Seeing The Flip Side Of The March Stock Market Crash

Jumia is straight up since we sent out the Trade Alert about it a couple days ago. I don’t know why. The chart is now parabolic and I’d have a hard time buying any more than just the tiniest of nibbles for now. Maybe it will keep going straight up, but I’d venture a guess that we’ll see this stock below $20 again at some point in the coming weeks. If not, we’ll have to pay up a bit to scale into more. Let the pitches come as they may.

Tesla hit yet another new all-time high today. The company was worth $30 billion when we loaded up on it. It’s worth almost half a trillion dollars now. Can I get a woo whoo and a hoo hoot?! Consider trimming a little of this one, even just 5% of it if you haven’t trimmed it at all, which I know a lot of you haven’t. I’ve seen Trading With Cody subscribers’ accounts with 25% or 35% or more of their portfolio in Tesla because they listened and made it their biggest position last year when I did. And some of you have literally experienced life-changing growth in your net worth over the last few years with our Trading With Cody stock picks and again over the last year our Tesla pick. Here’s a real, edited, email from last week:

“I hope this finds you and family safe and well. I just want to thank you… As you might remember, I am quadriplegic and live on a income that is fixed. You have provided me a window on a new life I could never have imagined.”

Emails and feedback like this make me so happy about what we’ve done. But as always, things can go wrong. Markets can crash. Economies can seize. War can break out. Interest rates can spike. Meanwhile, once again, most of us are finding our portfolios at or near all-time highs and so I humbly suggest and remind all of you to consider taking something off the table in TSLA if you haven’t yet. And maybe trimming a few other names if you’ve been buying too much again and find yourself closer to fully invested than you might should be right now.

Speaking of what can go wrong — the single biggest reason I’ve been cautious is because unemployed and/or marginally employed people are suffering badly and so are small businesses. But there are plenty of other worrisome things I want to highlight today but before I do, let’s recall that I don’t reel this cautiousness off lightly. You all know that I’m perfectly willing to be wildly bullish about technology and optimistic about the economy and the US and that such a state of mind is typically mind default. Look back to March when the markets were crashing creating what I saw as value and opportunities:

Don’t doubt the USA or mankind’s ability to prosper

March 18, 2020 by Cody Willard

We’re living through a crash. We might have just lived through a crash. But we might still be in the process of living through a crash.

The markets hate confusion. The markets can’t discount future cash flows if nobody has any idea what future cash flows will look like post-Coronavirus Crisis time. We don’t even know at this point if there will be a post-Coronavirus Crisis time.

The changes in our society from this Coronavirus Crisis seem huge right now. And it’s looking like it could be a long time before things return to normal, if they ever do.

Is the market pricing in a full US economic shut down for two weeks? Or is it pricing in for a full shut down for two months? It’s certainly not pricing in a full shut down for the next two years (yet?). I’d guess we’re somewhere near pricing in a full shut down for the next two months after today’s rout.

Is the Coronavirus Crisis going to break the global economic system itself? Or will all these supply chain factories and economic ecosystems correct themselves right back (perhaps even at Kurzweil Rate of Change Speed). Will all these people being laid off at retail shops and restaurants and casinos be rehired right back again in a few months.

Or will people stop going to restaurants? Will people stop going to other countries? Will they go back to working out in gyms? Will basketball remain a popular sport for people to play (not just watch)? Will people get back on airplanes? These are the great unknowns. And that’s what the market is pricing in today. Scary unknowns.

On the other hand, these are some things we do know: People will still buy shoes and clothes. People will still go on social media. They’ll be playing a lot more video games. They’ll be spending more times with their families. They’ll be streaming movies and videos since they can’t watch sports.

I’m pretty sure we’re about to see some serious new innovations and technological revolutions and maybe even more globalization but less so physical world and more so in the virtual societal world. Don’t doubt the US and don’t doubt the ability of mankind to persevere and prosper in the 21st century.

Here’s my strategy for today and the rest of this week, and it’s a lot like my strategy has been since the Coronavirus Crisis hit.

I’m covering a little bit of shorts. Rolling down some puts, meaning that I’ll sell some, say, SPY puts for $40 or so that I bought for $3 or so a few weeks ago. Then I’ll take some of those proceeds and buy a few SPY puts dated out to the end of this week or next week at or just in-the-money for say $6 or so.

Likewise, I continue to bid on some of my favorite names when the markets get slammed like they are again today, putting bids in below where I last bought them. I’m doing that across the board in most of our long positions, today including some TSLA, SQ, FB, QCOM, TWTR, etc.

Or here:

Trade Alert: Prepare For Better Times

March 11, 2020 by Cody Willard

I’m glad I’m not in NYC this week. Wish I hadn’t taken my family there last week. There’s no doubt that the developed world has become Coronavirus obsessed. I would imagine a lot of this germ-phobia is going to stay with us, and that next year flu contractions will be down 20%.

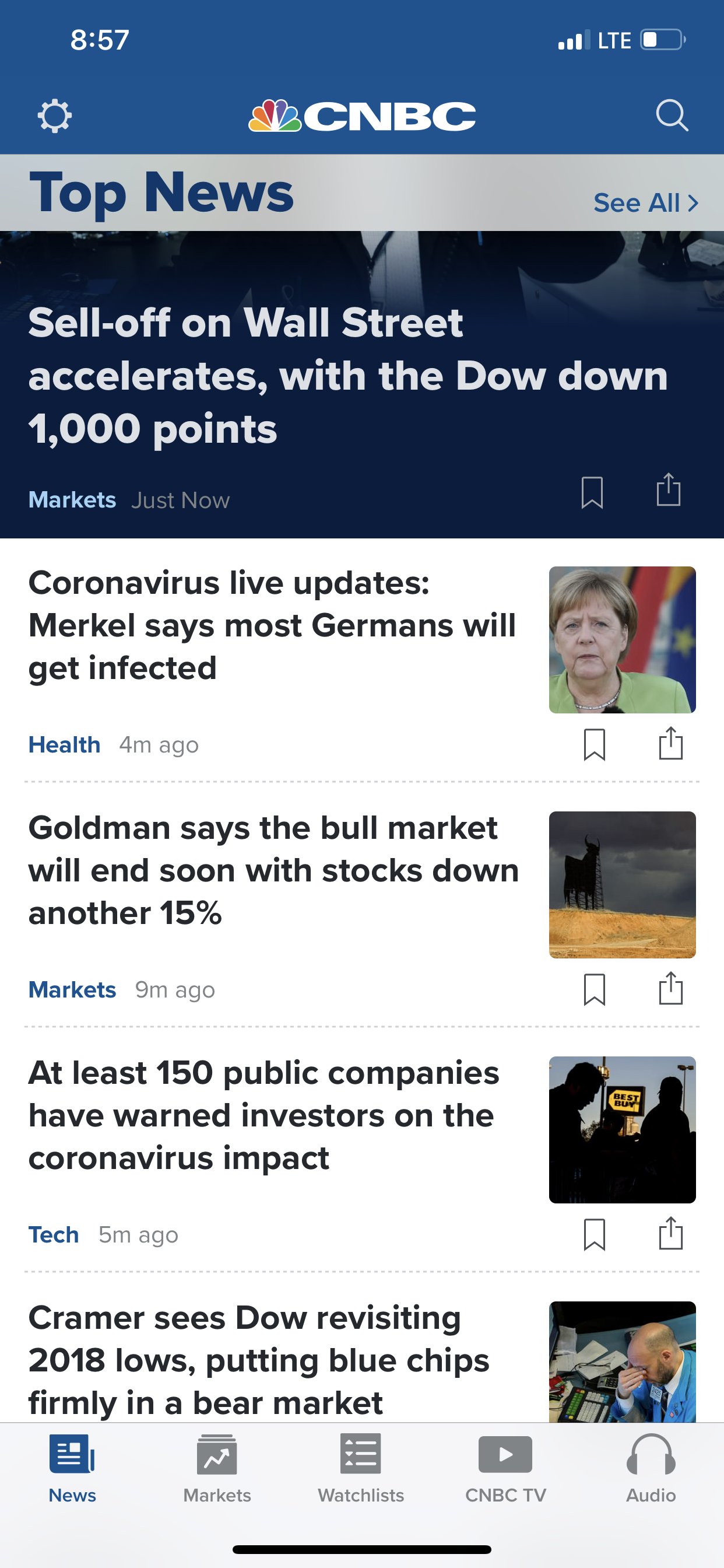

The stock market headlines are full of fear, warnings and what I might even call hyperbole. Here’s a screenshot I took from my phone this morning:

I know it’s hard to see past Coronavirus right now. Just like it was hard to see how stocks could ever pullback 20% when they were at their all-time highs, like just three weeks ago. Here’s what we should think about anytime we make a buy or sell decision, but especially right now. If everybody is scared about the real-life ramifications that they’ll be experiencing in coming weeks, and if everybody recognizes that earnings will be hit this year from Coronavirus, and if everybody thinks that the stock market the market is just about sure to go down (at least) another 10-15% and that the stocks can’t go up until after the Coronavirus has peaked and that won’t be for at least another quarter or two…

Then isn’t all of that exactly what the market is pricing in already? Look, I’m certainly not going to declare a bottom and cover all of my shorts (at least not yet). But I do think the risk/reward of scaling into more long exposure when you and everybody can’t imagine that stocks can go up in the next few weeks or months is probably pretty ideal, risk/reward-wise.

Again, I’d been predicting and preparing our portfolios some very bad Coronavirus scenarios since late January when the markets were at all-time highs and it was hard to picture that Coronavirus could impact things at all, much less the extreme manner in which has turned out to impact things (I did not expect the impact of Coronavirus to be this extreme). And it’s possible that the markets could outright crash another 30-50% or more if NYC and Seattle and LA and Chicago and the whole country gos on lock down for the next two months. So let’s not pretend otherwise and let’s make sure we’ve got some room to handle such a worst case scenario.

On the other hand, just as I’ve always done, I’ll remind you that we should prepare for the worst of times when things are great — and prepare for better times when things are horrible. The headlines, the markets, the economy — they are all in the horrible category right now. That doesn’t mean they can’t get more horrible-er, but I think that’s what most traders and investors right now, with the markets already down 20-2% from their recent highs, are preparing for.

So here’s what I’m doing today. I’m covering about 20-30% of my larger index shorts, including SPY, DIA, QQQ. I’m nibbling on some of my favorite longs, including CSCO, GOOG, ROKU, SNE. And I’m putting in limit orders 3-5% below the market to buy a little bit across the board in most all of our longs.”

So let’s fast forward to today and re-write a key phrase or two from those articles from the lows with adjustments for today’s reality and where the markets/economy/The Coronavirus Crisis stand now:

Here’s what we should think about anytime we make a buy or sell decision, but especially right now. If nobody is scared about the real-life ramifications that they’ll be experiencing in coming weeks, and if everybody recognizes that earnings will be rebound next year from Coronavirus, and if nobody thinks that the stock market the market is going to go down (at least) 5% and that the stocks can’t go down since the Coronavirus has peaked and that will almost definitely happen over just another quarter or two…

Then isn’t all of that exactly what the market is pricing in already? Look, I’m certainly not going to declare a top and sell all of my shorts (at least not yet). But I do think the risk/reward of scaling into less long exposure when you and everybody can’t imagine that stocks can go down in the next few weeks or months is probably pretty ideal, risk/reward-wise.

The Fed kept Boeing and the airlines and the cruise lines and dozens of other major industries afloat during the worst of the crisis by buying every dollar of debt these corporations wanted to sell. Hedge funds and giant banks front run this constantly too and have made small but guaranteed returns off this cycle. And they’ll do it again and create other programs to keep the game and the markets going whenever they have to. And because the US economy and system of government have always been the cleanest shirt in a dirty global laundry basket, the Fed and the US government can basically do whatever they want whenever they want. Nobody is against bailouts now. Even most libertarians would agree that when a government forces people to stay home and for businesses to shut down in the name of trying to control a pandemic that the government should take care these people that it’s temporarily forcing out of the economic system. But these programs never go away do they? And now a form of PPP, the vaunted Paycheck Protection Program, will always be here, right? After all, all programs from the Great Depression and from the 2008 Financial Crisis are still here.

So buy bitcoin? Yea, stick with bitcoin, but not just because the US financial system is dependent on free money, but also because the whole world is even worse about it. Bitcoin is probably the best positioned currency to some day replace the US dollar as the currency accepted around the world.

The US government is all in on keeping asset prices afloat and earnings juiced. Can it ever step off the pedal? Each politician, each lobbyist, each corporation is using the system to their own means thereby constantly making the system becomes bigger and bigger too. Since 2008, does anybody even pretend not to want bailouts or to be for fiscal conservatism or balanced budgets or the such? Nah.

Back to the negatives, it possible that China’s now the cleanest shirt? Probably not, but its strong economic bounce out of the Coronavirus Crisis has not hurt its global economic standing as a destination for capital. Despite the recent Ant Financial IPO that got pulled by the Chinese Communist Government when Jack Ma apparently tried to publicly push for more power for the company’s business model.

And meanwhile, I keep telling you all that I don’t know why the world and the markets have gotten complacent about the transfer of Presidential power that’s supposed to happen in January. Trump isn’t indicating at all that he isn’t leaving. That’s not bullish in my mind and as the days go by and no indication of Trump planning to leave continues to be the theme, the markets are likely to start thinking about it again.

What do we know about the Coronavirus Crisis now? Things will get worse before they get better. The light can be seen at the end of the tunnel as the vaccine gets closer to distribution.

Look, no easy answers as ever. I pretty much plan to pretty much continue to pretty much focus on great companies at good valuations and managing the markets’ ebb and flow along the way as we always have.

Rock on.