Robinhood, A Revolutionary Financial SuperApp.

We mentioned last week that we started buying Robinhood. Below is our in-depth analysis of HOOD and why we think it is such a great opportunity to invest in an extremely Revolutionary company with a huge addressable market ripe for disruption. Also, let’s do this week’s chat tomorrow, Friday, at 1:00pm EDT in the TradingWithCody.com Chat Room or just email us at support@tradingwithcody.com. Now, let’s get into it.

Robinhood, A Revolutionary Financial SuperApp.

Robinhood Markets, Inc.

Nasdaq: HOOD

Share Price At Time of Analysis: $12.47

Key Metrics

Exhibit 1

| Market Cap, curr (mm) | $12,260mm |

| Total Revenue (ttm) | $1.358bb |

| Gross Margin | 87% |

| Net Cash (mm) | $6.339 |

| Price/Sales (ttm) | 8.3 |

| Q1 2023 YoY Revenue Growth | 48% |

Source: Yahoo Finance.

Synopsis.

Robinhood is in the midst of Revolutionizing a $30+ trillion industry. What started as an online brokerage firm offering commission-free trading, zero account minimums, and fractional-share trading to retail investors is looking a lot more like a serious competitor to the established multi-trillion dollar brokerage, retirement, asset management, and financial advisory industries. Robinhood’s mission is to “democratize finance for all,” plain and simple. As we have mentioned before, Cody has long said that “the endgame of the internet is the total empowerment of the end user.” Robinhood is doing that very thing in the financial services industry–empowering the end user, and taking a small cut to do so. Unlike much of Wall Street today, which truly earns the majority of its income by nickel-and-diming, front-running, taking advantage of, and outright ripping off its customers, Robinhood is all about empowering its customers to trade, invest, retire, save, and spend their money in the most efficient way possible, all on an incredibly intuitive user interface (UI). While the company has had to overcome a few issues in the last several years (see the GME Fiasco discussed below), we believe management has demonstrated an excellent job of navigating bad press and a difficult market for retail investors. Additionally, Robinhood has not tried to end-run securities laws like some of its competitors (e.g., COIN), and is a registered broker-dealer with the SEC. With new offerings constantly being rolled out, a massive total addressable market, roughly $6bb in net cash (on a $10bb market cap), revenue growing 20-30% per year, operating expenses down 22% last year, and with the stock trading at roughly 6 times our profit estimates five years out, we think HOOD is a must-own at these levels.

HOOD Background.

We got interested in Robinhood a couple of weeks ago when, ironically enough, we stumbled upon the stock while looking for potential shorts in the FinTech space. It is always nice to find new longs when looking for shorts because it usually means that you are less subject to confirmation bias. After digging into the numbers and using the app for the past few weeks, we were astounded by the Revolutionary products constantly being rolled out by the company. And that the company had impressive fundamentals to match.

HOOD was founded by Vladimir Tenev and Baiju Bhatt in 2013 with a mission to “democratize finance for all.” The company came public in July of 2021 at a $32 billion valuation and raised around $2 billion at the time, and now have $6bb on the balance sheet. Robinhood originally offered commission-free and fractional-share trading with zero account minimums. This opened the door for many retail investors who formerly could not afford to buy even one share of GOOG or AMZN back when they were thousands of dollars per share. Additionally, by eliminating the standard $4.99 or $9.99/share commissions charged by online brokerages like E*Trade or TD Ameritrade, HOOD further encouraged trading of extremely small lot sizes that just wouldn’t make sense if you were only trading maybe $100 worth of stock. In response to Robinhood’s Revolutionary offerings, the other online brokerages were forced to likewise cut or eliminate commissions on most trades.

These characteristics led Robinhood to become a household name in 2020 during the COVID bubble as ordinary people rushed to invest extra cash from stimulus payments and savings that couldn’t be spent on normal activities like entertainment, eating out, etc. However, many of you might remember that Robinhood (along with other brokers) came under intense scrutiny when it prevented purchases of Gamestop (GME) after the stock’s monster rally in early 2021. While Robinhood stated that it was forced to stop trading in order to meet collateral requirements set by federal regulations, many investors accused HOOD of colluding with market maker Citadel Securities whom they claimed was simultaneously shorting GME stock. Robinhood routes many of its customers’ orders to Citadel for execution, and in turn receives a rebate on each trade in the form of “payments for order flow,” or PFOF (more on this later). Despite the allegations, in late 2021 a federal judge in Florida dismissed the collusion class action lawsuit on behalf of investors against Robinhood and Citadel stating that the evidence was insufficient to support accusations of collusion. You can also watch Vlad’s testimony on this topic to Congress, and we feel confident he was not lying to Congress.

HOOD’s Business Model.

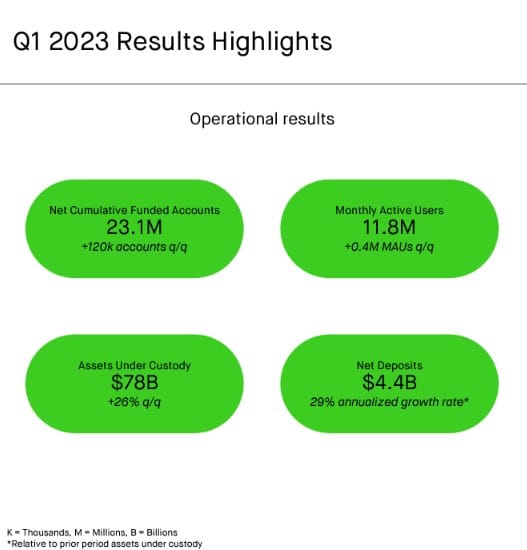

In terms of users, Robinhood has 23.1 million funded accounts and 11.8 million monthly active users (MAU). And while MAUs have dropped off since peaking in Q2 2021, funded accounts continue to grow slightly, and net deposits from customers have continued at an average rate of $1.5bb per month over the last 18 months. The fact that Robinhood has been able to steadily grow funded accounts and net deposits despite a precipitous drop in trading activity following the COVID bubble was quite impressive to us:

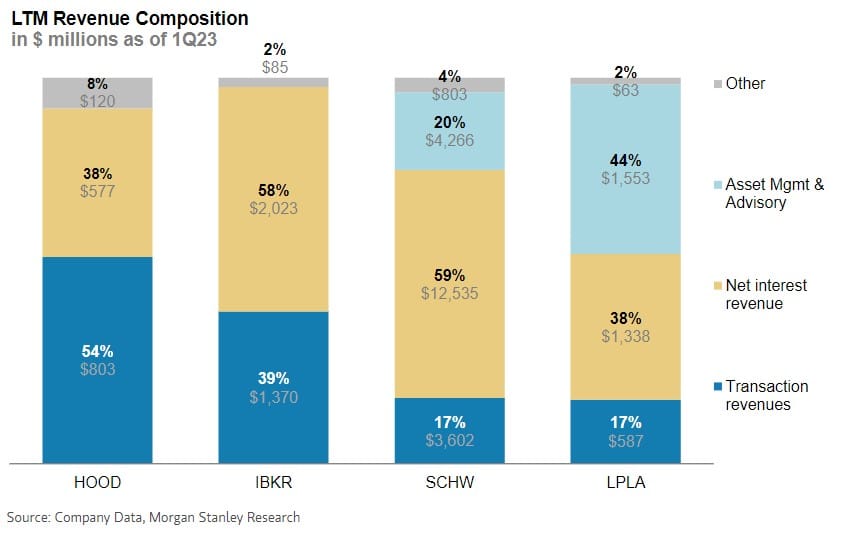

Robinhood (and most other online brokers today) does not earn revenue off of trading commissions. But that does not mean that Robinhood does not make money off of stock and options trading. Here is a comparison of the revenue breakdowns for some of the larger brokerages:

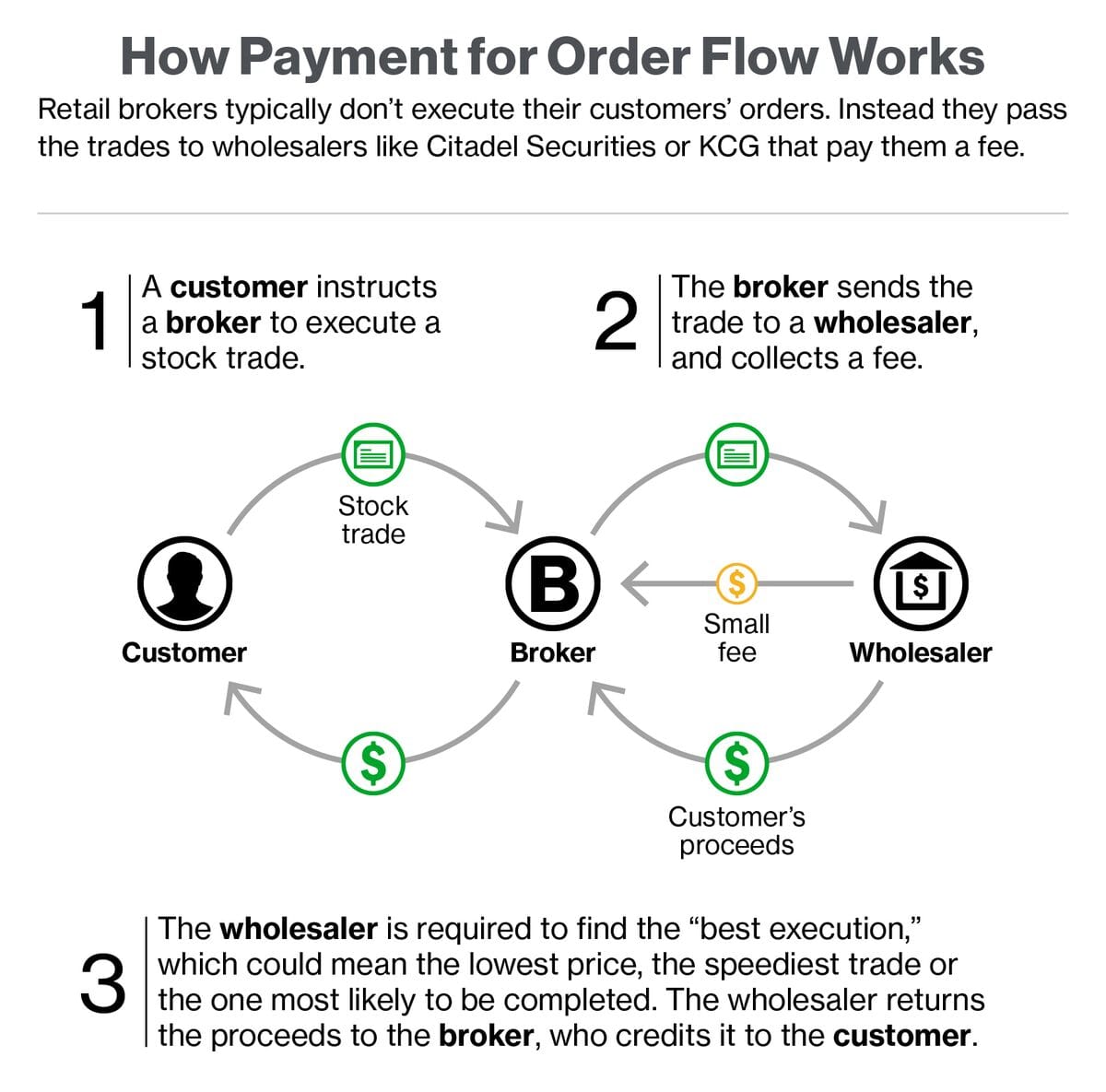

Robinhood’s transaction-based revenue comes primarily from PFOF. Below is a graphic explaining how this works. Instead of executing customer orders itself, Robinhood routes those orders to a wholesaler, like Citadel, who “makes a market” in the securities HOOD’s customers are trading. The market maker earns income from the difference in the bid-ask spread for those securities and gives a portion of that revenue back to the broker in exchange for receiving the orders.

Source: Bloomberg.

PFOF is prohibited in other countries like the UK and Canada, and the SEC considered outlawing the practice last year, but has since decided that it will not seek to ban PFOF. In response to the GME controversy, Robinhood developed a routing system that forces market makers to compete for order flow by incentivizing the best order execution. While PFOF originally constituted upwards of 80% of HOOD’s revenue, today that number has dropped to around 40% of the company’s gross revenue.

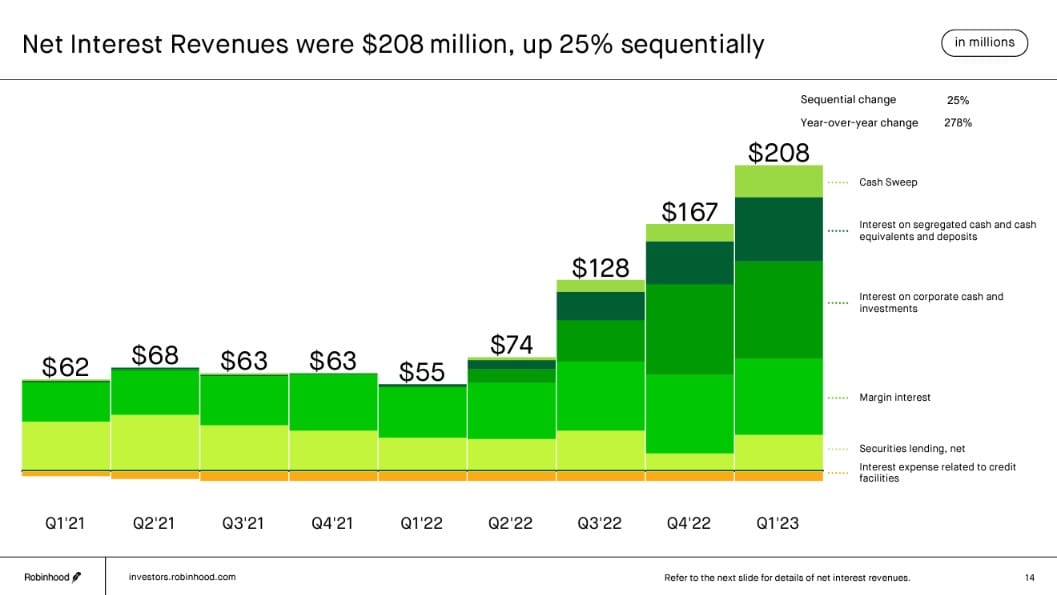

Currently, Robinhood is generating significantly more revenue from sources other than PFOF. Following the substantial rise in interest rates over the last 12 months, net interest income now constitutes almost half of the company’s revenue. As mentioned earlier, the company has around $6bb in corporate cash that it has invested in short-duration interest-bearing assets. Additionally, the company earns a spread (roughly 50 bps) on customer cash. Further, like ordinary brokerage firms, HOOD generates interest income from margin and securities lending. The growth and breakdown of net interest income is shown below:

Lastly, HOOD has several other unique revenue drivers, like its $5/month Robinhood Gold subscription business and fees from its spending card program. A Robinhood Gold subscription includes:

- 4.65% interest on your uninvested brokerage cash with cash sweep (1.5% without Gold)

- Bigger Instant Deposits

- Professional research from Morningstar

- Level II market data from Nasdaq

- Access to margin investing at 7.75% (11.75% without Gold)

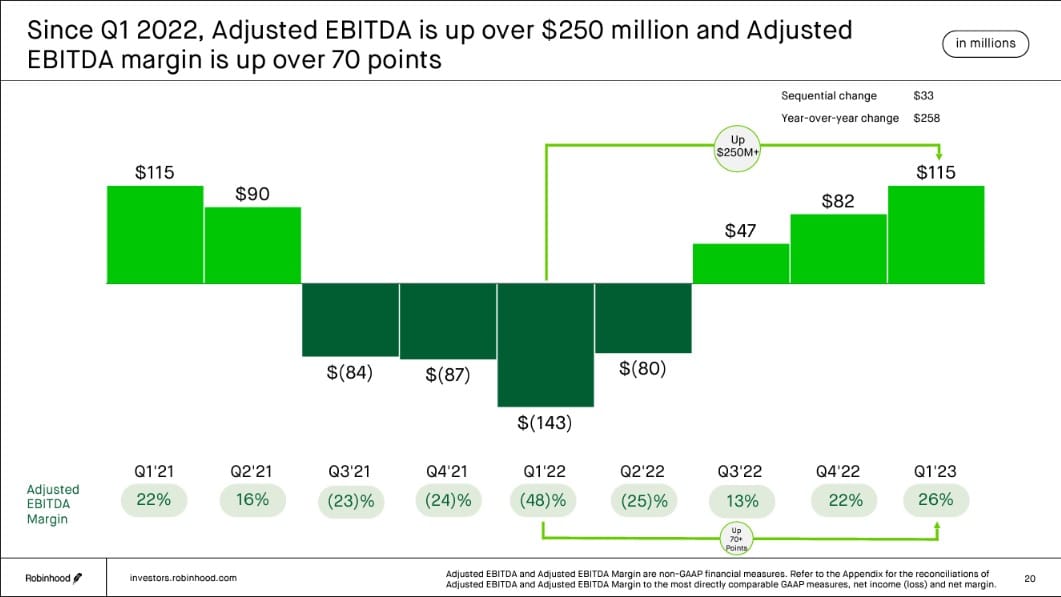

One of the most impressive things we discovered when reviewing HOOD’s financials is the substantial cuts to operating expenses that the company has made in the last few quarters. While most of corporate America continues to pay lip-service to the idea of cost cutting, HOOD is actually doing it, including the company eliminating 1,150 positions over the last two years. This has led to a substantial drop in operating expenses, resulting in a sharp rise ($250mm swing year over year) in quarterly EBITDA:

Unlike anything else we have ever seen, Robinhood’s founders voluntarily canceled nearly $500mm of their own previously-awarded stock options in an effort to bring costs down.

HOOD’s Revolutionary Platform.

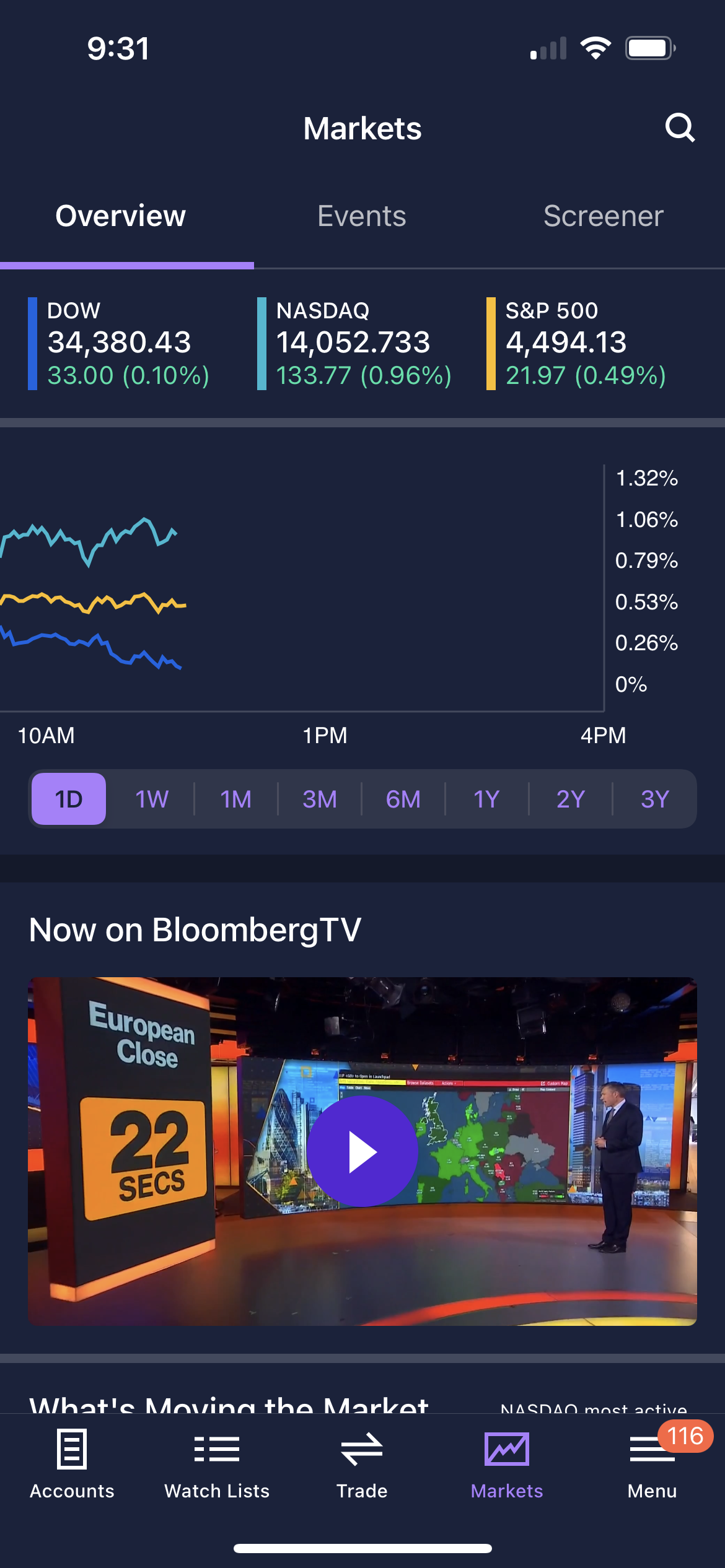

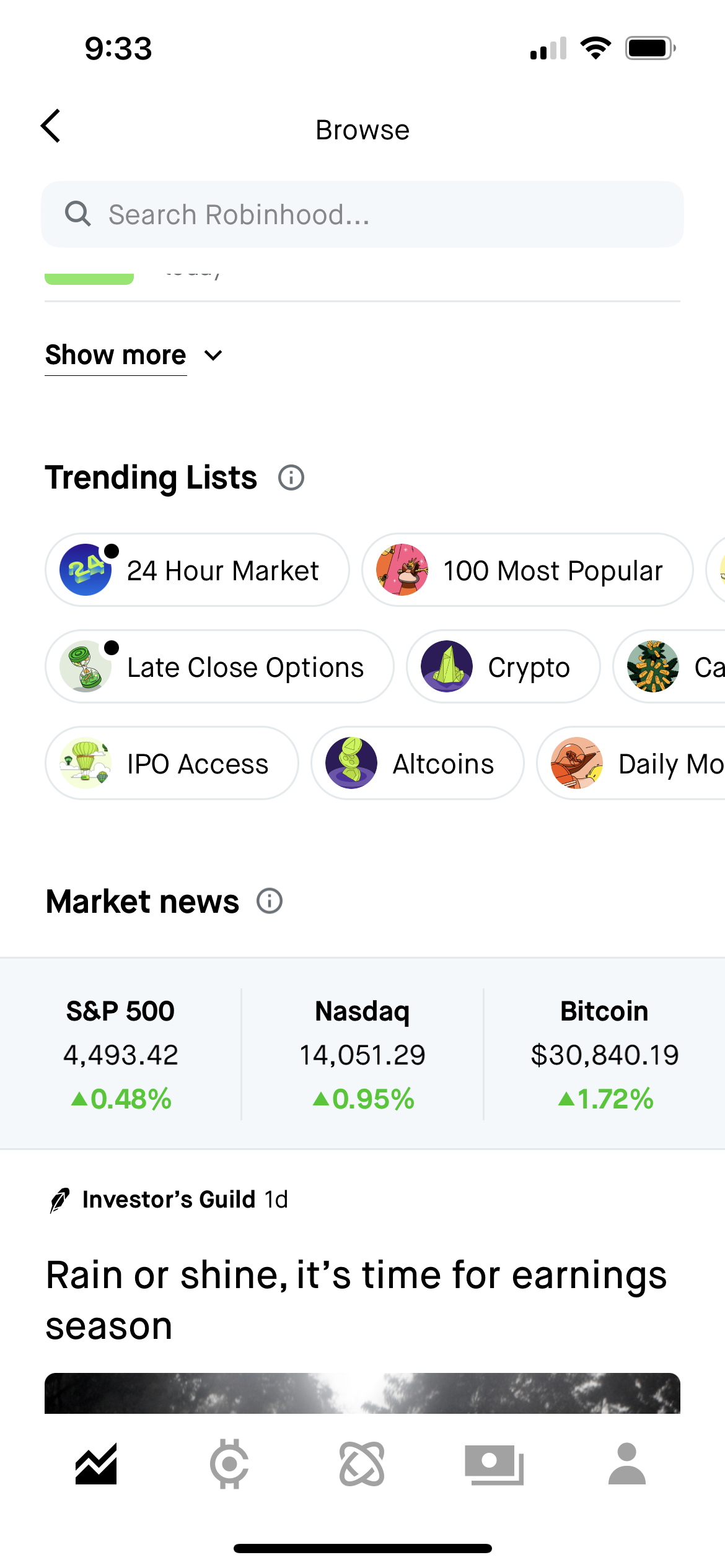

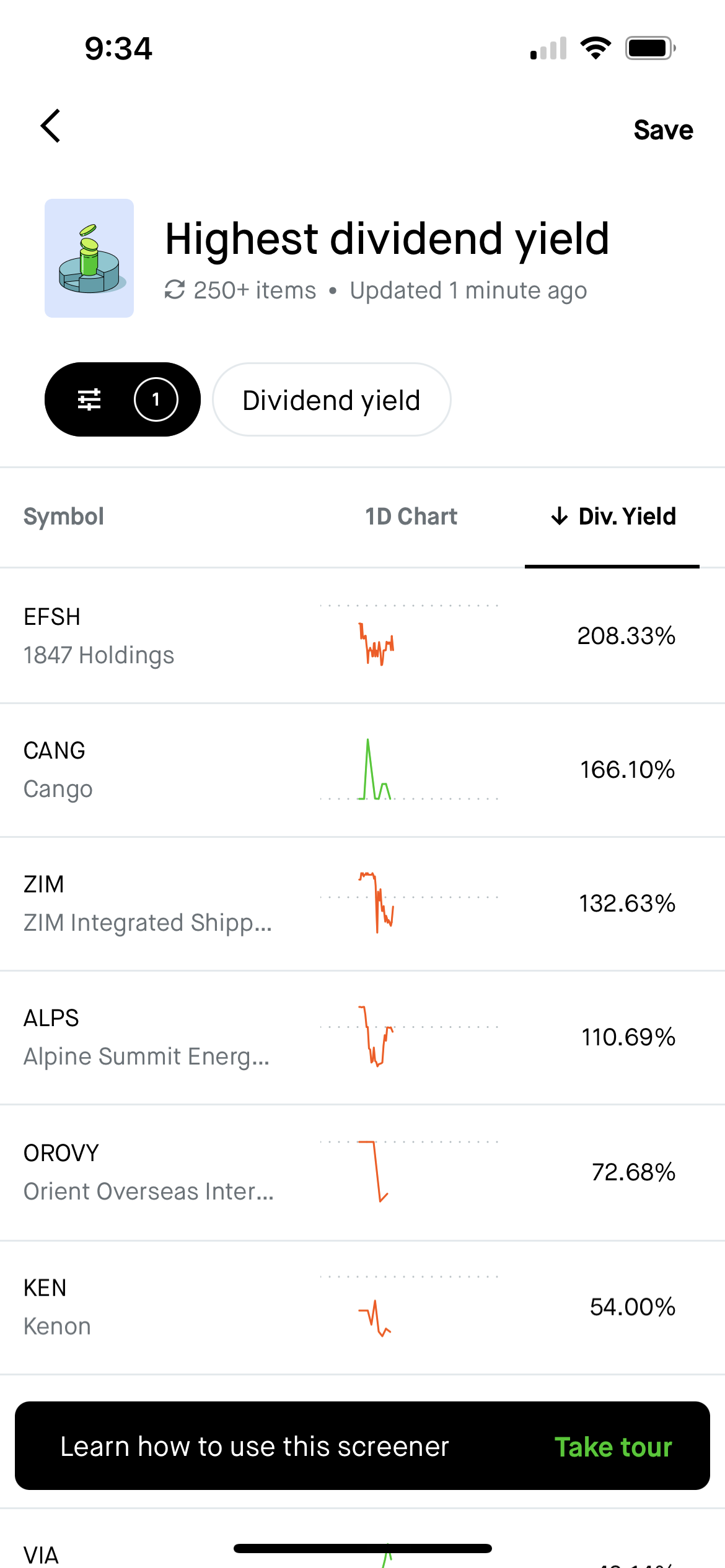

Robinhood is, in our opinion, the most Revolutionary financial app available today. It is amazing that Robinhood is one of the only major apps where you can consolidate investing, spending, saving, and crypto in one place. After using the app and comparing it to other brokerages (E*Trade and TD Ameritrade), spending apps (Cash App, Venmo and Paypal), Crypto Exchanges/Wallets (Coinbase Metamask), and banking apps (Wells Fargo and Chase) over the last few weeks, Robinhood clearly wins in terms of its intuitive user interface and comprehensive set of products. With the exception of its relatively simplistic, and frankly disappointing charting features, Robinhood continued to shock us with its advanced level of functionality and ease of use. In case you have never used or looked at Robinhood before, here are a few pictures showing the difference in the user interface and functionality between it and E*Trade on the mobile apps:

Comparison of the home/markets pages:

Order entry screens:

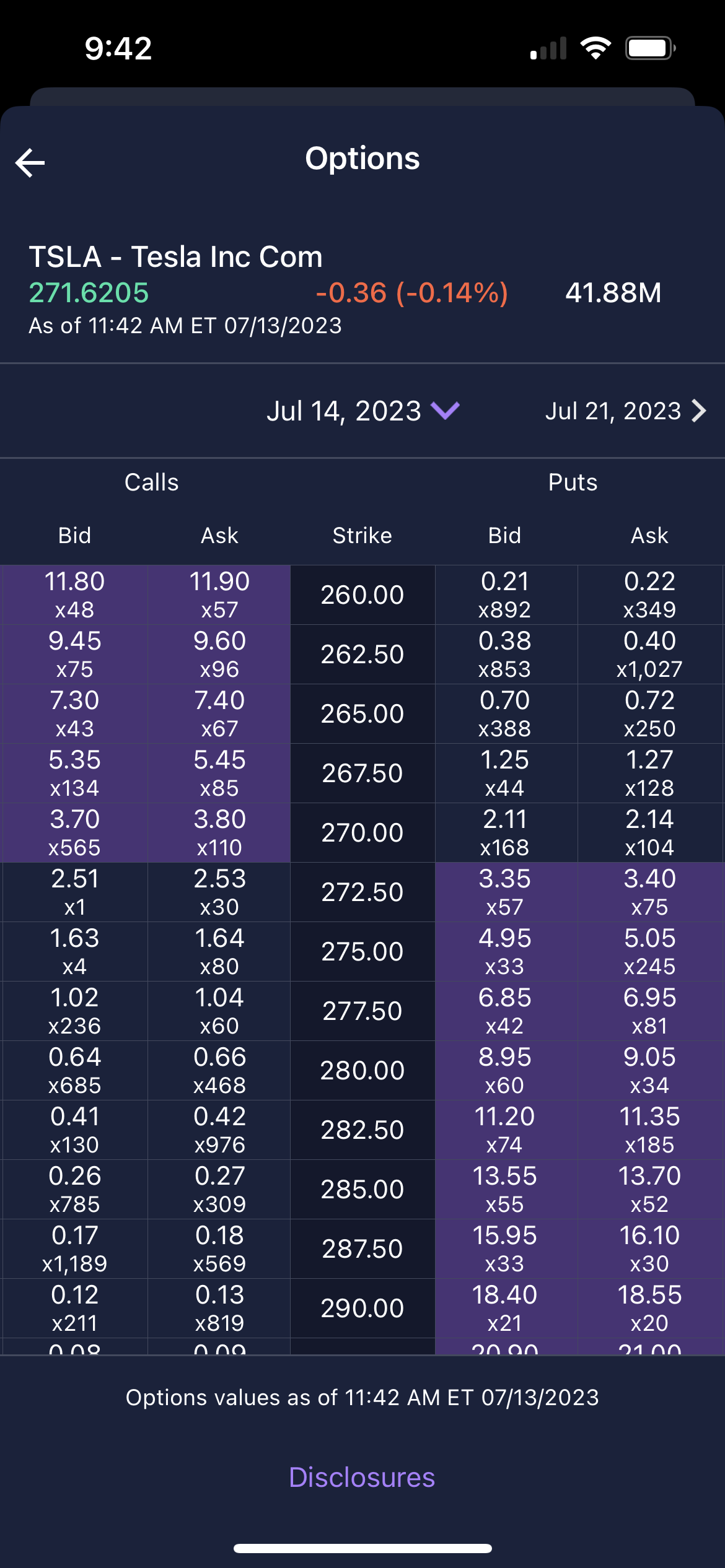

Options chains:

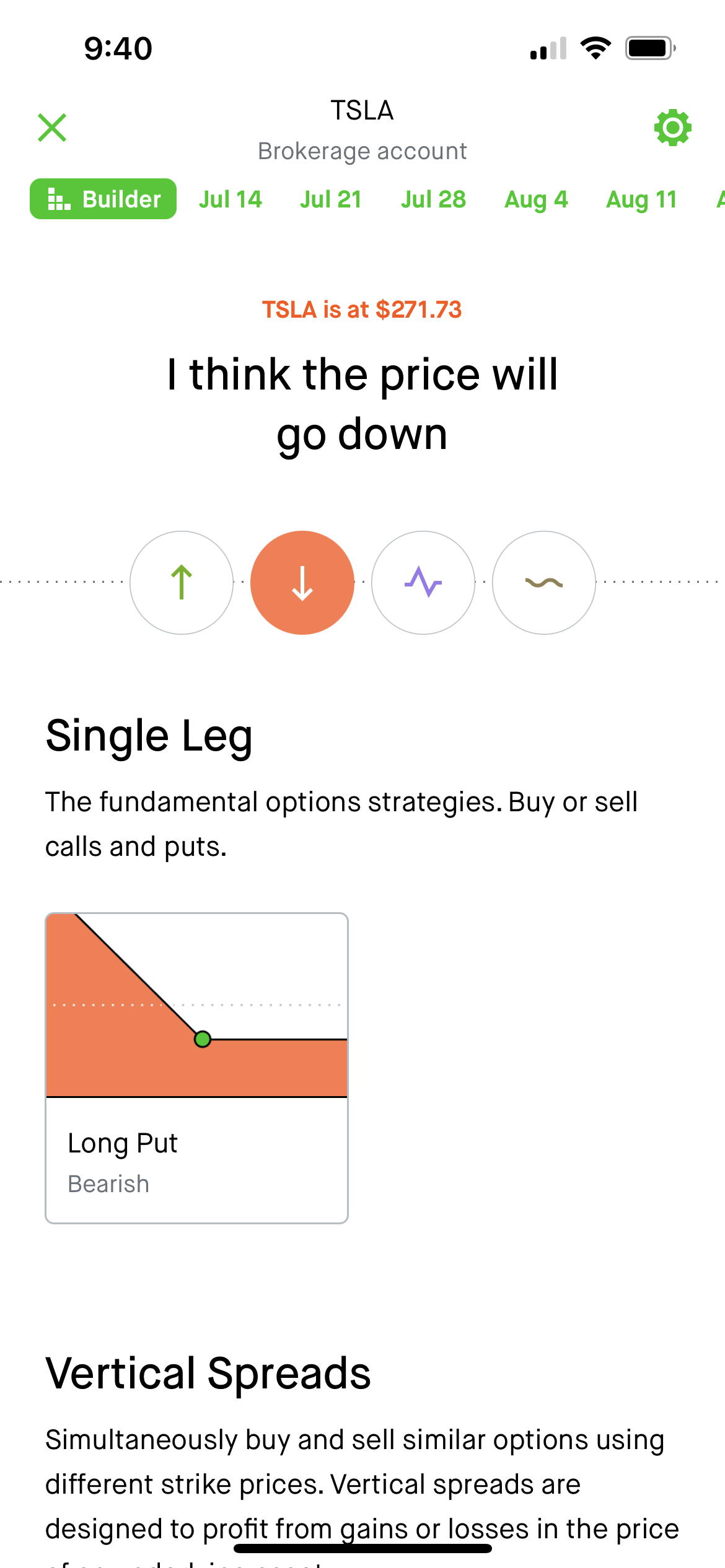

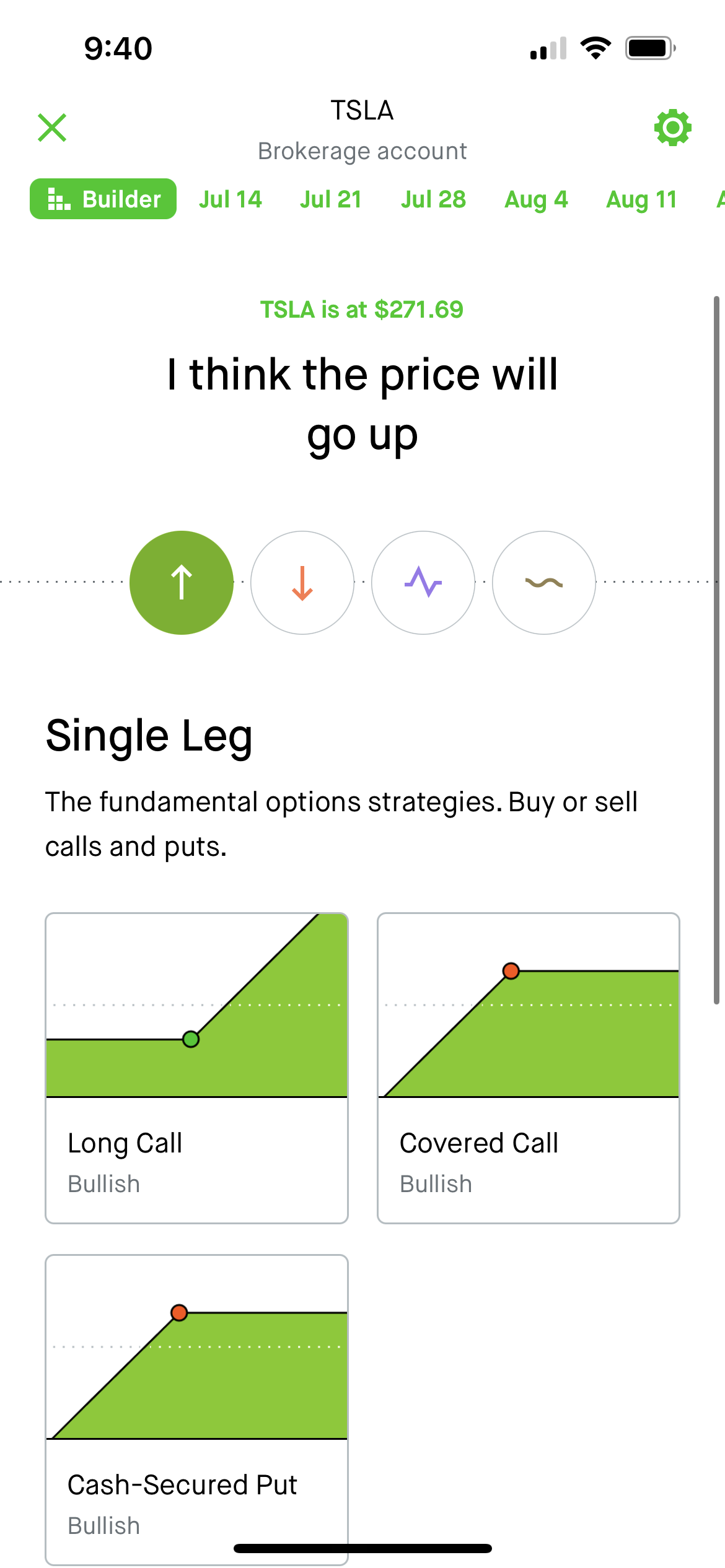

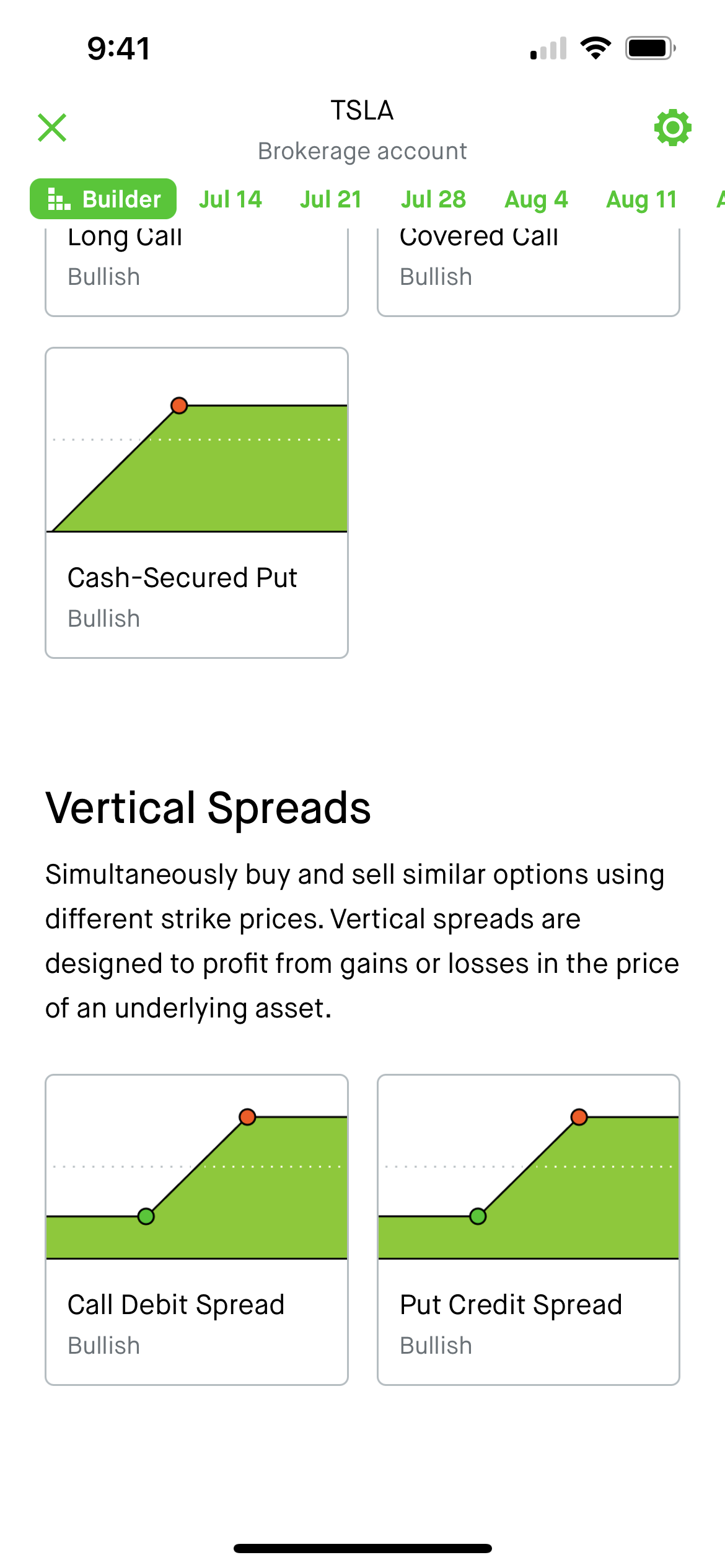

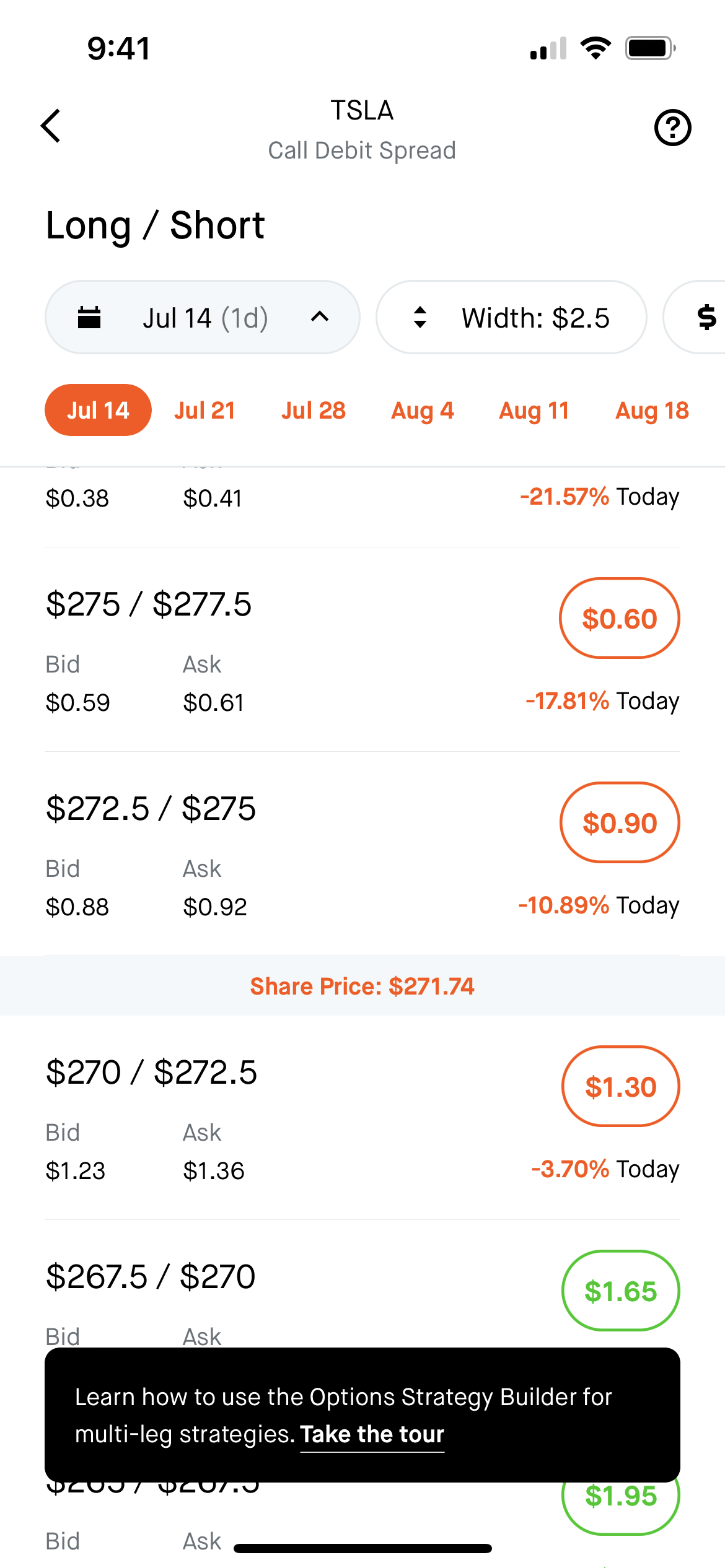

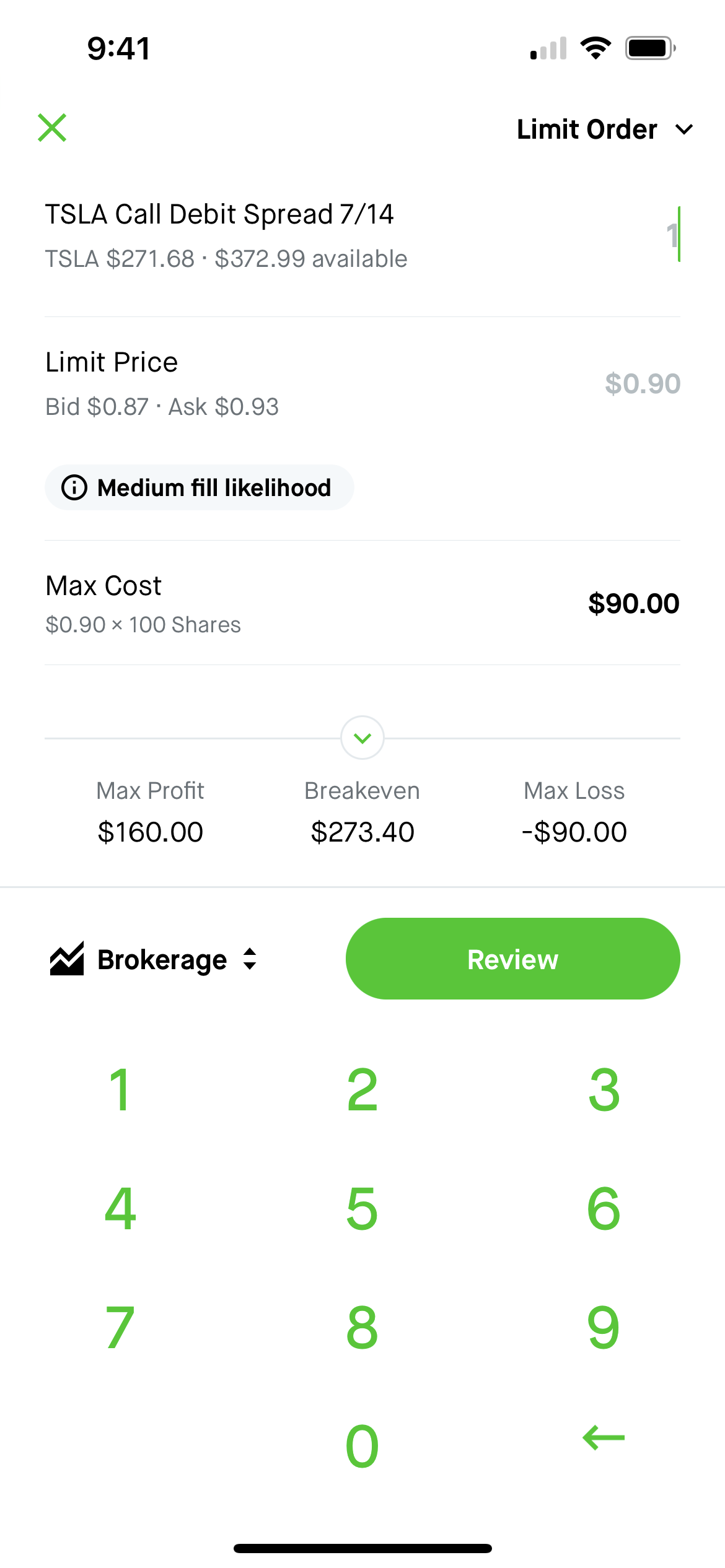

What’s cool about the Robinhood options screen is that it will automatically suggest and build options strategies for you based on what you think the stock price will do. E*Trade does not have comparable options building on the mobile app. Here is an example of building out a vertical call option spread on TSLA:

By simply selecting the spread width and expiration dates, HOOD will automatically choose the options to buy/sell and show you your max profit, breakeven stock price, and max loss on the trade:

And if you are confused about the proposed trades, Robinhood has an extensive knowledge place to educate new investors:

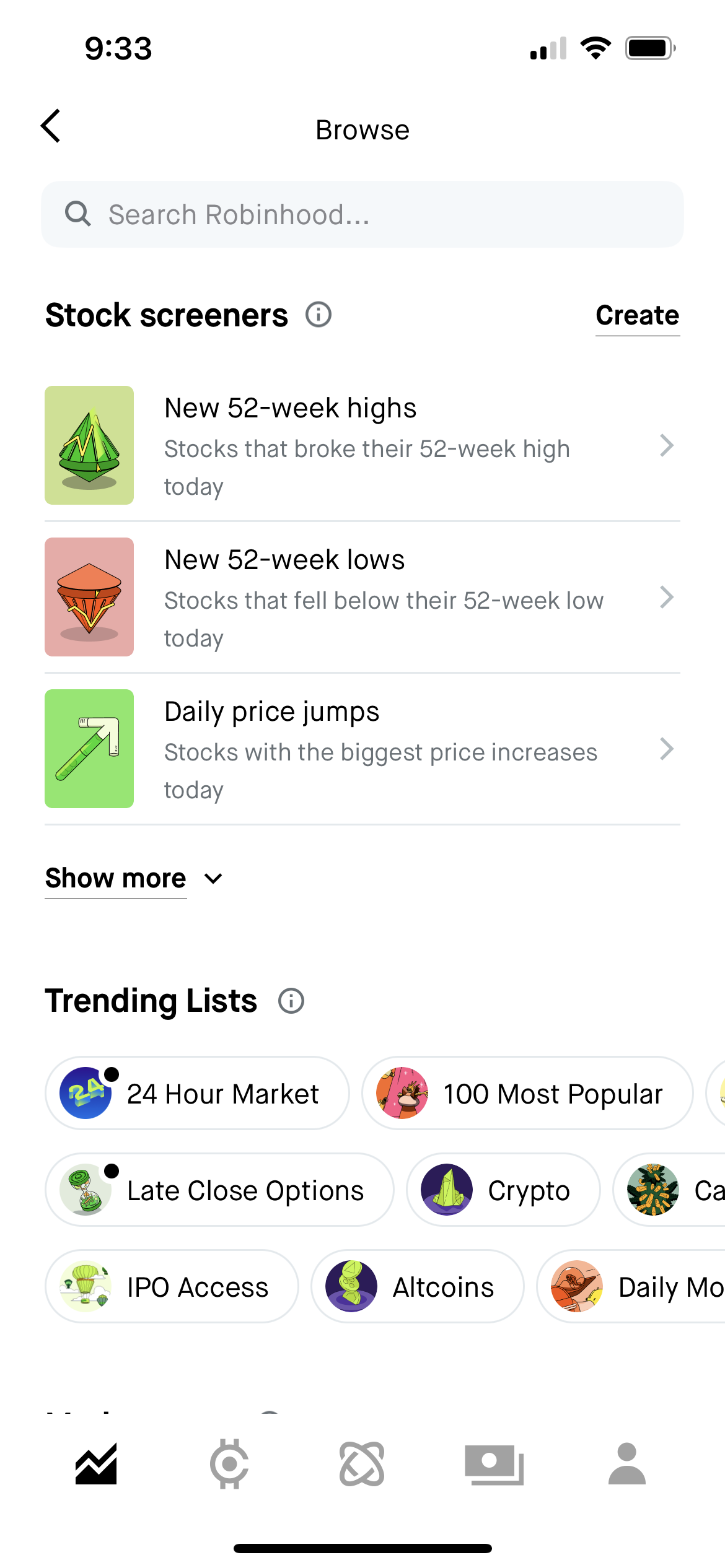

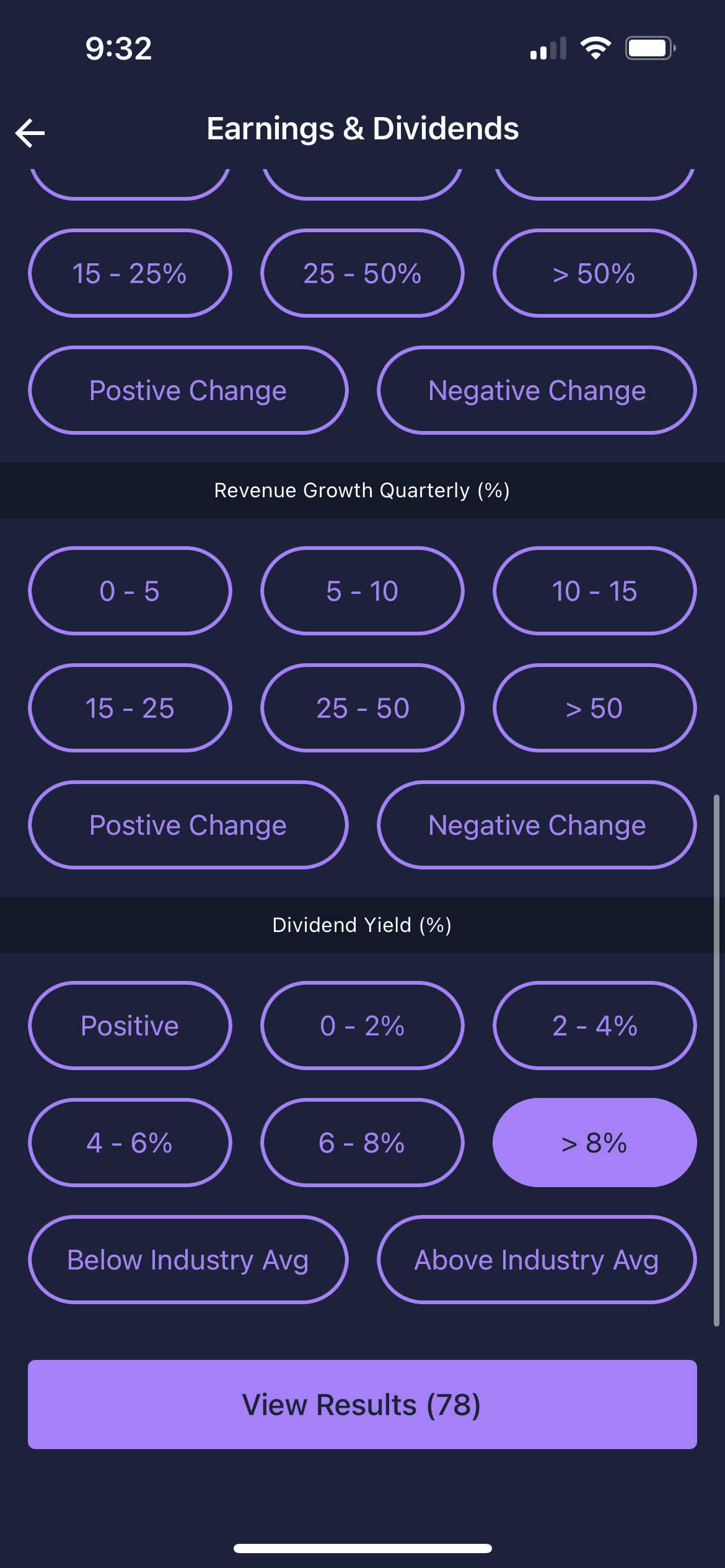

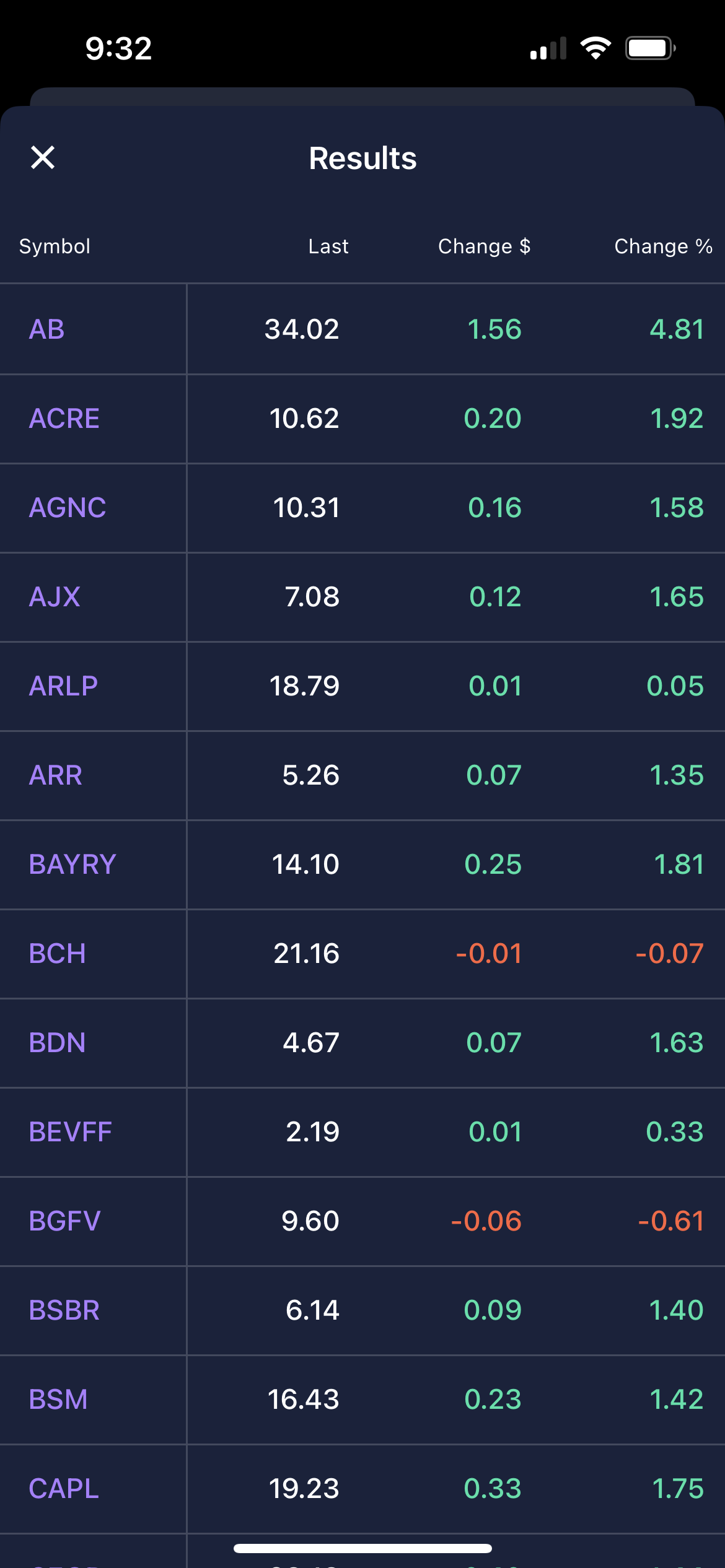

We also really like Robinhood’s stock screens (including pre-built and customizable screens) which offer some unique search categories that we have not seen on other brokerage apps. Here’s the comparison with E*Trade:

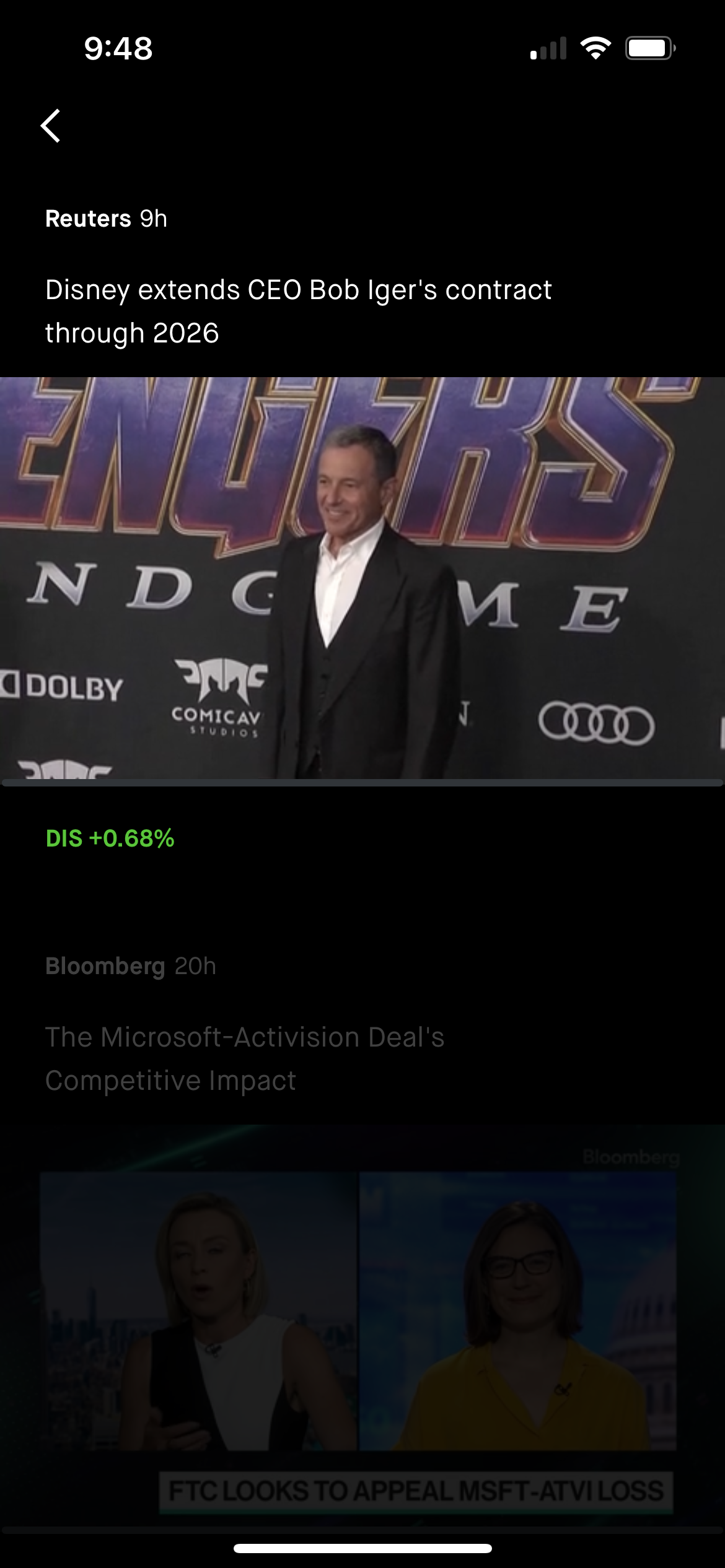

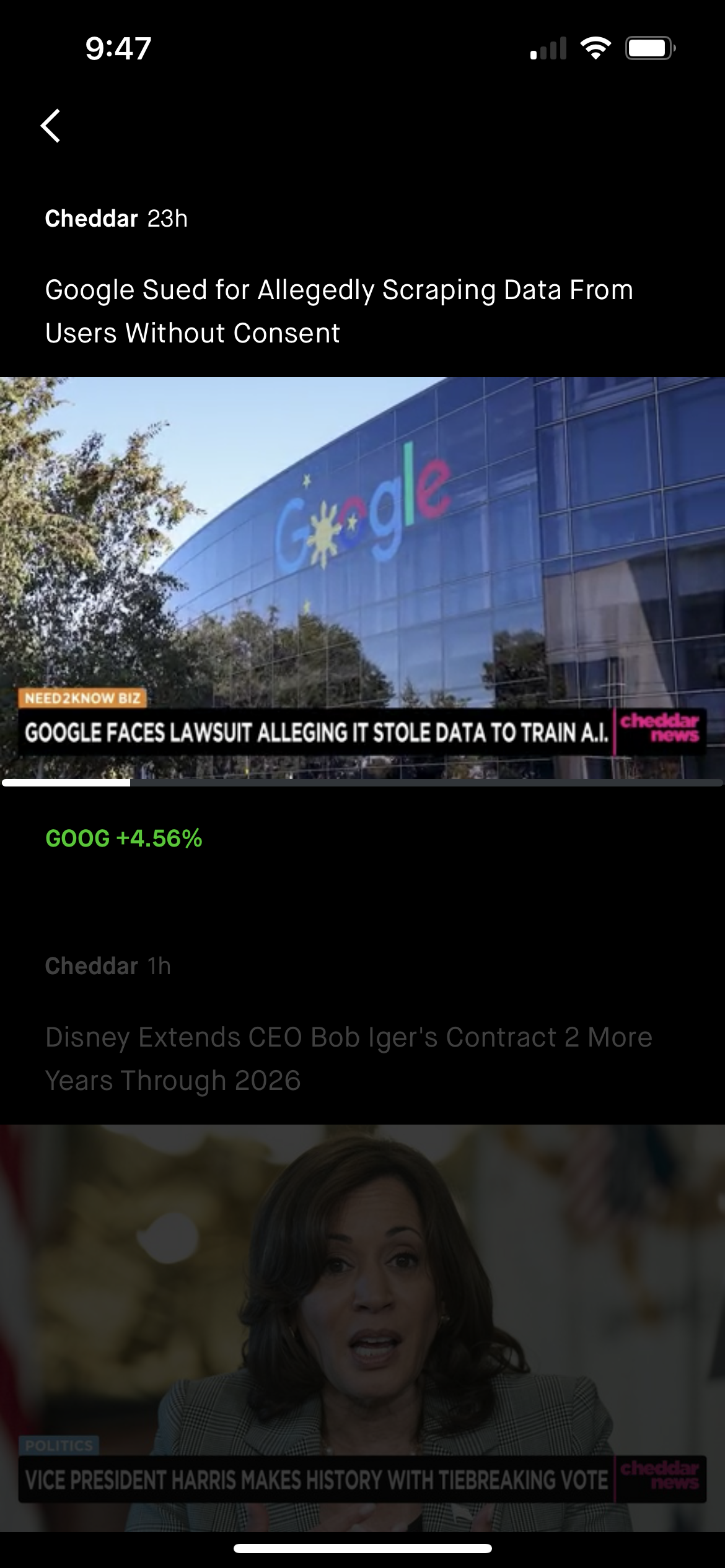

Lastly, another great feature we found on Robinhood is a TikTok-like video feed of relevant market and stock news (again, nothing comparable on E*Trade):

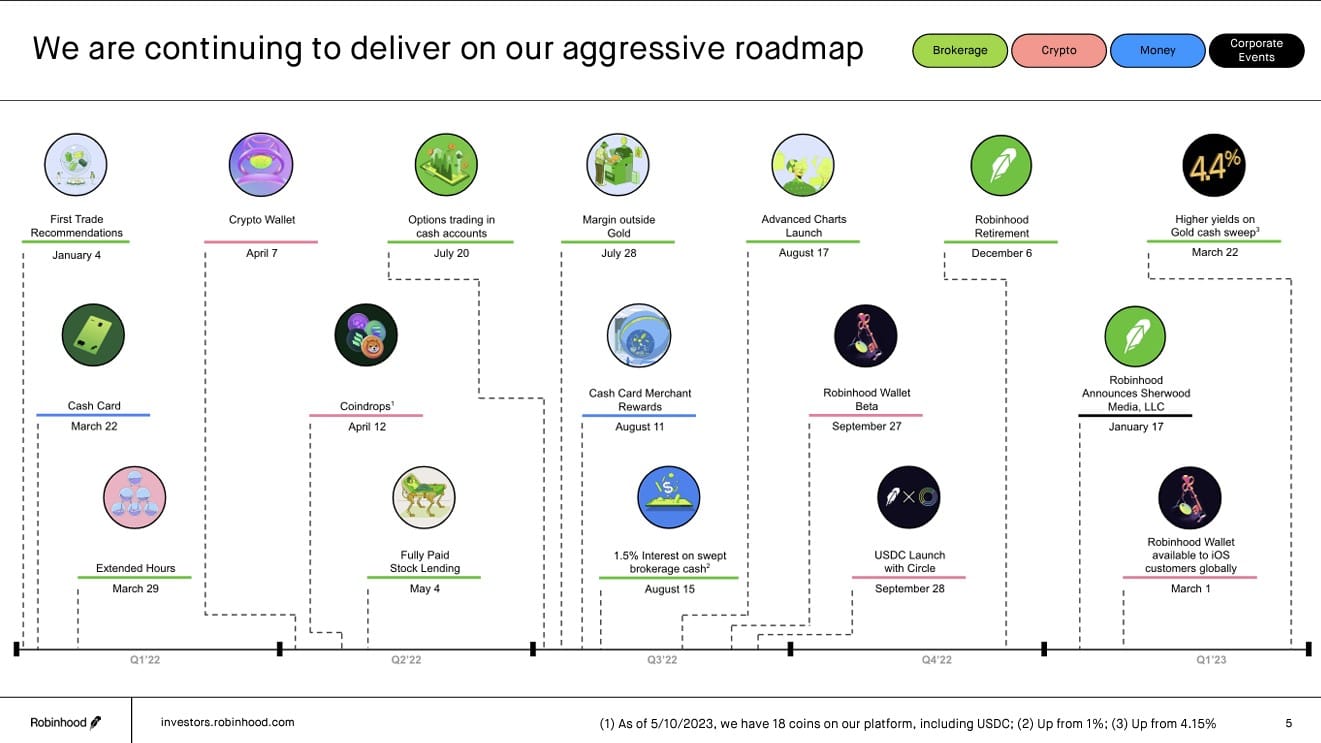

Robinhood is in a relentless pursuit of innovation and continues to roll out new and exciting products at a breakneck pace. The chart below shows the products that they have rolled in just the last 12 months:

HOOD’s New Products And Growth Opportunities.

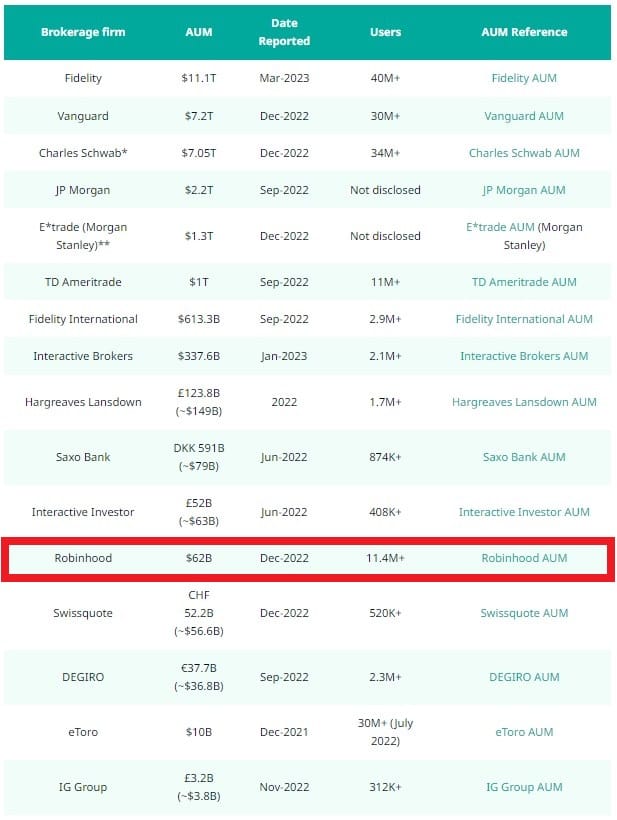

At the outset, it is worth noting that Robinhood is still a tiny player in the global brokerage and asset management business. The chart below compares the assets under management (AUM) of the various brokerage firms:

Source: InvestingInTheWeb.com

With only about $80bb under custody, Robinhood has lots of room to grow if it can continue to gain share from existing players like Fidelity ($11.1tt AUM), Schwab ($7.6tt AUM), or Interactive Brokers ($338bb AUM). Right now, Robinhood customers are depositing $1.5bb per month into the platform up from an average of $1.4bb per month in the prior year (7% growth in monthly deposit rate). Robinhood’s current customers are still very small (average account size comes out to ~$3,300), and with the constant addition of new features for sophisticated investors/traders, we see substantial room to the upside as new clientele adopt the platform.

With respect to the newer offerings, there are three products that have us really excited on Robinhood’s growth prospects, in addition to simply capturing share from existing players: IRAs, Crypto, and Advisory.

- IRA with a 1% Match.

Earlier this year, Robinhood introduced a first-of-its-kind IRA product which includes a 1% match on all contributions (no limit). While IRAs are nothing new, this product was created to offer self-employed workers and those in the Gig Economy access to a quality retirement product like those who work for big corporations. According to McKinsey, last year 36% of employed workers, or the equivalent of roughly 58 million Americans, identify as independent workers. This is up from 27 percent of the employed population in 2016. We think Robinhood could integrate with Uber, Upwork, and other platforms and allow workers to automatically deposit a portion of their paychecks every week into their Robinhood IRA. Like with its brokerage accounts, Robinhood will make money on transaction revenue, net interest income, etc. We expect in a few years, there could be tens, if not hundreds of billions of dollars flowing into IRAs on Robinhood to take advantage of the 1% match, as no other platform offers a competitive match on IRAs for self-employed and Gig workers.

- A Legal Crypto Marketplace And Non-Custodial Wallet.

Crypto looks like another great growth area to us. Obviously, crypto as a whole has been in a slump since the Bubble-Blowing Bull Market™ popped in 2021. But that said, you all know that we still think crypto will be a long-term secularly growing industry. Robinhood has long offered crypto trading on its main app, but it recently offered a separate non-custodial wallet to hold and store your crypto. For those unfamiliar, if you keep your crypto in Coinbase or Robinhood directly, you do not actually hold the crypto. Rather, those companies act as custodians for you and hold it on your behalf. The risk with custodial wallets is that if the custodian goes under, gets hacked, etc., your assets could be tied up in bankruptcy or lost completely since you do not actually hold the crypto. The disadvantage of a non-custodial wallet is that you cannot trade or exchange crypto directly from the app, but instead must transfer that crypto back to a custodial wallet with Coinbase or Robinhood.

What sets Robinhood apart with respect to crypto is that Robinhood, as far as we can tell, is actually following the securities laws, unlike Coinbase. Robinhood is a registered broker-dealer and thus is subject to all of the SEC requirements that come along with that. Meanwhile, Coinbase is openly flouting securities laws by operating as an unregistered exchange, selling unregistered securities. Hence the reason why the SEC is suing COIN (and Binance) and seeking to shut down its business. With FTX gone and COIN and Binance on the ropes, we think HOOD stands as potentially the ultimate winner in the crypto wars. Robinhood only offers 15 cryptocurrencies to trade, whereas Coinbase has around 250 (99% of which we think are scams and will eventually be worthless). Additionally, on Robinhood, you can seamlessly move your crypto between the trading platform and the non-custodial wallet without any fees since it uses the Polygon network. This is a stark difference compared to our experience with Binance, Coinbase, and Metamask, where you usually end up paying around 5% every time you move your crypto around. With Robinhood now offering a non-custodial wallet to safeguard your crypto, plus a lawful platform to buy and sell the few legitimate or semi-legitimate coins, we think Robinhood is perhaps the best play on the ongoing Crypto Revolution.

- Potential AI-Powered Advisory Service.

Lastly, Robinhood is currently working on a Financial Advisory feature that it plans to roll out by year-end. While details on the offering are still secretive, we think that there is a very good chance that Robinhood is building out an AI-powered financial advisor. While there are other companies who currently offer “Robo Advisors,” given Robinhood’s track record of rolling out extremely user-focused and intuitive products, we expect Robinhood’s AI Financial Advisor will quickly become the industry leader. In the long term, Robinhood’s CEO has stated that he expects the Advisor service to provide the quality of service expected with traditional financial advisors, but without the standard 1% AUM annual fee.

Discussion of Downside Risks.

The primary risk to owning this stock is that the company’s growth could stagnate and/or Robinhood stops innovating. We think both of those are fairly unlikely given management’s track record to date. Robinhood handily dealt with the GME fiasco and continues to grow deposits and accounts despite the significant negative PR that followed. As demonstrated above, the company is not slowing down its product rollouts and has continued to accelerate growth while simultaneously cutting operating expenses and staff.

Robinhood obviously faces competition in the brokerage industry from established players like E*Trade and Charles Schwab. Additionally, there are other startup FinTech companies like Block (Cash App), WeBull, SoFi, PayPal, Chime, etc. that offer products that overlap with Robinhood in one way or another. That said, we have not seen any other app that offers anything close to the comprehensive set of products available on Robinhood (stock trading, options, stock screens, crypto exchange + non-custodial wallet, spending card, IRAs, etc.). We think legacy players and newer entrants alike will continue to play catch up while Robinhood proceeds with its lightning-fast pace of innovation. However, Elon Musk has indicated that he intends to make Twitter into the “everything” app which would likely include a payments option. Elon and team are probably the only competitors we would seriously worry about matching or beating Robinhood’s level of innovation.

As a regulated financial institution, Robinhood also faces risks from changing securities laws and regulations. As mentioned, the SEC contemplated banning PFOF which would instantly eliminate nearly half of HOOD’s current revenue. While the SEC has indicated that they are no longer seeking to ban PFOF, that does not mean that another administration won’t seek to do so in the future. Additionally, HOOD is subject to certain capital/collateral requirements and the company could go under if it is unable to meet those requirements in the near term. For example, when the GME Fiasco went down in early 2021, HOOD was forced to raise over $3bb in capital in less than 72 hours to stay afloat. However, with over $6bb in unrestricted cash sitting on the balance sheet, we think HOOD is more than adequately capitalized.

Summary.

With the potential to become a Financial/Investing SuperApp, massive new Revolutionary growth drivers, and a management team that has simultaneously (1) rolled out tons of new products; and (2) substantially increased profitability, Robinhood is the FinTech stock to own in this market. With a comprehensive suite of Revolutionary financial products and more to come, Robinhood is a platform play that we can get behind. Robinhood is continuing to empower the end user and is looking to take an increasing share of a $30tt+ addressable market. With this in mind, we think HOOD has the ability to achieve a $100bb+ valuation in the next 7-10 years.