Six Ways To Invest In Facebook Before The IPO

Facebook recently disallowed the trading of its stock on secondary markets like Sharespost and Liquidnet. And with the news that they have chosen to continue the tech tradition of listing on the Nasdaq instead of the NYSE, the IPO is probably less than two months out.

With all this hype and focus on Facebook’s billion dollar acquisitions today, I figured I’d lay out everything I know about the publicly-traded companies who have exposure to the Facebook stock already.

I’m not advocating you go out and get long any of these names, I’m just spreading knowledge you might not be aware off, giving you a jumping off point to do your own digging. That being said I do think owning Facebook pre-IPO could be a catalyst for these stocks in the short term.

You know I’ve been saying Apple will reach $1000 for a long time now—certainly before Piper Jaffrey and Topeka Capital Markets made the call the other day. Well here’s a new prediction; Facebook will hit $200 billion in market cap, that’s Google’s value, within two years. It’ll probably fall far from there, but let’s save that for another time.

So take a look at these names and decide if they are for you. The Facebook Bubble is one of the biggest I’ve ever seen. Intel was a $50 million company when it came public. Now IPO’ing at hundreds of billions is the New Normal. When everyone is that hyped about a company even minimal exposure can make a stock run.

1. Microsoft Corporation (NASDAQ:MSFT)

(Source: Google Finance, 1 yr chart)

Here’s the one you probably definitely for sure know about. Everyone and their mother was HOWLING at what a dumb move Steve Balmer made buying into Facebook at a $15 billion valuation. 5 years and $85 billion later it looks incredibly prescient. More importantly MSFT prevented Google from establishing a relationship with Facebook. Making 7x on $240 million in 7 years would put Microsoft in the .000001% of hedge fund managers. Unfortunately even a ~$2 billion gain is little more than a rounding error for a company with ~$70 billion in revenue.

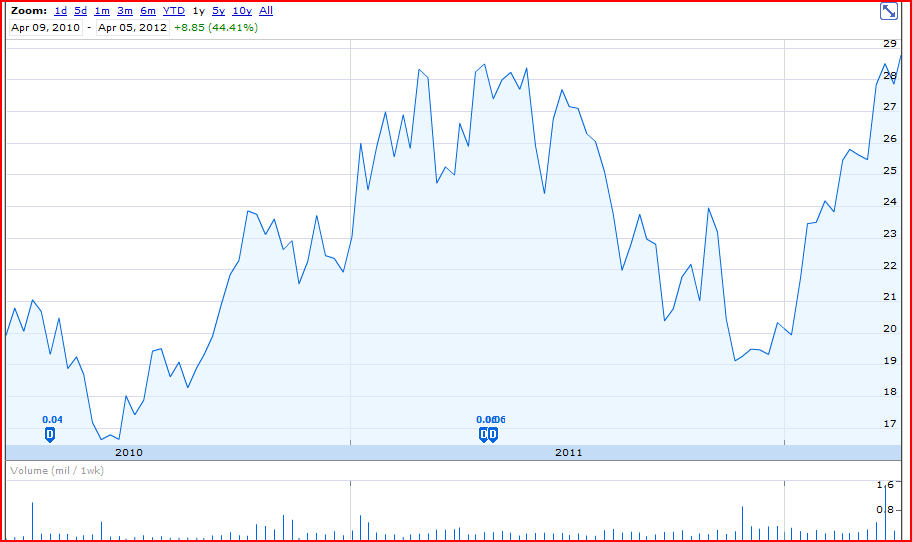

2. Interpublic Group of Companies, Inc. (NYSE:IPG)

(Source: Google Finance, 1 year chart)

Here’s one you likely don’t know about. IPG grabbed $5 of Facebook back in 06’ for an advertising agreement— Zuck & Co. would let them invest if their clients spent $10 million on ads.

Best legal kickback of all time.

IPG owned ~0.5% till they offloaded half at a $65.5 billion valuation (nobody’s perfect).

So if Facebook has almost doubled in value since then, IPG is sitting on ~$200 million of unrealized gains. Not bad for a company with a market cap under $5 billion. If Facebook runs to where I think it will that stake could start to become ~10% of IPG’s current value. It’s already up 43% in the last six months so a lot of this may be priced in—but I still think the stock will pop if Facebook hits $200B.

3. GSV Capital Corp (NASDAQ:GSVC)

(Source: Google Finance, GSV Capital)

GSV is throwback to the days of shell investment companies—something between a SPAC like Ackman’s Justice Holdings (JUSH: LON) and a mutual fund. The company has no ongoing business line of its own; it just buys stakes in tech companies on the secondary markets. Right now GSVC shares of some of the hottest new tech darlings—Gilt Groupe, Bloom Energy, Silver Spring Networks, Chegg, Dropbox, Zynga and Twitter. It even has a stake in the platform where you can buy stakes on the secondary market, Sharespost.

But its Facebook investment is why most people know of GSV. See the little ‘J’ on the chart above? That’s when GSV disclosed it had grabbed 225,000 shares for just less than ~$23. With Facebook’s last tick at ~$44 that’s a respectable gain (GSV’s own shares popped about 40% on the news). If you are hyper bullish on the bubble and are comfortable with paying for illiquid stakes and zero earnings as of now this could be a pretty good high risk/high reward trade.

4. Mail.Ru Group Ltd (MAIL: LI)

(Source: Bloomberg, Mail.ru since IPO)

This one is murky to say the least. Mail.ru is a Russian internet company that is a by-product of Digital Sky Technology, Yuri Milner’s investment firm. DST is one of the savviest internet investors and kind of the Kevin Bacon of hot internet stocks. DST bought its stake in Facebook, (originally 10% now diluted down to 5%) and then stuffed it into Mail.ru. After some typical upper-crust-Russian corporate drama most of Mail.ru’s stake was ceded to its parent DST (Facebook’s SEC disclosure says it is no longer a 5% holder). And while they still own shares I’d rather you wait till Facebook’s IPO than buy this name.

5. TENCENT HLDGS UNSP/ADR (PINK:TCEHY)

(Source: Google Finance, Tencent since its DST investment)

The biggest internet company you’ve never heard of. With a market cap of $52.5 billion Tencent owns some of the choicest Chinese digital assets. Its crown jewel is QQ, an instant messaging service with 800 million active users—the United States of America has around 300 million people not all of whom could be considered active.

And as for what we care about, Ten has an indirect stake in Facebook through its ownership interest in Digital Sky Technologies, around 10%. More important than the couple hundred million in Facebook shares that translates to is Tencent’s ability to invest alongside DST in the coming round of the tech bubble. And I expect DST’s new billion dollar fund to be hugely oversubscribed.

6 . Naspers Limited (ADR) (PINK:NPSNY)

(Source: Google Finance, 1 year chart)

Here’s one of my favorites that we need to do really serious digging on. Naspers is a South African media behemoth with a market cap of ~$21 billion.It’s up about 32% this year but I’d still look at it for the long term.

Like Tencent its Facebook stake is indirect. But interestingly Naspers owns huge stakes of both Tencent (34%) and DST (28.7%). DST owns 5.5% of Facebook which means Naspers has $1.6 billion in shares at a $100B valuation. And it owns a third of Tencent, which owns another 10% of DST so that’s another $180M for good measure. Thrown in part of the value of Tencent’s shares of $15B, plus DST’s value (rumored to be IPO’ng soon itself), plus a not-insignificant $4.5 billion in revenue and Naspers looks like a double or triple at first blush. I’d love to hear what all of you think about this name (especially vehement opinions to the contrary) and if you think it looks as outright cheap as I do. If Facebook runs to $200 billion I think this stock could run right along with it.