinance debt. This is a turnaround story, and while recent revenue and cash flow trends were positive, Broadwind still has a ways to go before we’d be confident enough to buy the stock.

Revolution Investing Rating: 3/10

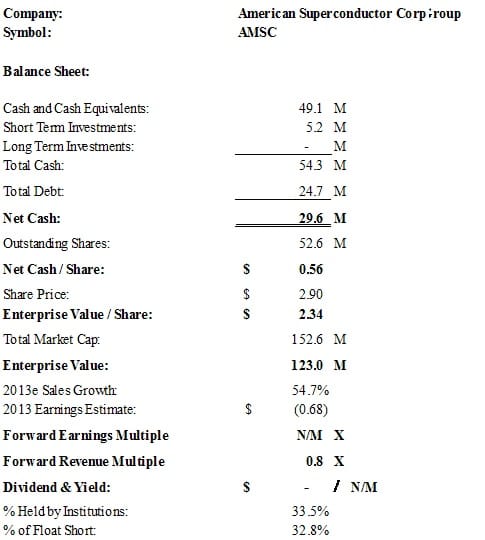

American Superconductor Corporation, together with its subsidiaries, provides wind and power grid products and services worldwide. The company operates in two segments, Wind and Grid. The Wind segment designs, develops, and licenses onshore and offshore wind turbines; provides customer support and consulting services; supplies electrical control systems used in wind turbines; and sells power electronics and software-based control systems for the wind turbine manufactures, as well as offers products that enhance power quality for industrial operations under the Windtec Solutions brand name.

AMSC saw improved results in its most recent quarter, largely due to sales of Smart Grid products, but the company is mired in lawsuits with Sinovel Wind Group, China’s second largest turbine maker, and is seeking more than $1.2 billion in damages. The company claims that Sinovel stole its technology. Sinovel contributed about 70% of AMSC’s revenue in fiscal 2010 before it stopped accepting shipments in March 2011. There’s too much uncertainty here for us to get behind the stock, although a favorable ruling in the Sinovel lawsuit would certainly provide a catalyst for the shares.

Revolution Investing Rating: 3/10

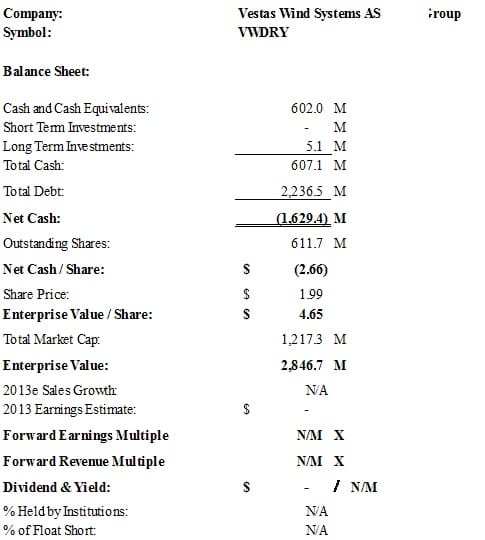

Vestas Wind Systems A/S engages in the manufacture and sale of wind turbines and wind power systems in Europe, Africa, the Americas, and the Asia Pacific. It also offers wind project planning, procurement, construction, and operation services; and after sale services, as well as sells spare parts.

Denmark-based Vestas has been restructuring for more than a year now and by the end of 2013 expects to have 21% fewer employees than it had at the end of 2011. It is also considering divestitures. While the share price got a bump recently after it said that it was in talks for “strategic cooperation” with Mitsubishi Heavy Industries regarding offshore wind projects, the stock plummeted following its most recent quarterly announcement. The CEO said in November that they see a dramatic decline in U.S. activity and that isn’t expected to improve in 2013. Vestas is working on a new offshore turbine that will have blades that cover 538 feet (diameter), but that isn’t scheduled for completion until 2014. The company also has substantial debt at this time. While a Mitsubishi partnership would be a positive, we’d say wait and see for now.

Introduction — Biomass and Biofuels (including Ethanol)

A biofuel is a type of fuel whose energy is derived from biological carbon fixation. Biofuels include fuels derived from biomass conversion, as well as solid biomass, liquid fuels and various biogases. Biofuels have garnered increased attention in recent years, driven by factors such as oil price hikes and the need for increased energy security. A 2007 U.S. law enacted under President George W. Bush, known as the Renewable Fuels Standard, or RFS, requires refiners to mix 13.2 billion gallons of renewable fuels, such as ethanol, with gasoline in 2012 and 15 billion gallons by 2015. As a result, numerous new entrants and stock IPOs in the sector have appeared.

Bioethanol is an alcohol made by fermentation, mostly from carbohydrates produced in sugar or starch crops such as corn or sugarcane. Cellulosic biomass, derived from non-food sources such as trees and grasses, is also being developed as a feedstock for ethanol production. Ethanol can be used as a fuel for vehicles in its pure form, but it is usually used as a gasoline additive to increase octane and improve vehicle emissions. Bioethanol is widely used in the USA (corn-based) and in Brazil (sugarcane-based).

Biodiesel is made from vegetable oils and animal fats. Biodiesel can be used as a fuel for vehicles in its pure form, but it is usually used as a diesel additive to reduce levels of particulates, carbon monoxide, and hydrocarbons from diesel-powered vehicles. Biodiesel is produced from oils or fats using transesterification and is the most common biofuel in Europe.

In 2010 worldwide biofuel production reached 105 billion liters (28 billion gallons US), up 17% from 2009, and biofuels provided 2.7% of the world’s fuels for road transport, a contribution largely made up of ethanol and biodiesel. Global ethanol fuel production reached 86 billion liters (23 billion gallons US) in 2010, with the United States and Brazil as the world’s top producers, accounting together for 90% of global production. The world’s largest biodiesel producer is the European Union, accounting for 53% of all biodiesel production in 2010. As of 2011, mandates for blending biofuels exist in 31 countries at the national level and in 29 states/provinces. According to the International Energy Agency, biofuels have the potential to meet more than a quarter of world demand for transportation fuels by 2050.

In 2012, the combination of falling gas prices and rising corn prices due to a drought in the Midwest has resulted in sharp losses for corn ethanol producers, with the loss per gallon of corn ethanol averaging $0.15-$0.20. Years of high production compounded the problem, as existing inventory levels were already high. More recently inventories have begun to fall as ethanol producers have slowed production and in some cases idled plants. While it’s too early to predict how the corn crop will turn out in 2013, it is clear that many of the pure-play corn ethanol producers have been severely impacted. Growing imports of less expensive Brazilian sugar-based ethanol have putting further pressure on American corn ethanol producers.

Biofuel is a broad category, but we’re bearish on the more pure corn ethanol plays at this time. We did, however, find a few interesting companies in the biofuel and biomass space.

Revolution Investing Rating: 8/10

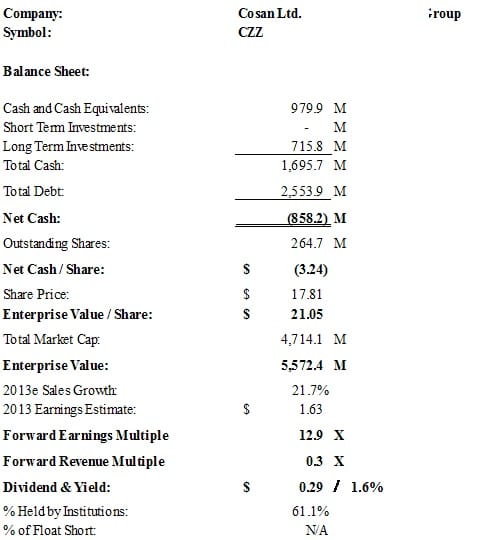

Cosan Limited engages in the energy, food, logistics, infrastructure, and farmland development and management businesses primarily in Brazil, Europe, Latin America, the Middle East, Asia, and North America. The company is involved in the production and marketing of a range of products derived from sugar cane, including raw sugar, and anhydrous and hydrated ethanol; energy cogeneration from sugar cane bagasse; and distribution and marketing of fuels and lubricants under the Shell and Esso brands.

Sao Paulo, Brazil-based Cosan has seen its shares soar this year as it has shifted its business mix away from sugar and ethanol. In May it agreed to buy control of Brazil’s largest natural gas distributor, Cia. De Gas de Sao Paulo. The diversification has stabilized the share price and the company recently affirmed its guidance for fiscal 2013 (March) results. Thanks to the newly diversified revenue base, Cosan could continue to enjoy multiple expansion; at 12.9x forward earnings, it is not expensive.

Revolution Investing Rating: 8/10

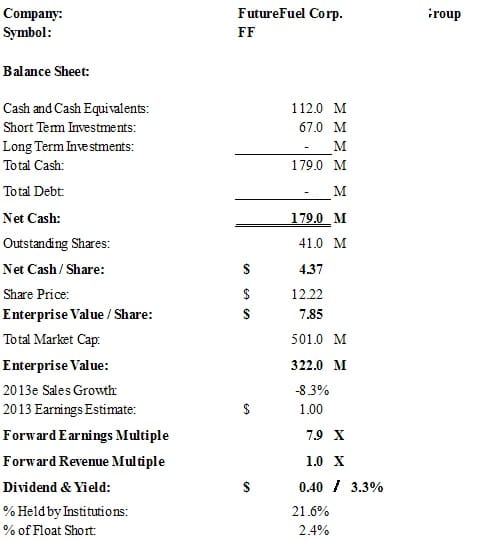

FutureFuel Corp. engages in the manufacture and sale of diversified chemicals and bio-based products in the United States. The company operates in two segments, Chemicals and Biofuels.

FutureFuel is a producer of biodiesel. The production facilities in the Midwestern U.S. produce both biodiesel and specialty petroleum products derived from biodiesel. It is also developing methods to convert cellulosic biomass (woody plant matter) into biodiesel. Biodiesel is a good alternative fuel option because it is producible from a wide range of agricultural and industrial feedstock, including waste lipids (e.g. bacon fat), and algae; it has a wide range of end-uses including the production of petroleum-based chemicals and liquid fuel and it can be used as a complete substitute for diesel in any diesel-burning engine.

The company has weathered some declines in its chemicals business but the outlook for biodiesel is strong and with $4.37 per share in cash, the business is selling for just 7.9x future earnings. It also pays a dividend of 3.3%. We like this one.

Revolution Investing Rating: 7/10

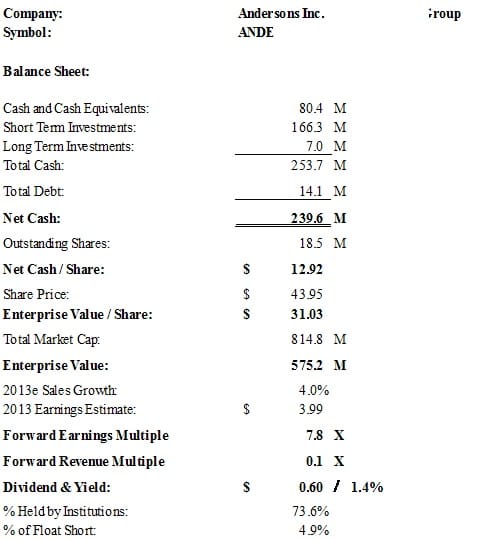

The Andersons, Inc. engages in the grain, ethanol, plant nutrient, railcar leasing and repair, turf products production, and general merchandise retailing businesses. It operates in six segments: Grain, Ethanol, Rail, Plant Nutrient, Turf & Specialty, and Retail.

The Andersons’ exposure to the struggling ethanol market was partially offset last year by higher prices for corn, which led to a significant increase in revenue in its Grain group in the most recent quarter. The company has been aggressively acquisitive, announcing that it will acquire Green Plains Energy Solutions’ agronomy business with 12 grain elevators as well as a 55 million gallon ethanol plant in Iowa and an Ohio-based agricultural nutrient company earlier this year. The balance sheet is solid and the company trades for a modest 7.8x forward earnings. There’s also a small dividend. Thanks to its diversified set of businesses, the stock could be well positioned to rebound if the market for corn and ethanol normalizes in 2013.

Revolution Investing Rating: 7/10

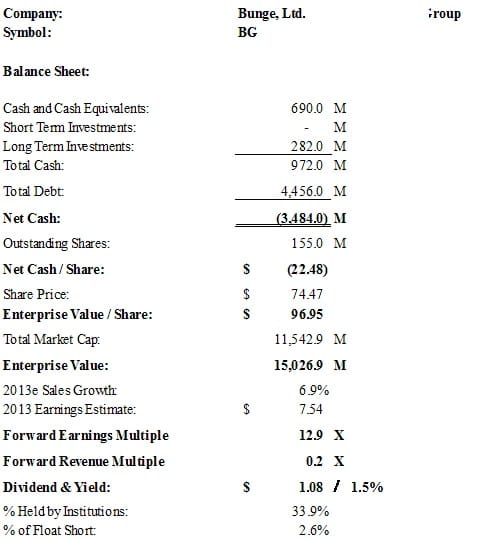

Bunge Limited, through its subsidiaries, engages in the agriculture and food businesses worldwide. It operates in four segments: Agribusiness (soybeans and corn), Sugar and Bioenergy (sugar, energy and ethanol), Milling Products (wheat flours, corn meal and milled rice) and Fertilizer (nitrogen, phosphate liquid fertilizers and potash).

Bunge is huge, well diversified and has a finger in just about every biofuel pie available. Its most recent quarter saw solid results despite a writedown related to ethanol activity in the U.S. This looks like a reasonably safe way to participate in the upside of biofuels, though at 12.9x earnings it’s not super cheap. Long-term buy.

Revolution Investing Rating: 6/10

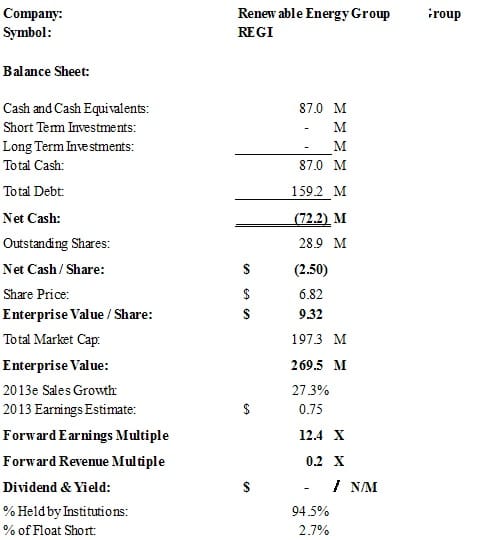

Renewable Energy Group, Inc. produces and markets biodiesel primarily in the United States and Canada. It is also involved in purchasing and reselling biodiesel and raw material feed stocks produced by third parties; providing toll manufacturing services to third parties; and selling glycerin, free fatty acids, and other co-products of the biodiesel production process.

REGI disappointed investors in its latest quarter when its risk management (hedging) activities resulted in negative EBITDA, instead of positive EBITDA that had been previously forecast. Top line growth is solid and the company has been investing in distribution, opening a sales terminal in New Mexico and it also obtained new terminal access in Long Beach, California. Management says it will continue to expand its distribution as it builds a national footprint. In late October, REGI acquired an offline biodiesel refinery in Texas and it is upgrading its plant in Minnesota. The top-line growth is forecast to remain strong for REGI but the mismanaged hedging activities give us pause. Long term we see potential here, but the balance sheet and valuation aren’t as attractive as that of FutureFuel.

Revolution Investing Rating: 5/10

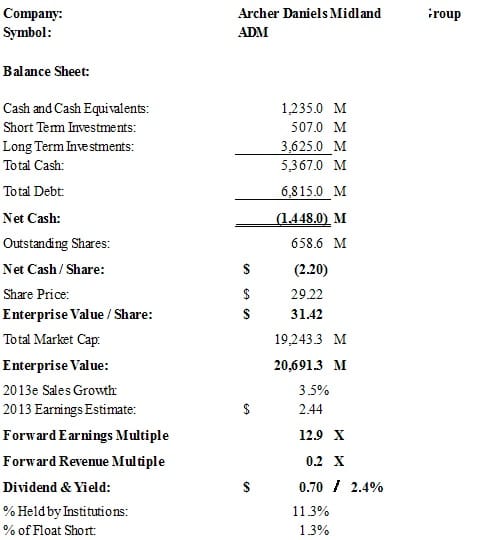

Archer Daniels Midland processes feedstuffs including oilseeds, cocoa, corn, and wheat. The company also manufactures vegetable oil and protein meal, corn sweeteners, flour, ethanol, biodiesel, and other food and feed ingredients. International growth is of growing importance to ADM, which currently makes just under half of its revenue internationally.

The company has been trying to acquire GrainCorp, Australia’s largest grain handler, in order to capitalize on growing food demand in Asia. Its $2.8 billion cash offer, however, is unlikely to get the deal done and GrainCorp is now courting other buyers. The company also announced the sale of its 23% stake in Gruma SAB. Gruma is the world’s largest corn flour and tortilla producer; ADM is looking to raise cash in order to fund the GrainCorp. deal. ADM is in highly competitive markets, and the ethanol industry’s difficulties aren’t its only problem right now. It has no control over rising input prices (corn) and little room to raise consumer product prices without affecting demand. At 12.9x forward earnings, it’s just not very attractive given the growth profile.

Revolution Investing Rating: 5/10

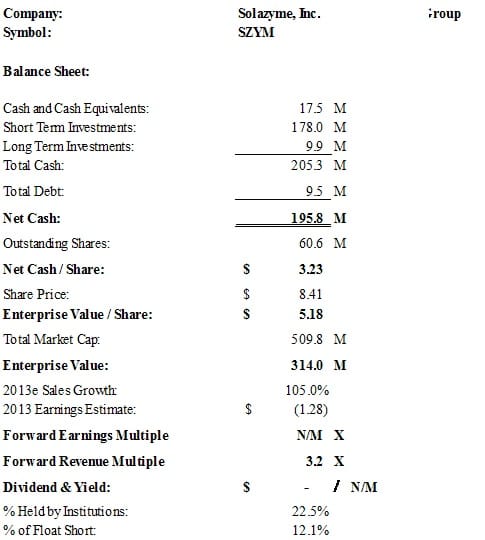

Solazyme, Inc. engages in the production of renewable oil with a focus on chemicals and fuels, nutrition, and skin and personal care markets. The company’s proprietary technology transforms a range of plant-based sugars into oils. Its renewable products could replace or enhance oils derived from petroleum, plants, and animal fats.

Solazyme is still an early-stage company with the accompanying risks. It has big plans for its technology, which basically creates specialized oils from bioengineered algae. In creating its oils, Solazyme can control carbon chain lengths, saturation levels and functional groups to create higher value oils with specific end uses in mind. It has entered into a joint venture with Bunge to produce oil from sugar and plans to open a $145 million plant at Bunge’s Moema (Brazil) sugar-cane mill in the fourth quarter of next year. The plant will produce 100,000 tons of its algal oil per year. Bulls point to the potential for a billion dollar business with 30% or better gross margins, but bears doubt the viability of Solzyme’s model. There are big plans and patent applications, but revenue in 2012 is expected to be less than $50 million.

The potential here is intriguing but the risk remains high. We’ll sit on the sidelines for now.

Revolution Investing Rating: 5/10

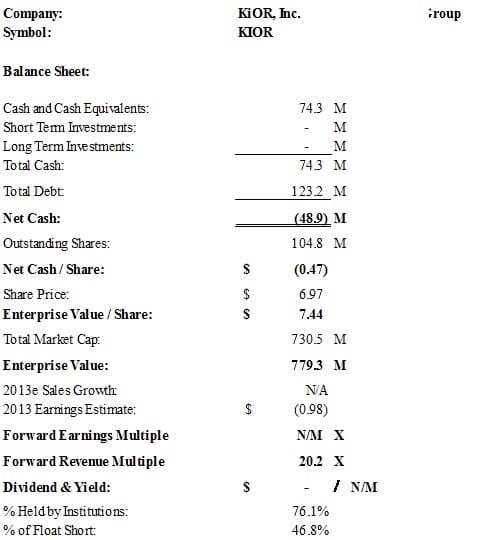

KiOR, Inc., a development stage renewable fuels company, focuses on producing cellulosic gasoline and diesel from non-food biomass using its proprietary biomass-to-cellulosic fuel technology platform. The company intends to sell its products to refiners, terminal and rack owners, and fleet users for use in their vehicles.

KiOR brought its first wood-to-fuel plant in Columbus, Mississippi late last year, much to the relief of investors who were concerned that delays might result in a cash shortage at the startup. Venture capitalist Vinod Khosla is behind KiOR, which probably helped it get an IPO done earlier this year at $15 per share. We like the technology—KiOR is taking wood waste and turning into crude oil which is then upgraded to cellulosic gasoline and diesel. It is planning another plant in Natchez, Mississippi. Early customers include FedEx, Hunt Refining and Catchlight Energy, which is a jv between Chevron and Weyerhaeuser Co. The new plant has already sold out of its first year of planned production.

This is another very interesting startup with some high profile backing. But with a 20x revenue multiple, we can’t put our weight behind it just yet. We’ll be watching, however. The longer-term potential is there.

Revolution Investing Rating: 5/10

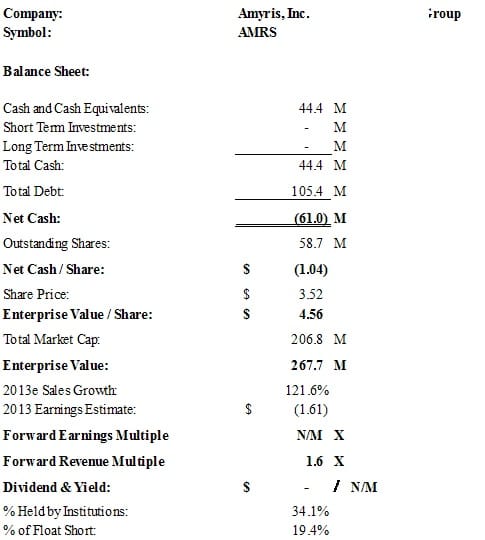

Amyris, Inc., an integrated renewable products company, provides alternatives to a range of petroleum-sourced products used in specialty chemical and transportation fuel markets worldwide.

Amyris uses genetically modified microorganisms to convert plant-sugars into farnesene, a hydrocarbon that can be processed into fuels (diesel and jets) or specialty chemicals used in cosmetics, flavors and lubricants. It’s developing other applications such as fragrance oils, and in the latest quarter partner Kuraray Co. received its first order for a farnesene-derived polymer that can be used to make rubber for tires. The company’s first commercial plant, at a Brazil site owned by Paraiso Bioenergia SA, is expected to begin production in 2013 and reach its capacity within three years; its next project, at a sugar mill owned by Sao Martinho SA, won’t realize revenue until 2015.

Amyris exited the unprofitable ethanol business earlier this year, which led to a sharp decline in sales and revenue. In its most recent quarter it did better than expected, losing “only” $20 million. The stock jumped on the results but we’re not convinced Amyris is out of the woods. It needs to raise financing before the end of 2012, which could prove dilutive, and the company doesn’t expect to be cash flow positive until 2014. The company is 21% owned by France’s Total SA and backed by Kleiner Perkins’ John Doerr. Given the fact that the company raised $84 million last February and now is going back to the well, we’re going to wait and see on this one too.

Revolution Investing Rating: 5/10

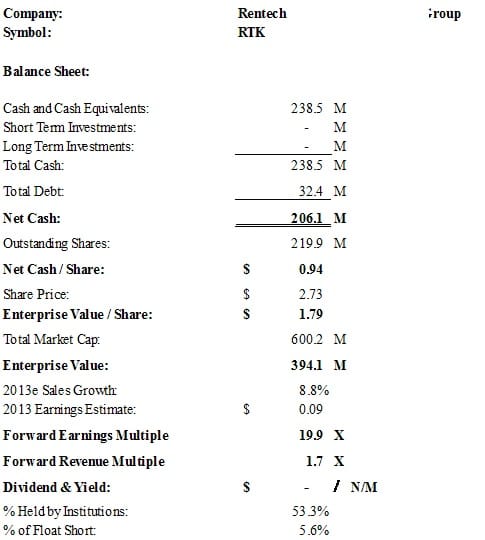

Rentech, Inc., through its subsidiaries, owns and develops technologies that enable the production of synthetic fuels and renewable power when integrated with third-party technologies in the United States. Its clean energy technology portfolio includes the Rentech-SilvaGas and the Rentech-ClearFuels biomass gasification technologies, which produce synthesis gas from biomass and waste materials for the production of renewable power and fuels.

Rentech has been investing in growing its fertilizer business while at the same time seeking to partner or license its renewable energy portfolio. Its technology allows for the utilization of both biomass and fossil fuels as syngas feedstock. The company recently shelved plans to build a commercial-scale coal-to-liquids facility in Mississippi, but it operates a demonstration-scale integrated natural gas- and biomass-to-liquids facility in Colorado. This is a turnaround story and it remains unclear to what extent Rentech will be able to monetize its renewable energy technology. The shares have more than doubled already this year, institutional interest is growing and the short interest has fallen recently, but we’d probably give it a little more time to prove its renewable energy strategy. Hold.

Revolution Investing Rating: 4/10

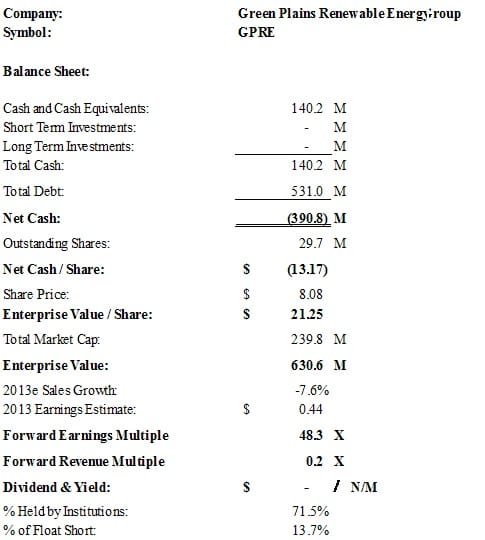

Green Plains Renewable Energy, Inc. engages in the production, marketing, and distribution of ethanol, distillers grains, and corn oil in the United States.

In late October Green Plains announced that it will sell 12 grain storage facilities in Tennessee and Iowa. The sale will help the company delever and increase its cash assets. The stock surged on the news, but nevertheless, Green Plains remains highly dependent on the ethanol market. Based on its valuation and difficult outlook, the shares aren’t attractive at this time.

Revolution Investing Rating: 4/10

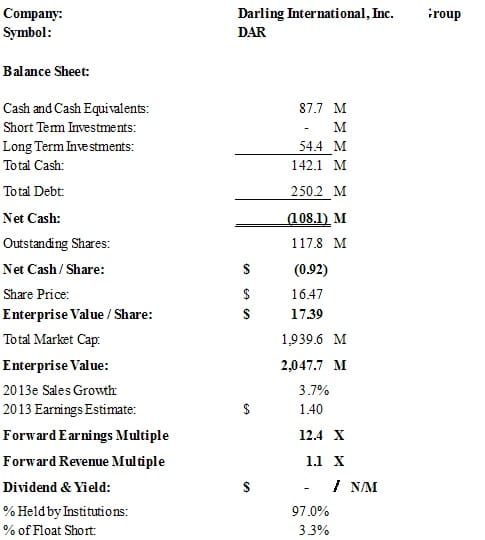

Darling International Inc. is the largest and only publicly traded provider of rendering and bakery waste recycling solutions to the nation’s food industry. The company recycles beef, pork and poultry waste streams into useable ingredients such as tallow, feed-grade fats, meat and bone meal, poultry meal and hides. The company also recovers and converts used cooking oil and commercial bakery waste into valuable feed and fuel ingredients.

Darling is getting into biodiesel via a joint venture with Valero Energy. The 137 MGY Diamond Green Diesel project is expected to become operational in 2013, but in the meantime its core business has suffered and the outlook remains weak. Recent performance was hurt by sluggish fat and grease prices, increased supplies of corn oil, a lagging export market and reduced biofuel demand. Assuming continued weak growth, we don’t like this one at more than 12x forward earnings.

Revolution Investing Rating: 4/10

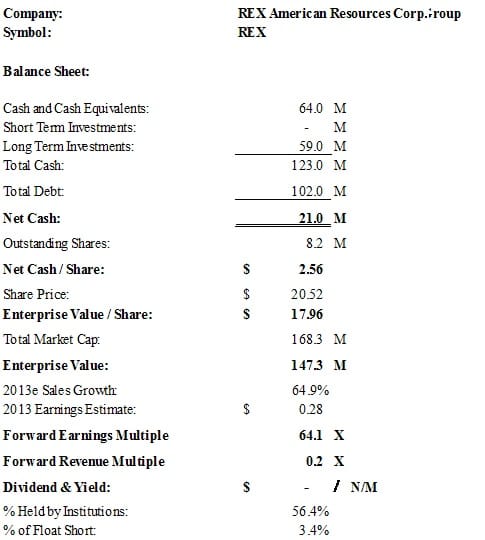

REX American Resources has interests in seven ethanol production facilities which in aggregate shipped approximately 710 million annualized gallons of ethanol over the twelve month period ended July 31, 2012. REX’s current effective ownership of the trailing twelve month annualized gallons shipped (for the period ended July 31, 2012) by the ethanol production facilities in which it has ownership interests is approximately 253 million gallons.

As a pure play in the corn ethanol market, REX has seen its share price collapse this year as the drought forced corn prices to record high levels. At this time it remains unclear if or when ethanol production will become once again profitable. The stock has had a 22% run over the past two months and looks expensive for a pure ethanol play.

Revolution Investing Rating: 3/10

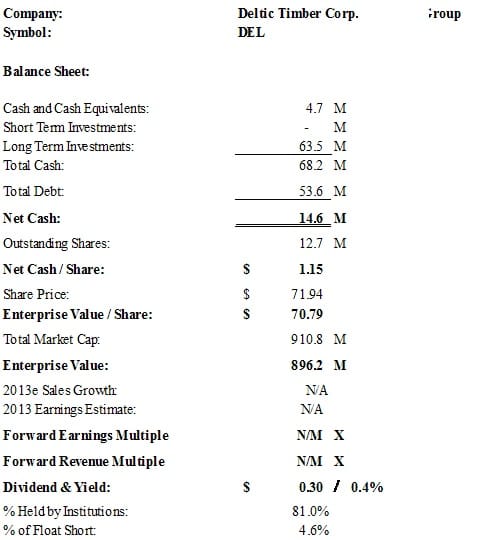

Deltic Timber Corporation, a natural resources company, together with its subsidiaries, grows and harvests timber, as well as manufactures and markets lumber.

Deltic could benefit by growth in the use of wood waste to create biofuels—down the road. Today its fortunes are determined by the market and pricing for lumber. It also has real estate interests. Forward estimates weren’t available, but based on 2012 year-to-date results, Deltic will earn somewhere around $0.70 – $0.80 per share in 2012. Even if that grew to $1 in 2013, the shares look expensive until a real rebound in building occurs. Sell.

Revolution Investing Rating: 3/10

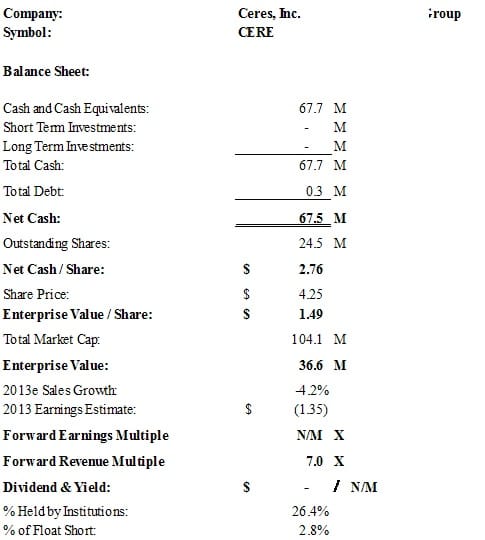

Ceres, Inc.is an agricultural biotechnology company that markets seeds for energy crops used in the production of renewable transportation fuels, electricity and bio-based products.

Ceres specializes in selling seeds specifically geared towards the production of renewable bioenergy feedstocks. Through the use of innovative plant breeding and trait biotechnology, Ceres produces low-input dedicated energy crops that are capable of producing high yields per acre. Specifically, the company produces enhanced seeds that increase yields for crops that will one day be necessary for the advanced biofuels market. Such non-food based feedstocks are critical for the production of sugars without disrupting the market of consumed food. Ceres has also received grants from the U.S. Agency for International Development which it is using to improve rice yields in India and other Asian countries.

Ceres IPOed in early 2012 at $13 per share and has fallen steadily since. Despite analyst support for the company, at 7x revenue and with negative revenue growth forecast for 2013, we can’t get behind the stock at this time.

Revolution Investing Rating: 3/10

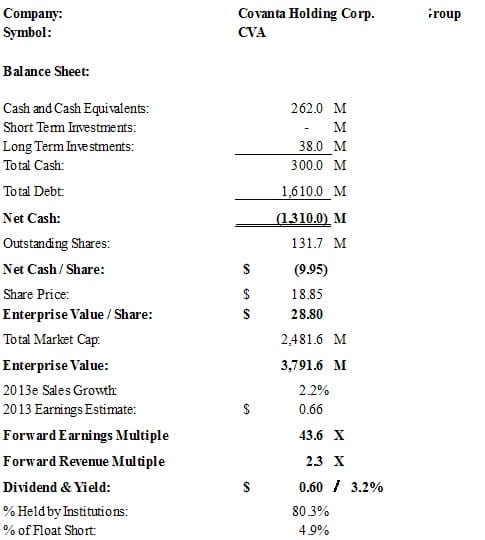

Covanta Holding Corporation provides waste and energy services to municipal entities primarily in North America. The company engages in the disposal of waste and the generation of electricity, as well as the sale of ferrous and non-ferrous metals recovered during the energy-from-waste process. It operates and/or owns 45 energy-from-waste facilities; and 15 additional energy generation facilities, including other renewable energy production facilities in North America (wood biomass and hydroelectric). The company also owns and/or operates 13 transfer stations and 4 ash landfills in the northeast United States.

Apart from the 3.2% dividend yield, it’s difficult to say what’s been sending Covanta’s shares higher this year. The company remains cautious in its outlook and trades at nearly 44x forward earnings—while revenue growth is projected to be in the low single digits. Don’t go there.

Revolution Investing Rating: 3/10

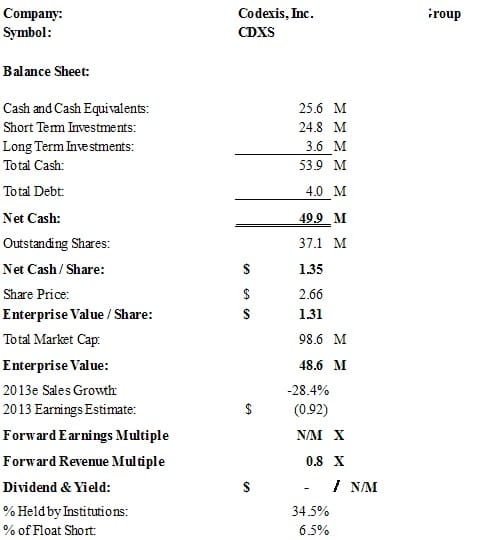

Codexis, Inc. engages in the production of custom industrial enzymes for use in the manufacture of biofuels, chemicals, and pharmaceutical ingredients.

Codexis got a new CEO in 2012, has laid off workers and had its former partnership with Shell reconfigured. Revenue and profitability continues to decline and while there may be some upside in the company’s forays into pharmaceuticals, its efforts in biofuel haven’t shown results. There’s next to no debt, so maybe new CEO John Nicols can turn this ship around—but it’s too soon to buy the stock.

Revolution Investing Rating: 2/10

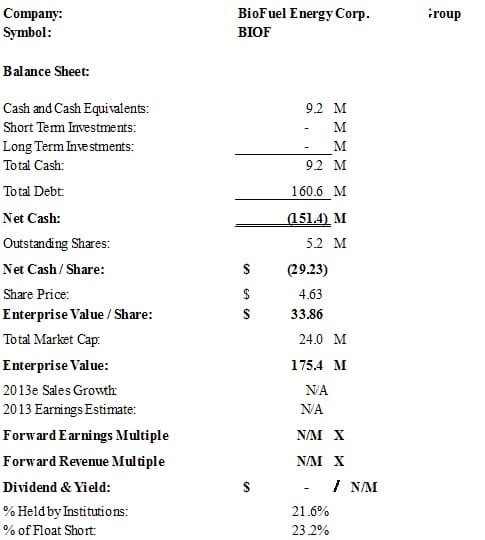

BioFuel Energy Corp. produces and sells ethanol and its co-products in the United States. The company offers dried and wet distillers grains with solubles, corn oil, and carbon dioxide. It operates 2 ethanol production facilities located in Wood River, Nebraska and Fairmont, Minnesota with a combined production capacity of approximately 220 million gallons per year.

Big debt, small cash, no analyst support and no diversification from the struggling ethanol business. This is a short.

Introduction — Energy Storage and Batteries

Companies involved in energy storage and batteries are increasingly focused on storage solutions for utilities which are working to integrate renewable energy into their grid. Renewable energy sources like solar and wind power are inherently intermittent and unreliable, making the long-term potential for growth of these energy forms dependent upon effective storage—otherwise utilities will be unwilling to make their grid reliant upon an undue amount of “new” energy sources, capping the potential for solar and wind.

Meanwhile, the growth in demand for electric car batteries has failed to meet expectations, as the uptake of electric vehicles has failed to meet forecasts, due in part to the global economic slowdown but also due to other factors like a relative lack of infrastructure for charging (in the case of pure electric vehicles). As such, many battery makers are turning their focus to large scale energy storage solutions.

In the lithium-ion battery sector manufacturers like Altair Nanotechnologies, A123 Systems and Ener1 are devoting substantial resources to renewables integration after ambitious expectations for electric vehicles proved to be overblown. In the lead-acid and advanced lead-acid battery sector, publicly held companies like Enersys, Johnson Controls, Exide Technologies and Axion Power International together with privately held companies like Ecoult and Xtreme Power are all working on demonstration projects.

The same is true in the flow-battery sector where publicly held ZBB Energy and privately held PrudentEnergy are conducting demonstrations. There is also intense activity from a number of private companies like Ambri, which is developing a low-cost liquid metal battery, Aquion Energy, which is developing a low-cost aqueous hybrid battery, and EOS Energy, which is developing a low-cost zinc-air battery. They won’t all succeed, but they’re all working very hard to bring cost-effective energy storage solutions to a highly cost-sensitive market.

Large-scale energy storage is still in its infancy, and at the same time the market for electrified vehicles is rapidly evolving, but it seems clear that the long term growth for effective and efficient energy storage will be strong.

Revolution Investing Rating: 7/10

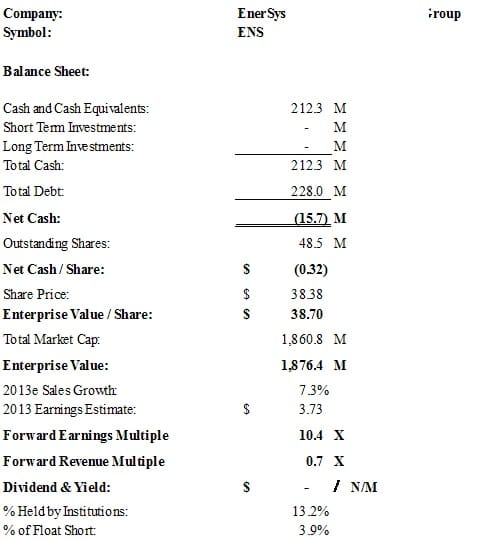

EnerSys , manufactures and distributes reserve power and motive power batteries, chargers, power equipment, and battery accessories to customers worldwide. Motive power batteries are utilized in electric forklift trucks and other commercial electric powered vehicles. Reserve power batteries are used in the telecommunication and utility industries, uninterruptible power supplies, and numerous applications requiring stored energy solutions including aerospace and defense systems.

EnerSys is involved in a variety of battery and energy storage fields, but one that may have substantial upside is its recently announced large-scale energy storage solution, OptiGrid Stored Energy Solutions. Analysts put the market size for large scale storage over the next one to two decades at between $200 and $600 billion. Large scale storage will allow utilities to better stabilize the grid and cope with issues like voltage regulation, frequency regulation, peak management and renewable power (i.e. wind and solar) integration.

There’s a solid balance sheet, steady growth and good cost management here, we like it long-term.

Revolution Investing Rating: 5/10

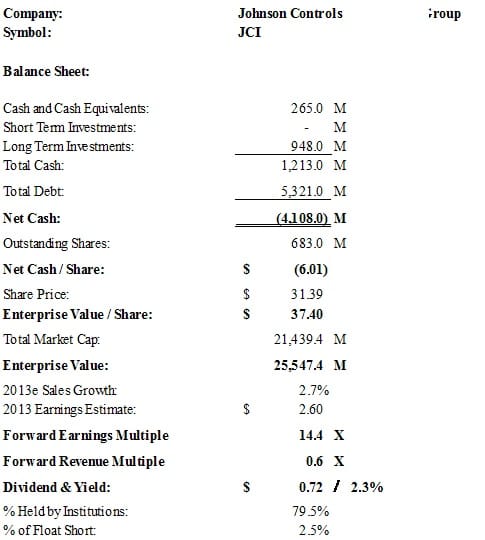

Johnson Controls, Inc. engages in building efficiency, automotive experience, and power solutions businesses worldwide. Its building efficiency business designs, produces, markets, and installs integrated heating, ventilating, and air conditioning systems, as well as building management systems, controls, and security and mechanical equipment.

Johnson Controls has a number of product lines, some of which rely heavily on both residential and commercial construction. It designs and manufactures integrated heating, air conditioning, and ventilation systems, building management systems, commercial and industrial refrigeration, energy efficiency systems for buildings, fire and safety solutions for buildings, etc. However, this company also manufactures automotive products, which include car batteries, car interiors and seating. This part of the company is seeing pressure in some areas since European car sales are weakening in many countries. Johnson Controls has also been involved in the A123 bankruptcy and tried to purchase the company’s assets for $125 million. A bankruptcy judge has now determined that an auction will take place December 6, 2012. The company sees 2013 earnings to be flat or slightly higher than the year ended September 30th.

Johnson Controls’ fortunes are made and lost with the macro economy—construction and cars. We like the company but at 14.4x earnings, it’s not yet time to buy. Neutral.

Revolution Investing Rating: 5/10

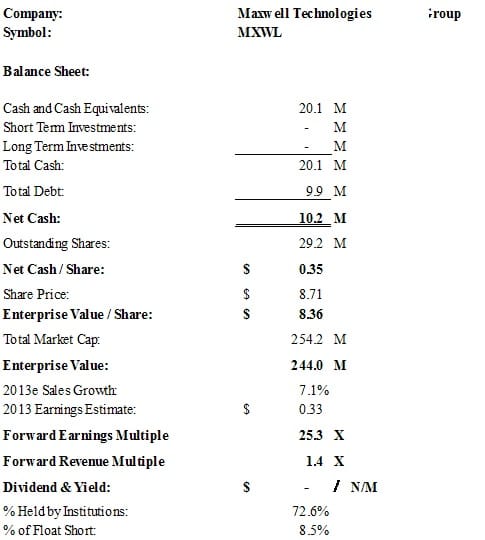

Maxwell Technologies, Inc. develops, manufactures, and markets energy storage and power delivery products, and microelectronic products worldwide. The company offers Ultracapacitors that are energy storage devices to provide energy storage and power delivery solutions for applications in transportation, automotive, information technology, renewable energy, and industrial electronics industries; and CONDIS high-voltage capacitors comprising grading and coupling capacitors, and capacitive voltage dividers used to ensure the safety and reliability of electric utility infrastructure and other applications involving transport, distribution, and measurement of high-voltage electrical energy.

There are some interesting long-term prospects for Maxwell, but for now the company appears stuck in a negative to flat growth environment. First, revenue growth in recent quarters was driven by ultracapacitor sales for hybrid buses and wind turbines, mostly in China. In its most recent earnings call, management expressed concerns about the impact that China’s upcoming leadership change may have on the government’s willingness to continue to subsidize deployment of these products. Then there’s a mechanical issue that is affecting its hybrid bus ultracapacitators, and which will have an impact on sales for the next six months. And finally, Maxwell’s “stop-start idle elimination” battery technology hasn’t taken off with American carmakers and its two European partners, PeugeotCitroen and Lamborghini, are weathering the European economic crisis. With sales trends in question well into 2013, 25x earnings is simply too much to pay. We’ll check back on this one in mid-2013.

Revolution Investing Rating: 4/10

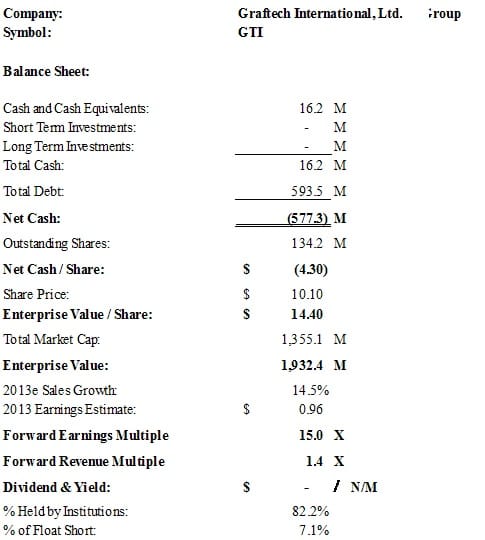

GrafTech International Ltd. engages in the manufacture and sale of synthetic and natural graphite and carbon based products worldwide. It operates in two segments, Industrial Materials and Engineered Solutions. The Industrial Materials segment manufactures and delivers graphite electrodes, which are used to produce steel and other non-ferrous metals; refractory products used in blast furnaces and submerged arc furnaces; and needle coke, a crystalline form of carbon used primarily in the production of graphite electrodes. The Engineered Solutions segment provides advanced graphite materials that are engineered synthetic graphite products used in the electronics, energy, transportation, defense, solar, metallurgical, chemical, oil, and gas exploration industries. This segment also offers natural graphite products, which enables thermal management solutions for the electronics industry; energy storage solutions for the transportation and power generation industries, as well as sealing materials.

GrafTech’s core business is suffering along with the global economy as steel making has declined, but the company is also involved in energy storage, fuel cell technology and the solar industry. Until the global economy improves, we’d stay away. The 14.5% growth forecast for 2013 is partially due to acquisitions and the 15x multiple feels high. Weak short.

Revolution Investing Rating: 3/10

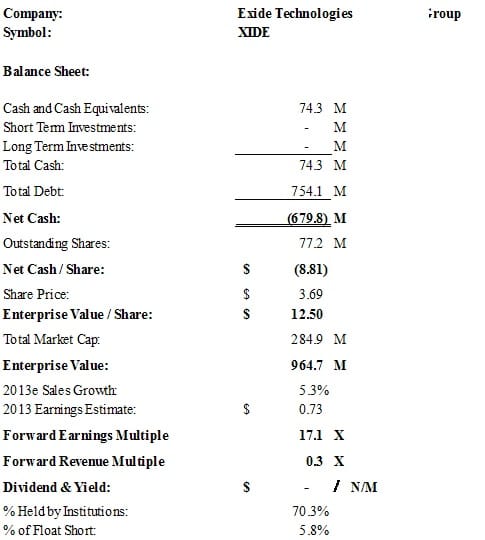

Exide Technologies engages in the manufacture and supply of lead-acid batteries for transportation and industrial applications in the Americas, Europe, and rest of the world. It offers transportation batteries, including micro-hybrids. It also provides industrial energy products that consist of motive power batteries and offers network power batteries that are used for back-up power applications in telecommunications systems, data centers, hospitals, air traffic control, security systems, utilities, railway, and military.

Exide is in essentially the same lines of business as EnerSys, but where EnerSys has proven competent at managing its balance sheet and expenses, Exide is highly leveraged. Even after slumping following the most recent quarterly announcement, Exide trades at more than 17x forward earnings—short this name.

Revolution Investing Rating: 2/10

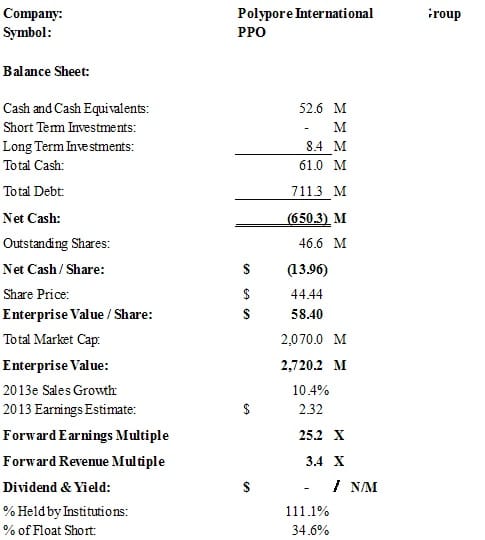

Polypore International, Inc., a technology filtration company, develops, manufactures, and markets specialized microporous membranes used in separation and filtration processes. It operates in two segments, Energy Storage and Separations Media.

Polypore’s battery technology goes into electric vehicles, which is a growing trend overall, but which has suffered this year with economic woes in the U.S. and Europe. The company says the trend in Asia remains bright, but Polypore invested heavily for additional capacity before being hit with a global slowdown in both vehicle as well as consumer electronics sales this year. As a result, its cost structure is set up for higher sales levels that haven’t yet materialized, especially after General Motors decided to idle production of the Chevrolet Volt, which runs on Polypore’s lithium ion battery. Longer term, its other business lines show promise, including consumer electronics, water filtration, and healthcare. The company announced in October that it has retained Wells Fargo to advise it on strategic alternatives for its Daramic lead-acid battery separator facilities.

The stock’s very expensive given the current environment and there’s about $14 per share of net debt there. Following a recent runup, PPO is clear short opportunity.

Introduction — Electric Utilities and Suppliers (including Smart Grid)

One hundred years after its inception, the electric utility industry is weathering a period of rapid change. Even as utilities have deployed smart grid technology like advanced meters and built increased intelligence into their grids, the demand for electricity is declining—but the need to shore up reliability and redundancy in the grid remains obvious, particularly in the wake of Superstorm Sandy.

Electricity use in the U.S. fell 2% this year through September, and was down 3% from a year earlier, as consumers buy light bulbs that burn 25% fewer watts and install energy efficient appliances. According to the Energy Department, power and coal consumption has fallen 32% from 1981, and is now at record lows based on data collected since 1973. Consumers purchased 280 million energy-saving appliances in 2011, cutting their utility bills by $23 billion according to the EPA.

The result is a margin squeeze for utilities, even as they’re trying to upgrade their grids to incorporate more expensive green energy sources and deploy smart technology to help manage loads and help customers save money. According to Theodore Hesser, an analyst for Bloomberg New Energy Finance, utilities are expected to invest $12.4 billion in smart meters and updated grids through 2015. Most analysts now expect annual growth in demand of just about 1% through 2030, compared with 1.7% growth between 1990 and 2011. This may lead utilities to seek more frequent rate hikes from regulators or delay capital investment.

So what does it all mean? For investors, the traditionally safe, high yielding electric utilities may not be as attractive as in years past. A small change in demand can have a significant impact on these businesses and their economics. Governments worldwide are going to push for better reliability and redundancy, and if that means higher electric rates, so be it. Utilities are also increasingly moving into higher profit services like installing programmable thermostats and retrofitting buildings with windows, insulation and roofing that use less energy—but these efforts could lead to even lower demand in the long run and a downward spiral for the utilities. On the other hand, an economic rebound is sure to bring higher consumption—to some degree. Should demand fall far enough, unregulated producers could find themselves in a situation where they can’t charge enough for their business models. Regulated utilities, on the other hand, may find relief in rewritten rate-making formulas that base profitability on a rate of return model, much like regulated telephone companies. Variable pricing based on peak versus off-peak usage is also spreading.

For those supplying the equipment—whether old fashioned grid equipment that simply needs to be upgraded or newer smart technology—the dynamics are also changing. While grid reliability remains in the spotlight today, the drive for smart technology is slowing in North America, where advanced metering infrastructure (AMI) has already been widely deployed. The same is true in Europe, where the economy is even weaker. Still, opportunity exists on other continents: Africa, Central and South America and Asia still have room to grow in terms of smart grid deployment. Municipalities and cooperative utilities in the U.S. are also showing increased activity more recently.

At the end of the day the utilities and regulators will have to balance the need to be green with the need for utilities and their investors to make a reasonable return. And they will—but in the near-term the shifting dynamics mean that even the good old electric utilities aren’t necessarily a great long-term buy unless you’re already retired and want the dividend income. And don’t forget, dividends are sometimes lowered or even eliminated if a company’s economics change drastically.

Revolution Investing Rating: 8/10

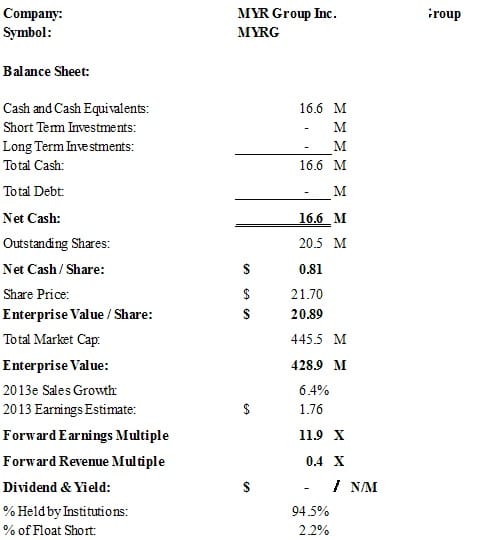

MYR Group Inc., through its subsidiaries, operates as a specialty contractor serving the electrical infrastructure market in the United States. The company operates in two segments, Transmission and Distribution, and Commercial and Industrial.

MYR Group is benefitting by upgrades to the grid being undertaken by electric utilities worldwide, and the company expects that trend to remain strong for several years. Third quarter revenue, cash flow and earnings all grew handsomely compared with the prior year, and although the stock has already jumped up some on that news, we agree that the upgrade trend continues for years to come. At 11.9x forward earnings, MYRG is still well priced for growth and there’s no debt on the balance sheet. Buy.

Revolution Investing Rating: 8/10

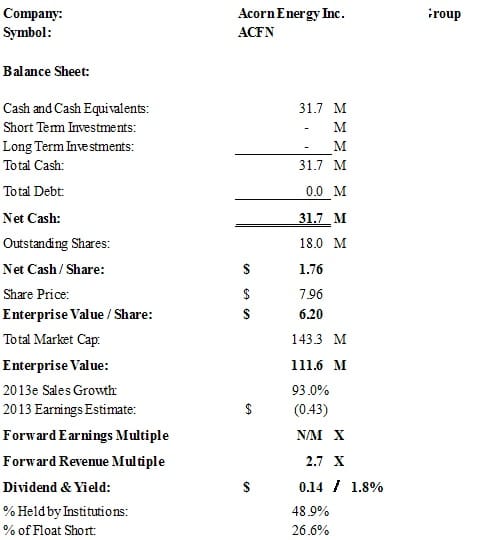

Acorn Energy, Inc., through its subsidiaries, provides technology driven solutions for energy infrastructure asset management worldwide. It offers sonar and acoustic related solutions for energy, defense, and commercial markets with a focus on underwater site security for strategic energy installations and other acoustic systems, as well as develops and produces real-time embedded hardware and software.

Acorn is still an evolving digital energy company and its revenue is expected to nearly double next year to $40 million. Recently it announced a 500 unit sale of its TransformerIQ advanced monitoring devices by a major California utility. The company said that unit sales with this utility could exceed 100,000 assuming successful integration, and it also believes that nationwide, the market for its Distribution Automation technology could number 30 million. Acorn said the inital sale is worth $1 million, which implies a price of $2,000 per unit, an eventual sales value with this one utility of $200 million, although volume discounts might be expected. No need to even mention the potential of the overall market nationwide, we like the potential here, as well as the clean balance sheet and, guess what? There’s a dividend too. Time to start collecting Acorns.