Stock market parallels: History rhymes but sometimes it doesn’t

Don’t forget to join me for this week’s Live Q&A Chat at 2pm EST at twc.scutify.com/members/.

There are a lot of old saws out there that are simply wrong (Don’t fight the Fed comes to mind), but one that I’ve always loved is Samuel Clemens’ “History doesn’t repeat, it rhymes.”

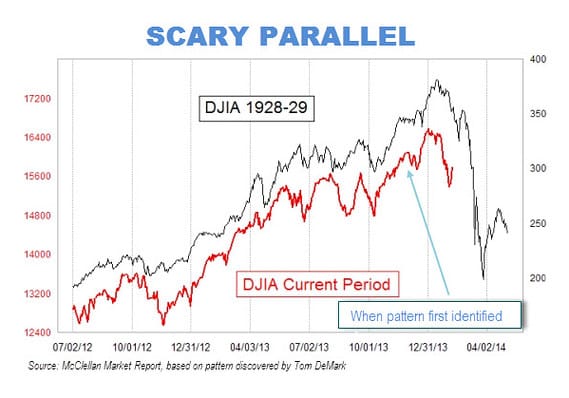

Over time, we see a lot chartists and history buffs overlay charts from various time frames and/or markets and the charts will line up rather shockingly. Remember this one?

But all times, all places, all markets are different. “It’s different this time,” is a saying that’s mocked all the time, but it in some ways says the same thing that Samuel Clemens’ saying does, that times, places and markets are always similar, but they’re never the same.

I was a lone voice back in market depths and scary financial crisis days back in 2009-2011 explaining how the policies of the Fed and the Republican Democrat Regime and the fundamental underpinnings of the economy were all set to send our markets into “The Biggest Stock Market Bubble in History.” I prepared my readers and my portfolio by being aggressively long as the markets climbed. I’m less aggressively long but still riding this ongoing Bubble Blowing Bull Market by being mostly long with just a few small short hedges.

Years before that, I’d launched a tech hedge fund into the bottom of the Nasdaq crash in October 2002. I closed the fund and sold everything and took a job as a TV anchor in October 2007 as I turned bearish on the markets and real estate and financials.

And before that I’d landed in Wall Street just around the time Alan Greenspan (did I mention we should always fight the Fed?) was saying the markets were in exuberance and subsequently watched the Nasdaq go up 200% in the next three years before it popped in March 2000.

I’ve been around and I’ve seen history rhyme but never repeat. And it’s been “different this time” every time.

If we assume that I was right in my analysis of the causes that led me to predict what is now becoming the Biggest Stock Market Bubble in History, then we should look at these same catalysts and see if anything’s changed enough to make us change our ongoing bullish stance.

The policies of the Fed — natural market rates are several percentage points higher than 0% or even 1%. Meanwhile, looking around the developed world you see that the Fed is, even at 0% rates and no formal QE, is amazingly less aggressive in their easy money policies than any other major nation’s central bank. In the end, all these low rates are forcing savers into ever riskier assets and enabling corporations to financially engineer higher shareholder profits. So, global central bank forces are still extremely bubble-blowing in nature.

Republican Democrat Regime — We just have look at today’s news that Kraft and Heinz are going to use money from Warren Buffett’s Berkshire Hathaway to consolidate the food industry further (which will further drive profits for shareholders as less competition and less selection enables the companies to charge higher prices, pay few employees and so on). The Heinz Kraft merger will be great for Heinz and Kraft and Warren Buffett’s Berkshire Hathaway shareholders but it’s terrible for you at the grocery store trying to feed your kids decent food at a decent price. And it’s another reason why corporate profit margins and corporate profits themselves are likely continued higher. So, governmental policies are still extremely bubble-blowing in nature.

Real economic fundamentals — Innovation, productivity, and prosperity are being driven by the App Revolution, the Communications Revolution, the Internet Revolution and other tech creations. Job growth is steady if not spectacular and there are still millions of people who are presently considered out of the labor force who are likely to start getting back in. Construction and housing are steady if not great. So, real economic fundamentals continue to be bullish.

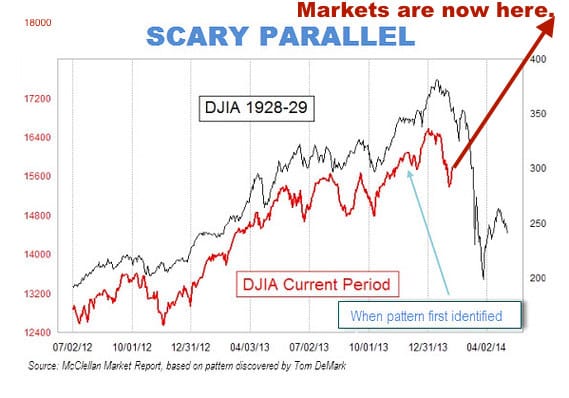

At some point, things will be “as good as they can get,” much like they were in 2000 and 2007 and the subsequent crashes might be equally or even more extreme on the downside. This market cycle and the next one will be similar but different than past ones. You might even say they’ll rhyme but not repeat. Here’s that same chart from earlier after I updated it to show where this market went despite those “scary parallels”:

Very few investors and even fewer analysts have been able to navigate these past couple and this ongoing cycle. Step back from the noise of predictions and doomsday speeches. Be prepared for bad times, but don’t go freak out until the analysis that predicted these last cycles, and their turns, tells you to.