New Chat Time + Don’t Lose Yourself In This Cryptomania

First off, we are moving this week’s chat to Friday, December 8th at 11:00am ET in the TradingWithCody Chat Room. Or as always, you can email your questions to support@tradingwithcody.com.

Crypto is back baby! (Spoiler alert: we added to our bitcoin hedges today, see discussion below). Bitcoin is over $42,000 and is now up about 21% over the last month. Bitcoin is up nearly 70% since it bottomed around $25,000 in September and is up about 155% year to date. The last time bitcoin was at $42,000 was in April of last year.

We are big believers in bitcoin and our most oft-repeated phrase when speaking of the never-ending centrally-controlled fiat money printing that continually devalues our hard-earned dollars, euros, yen, and yuan is “all roads lead to bitcoin.” Thus, we’ve increased our Bitcoin holdings quite a bit over the last twelve months or so when it was selling off for no real reason. Here are a few of the times we wrote about buying more ProShares Bitcoin Strategy ETF (BITO) in the hedge fund this year:

- June 1, 2023 (Bitcoin price $26,800): “We bought a little BITO for the hedge fund recently as noted and I’d be a serious buyer of more bitcoin near $20,000 and I’d probably nibble a little more here and there on any weakness in coming weeks anyway.”

- June 8, 2023 (Bitcoin price $25,000): “I like Bitcoin on any weakness here and we bought some BITO for the hedge fund this week below $15. I think Coinbase and Binance knowingly broke the law and have been allowing unregistered securities to trade and should be prosecuted.”

- June 16, 2023 (Bitcoin price $26,329): “We nibbled more BITO for the hedge fund near $14 on the big hit it took earlier this week, as planned. Will buy more near $13 if it gets there.”

- July 20, 2023 (Bitcoin price $29,798): “If you don’t own any Bitcoin, maybe nibbling a little BITO here isn’t a bad idea. I think Bitcoin is a great long-term value holder/hedge to our dollars but I would rather buy it on the next panic selling move that always happens every few months in crypto LOL.”

- August 16, 2023 (Bitcoin price $28,700): Nibbled some BITO and noted that it was one of our favorite buys at the time.

- August 17, 2023 (Bitcoin price $26,627): Bought more BITO.

- October 11, 2023 (Bitcoin price $26,869): “Most cryptos are silly, stupid and/or fraudulent as I’ve been saying for years. I’m sticking with bitcoin as I have since 2013 though. I should mention that I bought a little more BITO Proshares Bitcoin ETF for the hedge fund on the bitcoin sell-off today.”

Bryce back here in real-time. We were set up for this move in bitcoin and are not chasing this current rally. Bitcoin’s strength has brought back to life so many of the second-tier cryptos (Doge and ETH) as well as the outright fraudulent, stupid, and silly cryptos and crypto-related companies that were left for dead earlier this year.

Dogecoin:

Ether:

CleanSpark Inc:

HIVE Digital Technologies Ltd (HIVE):

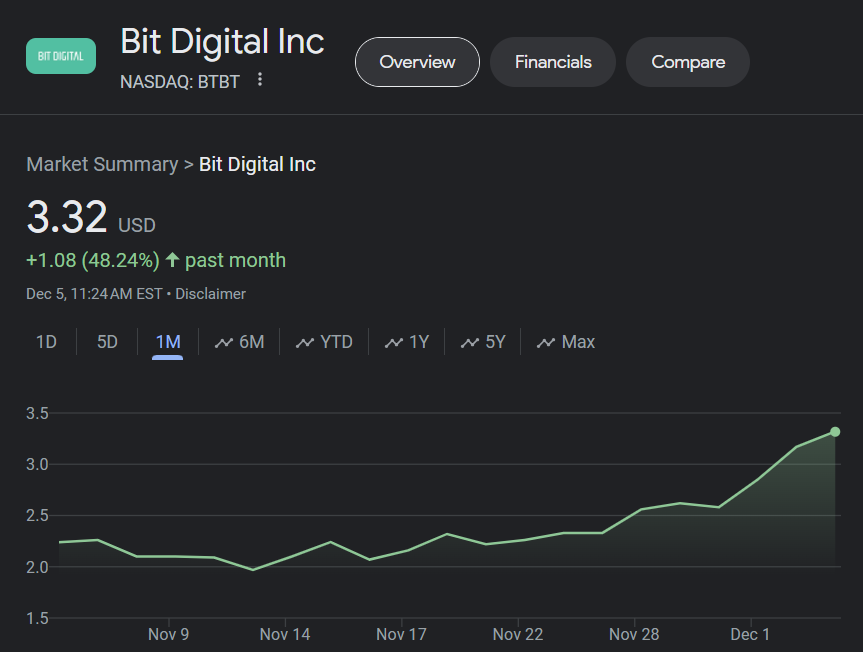

BIT Digital Inc (BTBT):

Other than Robinhood (HOOD), most of the companies involved with cyrpto have flouted some of the securities laws and we are concerned many of these companies are being less than candid with their financials. There is a reason that most of these silly bitcoin stocks were down 90% or more from their 2021 highs after the crash. Remember it was only six months ago when bitcoin was nearly half this price and everyone was worried that the SEC’s crackdown on Coinbase (COIN) and Binance would destroy the crypto market. Back then when we saw lots of headlines like this:

Looking at the charts above and the change in sentiment towards crypto that we see on the news, X.com (fka Twitter), etc. makes us feel like greed and mania are back for crypto, like it was in the bubble of 2021. Mania is defined as “an excessive enthusiasm or desire; an obsession,” and it is certainly evident that there is widespread mania for crypto at the moment.

It seems like everyone is pretty sure that the SEC will be forced to approve a bitcoin ETF sponsored by Blackrock or some other major asset manager and that will be a major catalyst that will propel bitcoin and the other cryptos to new heights. While we think in the long-term it probably will be good for the price of bitcoin if institutions can more readily buy it, we think that the actual approval of the ETF by the SEC might very well turn out to be a sell-the-news reaction. The people who are buying bitcoin today in anticipation of the ETF approval are probably not long-term holders and are likely sellers as soon as they see the upward price momentum start to fade. We call these buyers “weak-handed” bulls because they will sell as soon they start to lose money, causing further price declines for bitcoin. Most of these people have not been in bitcoin for over 10 years like TradingWithCody.com subscribers have and are only looking to make a short-term profit.

Don’t be a crypto manic. Bitcoin/BITO has been great for us for many years and we were opportunistic in adding to our position earlier this year when bitcoin was 40% lower. Now’s probably a time to lock in some of those gains. In the hedge fund, we sold some Jan. 2024 BITO covered call options with a strike price of $20 to protect our large BITO position. We also picked up some puts on some of the worst crypto-stocks like HIVE, BTBT, and Marathon Digital (MARA) as additional hedges for the hedge fund. Cody hasn’t changed anything in his personal accounts lately as he trimmed some bitcoin there the first time it was at these levels. As always, remember that buying puts is extremely risky and these companies are heavily shorted and they can go up BIG if crypto keeps on a rallying, so be careful. If you don’t play with options but bought BITO earlier this year when we were pounding the table, you might consider simply trimming a little bit of your position (maybe 10-20% of your bitcoin/bito position and lock in some gains here.

Mostly, as usual, let’s be cool.