The Banking Crisis and Minor Trade Alerts on Solar Stocks, Space Stocks, COIN, UBER, and UPWK

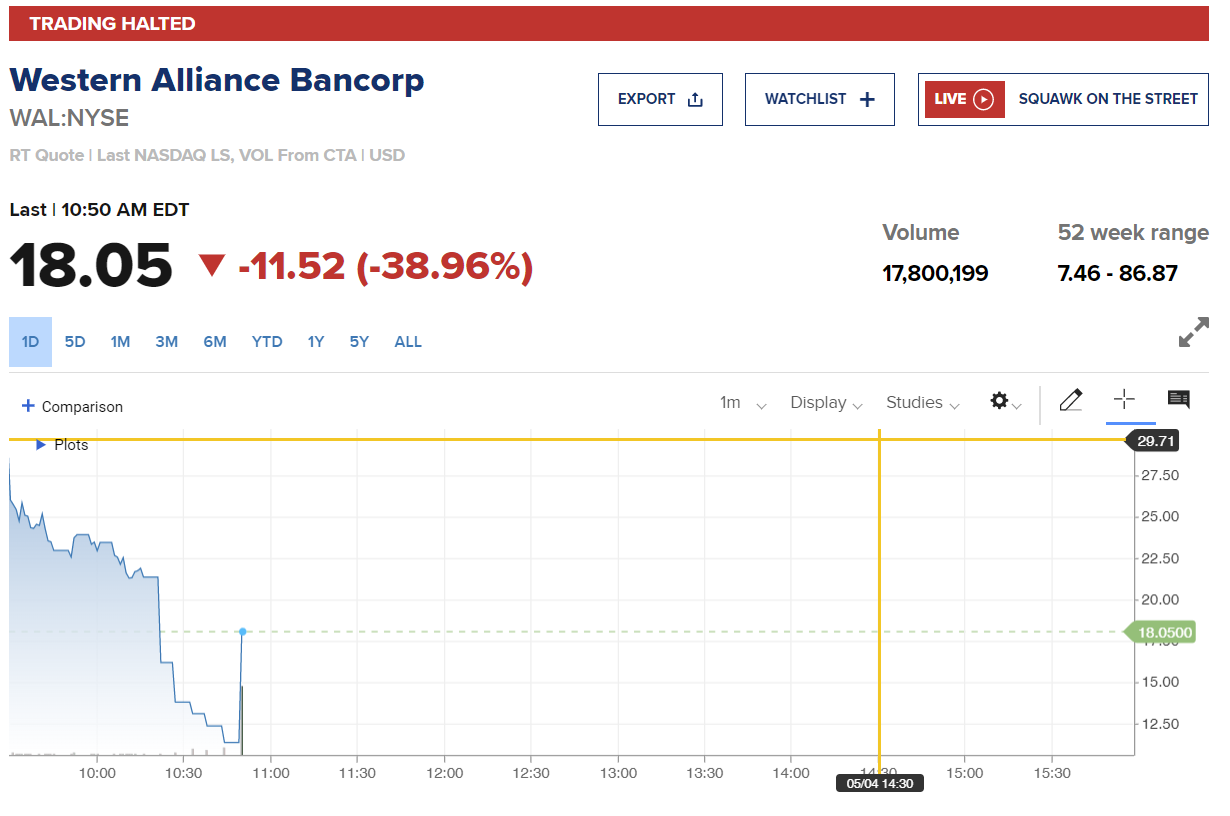

“…the U.S. banking system is sound and resilient.” – Federal Reserve Chairman Jerome Powell yesterday at 2:30pm ET. Four hours later:

Not four hours after Chairman Powell claimed that all was peachy in the banking system, we found out that two more large regional banks — PacWest and Western Alliance — are both exploring sales of their distressed businesses, and both stocks are down big today. Powell really didn’t have much credibility before this week’s press conference and now we’re not sure it can go much lower at this point. The Fed has known now for nearly two months that regional banks are struggling, and it supposedly looked into and analyzed the stresses in the system, and yet they come out yesterday and say all is swell? They really failed to do the one thing they are supposed to do in making sure our banks are safe places to keep money. Perhaps if the Fed, as a supposed “regulator” of banks, had actually done some regulating we wouldn’t be in this position? The bottom line is the Fed has and always will be reactive rather than proactive and they will often find themselves trying to fix the crisis they themselves caused/allowed to happen. End the Fed. Or at the very least, as I’ve long said, somebody needs to fire Powell. The stock market would go up 3-5% the day he’s gone.

Now to the markets. We ended up being well positioned for the crash in the solar stocks and we sold and/or rolled down many of our puts in ENPH, FSLR, RUN, and SPWR. It was nice to see our one solar long, SEDG, pop today after they reported a blowout quarter.

COIN puts have also been working out nicely and we took some profits on those today. QCOM had a tough quarter with smartphone deliveries and guidance coming in lower than expected. The read through for AAPL is not great and is likely what is causing the pullback in the stock before earnings. After the huge run up this year, if AAPL shows any weakness in the quarter we expect there is likely room to fall from here. As we have mentioned before, we think AAPL is probably overvalued here.

UBER had a spectacular quarter and reported surprisingly high revenue growth in its main mobility business despite what many expected would be a slower quarter. More importantly, the company is really doing a good job of bringing costs down and still growing topline at the same time. UBER indicated that they expect adjusted EBITDA of $660 million to $700 million in the next quarter which would be a massive jump from years past. UBER was a pretty big position for us so we trimmed a little bit of common stock after the pop in the last two days but it is still one of our top 3 positions in the hedge fund and we think it has room to run from here.

We have been slowly adding to our basket of beat-up space stocks like BKSY, RDW, and RKLB (when its below $4).

Lastly, we have been building up a small position in UPWK after it has been absolutely crushed this year. The company reported a pretty good quarter last night and the stock crashed initially but bounced back quickly. For those that don’t know, UPWK is the leading online freelancing platform and is used by many large corporations to hire high-skilled talent for web, mobile & software development, content creation, technical writing/editing, sales & marketing, accounting, engineering, etc. The stock has been beaten up lately on fears that corporate cost cuts will disproportionately reduce total spending on freelancers. Additionally, there is the fear that many of the services formerly hired on UPWK like content creation, writing, etc. will be eliminated by ChatGPT and other generative AI platforms. However, we like UPWK because it is a revolutionary platform play, has already achieved a critical mass of users, and is one of the few cloud/software companies out there that is trading at a reasonable valuation and still has some growth potential. We are nibbling on some shares around $8 and will add more if it drops from here.

That does it for today. We’ll do this week’s live Q&A chat tomorrow at 1 pm EDT in the Trading With Cody Chat Room or just send us an email with your question. See you then!