The Apple Suppliers in the Revolution Portfolio

Sometime next week, probably Wednesday September 12th, Apple will release the new iphone. If you consider Apple’s design iterations this one is a big deal. The iphone 5 will almost surely have a totally new shape, the first change in that department since the iphone 4 was released in June of 2010. I’m betting there are millions of Verizon Wireless VZW customers who have been waiting for a totally new device; the iphone 4 was eight months old when it launched on the network and save for Siri the iphone 4s is pretty much the same. It looks like Apple’s ubiquitous headphones will be getting a refresh too. Check out the picture below, a pretty reputable Vietnamese site claims to have obtained a pair:

Part of the reason Apple’s stock has been rising recently is all that iphone rumor trading and anticipation and I wouldn’t be surprised about another 5% tick up from here, which would be closing in on $700. If history is any guide there will be a mini sell-off between the announcement of the phone and its release, which the financial media will read as “Investors Disappointed By New iPhone” which will further knock around the stock. And that will be the moment to buy some more.

Some of you have read my ebook about Apple’s suppliers and have been following my argument this year about that group of companies. Let me re-summarize: any company that is tied to Apple’s ecosystem will see benefits for years to come. It’s that simple. Cupertino’s absurd balance sheet will enable them to corner value chains in a way we haven’t seen since the robber barons. I’m not being overly dramatic. The Top 20 companies (including Apple) have about $300 billion in cash on the books. By 2016 I expect Apple to have that much in its own checking account. And it just purchased a publicly traded company, the first time its done that since the Steve Jobs comeback. Point being you want to own companies that deal with Apple as they’ll benefit from the behometh’s largess. I want to go through our Portfolio and look at the names most directly impacted by Apple.

Fusion-IO FIO and Broadcom BRCM are the two picks from the book I’ve deemed worthy for Revolution Portfolio. Fusion-IO finally (finally) shed its reticence last quarter and talked about Apple as a customer. Here’s an email I received from a subscriber back in June:

Hi Cody,

I have been your subscriber for the past 8 to 9 mths now. I like you to address your call on FIO. Could you please clarify whether Apple is one of FIO’s customer? In your blogs you seem to suggest that Apple is one of FIO main clients but I cannot find any information to substantiate your claim.

Please reply, I pay good money for your insights and I do not want to be mislead in any way.

Thanks

Save a mention of Apple in its IPO filing (and during in person conversations with money managers) FIO was terrified of admitting that it did any business with Apple. Which isn’t surprising right? But the impact of Apple on the balance sheet has become so large that concealing it would be akin to securities fraud. Management finally came out and said that Apple + Facebook FB is 53% of revenues. After talking to my sources in tech corporate purchasing circles I’m convinced that spending on FIO is about to accelerate in the next few quarters, helped by the Apple aura. I’m looking for the quarterly revenue number to roughly triple over the next couple quarters to about $300 million.

Broadcom’s inclusion in the next iphone and brand-new ipad nano is almost guaranteed. But I’m really excited about just how far out they are planning. While BRCM’s BCM4334 will be in the new iphone, they should see serious margin expansion from the BCM4335 next year. I don’t think revenues will grow as fast in years past but with increased profitability I could see Broadcom getting way bigger. Think Qualcomm QCOM bigger.

Nuance NUAN is still all about Siri, which Apple is about to expand. I’m betting that Apple is going to make a big push for developers to build offerings on top of Siri, something they’ve already been experimenting with companies like Yelp YELP and OpenTable OPEN. Apple will take a cut of sales made by talking to Siri and the royalty pie it pays Nuance for its voice recognition IP will keep compounding. Plus the mini ipad is going to be HUGE in healthcare for the simple reason that care providers can put in in their pocket, unlike the full-sized ipad. Nuance has been building its medical transcription business for just this moment, and its going to sell billions of dollars of apps on the new mini ipad platform.

Juniper JNPR and F5 Networks FFIV aren’t in physical Apple products but they are both Apple partners that will grab plenty of Apple’s CAPEX in the next few years. Here’s something I wrote about Juniper in April:

Juniper Networks, Inc. makes the routers and switches and networking equipment that power the Cloud Revolution. Their M-series routers are an industry standard and its highly likely that Apple is purchasing their equipment by the pallet. And the sentiment around Juniper is so negative (it’s only up 3.6% this year while the S&P is up 10%, and it’s down 44% over the last year), that any little surprise could send the stock soaring.

Same holds true now. Apple is spending truckloads of money on data centers and there are rumblings of at least three more multi-billion domestic server farms in the works. Juniper is so hated that the stock is primed for a big run on the analyst-upgrade dance. Estimates are too low for 2013, I think they could climb closer to $5 billion than the averaged projection of $4.68 billion, and if they do deliver that kind of topline growth, the earnings will be much higher than the projected $1.11.

F5 is enabling Apple on the enterprise side, a market that Apple is about to storm. This is F5 describing its relationship with Apple:

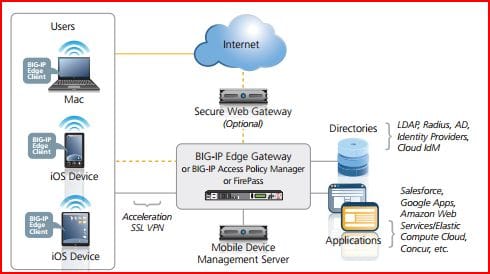

F5, as an Apple developer, has worked with Apple to provide organizations with protected access to network resources from numerous access points, including the Safari web browser as well as a wide range of Mac OS and iOS mobile devices.

Translation: employees of multi-billion dollar companies own multiple iDevices like the rest of us and hate their Blackberries (addicted, yes, love, no) and want the same experience at work that they have at home. Steve Jobs said he hated dealing with corporate purchasing departments because the people making decisions weren’t Apple users themselves and wouldn’t be the ones using the products. That isn’t true anymore and F5 has a turnkey service for corporate America looking to increase productivity and keep its minions happy with a company ipad. The estimates are that Apple will do about $19 billion in enterprise sales for 2012; by 2020 I expect that to be closer to $100 billion.

Sandisk’s SNDK relationship with Apple is complicated (I know about 138 of you just shook your head thinking about your own Facebook relationship status. I apologize). The company is on the official Apple supplier list and has its products in the ipod nano. But most tech blogs that physically rip apart Apple products for a living say that its Toshiba’s NAND memory, not Sandisk’s in the iphone and ipad. But the company is telling a different story to analysts and when it meets with investors and I think they are going to be a key iphone supplier in the coming generation. Here’s a slide Sandisk had in an investor presentation this year:

You can read that as SanDisk boasting it is in Apple-like products but I think this is as close to a confirmation as you’re likely to get from an Apple supplier. And analysts aren’t even talking about Sandisk’s diversification into SSD, which I think will start materially impacting the bottom line next year.