Omicron Impact, Biggest 5 Positions, Near-Term Market Predictions, Crypto Faves and Trade Alert: FUBO Gone

Here’s the transcript from this week’s Live Q&A Chat.

Q. What is your view on Omicron? Will it be serious enough to disrupt chips productions and other supply chains?

A. I think it already has and will continue to do so. Covid is going to be less disruptive over time, but we are in a rough patch right now and the odds are that there are other variants already out there or about to come out that could be more deadly if not more transmittable than Omicron’s remarkable ability to spread. With a daughter on oxygen with a trachea tube to breath through, I’m not sure it can get much worse than Omicron because the biggest threat to her is just getting Covid at all, even it’s Omicron isn’t as severe as other variants for most people. We do have her one vaccine in and she’s due for her second next week and hopefully that will help protect her too, but this disease is scary for my family and me and for millions of others with similar risk profiles in their family.

Q. My prayers for Amaris and your family. Be safe all.

A. Thank you and you too.

Q. Can you please share your 5 largest and smallest positions? Thank you very much!

A. Not necessarily in this order for 5 largest: FB, TSLA, RKLB, UBER, QCOM and not necessarily in this order for the 5 smallest: SPCE, FUBO, AMZN, TWTR, RDW. As a matter of fact, I’m selling FUBO here. Time to free up that capital, cut that loss and let me find some other great investments. Streaming video is great and I like FUBO fine and I might buy it back in a month or two, but I’m going to be disciplined and cut this loss right here right now. Mea culpa on this name.

Q. Can you please give your view on SPX over the coming weeks?

A. I predict the S&P 500 Index goes up 1% over the next couple days, then goes down almost 2% next week and then rallies next Friday 1/2% and then starts off the new year with a 1.5% premarket rally and then a fade to flat and then a small rally and then a small rally and then a small fade and then a 1% move lower and then a small fade and then a small rally and then who knows. LOL.

Q. Cody, can you expound upon your AAPL, GOOG, and AMZN 2022 predictions and provide any recommendations on actions, if any, we should take if we own these?

A. All three are trading at historically high P/E multiples and I think each are overowned right now. I woudn’t change anything if you own them though. I plan to just mostly sit tight with all 3 as I have for many, many years now.

Q. Cody, I was surprised to see recent trade alert to buy CGC, KD, IONQ, ORGN when there are lot of well known stocks down 50%. Though you mentioned about providing a detailed write up after new year, can you give a brief 1-line summary on the reason to pick these stocks?

A. CGC is a good company with big backers in the pot stock world. IONQ is a quantum computing start up with potential. KD is a spin off from IBM and it’s hated and nobody knows it, but it’s trading at 0.2x sales. Yes, you read that right. ORGN is a startup that has a platform converts the carbon found in biomass into useful materials.

Q. Hey Cody – if you were just starting to invest in crypto and had 10k what % would you put in BTC/ETH/HNT? Thanks.

A. Probably about 1/3 into each, maybe a little more ETH than the other two.

Q. Would really enjoy your take on UPST- Upstart Holdings. Thanks as always for your outstanding insights on all things markets. Happy Holidays!

A. I’ve looked at it before, it’s a good company but the stock remains quite expensive.

Q. Would also really appreciate any thoughts on IS- Ironsource.

A. I don’t know it, but I’ll take a look and if I like what I find, I’ll let you know.

Q. Cody – Thank you very much for your guidance this year! I hope you and your family have a fantastic holiday season. Before yesterday, ABNB has seen a pretty significant pullback from its highs about a month or so ago. Would you recommend buying a tranche here?

A. I can think of worse ideas than nibbling a tranche of ABNB after this pullback, but I haven’t done so lately myself.

Q. Additionally, I know we exited Square at much higher levels earlier this year. What do you think of its valuation now after a significant pullback?

A. I’m warming up to it.

Q. Any update on Immersed?

A. I just texted the CEO and asked him directly for you. His response: “Yes, I am planning to post an update on Jan 1st (just over a week from now). Their email address should be logged in our investor list once we push it out. (because they made a WeFunder account).”

Q. Any opinion about NOTV as they have pulled back a little recently?

A. Seems like a good company but again, expensive. I’ll keep it on my radar.

Q. I hope you and the girls are smiling I cannot help but thinking that peloton appears incredibly cheap right now With the pandemic surging again. Might this not be a good time to to get in?

A. I think PTON might be in a vicious cycle of lower prices, tougher competitors and they ain’t no NFLX of the gym.

Q. Don’t forget to take a look at VIAC. You might be interested in VIAC (paramount +, Pluto TV, showtime), trading below book value, ver low PE, totally clean balance sheet with $4.8b cash, $17B debt, and selling as we speak $4.8B of assets that range from a building in NYC $780M, studio city in CA for $1.815B, and Simon and Schuster for $2.15B. They have deals with TMUS (free paramount + for a year, heavy marketing starts next quarter), sky (CMCSA) to have a joint venture for a steaming Sevice in East Europe, They own shows like Yellowstone and doing a spin-off with 1883 coming out this coming Sunday.

A. VIAC is probably a buy at some price, but I’m not sure where. I’ll keep it on my radar as I’ve studied the company many times over the years. ‘

Q. Feet to fire: SQ or PYPL?

A. Both?

Q. Do you think nuclear energy has an attractive future?

A. Yes, but not for another 10 or 20 years.

Q. Are you adding to BKSY at $5.5 price now?

A. Nah, not much yet.

Q. Hi Cody – could you please rate the following on the 1-10 scale, based on current price : BKSY, RDW, CDXS – thanks!

A. 6/10 for BKSY and RDW. 7/10 for CDXS.

Happy holidays everybody! Please be careful if you have loved ones at risk and be respectful of those who are being careful for their loved ones or for themselves. Be respectful is a good thing in general, actually. Let’s all work on being less self-righteous and being more respectful of everybody in 2022! (Hmm, was that last sentence self-righteous?)

Two thoughts before I go — if you need a last minute gift for the investor/trader friend or family member whose gift didn’t get delivered or something — get them a year of Trading With Cody. We’ll even give a discount if you let us know today before Friday (markets are closed Friday). My team will work with you on details if you just reply to this email or email at support@tradingwithcody.com.

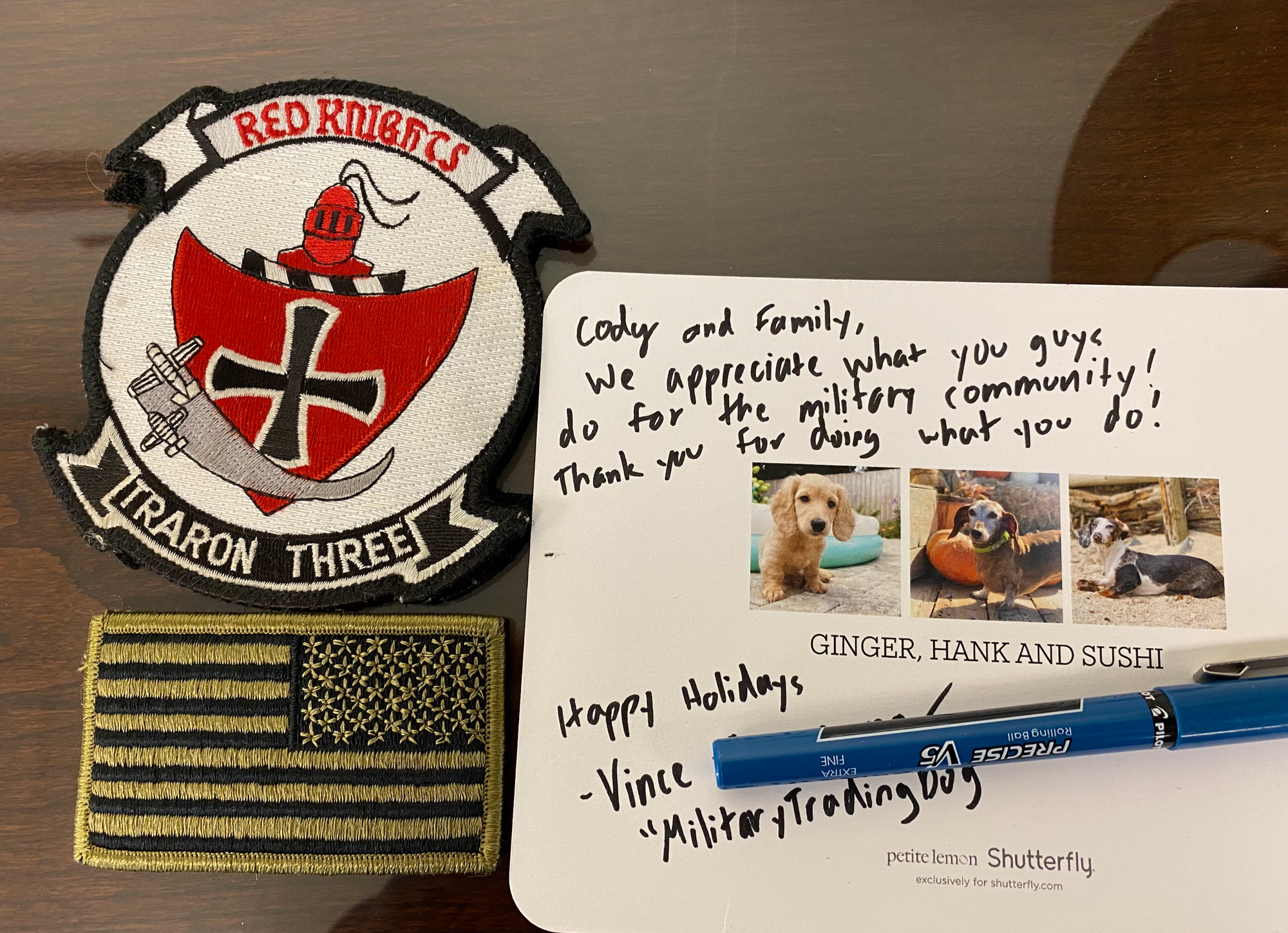

Lastly, I got a really nice card from one of the active many military members that get Trading With Cody for free while they’re active. If you know someone actively serving in the military or on a police force and want to give the gift of Trading With Cody to them — it’s actually free in that case. We give Trading With Cody for free to any active service member or police force member. Here’s a card the card: