Personal note, Markets notes, and why I’m avoiding Paypal’s stock

On Sunday, my family and I drove up in the RV we bought and set up for transporting my nearly six month old Amaris back and forth from Albuquerque to the small town we live in 150 miles away and we spent yesterday morning at the UNM Hospital with her. They put Amaris under and pulled her tracheostomy tube to give her a once over and check for any scarring, granulation and what not. The ear nose and throat specialist, a Dr. Kraai, is a confidence-instilling, terrific surgeon and as my wife put it: “It was a long day but Amaris is such a warrior princess. The doctor discovered her airway is 70% smaller than it should be. They increased the size of her trach. The doctor says everything looks great. They will reevaluate every 6 months and once her airway is larger they will perform a surgery to increase and strengthen the airway and we can ditch this trach. She now weighs 9 lbs and is 23 1/4 inches long.”

So I didn’t get around to writing for you guys until last night. We have several people who we’ve brought on to help us take care of Amaris and I got a chance to catch up on some work and writing as Lorena sat holding Amaris until 11pm last night when I took over for her until 4am this morning. I am back in the office full speed for the rest of this week so let’s jump in.

With the markets having rallied so strongly off their August lows, are there any bears left? Are there any scared bulls around?

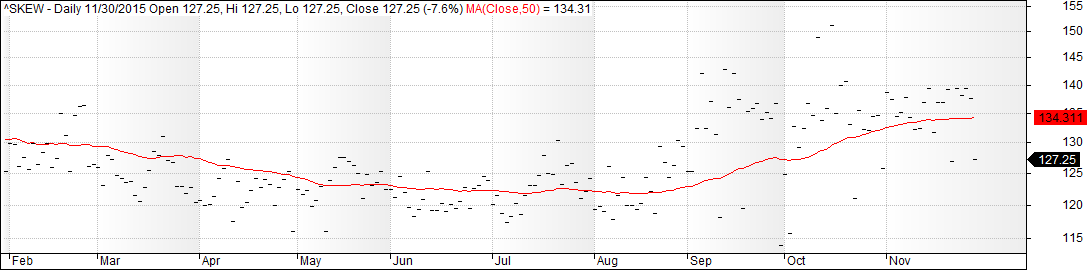

Here’s an interesting answer to my question posted by on Scutify: “Bears are betting on a crash and bulls are still scared. That’s what the $SKEW keeps telling us. The 50 day running average of $SKEW is at 134, it’s highest ever. In the recent 2 months here have only been a handful of days that SKEW went below 130. This means ppl keep overpaying for crash insurance. If history is a guide then that’s money that goes straight into the pockets of the good folks option market makers like Goldman Sachs.”

And another comment from a Scutify user: “From the bull perspective I’m still not comfortable holding anything but the leading momentum. $DY,$HD, $FSLR, $SBUX, $NKE are stocks I would add with more confidence.”

And finally: “I’ll still be a bear….and like a broken watch eventually I think I’ll be right …..haha”

It seems most bulls are still scared and most bears are still hanging around expecting to get paid thinking that they’ll catch some big gains in a crashing stock market.

Speaking of being a bear, here’s more evidence of the price gouging in biotech/health care that I think is under a pendulum swing the other direction:

“Pharma and biotech got greedy from their ability to profiteer using the Obamacare and other Republican/Democrat taxpayer-funded programs that their lawyers wrote the laws for. I think they have a long way to fall as the pendulum now swings the other direction to government crack down on price gouging the programs “Prices for several acne and other dermatology drugs have skyrocketed in recent years”

…

Now let’s talk about why I haven’t invested in Paypal which is a stock several of you Trading With Cody subscribers have asked me about. It’s important to review stocks we don’t choose to buy just as is its important to see the analysis when we do the analysis and do choose to buy.

Paypal was spun out of eBay a few months ago and the stock seems quite overvalued to me and facing competitive threats from all comers. I actually use PayPal to manage most of our Trading With Cody subscribers, and I’ve never been pleased with the service and have felt like I am overpaying at 2.9% of fees which is what Paypal’s cut of every dollar they process for me. I am locked in to their service for now though and I suppose 2.9% is indeed better than the 30% cut that Apple and Google take on their respective App Store transactions.

But the reason Google and Apple can charge 10x more on every transaction than Paypal can is because they have a duopoly on App Store payment processing. Paypal on the other hand is under constant attack from other Internet-based payment processors.

Those competitive threats to Paypal include: The aforementioned app stores, Apple Pay, Google Wallet, Android Pay, Visa, Mastercard, American Express, Jack Dorsey’s Square, Dwolla, Amazon…you get the point.

On a valuation front, Paypal is trading at 23x next year’s earnings estimates but the fact that the company is growing its topline 15% per year makes that valuation not unreasonable. In other words, if the company can continue to deliver 15% growth, the stock could double from these levels, but as a customer and as an analyst, I wouldn’t want to bet that Paypal will be able to continue to deliver that kind of growth in the face of all this rising competition and mobile app revolution. With that strong growth rate and potential for upside in the stock, I’m not looking to short PYPL either. Investment and trading success depends largely on avoiding risks in addition to making great picks, so let’s just avoid this Paypal for now.