Tesla and Netflix Earnings Preview

We will do this week’s Live Q&A Chat today as usual at 3:00 pm ET in the TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com.

The markets are forgetful day-to-day these days, as we drop, bounce, drop, bounce sometimes all in one day for the last week or so. I continue to think that a lot of semiconductor stocks are crowded and overvalued. But I’m mostly sanguine on the rest of the market right now.

Tesla and Netflix will report earnings after the close tonight. Expectations for both seem pretty low.

Everybody knows that Tesla’s margins have suffered as the company has been on a price-cutting binge all year, spurring demand for Tesla’s at cheaper prices and putting the hurt on all the other EV companies who can’t hardly figure out how to make an EV that anybody wants and certainly haven’t figured out how to make an EV profitably (BYD in China being the lone other sustainably profitable EV maker).

Tesla’s been constantly improving its manufacturing capabilities, reducing complexity and always refining every step of the manufacturing process. The company had to slow manufacturing last quarter as they retooled their Austin factory to prepare for the rollout of the Cybertruck, which I’ve said will be the greatest selling vehicle in history ever since the first time they revealed it.

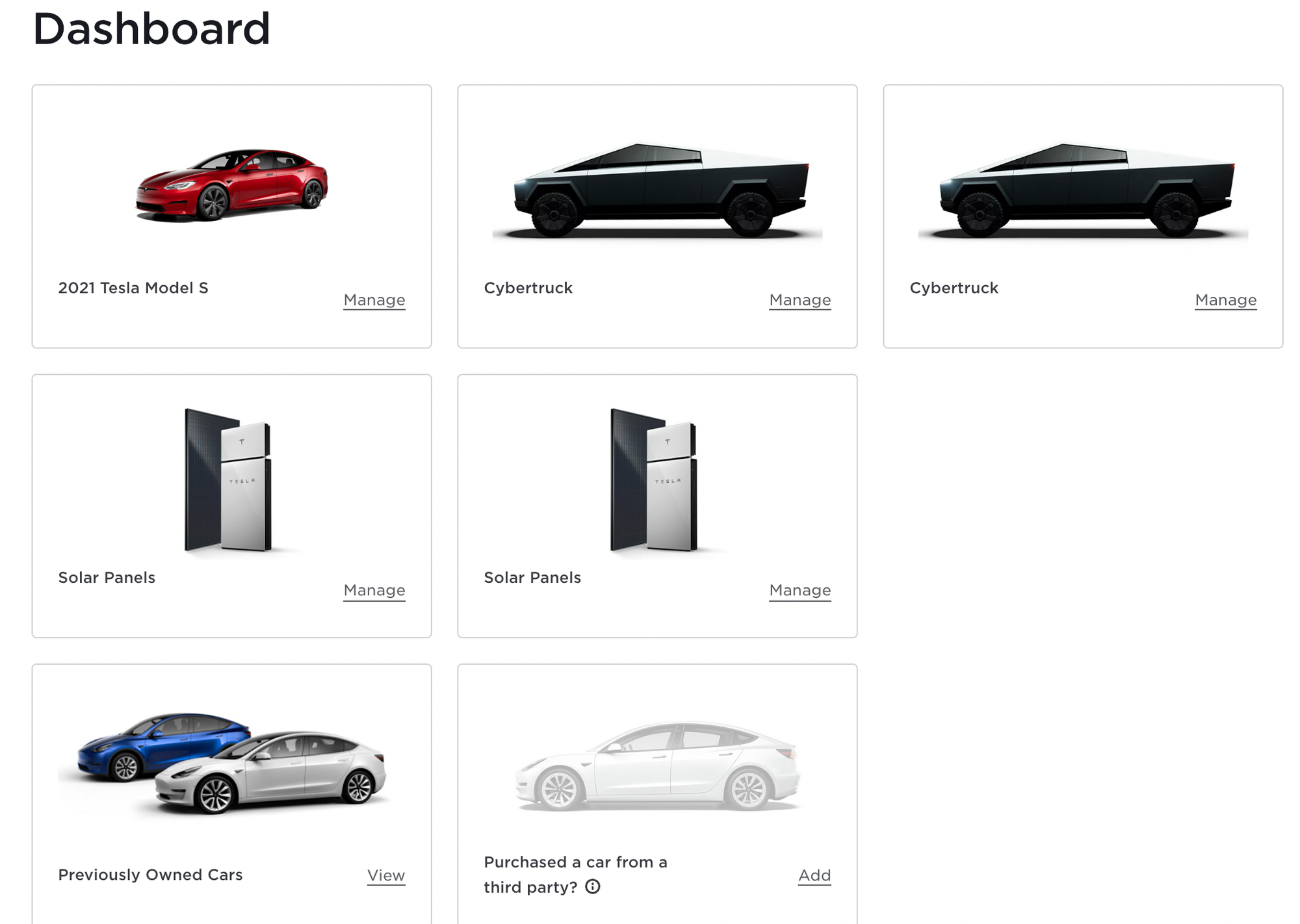

I have two Cybertrucks on order. My wife put the first order in as soon as the reveal was over and we are about number 35,000 out of the 2 million plus orders for Cybertruck that Tesla has so far. I still haven’t heard anything from the company regarding my order, but that makes sense. They’ll likely deliver tens of thousands of Cybertrucks in the first six months, ramping up to run rate of delivering probably half a million of them a year by the end of next year.

Nobody’s quite sure what the margins on the Cybertruck will be in a year from now, but it’s possible it could be more profitable than the Model 3 and Model Y are on a per unit basis. Tesla also rolled out a new version of the Model 3 and Model Y that look very cool and are probably going to help drive even more interest in Tesla cars at those lower price points. Margins on those updated models could be better than the margins on the old ones because the company is getting ever better at designing and making those cars.

Most analysts will be focused on gross margins for the cars on the earnings report tonight but, for me in addition to focusing on the Cybertruck update, I’ll want to hear more about progress on the Optimus Robot program and about how the Dojo Supercomputer that Tesla has made is doing on its machine-learning capabilities. I expect that Tesla could end up selling access to the Dojo Supercomputer to other companies as Amazon does with its Amazon Web Services AWS business. If that happens, Tesla’s overall margins will go higher as selling access to Dojo will have gross margins up above 80% probably. Battery sales, solar sales, and a new HVAC business line are also possible things to listen for on the call.

Feet-to-fire, I’d expect TSLA to be up 3-5% tomorrow.

Netflix, meanwhile, has seen its stock languish for weeks on end, falling from $450ish to $350ish in the last couple months. In a vein similar to how Tesla created the modern EV industry and is the only (US-based) EV company that can figure out how to make money on its EV cars, Netflix pioneered its industry and is the only company around that knows how to make money on streaming video.

Expectations going into the report tonight are low as the many wannabe competitors to Netflix out there, from Disney+ to Paramount+ to Peacock etc are all struggling to balance costs and to find meaningful growth. Netflix meanwhile will churn out billions in profits this year on tens of billions of dollars of revenue. I expect the company will probably be able to match expectations on the revenue topline and will beat expectations for earnings as they probably didn’t spend as much making content the last few months while the actors and writers guilds have been striking.

Most analysts will be focused on how the company’s various pricing schedules are doing and whether the advertising business is taking off relative to expectations and also how the password sharing crackdown is helping (or hurting?) sales.

The thing I’ve always loved about Netflix as I’ve owned it off and on over the last decade or so, is how the company loves to do things opposite of others in its industry. People always hated late fees when we used to rent movies, so back in the DVD days, Netflix didn’t have late fees. People always hated having to wait for the next week to see what happened in their favorite TV shows like Lost on ABC back fifteen years ago. So Netflix started dropping the entire season all at once. People hated advertising while watching TV, so Netflix didn’t have advertising. But the company will also pivot and shift based on customer feedback, as the company discovered that some people wouldn’t mind a few ads if its helps pay for the service, so they give them the freedom to let people let advertisers help pay for the Netflix service.

Feet-to-fire, I’d expect Netflix to be up 5-10% tomorrow.

I’m mostly sitting tight on both of these positions right now. TSLA been my biggest position in the hedge fund since early after I launched it back at the beginning of 2019 and it still is although we have shorted a few near-the-money call options dated out to November and December to hedge the position a bit. I’ve just started buying some NFLX and NFLX calls in the hedge fund a few weeks ago and it’s a medium-sized position right now.

Steady as she goes overall, folks.