Notes on the markets, AI, Facebook’s dominance, the Panama Papers and more

US stock markets get hit today, in part because the Yen is spiking against the dollar while investors in US-based multi-national corporations want a weak dollar.

I could just see the Yen breaking thru to new highs and taking out the resistance levels…and then topping. All that said, I don’t trade currencies. I do own $SNE Sony for the last year or so from the mid teens and plan on owning it for a few more years even tho I know that a strong Yen will hurt its ability to profit from overseas sales.

Here a few more notes for you to start off today:

Here’s a great interview all about #ArtificialIntelligence. Also, I am surprised that $IBM isn’t using their own chips to build the next gen Watson. From $NVDA CEO: “I think Watson is absolutely the right answer. AI, deep learning, cognitive computing. We partner with them—the next generation of Watson will have Nvidia GPUs in it. We’re partnering with them to build supercomputers together.”

Today’s news that the Treasury is nixing the $PFE for $AGN tax inversion merger is exactly I typically sell any position whenever a company I own announces it is being acquired. I don’t do the arbitrage thing and/or hope to hold out for a little bit more.

I’ve been a Tesla bear (but not a short) mostly because I think the company’s reliance on government subisidies for building and selling their product will come back to haunt them. But in the meantime…the $10BB in backlog sales for the $TSLA Model 3 is either the top or its a reason to avoid ever shorting this growth company. I’d rather short a company struggling with demand than one struggling to meet to demand.

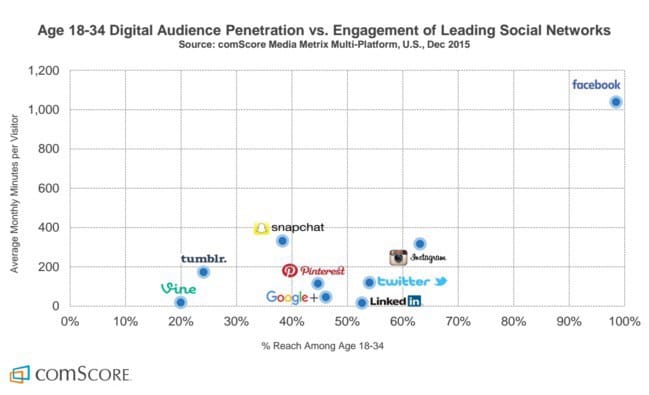

Man, $FB‘s beyond critical mass at this point…this kind of market share just continues to feed upon itself in a strong get stronger kind of way. More people spending more time posting and consuming content on Facebook makes more people post and consume content on Facebook, and so on. All that said, it is true that Facebook sometimes feels like it’s your grandma’s social network though, huh?

http://www.headlne.com/hdl/717…

Q. “Why doesn’t a Microsoft or someone buy Sony?”

A. $MSFT and $AAPL would get anti-trust trouble from trying to buy $SNE. Not to mention culture issues integrating a US-based firm with a Japan-based firm. I don’t think $SNE‘s board or the Japanese government would favor selling the company either.

Q. “Out of $NVDA $QCOM and $AMBA which I thought had the potential for the highest percent return over the next two years.”

A. I think I’d prefer to just own a basket of all three stocks you’re asking about —$NVDA $QCOM and $AMBA. They are all chip stocks per se, but each are set up very differently and are in very different places in their current business fundamentals and valuations and so on.

Q. “Do you ever buy weekly options.”

A. I almost always use the standard monthly options unless otherwise specifically stated. Mainly because they have a larger trading base and are a bit more liquid than the weekly options.

An interesting story that’s been making headlines around the world is the leaking of the Panama Papers. Here’s a terrific debate that I had on Scutify yesterday regarding the Panama Papers:

Resistivism1d ago @LunaticTrader What do ypu make of the Panama Papers, serious potential impact?

LunaticTrader1d ago @Resistivism My first reaction was “what’s the news?” => Didn’t we know already that wealthy people in stable and unstable countries are putting their nest eggs in various jurisdictions like Liechtenstein, Panama, Singapore, Switzerland…. Even a squirrel is smart enough to hide food for winter in more than one place. What’s wrong with setting up a corporation in Panama?

1d ago @LunaticTrader Someone’s got to pay for roads, judges, police, army, school, etc. Taxes are how that’s supposed to b done. “A huge leak of confidential documents has revealed how the rich and powerful use tax havens to hide their wealth.

Eleven million documents were leaked from one of the world’s most secretive companies, Panamanian law firm Mossack Fonseca.

They show how Mossack Fonseca has helped clients launder money, dodge sanctions and avoid tax.”

http://www.bbc.com/news/world-…

1d ago @Resistivism I’m not sure the Panama Papers leak will be much of a market catalyst one way or the other, but it makes me happy that people and companies will now be in trouble and hopefully punished for avoiding their obligation to pay for the things our tax dollars go to pay for.

DC1d ago @CodyWillard ” supposed to be done” indeed. we cannot blame companies/rich people people for setting up systems to avoid taxes while politicians are helping them…..http://www.wsj.com/articles/eu… => if they give us the opportunity to pay less taxes, would we say ” no thank you, bc someone needs to pay police, roads….” ? Or am i seeing this wrong ?

1d ago @DC The Panama papers reveal that there was a lot of tax fraud, taxi vision, and other rule breaking going on by a lot of very wealthy and very politically, connected people

LunaticTrader1d ago @CodyWillard “Someone’s got to pay for roads, judges, police, army, school,..” => That doesn’t have to be paid for with income taxes. All of these can be replaced by “pay per use” systems. => E.g. even in “socialist” France the highways are run by private or semi-private entities and you pay to use the road. See: http://tinyurl.com/j7kzz38 And even if you have to tax, income tax is the worst possible way to collect tax, creating an incentive to avoid that tax by hiding income.

LunaticTrader1d ago @CodyWillard Instead of income tax it is much better to tax things you can’t hide. E.g. it’s difficult to hide your car or home. You can’t hide if you are using land. => If somebody is using/exploiting a piece of our common capital, this planet, then it is fair that he compensates the other people for it. So, that’s taxation that is fair and easy to implement without loopholes.

LunaticTrader1d ago @DC Indeed, you cannot blame any company or wealthy person to avoid tax in every way possible. Because in an economic system that is based on competition you have to assume that your competitors are doing the same. So, everyone is under pressure to reduce their costs of doing business in order to stay competitive and avoid bankruptcy in the long run.

21h ago @LunaticTrader @DC The Panama Papers aren’t just revealing oligarchs and global corporations trying to legally avoid taxes. They reveal previously hidden corruption at the highest level in Iceland for example, uncovered in full detail:

“According to court records, Wintris had heavily invested in three major Icelandic banks which collapsed during the financial crisis.Wintris was listed as a creditor to the banks and therefore could have stood to gain from their collapse. Gunnlaugsson’s opponents allege his reluctance to fully repay the deposits of foreign investors following the bankruptcies amounts to a conflict of interest.

If he had fully repaid, it could have negatively affected both the Icelandic banks and the value of the company’s bonds.”

http://www.euronews.com/2016/0…

LunaticTrader2h ago @CodyWillard @DC I have no doubt that a portion of those accounts and companies in Panama will be questionable in nature. If I see a parking garage with 1000 cars in it I also have no doubt that some of those cars have been used for criminal purposes. => I guess what I don’t like about this Panama papers reporting I have seen is that they crank out names while painting the picture that everybody must be hiding fraudulent money there. That’s not right.

LunaticTrader2h ago @CodyWillard @DC For example, Messi the football player is involved. What is he supposed to do? Put all his earnings in Argentina, betting that the Argentinian government will somehow stop destroying the peso for a change? => The freedom to put your money in another country (aka vote with your wallet) is a very important mechanism to keep politicians somewhat sane. If they implement stupid regulations then money starts fleeing the country. That’s how it should be.

DC2h ago @CodyWillard corruption at the highest level…..ok fair enough but still if one is surprised by this i don’t really get it anymore…..how many countries are doing business with saoudi arabie that is responsible for more beheadings than IS ??? => i think that’s much worse than this but that’s just me probably…just sayin….and as far as Panama goes….which country needs taxes from the 1% rich while it’s easier to take it from the other 99%….http://bit.ly/1MQ6Jbk

LunaticTrader1h ago @DC How funny, Belgium balks at taxing 60 multinationals in the same way it taxes its own citizens. Nearly every “noble” family in Belgium was mentioned in the Panama papers and that’s called scandal. But can you blame them? Belgian citizens get taxed at +50% rates, while multinationals got and get special deals. So, those families decided to go multinational with their assets too. Logic.

And I leave with you my Deep Thought of the Day – I want to create investment portfolios like Wintergatan creates music. This is actually a great song created using only one man’s hands, a machine and 200 ball bearings called Marble Machine.