Tale of two markets and some portfolio management thoughts

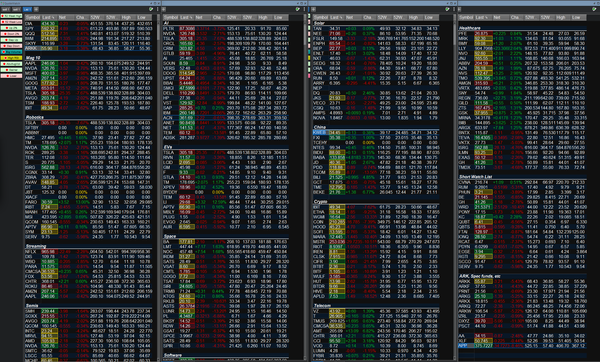

The markets are up, with a 1% move on the open that’s now faded a bit. The markets are being very selective about which stocks are working, especially in tech. We’re not quite 10% through with the trading year, and the market is up about 5% on the year. Annualized, of course, that would be a 50% up move by the end of the year. Nobody knows for sure how the markets will play out this year, but I’m pretty sure that a 50% move higher isn’t going to be straight up. And even as I’m bullish and have been calling for this market to enter yet another bubble, I’m not looking for that kind of a pop. It’s going to be a wild ride this year, as it is every year.

We’ve had our share of ugly earnings report as we leave this earnings season (we also had some big winners of course), and last night brought us Nuance shooting themselves in the foot. Last I mentioned Nuance was back in January 10: “I’m also buying some Nuance common stock here. Been a long time since we’ve bought any Nuance and it’s been a tiny position since we trimmed most of our long at higher levels.”

The stock run up a little bit after that but is now down about 10% from where I’d nibbled on it. It’s still up nearly double from my original Revolution Investing buy but I’m again disappointed by the management’s execution in this growth market. I’ve been, as usual, cut-throat in my moving on from stocks when their stories don’t play out with our analysis and I’ve got some more sources, analysis and thought to crank out about what to do with Nuance.

Facebook and Apple both look like they could actually get some mojo going here, if the markets can stick it out and not get panicky in the near-term. It’s a tale of two markets, as the Qualcomm’s, Lindsay’s, FutureFuel’s, and the Google’s of the world and others hit all-time highs while the Apple’s, Nuance’s, VMW’s of the world flounder.

One of those most important lessons that I’ve learned over the years of managing money is keeping a laser focus on our overall strategies and tactics, such as with our winners and letting go of the underperformers.

Speaking of FutureFuel, I’d like to buy some more common stock in that one on any pullback here (though it did hit a new 52-week high this morning so who knows when the pullback will come).

I’m also going to look at buying some BKX or XLF or MS puts as part of managing our overall portfolio and reducing our long exposure a little bit more.

I’ll send out a latest positions in a bit. Rock on.