Tesla’s Autonomy Moment (And How It Might Effect Uber)

So after four days of using FSD 12.3.3 every day to navigate city streets, interstates, and rural dirt roads, I have to say that this version of FSD is impressive!

After Cody downloaded the latest full self-driving (FSD) software for his Tesla, we decided I should put it to the test in my city (Las Cruces, NM), because Cody lives in a town with one stoplight and it’s not really the best testing ground for autonomous vehicles.

You’ve probably read about the latest FSD, but until you try it out for yourself, it’s hard to understand just how good it is at driving the vehicle like a human would. To be clear, it’s not perfect yet; I’ve been telling people that it works perfectly probably 95% of the time. And driving correctly 95% of the time obviously is not good enough for the car to be considered “fully autonomous.” Cody pointed out that in telecom and computing, you need to achieve five-nines reliability, which means the system works without failing 99.999% of the time. Five nines reliability translates to only about 5 minutes of average annual downtime for the system, and FSD 12.3.3 is not there yet.

Even though FSD 12.3.3 still has a ways to go, you can certainly see the light at the end of the autonomous tunnel. And, more importantly, given the rapid acceleration of the rate of exponential development of AI (Elon said last night on a podcast that “AI is the fastest advancing technology that I have ever seen of any kind, and I’ve seen a lot of technology“), it’s quite possible that Tesla achieves Level 5 autonomy (which is defined as a vehicle that “can drive anywhere in road traffic and under all conditions without human beings“) within the next year or two. Elon tweeted on Friday that Tesla is revealing the Robotaxi on August 8th, and thus Elon/Tesla must also be thinking that Level 5 is around the corner if it plans on Robotaxis hitting the streets sometime next year.

Given these developments, I thought it was appropriate to break down why autonomy is so important, the economics involved, and how it will impact Tesla (TSLA) and some of our other holdings like Uber (UBER).

Let’s start with the big picture. What is autonomy and why is it so important? Obviously, autonomy as a concept is nothing new and humans are constantly creating new ways to automate everyday tasks. At its most basic level, autonomy allows computers or other mechanical systems to do automatically what humans previously did manually. So, first and foremost, autonomy frees up resources — namely, human labor — to perform other valuable tasks. Modern factories are full of robots (empowered by software from Rockwell Automation (ROK)) that assemble parts, install screws, weld metal, paint cars, etc.; all tasks that were performed by humans at one point in time. Machines cost more upfront, but the savings over time are massive.

In addition to the time savings involved, autonomous machines usually turn out to be more efficient and productive than their human counterparts. Machines don’t show up late to work, they don’t quit on a moment’s notice, and they can work 24/7 without getting tired or needing to eat. Robots are usually less prone to making mistakes and are very good at performing precise tasks over and over again without error. Moreover, autonomy brings with it big safety benefits, because it removes humans from doing lots of hazardous work.

These clear benefits of automating repetitive and mundane tasks, like assembly-line work, have led humans to continually develop new autonomous technologies. Self-driving cars are the next step in the natural progression of all repetitive and mundane tasks being automated.

Further, the economics of self-driving cars in particular are interesting. Most vehicles sit idle most of the time, and using FSD, those vehicles can be put to productive use while they are not needed by their owners. Anytime a piece of capital equipment is not being put to use, it costs the owner money in terms of its opportunity cost. A car, just like a robot in a factory, has the capability to run almost 24/7. With FSD, Tesla owners can allow their cars to be a part of the Robotaxi network and earn income for the owner and Tesla while the owner doesn’t need the car.

But what makes Tesla’s FSD so good? This is an excellent post on X.com explaining Tesla’s edge in FSD, and why all of the competitors, like Waymo, Aurora Innovation (AUR), and the other car OEMs, will never catch up. Essentially, it boils down to the simplicity of Tesla’s hardware, its edge in AI and compute capabilities (remember, Tesla has one of the top 3 largest supercomputers in the world), and the absence of a need for advanced GPS or a high-res map to function, like Waymo requires.

For Tesla, achieving autonomy (or something close to it in the near term), will be a game changer for the company. We see at least four major impacts on Tesla’s business based on the new FSD software: (1) increased FSD penetration; (2) pick-up in overall vehicle demand; (3) beginning of the Robotaxi model; (4) potential for direct Robotaxi sales to Rideshare partners; and (5) licensing to other OEMs.

- Increased FSD Penetration

The immediate impact of better FSD will be significantly increased FSD subscriptions. FSD costs $12,000 upfront, or you can pay a recurring monthly fee of $200. As of the second quarter of 2023, an estimated 400,000 vehicles had FSD installed. For simplicity’s sake, let’s assume that all of those FSD installations are monthly subscribers. That translates to $960 million in annual recurring revenue (ARR) for Tesla from FSD. Tesla is currently giving every Tesla owner a free one-month free trial of FSD, and all new Tesla buyers will also receive a one-month trial. One of the heads of Tesla’s AI division posted that FSD has been deployed on 2 million vehicles in the US as of March 2024. If half of the 1.6 million (2 million FSD installs – 400,000 subscribers) vehicles that are on the free FSD trial period end up signing up for the service, that will translate into $1.92 billion in incremental ARR for Tesla. At 85% gross margins, that would mean Tesla could earn an extra $1.63 billion in profits over the next twelve months, which equates to an 18.6% increase over Tesla’s total profit in 2023. Not bad.

2. Increased Unit Shipments

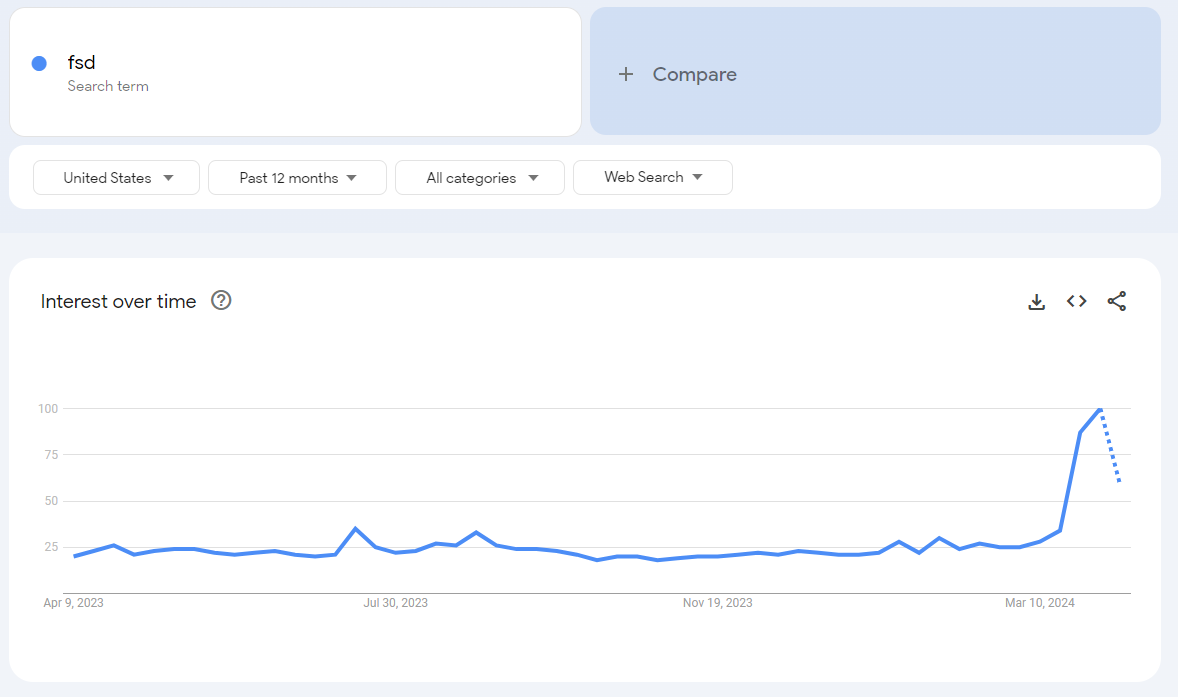

Importantly, the new and improved FSD software will likely drive increased unit shipments. Most analysts, including Tesla bulls like Adam Jonas at Morgan Stanley, are now modeling year-over-year declines in unit shipments in 2024. However, we think as word of just how good FSD continues to spread, a lot of new car buyers might consider purchasing a Tesla. For example, check out how searchs for “FSD” have trended over the last twelve months:

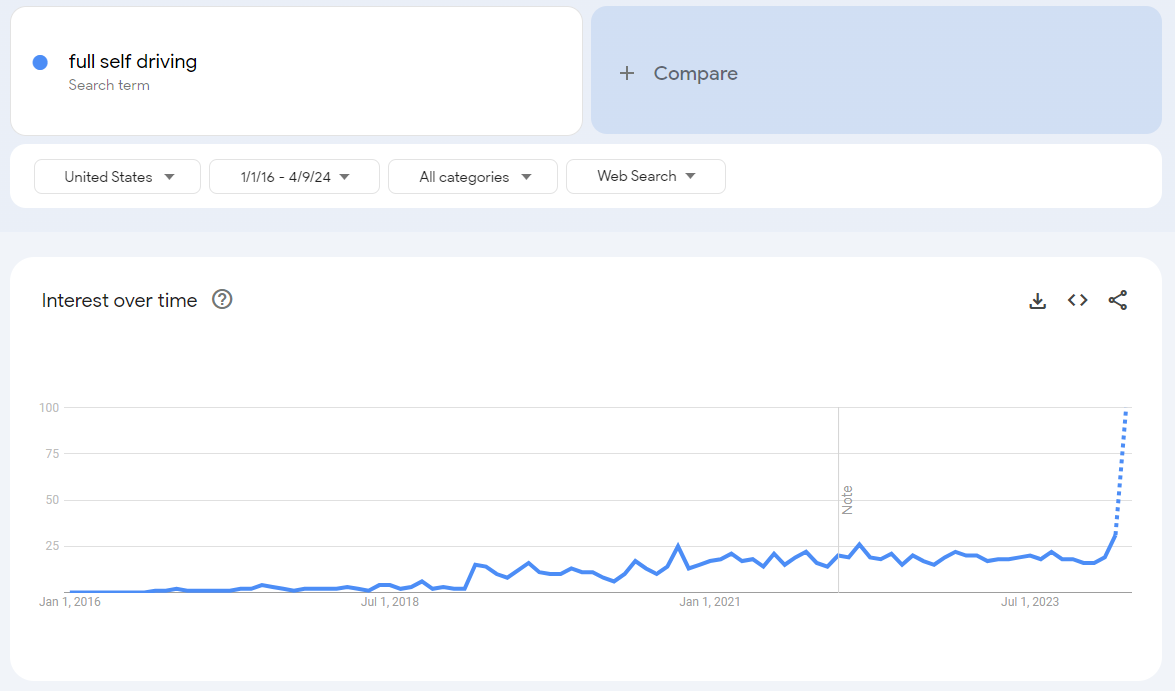

And here is how “full self-driving” has trended since Tesla first announced it in 2016:

And a personal anecdote to throw in here: everyone who has ridden with me while using FSD has been thoroughly impressed. Two of the people are now very seriously considering buying Teslas with FSD and everyone else said that they could see themselves buying a Tesla at some point in the future.

In short, the ability to own a car that can drive itself is likely to cause a lot of people to start buying Teslas that wouldn’t before. There’s a good chance that not only do Tesla’s deliveries not shrink in 2024, but they actually might grow over 2023 levels. If that happens, all of the analyst estimates will get revised upwards and we will likely see some positive traction in the stock.

Let’s say that Tesla deliveries increase 10% over 2023 levels, which would put the company at about 2 million units sold in 2024. If the average selling price holds at $46,000 (where it was in 2023), then Tesla would generate over $90 billion in revenue for the year. At 20% gross margins, that’s $18 billion in gross profit for the company, up from about $15 billion in 2023.

3. Robotaxi

We’ll know a lot more about the Robotaxi program in August after the unveiling. But the model is fairly straightforward: Tesla plans to operate a fleet of fully autonomous vehicles that will drive around and give rides to people Uber-style. The Robotaxis will likely have people in them at first, but eventually, there will be no one in the driver seat and the Robotaxis will most likely not even have steering wheels.

Let’s model out the economics for how this works on a per-vehicle basis. The Robotaxi will be a much cheaper vehicle to produce compared to Tesla’s existing S3XY lineup using Tesla’s new “unboxed” manufacturing approach. The retail price for the next-gen vehicle is supposed to be about $25,000, so if you back out Tesla’s average gross profit of about 20%, that would mean Tesla can produce one of these vehicles for about $20,000 a pop. Tesla will likely depreciate the car on a 5-year basis, which means it will incur $4,000 per year in depreciation expense. The average Uber car drives around 40,000 miles per year and the average cost to the consumer is between $1-$2 per mile. Without the need to pay a human driver, Tesla can charge much less than Uber so let’s say they charge half price, or $0.50/mile on average. That translates into $20,000/year in revenue per Robotaxi. On the expense side, tires cost about $0.05/mile, charging $0.05/mile, insurance is another $0.08 per mile, and depreciation works out to $0.10/mile. So Tesla’s gross profit will be about $0.22/mile, which works out to 44% gross margins.

Tesla has the capacity to produce about 2.4 million vehicles right now. If they use all of their spare capacity to produce Robotaxis next year, that would translate to about 200,000 Robotaxis hitting the streets in 2025. Realistically, we think it is probably at least 2026 before Tesla receives regulatory approval for the Robotaxis. But, those 200,000 Robotaxis have the potential to produce $4 billion in new revenue for Tesla, or $1.8 billion in gross profit for the company. Tesla will probably get its Mexico factory online in the next three years or so, and that will enable them to start producing millions of Robotaxis per year. If the Robotaxi fleet can get up to 3 million units (roughly half of Tesla’s current installed base), then we are talking about $60 billion in revenue and $27 billion in gross profit, which would more than double the company’s current profitability.

4. Rideshare Partners

We think it is more likely than not that companies like Uber and Lyft will end up partnering with Tesla, rather than competing with Tesla in the rideshare market. Uber is already partnered with Waymo, Aurora, and other self-driving companies, and Uber’s goal here is to be a manufacturer-agnostic platform for self-driving mobility.

Moreover, Tesla and Uber already have a pretty good working relationship. Tesla and Uber have already worked together to incentivize Uber drivers to buy Teslas. For example, Uber announced in January that it would offer its drivers a $3,000 rebate if they bought a new Tesla. Uber and Hertz also partnered to allow drivers to rent Teslas at reduced rates. And Uber itself has purchased Teslas to operate as part of its fleet in Japan.

Uber has always planned on implementing autonomous vehicles into its business. The company can utilize its massive base of users, AI routing technology, pricing structure, etc. to leverage Tesla self-driving vehicles and increase its overall profitability. Uber will also be in a good position to help Tesla make the transition to fully autonomous vehicles because its drivers may be needed to monitor the vehicle until full regulatory approval is given for Level 5 vehicles.

Overall, we think full autonomy will be good for both Tesla and Uber. Tesla will probably sell millions of Robotaxis to Uber, and Uber will be able to offer cheaper rides at better margins because there will be no human driver in the seat collecting a paycheck.

To be clear, full autonomy is certainly a risk to Uber and the company could face an existential crisis if they don’t end up partnering with Tesla as we think they will. However, we think it’s too early to try and predict Uber’s demise and usually faraway competition is a bad reason to sell a company like Uber that continues to kick butt every day/quarter/year.

5. OEM Licensing

Every other vehicle manufacturer is going to want to license FSD from Tesla once they realize that every consumer wants it in their car. Tesla’s FSD software is simple and does not require expensive hardware like radar or LiDAR to function, so other OEMs won’t have to dramatically change the design of their vehicles for the cars to become autonomous. In fact, Teslas use only eight relatively cheap cameras to perceive the real world and navigate the vehicle. The other OEMs might need to buy Tesla’s FSD chip, but other than that it should be fairly easy for OEMs to integrate their vehicles with Tesla’s FSD software. This will be another source of high-margin recurring revenue for Tesla in years to come.

Conclusion

In sum, we think FSD could boost Tesla’s revenue to around $110 billion and operating profits to $12.4 billion over the next twelve months. That’s significantly higher than estimates from the bulls at Morgan Stanley model who have Tesla sales at $93 billion and profits of $2.4 billion for 2024. We are already one month into the second quarter so our numbers probably won’t entirely materialize in calendar 2024, but the point remains that even the most optimistic estimates for this year are probably too low if FSD does for Tesla what we think it might.

It is a really exciting time to be a Tesla investor, and the fact that we may finally be reaching full autonomy (which Elon originally promised over eight years ago) is surreal. If you haven’t ridden in a Tesla with FSD 12.3.3 yet, we would encourage you to do so and would love to hear your thoughts.

Again, it’s not perfect, but it sure feels close.