Predictions for 2024 - What's Next For Megacap Techs, AI, Crypto, Oil?

Here are some markets, economy and stock predictions for 2024 and I'll start by discussing what would probably be the most unexpected outcome for the US economy in 2024. I'd like to remind you all of something else I wrote in that predictions for 2023 piece from last year:

We'll do chat this week at the usual time, 3:00pm ET on Wednesday, December 27th, 2023, in the TradingWithCody chat room or email us at support@tradingwithcody.com.

Please Follow us on our LinkedIn Page and Connect and Follow Cody here.

Last December when the stock markets were down 30% or more and many stocks were down 70% or more in a straight line, I predicted that 2023 would be a good year for most tech stocks and that many small caps would go up 10-20x even as rates would stay near their recent highs. That turned out to be correct despite the fact that, as I wrote at the time, "a decent goldilocks-y US economy with flattish corporate earnings growth/decline with increasing margins throughout the corporate world would probably be the single most unexpected outcome for the US economy in 2023."

Here are some markets, economy and stock predictions for 2024 and I'll start by discussing what would probably be the most unexpected outcome for the US economy in 2024. Before we jump into this year's predictions, I'd like to remind you all of something else I wrote in that predictions for 2023 piece from last year: "The markets and the economy are not the same, of course."

1) AI continues to capture the imagination of the world and the biggest corporations on the planet finally start to use AI for real-world business purposes, including supply chain management, distribution improvements, customer service interactions and especially helping giant tech companies refine and profit on ad spends by their customers (ie, Meta (META), Google (GOOG), and Amazon (AMZN)) and maybe by the end of next year we'll even see some TV shows and big budget movies that are made using generative AI. That said, after a strong first quarter for most all AI stocks, many of the smaller AI stocks will get crushed and end the year down 90% or more as most smaller AI companies fail to deliver on the many overhyped promises they've made about how they will use AI to generate growth—thinking of stocks like C3.ai (AI), Soundhound.ai (SOUN), Upstart (UPST), and Palantir (PLTR), etc.

2) The US economy grows about 2% in the first half of 2024 but gets ugly by year-end, contracting 2% in the fourth quarter of 2024.

3) At least five tech companies, each valued at more than $50 billion, announce their intentions to move their headquarters from California to Texas (like Tesla did a couple of years ago). Texans become even more insufferably proud of their state than they are already. New Mexicans like Bryce and me just have to deal with it.

4) Sam Altman gets fired from ChatGPT again and this time it sticks. Microsoft (MSFT) runs into problems trying to monetize its ChatGPT partnership after this happens. MSFT finishes 2024 down 15% or more.

5) Same as I predicted in 2023 (correctly, it turned out): "The Fed won’t cut rates but they will keep them near 5-6% for most of the year." Inflation will creep back up and spend most of the year around 3-4% causing much angst and eventually fear in the broader markets. The same consensus that was so bearish heading into 2023 is now wildly bullish heading into 2024. Obviously a 50% move in the megacap tech stocks this year brings out the bulls again, just as a 33% decline last year brought out the bears last year at this time. It's always amazing, though not surprising, how human nature works that there are always bulls/buyers at higher prices and bears/sellers at lower prices.

6) As such, I don't think the Nasdaq 100 (QQQ) will be up another 50% in 2024, rather I expect it to be flattish next year. The best-performing megacap tech stock will be Tesla (TSLA) which will be down 10% or more in the first half of 2023 but will be up 30-40% or more in the second half of 2023. The second-best megacap tech stock will be Amazon (AMZN), up 20% next year, followed by Google (GOOG), which will be up 15% or so. Apple will be down 5% and the worst megacap tech stock will be a toss-up between Microsoft (MSFT) and Broadcom (AVGO), each being down 15% or more in 2024. The Russell 2000 (IWM) will be up 10% for the year at the end of 2024, while the S&P (SPY) is down 5% on the year and the Dow Jones Industrial Average (DIA) will be down 10% on the year.

7) Bitcoin pulls back 15-20% before its "halving" event happens in April, which allows bitcoin and other cryptos to rally into the event only to drop 20-30% in the two or three months after the halving happens. Bitcoin stabilizes in the high $30,000s (bottoming around $36,000) next summer and into year-end when bitcoin finishes at $42,733 or so. Recent highflying cryptos like Bonk and Near finish 2024 down 50% or more on the year while Dogecoin doubles in 2024 (call it the "Elon effect" -- I would have expected him to give up on Doge by now, but he's still bulling it). Ethereum ends the year down more than 20% from its current levels at $1813. Gary Gensler leaves the SEC next summer and the next SEC Enforcement Chief comes in and actually does his/her job as the government steps up prosecution of the founders of thousands of silly, stupid and/or fraudulent cryptocurrency tokens that have been illegally pawned off on the public in the last five years. Coinbase (COIN) gets its own comeuppance as the company settles with the SEC for $7.2 billion and Brian Armstrong has to give up his job as CEO.

8) Oil becomes one of the most volatile sectors in the market in 2024, spending the year trading between $55 and $90 a barrel and finishing the year at $77.

9) Gold becomes one of the least volatile sectors in the market in 2024, spending the year trading between $1800 and $2200 and finishing the year at $2047.

10) GM (GM), Ford (F), and the other legacy automakers all but throw in the towel on their heretofore ballyhooed EV strategies as buyers continue to avoid their crappy software and horrible charging networks. GM writes down more than $5 billion on their EV business and the stock ends the year at less than $20 a share.

Bonus predictions:

War) China blockades Taiwan, Russia ends the war in Ukraine having taken much of the territory it set out to take, and Israel keeps the pressure on Hamas through the end of next year.

Election) Trump wins but it's a very close election and the Democrats and Republicans keep pushing our democracy into an ever more precarious place as they trade investigations and lawsuits. Fewer bills and laws will be passed in 2024 than in any year in the last century as the infighting escalates. (Gridlock would be good for stocks even if it makes your social media timeline and cable news channel ever more dismayed.)

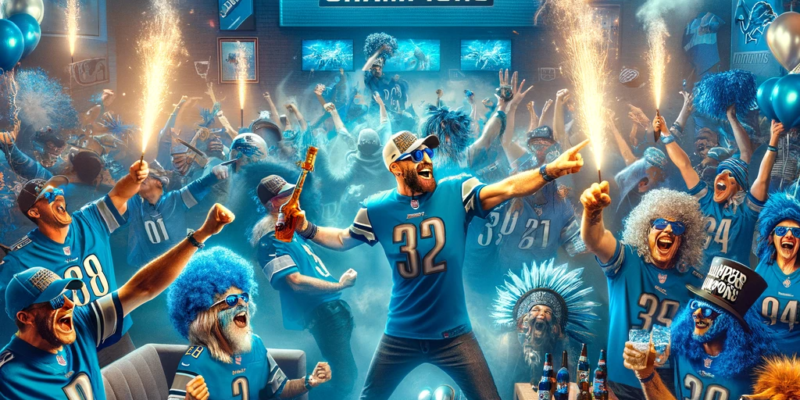

Sports) The Detroit Lions shockingly win not only a playoff game, but they actually will beat the Ravens in the Super Bowl, making their long-suffering fans happy for a day or two. It'll be a helluva parade in Detroit. The Knicks get all the way to the Eastern Conference finals but lose to the Celtics who go on to lose to the Dallas Mavericks behind Luka Doncic's 40/10/10 average in the Finals. I leave you with an AI-generated picture of the Detroit Lions' fans celebrating their (predicted) super-bowl victory:

Thank you to each and every one of you for being a part of Trading With Cody. Happy New Year!