Stock picking, investing and trading ain’t easy

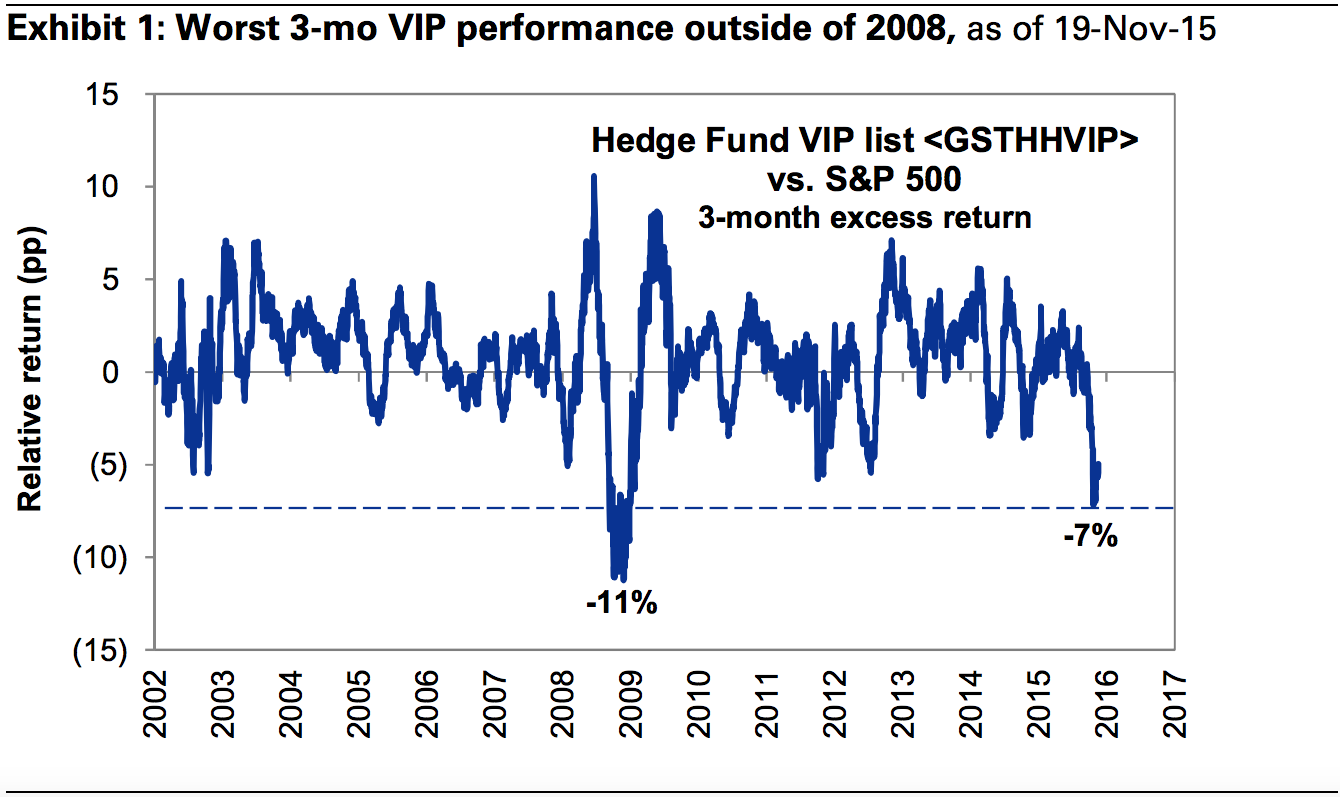

I have worked my butt off and taken a lot of risks and made a lot of predictions and put my money where my mouth is when it comes to our stock picks. I’ve made a lot of mistakes along the way, and we’ve certainly had a few picks that we lost money on over the past few years, but when I saw this chart that shows how hedge fund managers are doing, I was quite proud of how well our stock picks have done and our playbook has performed since I left TV in 2010 and started investing/trading again in 2011.

I launched this Trading With Cody service about the same time and we’ve had a remarkable renewal rate as we’ve delivered real results.

We’ve been on the right side of what I predicted would be a Bubble-Blowing Bull Market and I’ve reminded you to ignore the noise as we’ve used hyped non-crises when the Eurocrisis, Fed rate hike hysteria, China slow down, currency wars and so on to buy more stocks and have then been able to take some partial profits when the Bull Market got back to new highs. Also key has been the fact that I’ve completely avoided energy stocks and caught some huge short profits in Blackberry, Valeant and Pandora to name a few.

We don’t want to get overconfident and we must stay vigilant as we never forget how hard it is to find and hold onto great stocks, to buy more of Revolutionary companies when they’re down. When we were loading up on Apple, Google, Facebook and Amazon while calling them the Four Horsemen of Tech back in early 2012, most other folks were betting that those stocks were already in a bubble and many investors were afraid to own stocks of any sort as the pain of 2008’s market crashes lingered. Don’t think it’s been easy to have picked those names and our other mega-cap winners. Here’s what I faced when I was making Facebook one of my top 3 largest positions for example:

“Facebook is not the operating system for the cloud/app/mobile revolution. It’s the Wordperfect.”

“The $FB shorts still have the advantage, but thanks for the update. Still holding for $10 or not at all.”

“Biggest internet ipo ever?? bah humbug. Sit on my facebook! FB will be no higher than opening price in 10 years.”

“Good luck with the trade, I wouldn’t pay $40 billion for FB, not even close. You need massive revenue growth to justify current valuations imho….But I am a deep value guy….lol”

Those last two comments were from emails sent to me by, you guessed it, real billion dollar hedge fund managers. There are few market leaders out there and as those hedge fund managers and the ones who make up that chart above can tell you, it’s hard to pick the right stocks, undiscovered or mega-cap and then to navigate the markets and ride them to all-time highs like we have.

That said, while we’ve got a dozen or so stocks that have been huge winners for us and are at or near all-time highs, I’ve got two glaring losses that keep me up at night. Neither is a big position for me but I’ve been spending a lot of time analyzing each of them. I’m working on some spreadsheets and further analysis on each to be sent out to you later this week. One of them is a screaming buy and I’ll let subscribers to Trading With Cody know when I buy more of it this week.

Cycles in the market can reverse and even great stocks and companies can get sold off and remain down for years at a time. Remember how scary and painful it was to see so many of our stocks down huge in those panicky market sell-offs in August? There were pros and retail investors and traders alike who were all selling down their positions and joining the panic. It’s fine to take pride in our actions and analysis and performance, but let’s not fool ourselves into thinking our portfolios and picks are bulletproof. Stick with the playbook – be vigilant, trim when others are greedy, nibble when others are panicking. Rock on.