New Chat Time, UBER & ROK Earnings

Good morning all –

Cody has to run to a funeral today at the Mescalero Apache Reservation and we need to move the chat to Wednesday, tomorrow 8/2 at 3:00pm ET in the TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com.

Two of our bigger longs, Uber and Rockwell Automation, reported and are down this morning so let’s do a quick review of the prints.

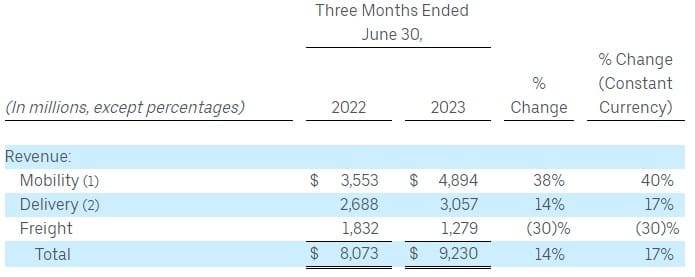

UBER – Uber missed slightly on revenue (-1.16% v consensus) but had a nice beat on earnings (beat 49.85%). Revenue growth slowed to 14% YoY in large part due to a 30% drop in Freight revenue. Excluding the freight decline, Uber’s core Mobility and Delivery businesses still grew substantially as shown below:

As we have been saying, UBER needs to remain focused on cutting costs and achieving profitability, and the company actually did that for the first time this quarter. Uber achieved GAAP Operating Profit ($326mm) for the first time in the company’s history and cranked out over $1bb in free cash flow. The stock has had a huge move this year and it makes sense that it could drop a little given the revenue miss. That said, with the company still growing in the mid to high double digits, it has some real profit potential if it continues on this trajectory over the next few years. And we expect the revenue growth could accelerate from here once this current freight slump is over. Uber is a great platform and we think they will continue to disrupt the freight, taxi, and delivery industries for years to come. Uber also discussed their AI potential and the company is probably one of the better positioned AI plays right now. As we have long said UBER is a great AI play, they have a ton of data from their millions of drivers and customers and can take advantage of advances in AI to leverage the data and make the product more efficient, profitable, etc. The stock is down about 5% as of this writing and we are holding tight for now.

ROK – Rockwell had a small top and bottom line miss but really is doing what we have been expecting them to do. They made a change to their distribution network that apparently impacted the results this quarter and the stock is down about 10% on the day but slightly more than that from its near all time high of $341 which it hit last week. Sales still grew 14% YoY which is very good for an industrial company like ROK and reaffirms our belief in the Automation and Redomestication Revolutions. The company even upped its full-year EPS guidance which was encouraging. Again, we are holding tight with this one.

Steady as she goes for now. Don’t forget, we are moving chat to tomorrow 8/2 at 3:00pm ET in TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com.