Stock Market Events That Mattered

Bryce Smith is my new partner but you might remember him having helped me write a book about the stock market and some Trading With Cody analysis over the years too. Ten years ago, we wrote a book called, “Stock Market Events That Mattered (Or Did They?): A Choose-Your-Own-Experience Stock Market Adventure Book” where you get to go back and put yourself in the shoes of a hedge fund and make trades based on real historical events. I had Bryce sit down today and write up our analysis on the earnings season that’s just about over now, along with the markets and the economy.

“How good are your investing and trading skills? Can you rise through the ranks from being a Junior Trader to Wall Street Legend without falling to Shoe-shiner? Start playing Stock Market Events That Mattered right now and prove that you can!” You can order the book from Amazon here.

He also wrote this very prescient and profitable analysis up on Facebook ten years ago for me that you can find at the bottom of today’s analysis:

IS THE SUN RISING ON THE 2022 BEAR MARKET? IGNORE THE ROOSTER.

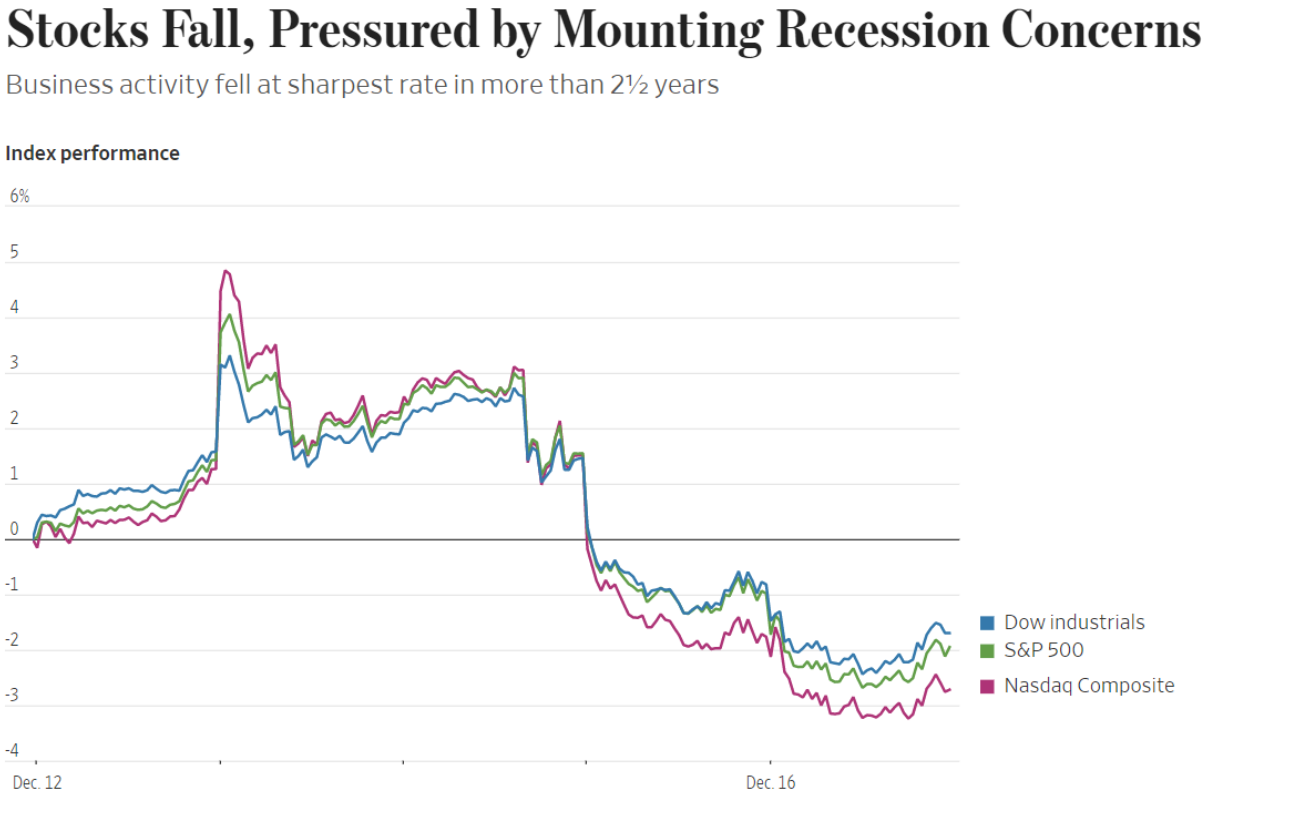

Is the bear market of 2022 over? Are we already in the early innings of the next great bull market? Only two months ago, the news was dominated with headlines that looked like this:

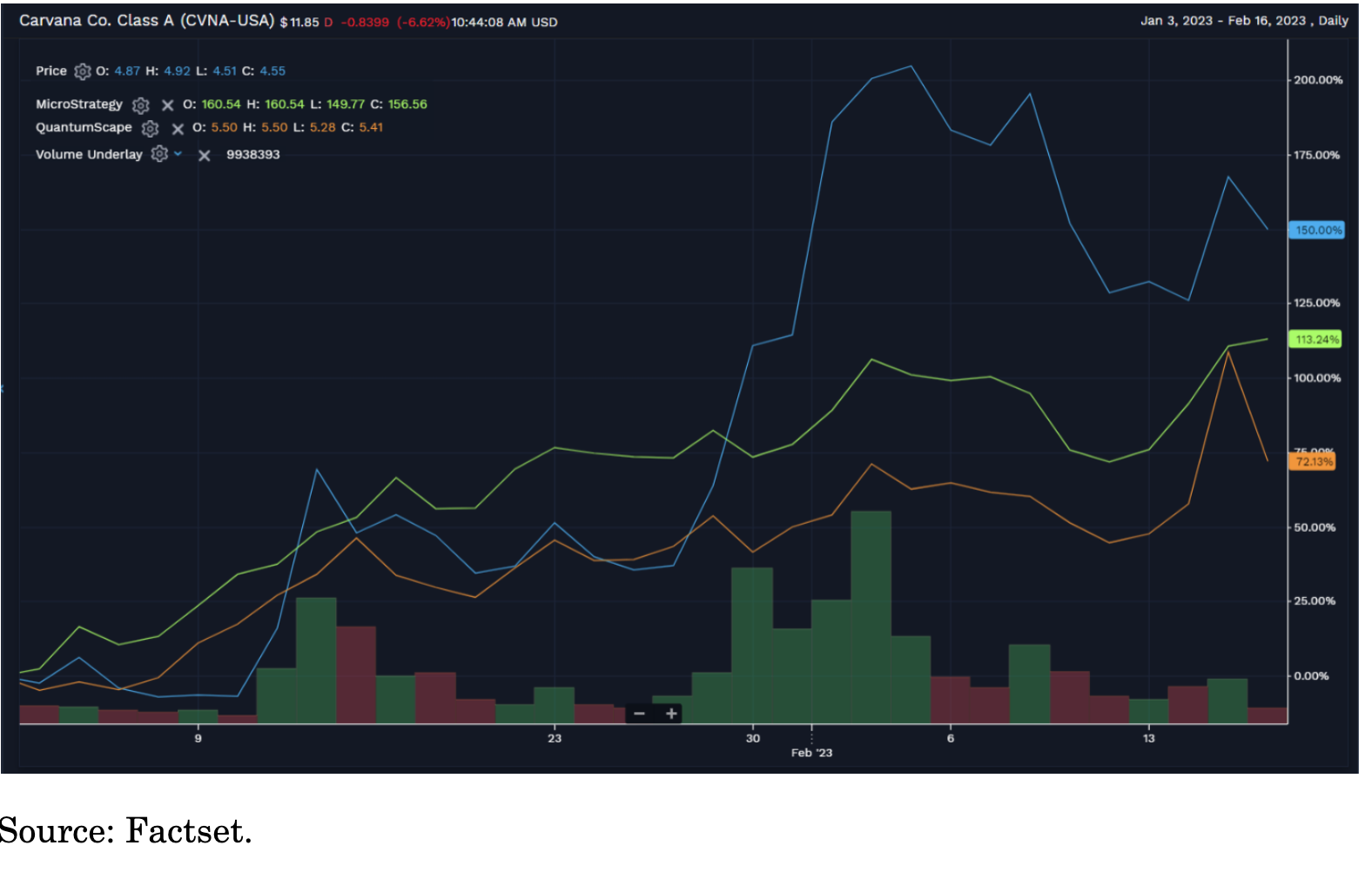

The year 2022 ended with the S&P 500 posting a 19% decline (the biggest pullback since 2008), the DJIA down 8.8%, and the Nasdaq down a whopping 33%. Yet 2023 started off with a quick reversal with the Nasdaq already up around 15% year to date. More notably, many of the most heavily-shorted stocks (some of which are truly fraudulent and/or soon to be bankrupt companies) are up even more (Carvana is up around 150% ytd). Here is a year to date chart of CVNA, FSR, and MSTR:

This kind of price action has many of the pundits, experts, and CEOs doubting the possibility of any kind of severe recession. In fact the current “consensus” view now seems to be that the Fed will pull off a “soft landing.” According to Investopedia, a “soft landing” is a “cyclical slowdown in economic growth that avoids recession.” The support for this idea comes from the fact that the Fed already raised interest rates significantly starting in March 2022, which caused inflation to come down from around 10% to around 6%, and all while the labor market remained strong with the unemployment rate still at 3.4%. Because of the positive trend in the inflation number, Wall Street is expecting (hoping?) that elevated rates will not remain for as long as originally thought.

So is the year-to-date price action in the Nasdaq and many of the speculative names truly a reflection of the fact that the underlying economy is doing better than expected? I’m reminded of this quote from One Up on Wall Street by Peter Lynch: “In centuries past, people hearing the rooster crow as the sun came up decided that the crowing caused the sunrise. It sounds silly now, but every day the experts confuse caused and effect on Wall Street…”

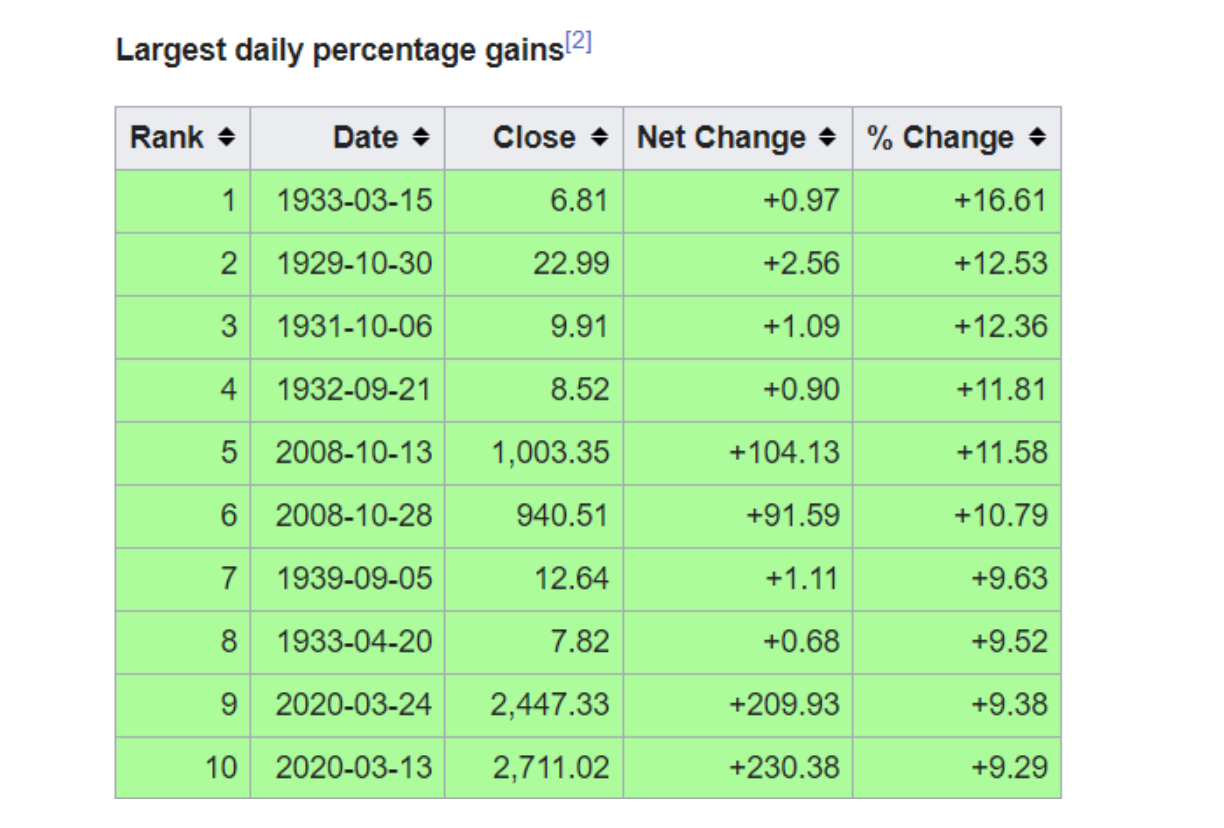

On Wall Street, the rooster(s) are stock prices. It seems that the “experts” are confused this rally in stock prices with health in the underlying economy. I mean, if stocks are going up, can things really be that bad? Here is a chart from Wikipedia showing the 10 largest one-day advances in the Nasdaq Composite throughout history:

And here is the same for the S&P:

In each instance, the largest single-day gains for the indexes came during some of the worst bear markets in history. It would have been foolish to look at the price action on any of these days and thought that the underlying economy was in good shape.

Fundamentals matter. And the crowing of the rooster (prices going up) does not mean that the fundamentals have improved. Carvana’s business model isn’t working, the insiders sold nearly $6 billion of their own stock, and now the company is out of cash. So unless they raise cash through a secondary offering or private bailout (see BBBY), the stock is likely going to zero. The hard part with shorting Carvana is that almost everybody knows Carvana is likely going to zero. Depending on the source, the short interest as a percentage of Carvana’s floating share is in the range of 50%-70%! So it doesn’t take very much short covering to make the stock go up significantly very quickly. Obviously then, we can ignore the squeezy action in Carvana (and the hundreds of similarly-situated stocks) when trying to assess the health of the economy and corporate earnings.

However, the picture doesn’t get much when we look at the earnings and growth from many of the Nasdaq names. Even though Google might be one of my favorites longs, its revenue in 2022 was up only 10% (down from 41% the year before). Even worse, Google’s Q4 Youtube revenue was down almost 8% from the year-ago quarter. Overall, its EPS fell from $ 5.61 in 2021 to $ 4.56 in 2022. At these prices, GOOG now trades at a 21.3 times on a TTM basis.

Zooming out slightly, earnings for the S&P 500 are on pace to be down 4.9% for Q4 ’22. Further, according to Factset, 82% of the S&P 500 companies that issued EPS guidance for Q1 2023 issued negative guidance. WSJ reports that the forward P/E for the Nasdaq now stands at 25.24. Not necessarily cheap.

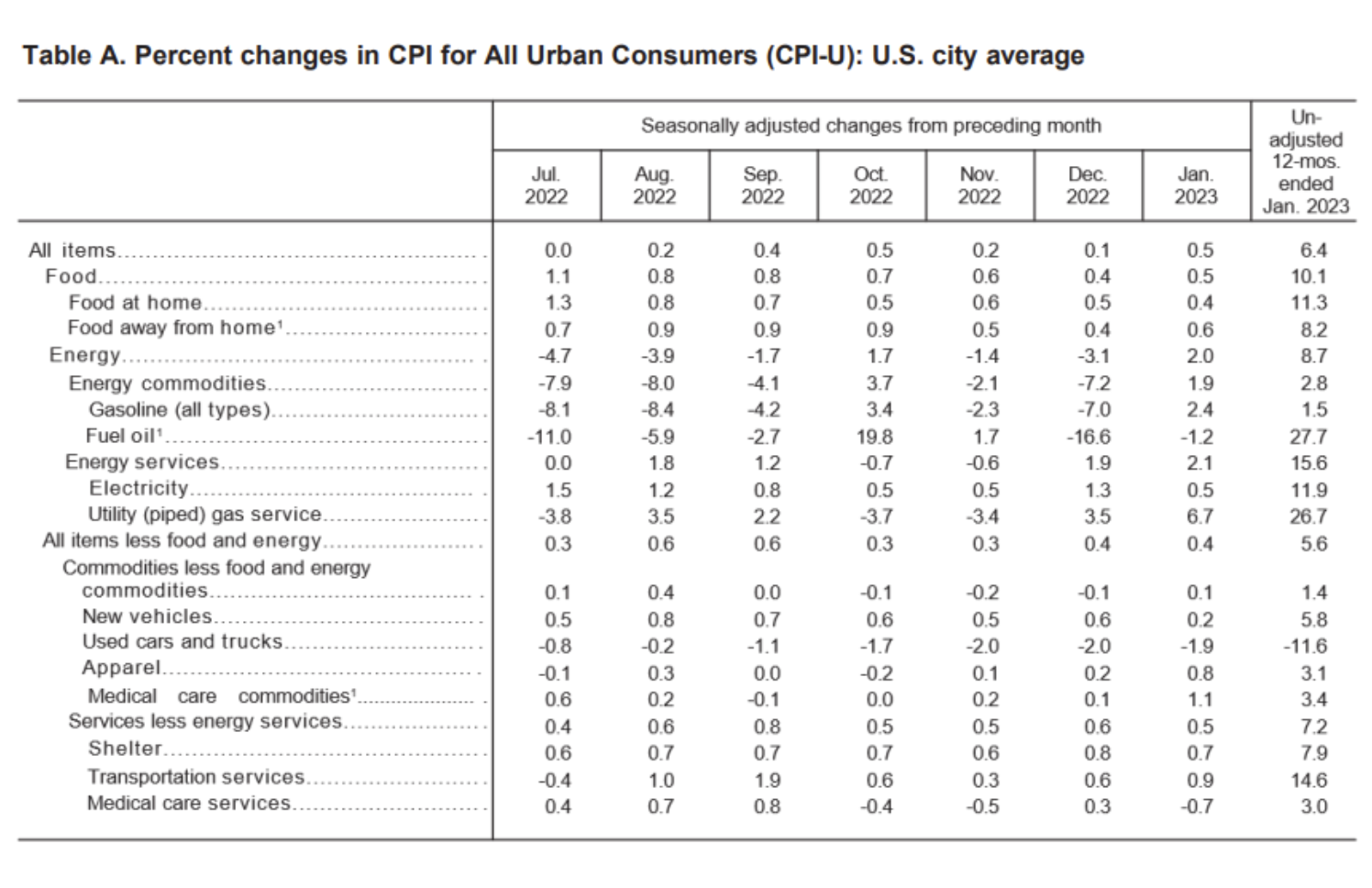

Looking at the fundamentals of the economy itself, it isn’t clear that inflation is actually slowing as much as the market might have you believe. Here is the breakdown from the latest CPI report:

Excluding used cars and trucks, every other category is up, with many up double digits. Looking at this makes us think we are long ways from the Fed’s target rate of 2%. The idea that they will stop raising rates and/or start cutting anytime soon seems unlikely to us.

We’re not ones to try and game the Fed, but we don’t see how they achieve a “soft-landing.” Raising the fed funds rate from essentially 0% to 5% in less than a year is significant, and we think it is unlikely that we are seeing the full impact of that change just yet. It is important to remember that we are in Year 1 after almost 14 years of consistent 0% interest rates and quantitative easing. We believe there are entire business models (like CVNA) that were built on and depended on 0% interest rates and easy money policies. It will take time for the trillions of dollars of liquidity that the Fed pumped into the market over the last almost decade and one-half to come out of the market. We think we are likely in the early stages of a recession and would not rely on continued resilience in the labor market and consumer spending as signs that a recession won’t happen.

We often say that “things happen slowly, and then all at once.” As demonstrated by the pullback in corporate earnings already, there is some degree of pain happening at the very high levels of the economy. Tech companies have laid off thousands of workers most of whom were paid salaries in the hundreds of thousands. Ordinary people cannot afford to buy the car or the house that they could have bought in 2020 because rates are three-five times higher today.

We don’t know what the timing will be for the next recession, and even though we expect one is coming, that doesn’t mean you shouldn’t own stocks, or buy more of your favorites on weakness. Every crash usually turns out to be a great buying opportunity. But we don’t want to chase this market either.

— == —

Cody here now. Here’s the Facebook analysis that Bryce wrote for Trading With Cody subscribers back eleven years ago when Facebook was at $20 per share or so:

Facebook analysis from a kid half my age

September 20, 2012 by Cody Willard (And Bryce Smith)

I asked a really bright student who just started college and who loves trading and Wall Street and technology and all that stuff to take what he knew about my Facebook analysis and build off it with more detail and maybe some new insights into the stock that we might have missed.

He sent me this a couple weeks ago when the stock was just about at $20 a share and I finally read it and really liked the analysis so I wanted to share it with all of you. The kid’s name is Bryce Smith and he’s actually a graduate of Truth of Consequences public school system. Yes, that really is a town in NM. Without further ado, here’s his Facebook juice:

Facebook is a revolutionary company that will offer significant return to investors over the long term. Coming public in May the stock is off 50% from its IPO price of 38$ per share with a near $100 Billion dollar market cap. Today the company is valued at $41 billion. The company has shown significant growth over the past and has nearly 1 billion monthly active users.

Current Financials

Facebook is currently spending 38% of their operating income on R&D and General Expenses. According to the Q2 conference call, they are spending heavily on infrastructure expansion around the world and also bringing in the best minds in the business to work out mobile expansion. They call themselves a “mobile first” company.

In 2011, there were 700 million Smartphone subscriptions around the world. This number will increase to 4-5 billion by 2016. Some estimates are in the 10 billion range by 2016. With 543 million mobile users, that is 77% of total smartphones in the world. Assuming that this market penetration holds over the next four years, that would put Facebook on 3.08 Billion smartphones in 2016. Today there are roughly 1.1 billion personal computers in the world. With 412 million Facebook users currently accessing the website via pc, that is only 37% penetration into all of the pc‘s of the world. When you get a smartphone, you are more enticed to use Facebook even if you previously didn’t have an account. I personally can say that I created my Facebook account on a tablet and I can count the number of times that I have accessed it on a computer using my fingers.

With the Facebook App now standard on iOS 5 and OSX, even more people will be tempted to create an account do to easy access. A person with Facebook on their smartphone may access the website anywhere from 3-5 times a day. Even if Facebook only makes $4.84 per user (the current metric) in 2016, that takes revenue to $14.9 billion by 2016. Facebook’s estimated revenue for this year is somewhere in the range of $5.5 billion. Assuming a 30% net profit margin, the company will make $4.5 billion in 2016. That means that EPS will be in the range of $2.08. At a justifiable P/E of 20, that takes the company to a price of $42.

Apps, Adds, and the Facebook Platform

The Open Graph is one of the startup programs happening at Facebook. Apps integrated with Facebook will be very public on the news feed. Not only do my friends get to see what app I am using, they will see what I do with it as well. This is social advertising at its utmost potential. To be able to see the utility of an app makes more people want to use it. Currently, 1 Billion pieces of information about apps are shared every single day. Mark Zuckerburg called it a startup program. App developers know that when they integrate with Facebook, they will be getting the best return possible.

Mark Zuckerburg’s key focus in the last conference call was better, more social ads. By keeping this focus at the top of Facebooks priority, they are starting to come up with effective ways of monetization, especially in the area of mobile. The Sponsored Stories campaign is already starting to take off and is generating $1 million a day, half of which is coming from mobile. These initiatives will continue to gain traction as Facebook creates a deeper user experience and as advertisers see the ROI generated by their Facebook add.

Along with these areas, the expansion of the Facebook platform will take the company to the next level in terms of monetization and ultimately profitability. As we have seen with mobile, the closer you are to Facebook, the more you integrate it into your life. In the conference call, CEO Mark Zuckerburg gave insight into the expansion of the Facebook platform. He said that someday even your car will be integrated with your Facebook profile. The platform will gain more utility to consumers as it expands and grows deeper into every social and business enterprise in our modern world. Apple and many other companies are now looking to take commerce online. Mobile banking has already been a big success. If it were integrated into the Facebook platform, it would offer even more utility. For example, most people have several bank accounts, credit and debit cards, income streams, and bills to pay. With Facebook, one simple login and password would give you access to all of these. This is one small example of how big Facebook could be. In Zuckerburg’s own words, “It’s worth calling out that our vision for platform is bigger than what most people perceive”.

Summary

What I have discussed will give Facebook the opportunity to increase what it charges for advertising. I think it is fair to say that through these initiatives, Facebook could double what it makes per user in four years. So say Facebook makes $10 a year per user, or 2.7 cents a day per user. Multiply that times 3.08 Billion users and it gives you $30.8 billion in revenue in 2016. At 30% net profit margin, that means the company will make $9.24 billion or $4.30 per share. At a p/e of 20, that values each share at $86 or a $184 Billion Market Cap.

— == —

Cody back in real-time 2013 here. Pretty good stuff, huh?

See you next week.