Revolutionary Magnets (PLUS Trade Alert: Buying Rivian, Selling U)

“No self-control

A chain reaction as my body lets go

A strange kind of light

The tempo takes me and the circuit excites

Magnetic

The rhythm of a dangerous dance

(Let’s dance in the static)

Suck you in twice as fast

Magnetic

The rhythm of a dangerous dance

(Let’s dance in the static)

Suck you in, you’ll never last” Earth, Wind and Fire

Before we jump into the report that Bryce wrote on the stock he’s been working on this week, I have a couple Trade Alerts for you.

First, we’re giving up Unity for a while. The ad business that they’ve become increasingly focused on over the last couple years is not working out as well as they had hoped and we were in the company for its software/gaming engine platform which the company seems to be less focused on than we’d like. As always, we can revisit this name later if the fundamentals and/or the price make it more compelling again.

We’ve been nibbling on a starter position in Rivian before the earnings call tonight. Long story short is that with a valuation of $17 billion and net cash of $12 billion made us dig in a bit more. The company is going to burn several billion in cash over the next two to three years as they ramp up production of their EVs but the fact that they are the only US company other than Tesla to actually deliver a significant number of quality EVs to customers who actually like them and haven’t had to stop driving them because the batteries are blowing up. We’ve spoken to several Rivian owners directly. If any of you reading this own a Rivian please send us a note on your experience with it so far. We’re still doing deeper homework on this name but have started building what is, for now, a smallish position. We’ll learn more about the company and its roadmap and execution on tonight’s earnings report.

Now onto the new report on MP which has been in the hedge fund since I first added and sent out the Trade Alert on it back in October 2020 at $13 per share.

Pretty Much All Revolutionary Roads Lead To MP Materials“I would not give my rotating field discovery for a thousand inventions, however valuable… A thousand years hence, the telephone and the motion picture camera may be obsolete, but the principle of the rotating magnetic field will remain a vital, living thing for all time to come.” – Nikola Tesla

Key Metrics

Exhibit 1

|

Market Cap, curr (mm)

|

$5,570

|

|

Total Revenue (ttm)

|

$528

|

|

Current Gross Margin

|

~75%

|

|

Current Operating Margin

|

62%

|

|

Net Cash Per Share (as of 9/30/22)

|

$3.30

|

|

Price/Sales (ttm)

|

10.55

|

|

Consensus Forward P/E

|

30.21

|

|

YoY Revenue Growth (ttm)

|

54.3%

|

|

Consensus 2023 Revenue Growth Est.

|

-7.7%

|

|

Consensus 2024 Revenue Growth Est.

|

54.6%

|

Source: Yahoo Finance.

Synopsis

The smartphone in your pocket, the Tesla in our driveway, and the wind farm on the ranch 50 miles north of our office all could not have been built without rare earth elements (“REEs”). MP Materials owns the only commercially-viable REE mine in the western hemisphere and stands out to us as one of the few early-stage growth companies which is currently generating substantial revenue and profits and is trading at a reasonable valuation. Even setting aside the significant growth prospects of MP’s Stage II and Stage III business plans (discussed below), it presents an exciting opportunity to invest in the only operating US REE mine in North America. With revenue expected to grow 54% in 2024, MP looks attractive at these levels trading at roughly 30 times 2023 earnings. Moreover, many if not most of the other revolutions we are or have been betting on (EVs, Space, Renewables, Smartphones, Apps, Crypto, High-Tech Manufacturing/Automation Revolutions) depend on a consistent source of REEs to build their products and empower their services. When we factor in the expected growth of MP as it builds out its refining and magnet-production capacities to serve these industries, MP looks cheap trading at about 4.6x our 2028 earnings estimate.

The REE Market

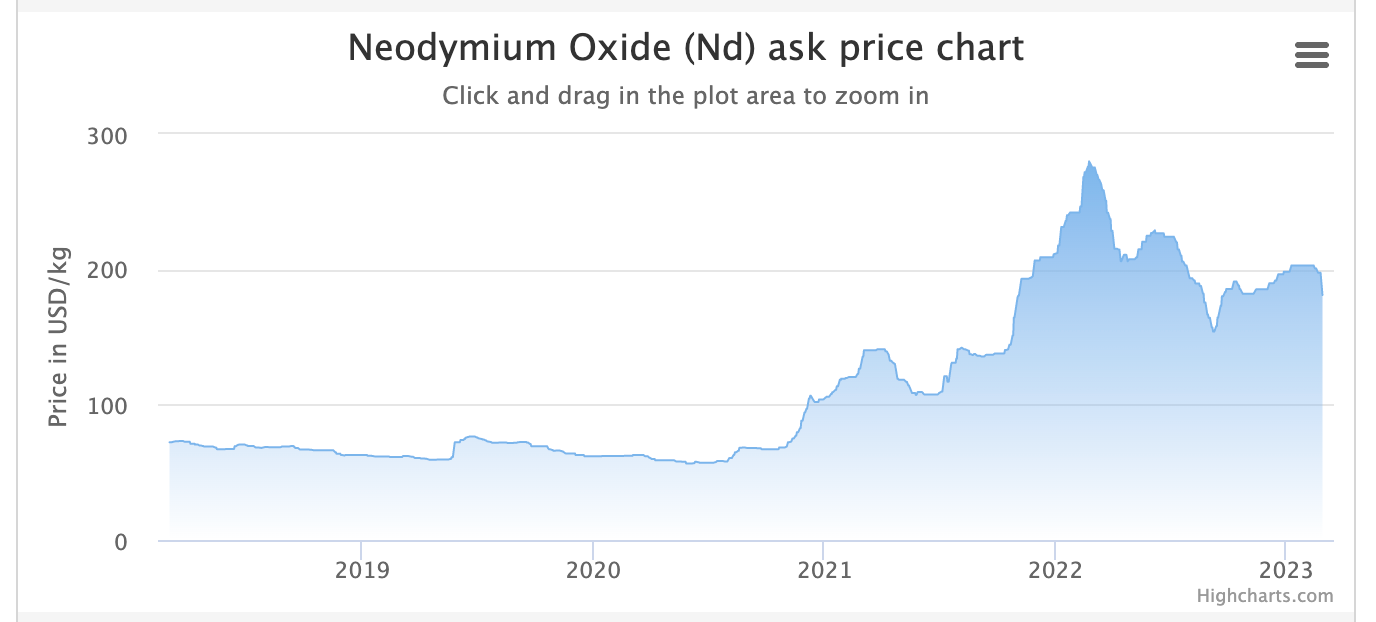

MP is essentially the only mining company in the United States which is focused on building out domestic REE production, refining, and manufacturing capabilities. To understand MP’s business model and growth prospects, you have to understand the current makeup of the global REE market. The first question you might ask is, “What are REEs?” REEs are a set of seventeen metallic elements used in more than 200 products across a wide range of applications, ranging from smartphones to electric vehicles to wind turbines to laser-guidance systems on missiles. MP is primarily producing a condensate of two REEs known as Neodymium-Praseodymium (NdPr) from its Mountain Pass mine in California.

According to Politico, China currently accounts for 63 percent of the world’s REE mining production, 85 percent of REE processing, and 92 percent of REE magnet production. In the middle parts of the 20th century, the US produced (via the Mountain Pass mine) most of the world’s REEs. However, China ramped up its REE capabilities in the 1980s and 90s and quickly undercut its competitors. Because of its cheap labor and loose environmental regulations, China rapidly captured REE market share and made production in the US uneconomic. Adamas Intelligence forecasts that the value of global magnet rare earth oxide consumption will triple from $15.1bn in 2022 to $46.2bn by 2035.

MP Background

The Mountain Pass mine changed hands several times in the 2000s, was eventually shut down, and its operator MolyCorp, went bankrupt in 2015. MP bought the Mountain Pass mine out of bankruptcy in July of 2017 for about $20 million. The company restarted operations at the mine in 2018 and came public through a SPAC in 2020, raising $489 million. Because of China’s recent export restrictions, the rapid rise of EV adoption, and the continued demand for other high-tech products, the price of REEs skyrocketed in 2021 and 2022. This resulted in substantial profits for MP as it ramped up production at the mine around the same time.

Today, MP is producing about 15% of the world’s supply of REEs. Even though MP has substantially increased US production of REEs, almost all of the refining, processing, and manufacturing remains in China. This means that MP has to sell the raw materials it produces to Chinese companies for refining. Accordingly, MP has entered into offtake agreements with Shenghe Resources Holding Co. Ltd, a Chinese controlled company that processes, markets, and sells REEs. Since its founding, Shenghe has purchased virtually all of MP’s REE production. MP renewed its agreements with Shenghe in March of 2022 which extended the term of their original agreement for two years, with the option to extend the agreement for an additional one-year period. Pursuant to this agreement, Shenghe is required to purchase on a take-or-pay basis the rare earth concentrate produced by MP as the exclusive distributor in China. Shenghe also owns about 7.7% of MP.

MP’s Execution and Growth Plan

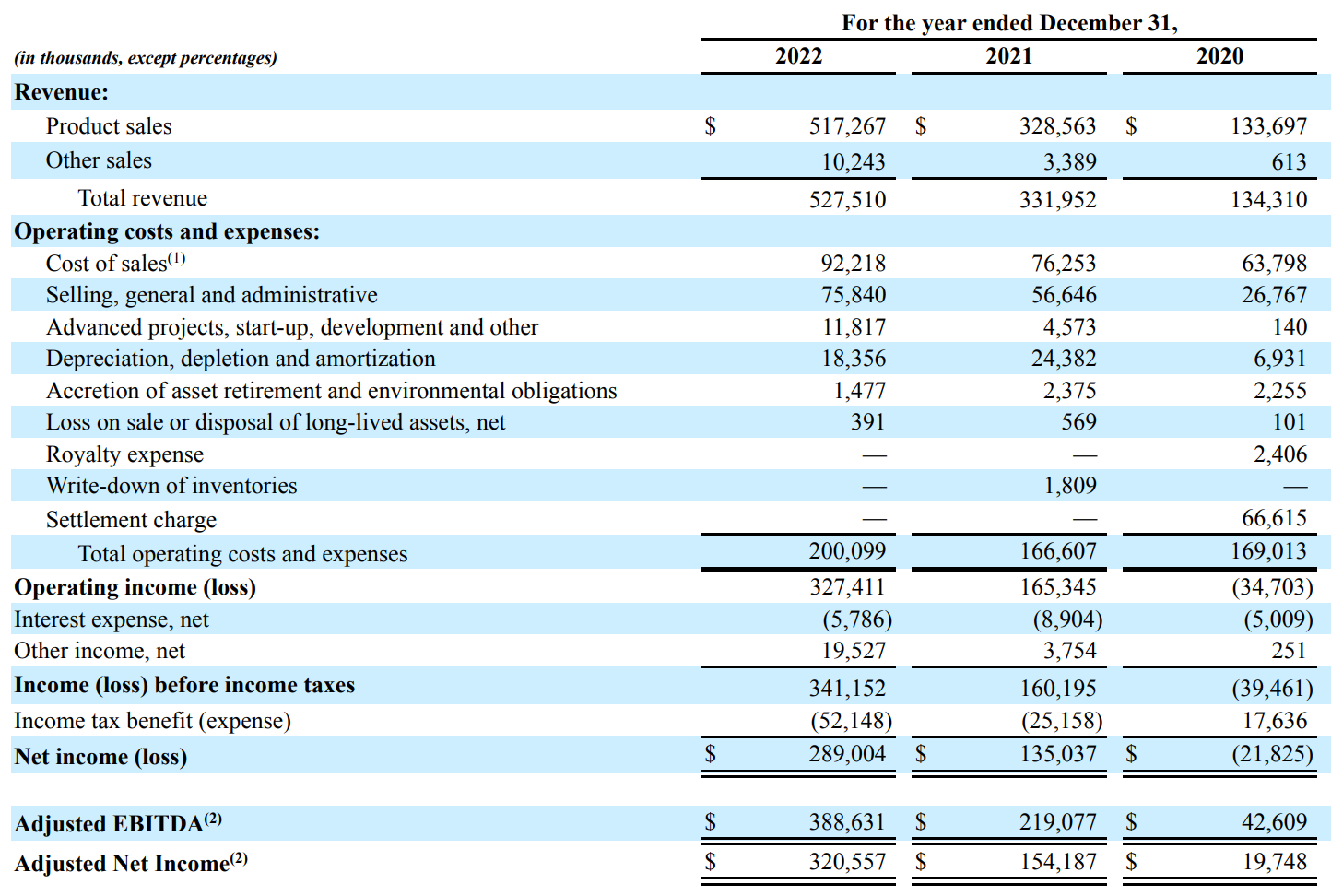

MP has a three-stage business plan which involves progressing up the value chain from mining (Stage I) to refining (Stage II), and ultimately manufacturing of REE magnets for EVs and other uses (Stage III). In our view, despite its executives having relatively little experience in the mining sector, MP has demonstrated extraordinary execution of its Stage I mining operations. After buying the idled mine out of bankruptcy in 2017, MP quickly cranked up production and began generating substantial profits. Here is MP’s income statement for the last three fiscal years:

Keep in mind that this growth has come almost exclusively from MP’s Stage I mining operations. As seen above, MP has demonstrated excellent operational improvement of its Stage I business since ramping up in 2019-2020. With the mine now up and running, MP has been shifting its attention to getting its Stage II and Stage III operations up and running. MP has already constructed its Stage II processing facility and commissioning of the facility is ongoing. The Stage II facility will convert MP’s NdPr concentrate into NdPr oxide which is a direct input for the production of rare earth magnets. MP recently entered an agreement with a giant Japanese conglomerate Sumitomo to be the exclusive distributor of MP’s NdPr oxide in Japan. MP expects to begin selling commercial quantities of its NdPr oxide in the second-half of 2023. MP is also currently constructing its Stage III magnet factory in Fort Worth, TX. MP has entered into a definitive supply agreement to supply GM with materials, alloys, and ultimately magnets to be used in GM’s EVs. MP expects to begin producing Stage III materials in 2025.

We like MP because it clearly stands to benefit from the continued growth of secular industries which we invested in like EVs, renewables, space, automation, and other high-tech markets which require REEs. In our view, the demand for REEs will only continue to grow, and MP is the only viable investment in the US to capitalize on this secularly growing industry. Additionally, the company fits into our investment theme of reshoring US production capacity and will ultimately benefit from ever-growing geopolitical tension between the US and China. The US government has already made substantial investments in MP because the government is very concerned with continuing to source REEs from China which are used across the defense industry. China has placed export controls and quotas on the REEs in the past and there is no doubt that China will prioritize the production of its own defense and high-tech equipment using the limited REE supply instead of shipping it to the US. Further, while we originally had doubts about management’s ability to execute, they have demonstrated three years of operational excellence in their Stage I mining business. With almost 80% gross margins and $353mm in operating cash flow in 2022, managemen has shown that they can deliver on their promises. As an additional testament to MP’s operational efficiency, the company has been diligent in protecting their cash reserves (standing at $1.26bb as of 9/30/22) and has financed all of its capex spend on Stage II and Stage III projects using operating cash flow generated by the mine.

Discussion of Downside Risks

While we think MP will be a long-term beneficiary of US tensions with China and the re-domestication of the supply chain, in the short-term MP’s business could be significantly disrupted if China decides to stop buying MP’s NdPr concentrate. As mentioned, virtually all of MP’s sales come from China because it controls 85% of the world’s REE processing capabilities. However, unlike some of the company’s bears, we do not fault MP for selling its production to China, because China is basically the only buyer of REE concentrate at the moment. In fact, its part of the bullish case for MP because other countries, including the US, will become customers in coming years. But until MP or other companies build processing facilities, if MP wants to sell REEs, it has to sell them to China. Obviously, this presents a risk to the business if China/US relations deteriorate further in the near term.

This leads to the next risk that MP faces. MP’s growth is dependent on successfully building out its Stage II and Stage III production facilities. While we think MP has made significant progress on these parts of its business model already, this side of the business is still unproven. As MP ultimately moves away from selling to Chinese customers, it will likely experience headwinds as it attempts to market and sell its products to end-users with whom it currently has no business relationship with. The Sumitomo and GM deals are promising, but MP will have to keep entering agreements like this with REE buyers around the world if it is to succeed on its Stage II and Stage III business plans. Additionally, MP’s revenue and profits will likely take a hit in 2023 as MP makes the transition to selling Stage II and Stage III products.

Lastly, it is possible that the current buyers of REEs shift to other materials to build their products. Because of the high price and short-supply of REEs of late, Tesla and others started building electric motors with non-REE magnets. However, these motors do not perform as well as motors with REE magnets, and we think that as the domestic REE supply increases, manufacturers and end-users will continue to use REEs in their products.

Summary

We think MP is well-positioned to capitalize on the growing demand for REEs as the EV, Renewable, Space, Automation, and many other high-tech revolutions continue to play out. As management has already demonstrated the ability to execute on their plans and guidance, we are confident that MP will continue its march to becoming the only vertically-integrated supplier REE products in the USA. We like MP at these levels and think in comparison to the valuations of many of the SPAC names that came public in 2020, MP stands out as one of the few which has actually executed on its growth plans while demonstrating near-term operational efficiency.

We’ll do this week’s Live Q&A Chat Thursday at 2pm ET in the chat room or just hit reply this email.