The Endless Progress Of Technological Advancement And Wealth Creation

“The greatest shortcoming of the human race is our inability to understand the exponential function.”

Please note, we’ll do this week’s chat on Thursday (3/28/24) at 10:00 am ET in the TradingWithCody.com Chat Room or as always you can email us at support@tradingwithcody.com.

“The greatest shortcoming of the human race is our inability to understand the exponential function.”

— Professor Albert Allen Bartlett

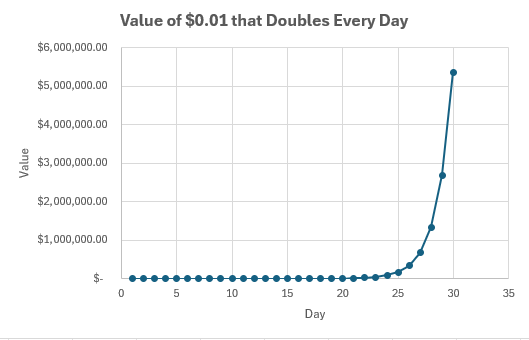

Have you ever heard this old fable: Would you rather get a one-time payment of $1 million today, or instead receive one penny today and that penny doubles in value every day for 30 days? The latter choice is the better option, as your penny will have turned into $5,368,709.12 by the end of day 30.

When growth rates get exponential, look out above! You’ve probably heard the term “hockey stick” used when something like the price of a stock or cryptocurrency starts to go up in a straight line. That’s because when exponential growth begins, the increase looks relatively flat at first compared to what it looks like once it really starts to build upon itself. In the penny fable above, at the end of day 15 (halfway through the investment horizon), the value of the investment is only $163.84. It’s not until day 28 (with only two more compounding periods left!), that the investment finally crosses the $1 million threshold. The nature of compounding exponential change — slow growth at first, followed by rapid growth toward the end — yields the famous “hockey stick” shape when plotted on a line chart:

We live in a time with a surprising amount of hockey sticks — from population growth to computing power to genome mapping — and sometimes it is useful to step back and simply appreciate just how big and fast our world has changed in recent history and how fast it will change going forward. As humans, its hard for us to imagine what the future will look like because we often fail to grasp just how big things can get when exponential growth is in play. One of the main reasons we call ourselves “Revolution Investors” is because the exponential rate of technological change (what Cody calls the “Kurzweil Rate of Change” after futurist Ray Kurzweil) continues to accelerate and push technological development to new heights and surpass all human estimations. Each new technological innovation helps create new products and sometimes entirely new markets that in turn create more products and more markets that ultimately create trillions of dollars of new wealth. We want to continue to bet on these Revolutions and part of our job is to remind ourselves that this exponential change is happening all of the time and we have to find the companies that are making these Revolutions happen and potentially growing exponentially.

Despite the many challenges facing the world today — from inflation to wars to drug use to racial, religious, and even partisan, tensions — we live in a time of unordinary relative peace and prosperity, thanks in large part to the exponential growth of the economies of the world and the United States in particular. The United States, for all of its flaws, is still the best country on Earth (in our opinion) and our Constitution and system of law remain largely in place (despite the best efforts of the Republican-Democrat regime). Most of the courts, companies, and people in this country generally follow the law which makes the United States one of the best places in the world to live, create, design, build, and enjoy life. The immense wealth created in recent decades around the world because of technology and free markets acts as major deterrent to large-scale war, which is one of the most destructive forces humanity has at its disposal. Throughout most of human history, the major powers (like England and France, for example) engaged in full-scale wars with each other with times of peace being the exception, not the norm. Today, the US is the only real superpower and its largest adversaries (China and Russia) are still way behind it in terms of economic and technological strength. Importantly, China which probably poses the most significant existential risk to the United States also wants to avoid a full-scale war with the US due to the immense trade China has with the US currently. Dollars, not guns, have proven to be the most important method for achieving world peace that humans have ever known.

All of that to say this: now is as good of a time to be alive and investing in the United States as ever before. While we think the markets might be a little stretched right here (we have been saying we are getting closer to full-on bearishness), in the grand scheme of things, we will continue to be long Revolutionary stocks in the US for the remainder of our careers as the wealth creation from the accelerating rate of technological change continues to happen.

Now, let’s look at some of the most important hockey sticks (those things that are growing exponentially) in the world today and discuss how they affect the economy, the markets, and our investments.

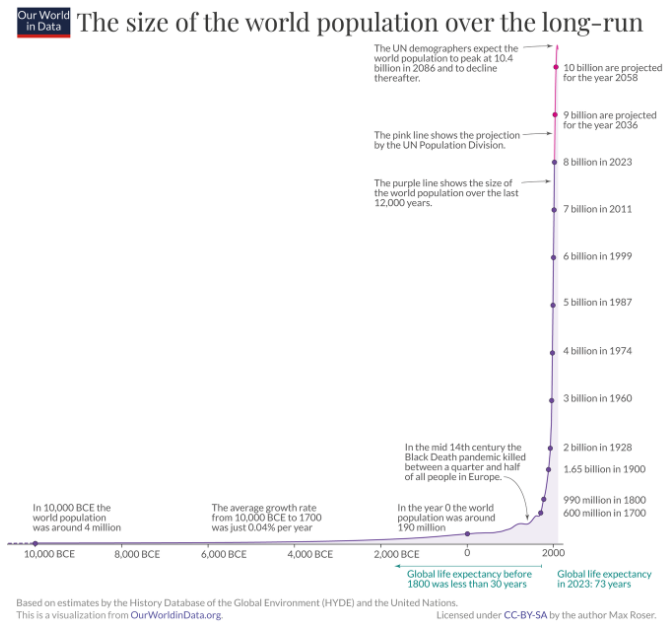

- Population Growth

Source: Max Roser and Hannah Ritchie (2023) – “How has world population growth changed over time?” Published online at OurWorldInData.org.

From 10,000 BC to the year 0, the population of humans grew from approximately 4 million to 190 million, for a net change of 186 million people. From year 0 to the beginning of the Eighteenth century, the world added about 410 million people. When The Industrial Revolution hit in full force in the mid-1700s, the population started to explode and quickly doubled in just over 100 years. We crossed the 1 billion mark in 1804 and quickly reached 2 billion by 1928. From there, things got really crazy and today over 8 billion souls are walking this Earth, and that number is growing by about 200,000 people every day.

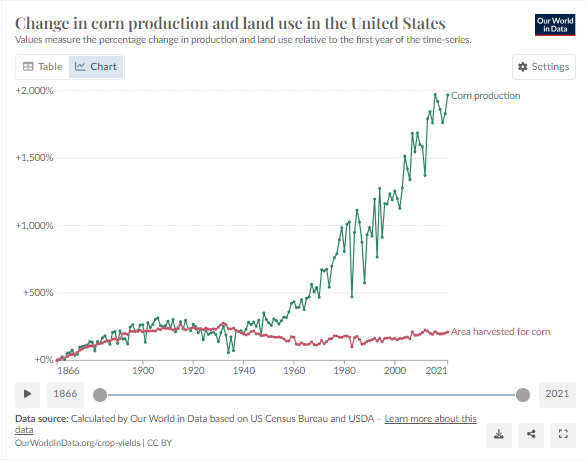

That’s a lot of people to find houses for, feed, and clothe. Early in The Industrial Revolution, economists like Thomas Malthus predicted that the world would be unable to produce enough food to feed the rapidly growing population. Yet somehow food production, which is nearly totally reliant on scarce resources (land and freshwater), has also grown exponentially. Look at the change in US corn production since 1866. It started growing exponentially around 1940 even though the area of land dedicated to corn production was essentially flat over the same time period:

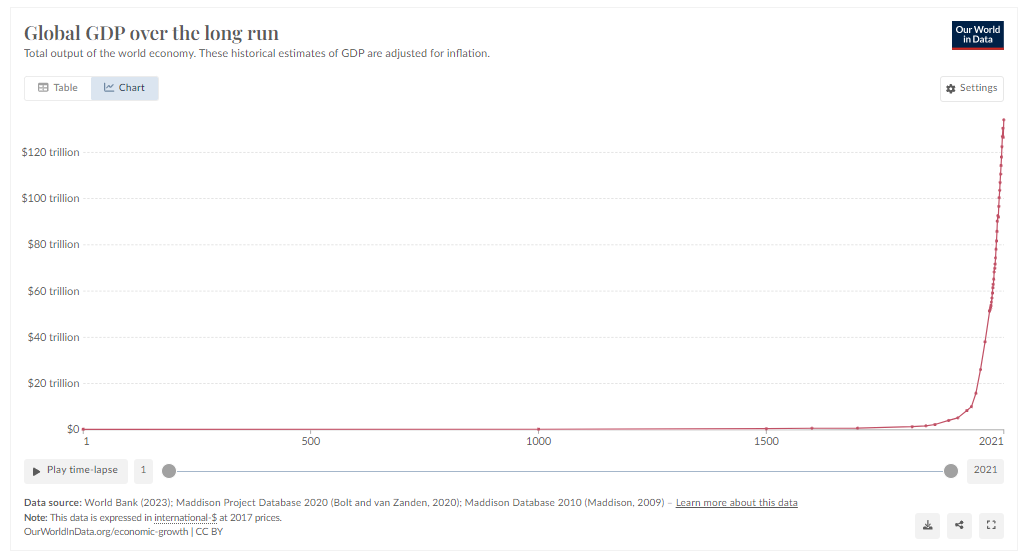

Source: “Data Page: Global GDP over the long run”, part of the following publication: Max Roser, Pablo Arriagada, Joe Hasell, Hannah Ritchie and Esteban Ortiz-Ospina (2023) – “Economic Growth”. Data adapted from World Bank, Bolt and van Zanden, Angus Maddison.

Energy, housing, clothing, etc. have all kept pace with human population growth and all of the doomsayers who predicted that we would run out of resources to maintain this exponential population growth have been proven wrong.

That said, having 8 billion people on Earth is quite a lot and at some point, our natural resources and environment will be strained by all of these people. For that reason, we think The Space Revolution will be one of the next enabling Revolutions that allow the human race to keep growing exponentially by opening up new planets for people to live on in the near future. History teaches us that humans always use technology to find a way to keep the exponential growth growing.

2. Global GDP

As we might expect, with the explosion of productivity and population growth resulting from The Industrial Revolution came an explosion in global GDP:

Source: OurWorldInData.org

In 1820, when James Monroe was the President of the United States, the entire global economy was worth about $1.36 trillion (adjusted for inflation), or about 56% of NVIDIA’s (NVDA) current market cap. For reference, NVIDIA has added right about $2 trillion in market cap since the October 2022 lows, which is roughly equivalent to the GDP of the entire world in 1860, when Nikola Tesla was just a four-year-old child.

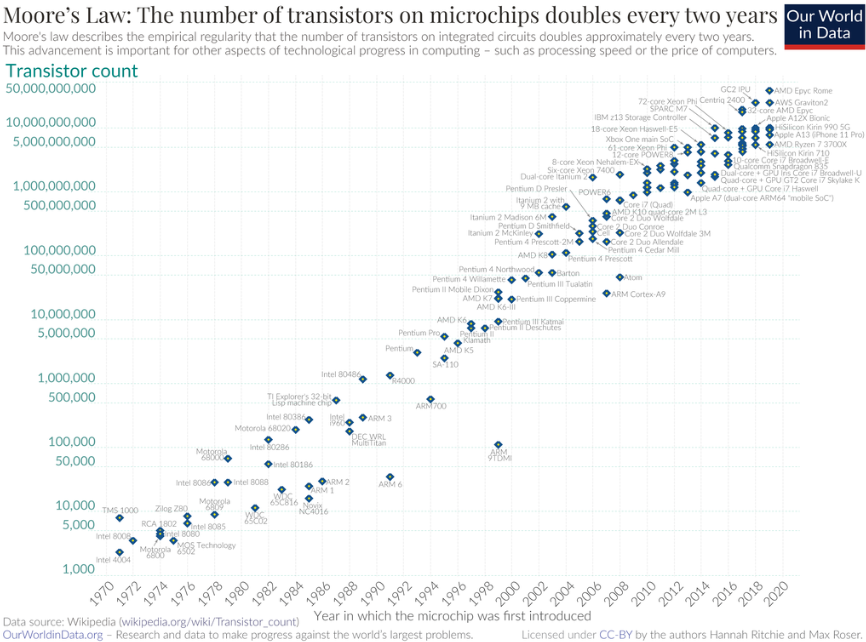

3. Moore’s Law

Source: Wikipedia (graph is logarithmic).

In the tech world, one of the most important and oft-cited examples of exponential technological progress is Moore’s Law. We discussed Moore’s Law two weeks ago, but in essence it is the observation of Intel co-founder Gordon Moore that the number of transistors crammed in the same area of silicon roughly doubles every two years (doubling the transistors per square inch means doubling the computing power of the microchip). Moore originally made this observation in 1965, when computing was still in its infancy and at that time he predicted that this trend would only continue for ten years or so. Now, almost 60 years later, Moore’s Law is still alive and well (as shown in the chart above), although some in the chip industry (including NVIDIA CEO Jensen Huang) have claimed that Moore’s Law is dead.

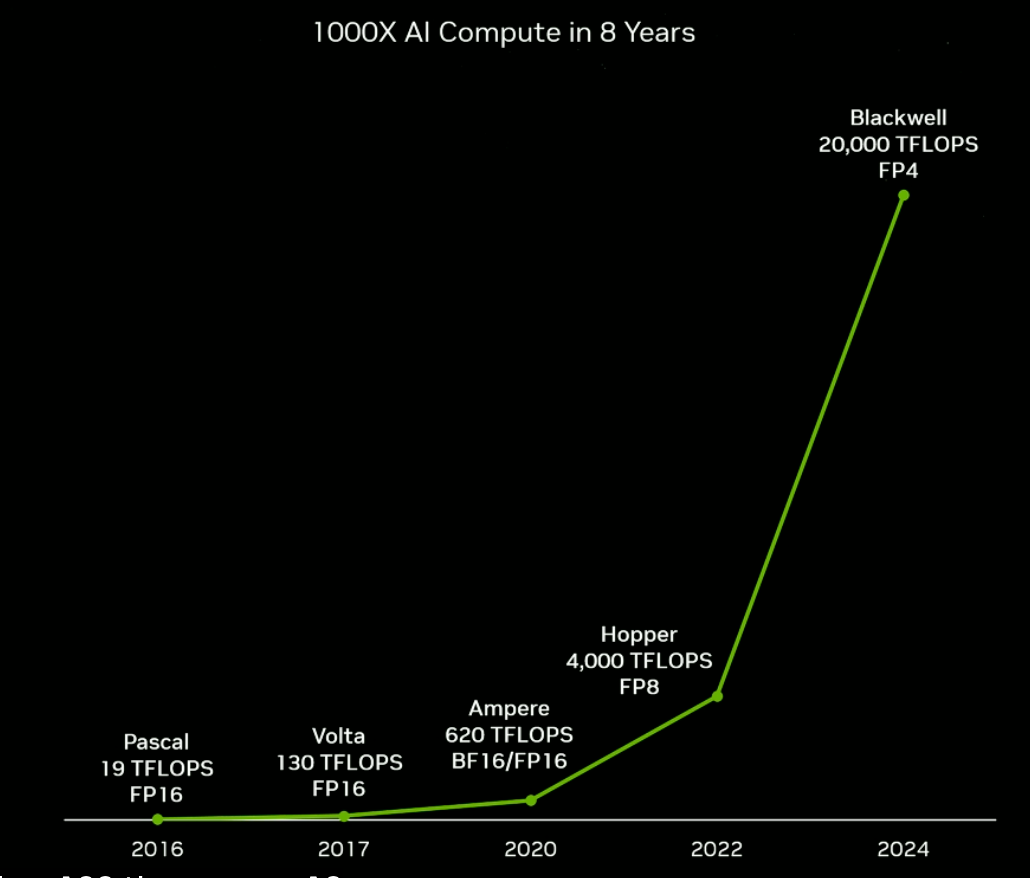

What’s ironic is NVIDIA has actually accelerated Moore’s law. As we mentioned last week, NVIDIA chips have seen a 1000x increase in computing power in the last 8 years, when under Moore’s law we would only expect to see a roughly 32x improvement. NVIDIA has accomplished this improvement not by necessarily increasing the number of transistors per square inch, but by changing the entire framework for how computers operate. NVIDIA invented the concept of “accelerated computing.” NVIDIA GPUs have thousands of small cores that are great at handling many relatively simple calculations. Those thousands of small cores on a GPU can do extremely intense computational workloads when they work in parallel with one another. In other words, GPUs are fantastic at computing the specific tasks for which they were designed, but not great at general-purpose computing which is more suited for CPUs. CPUs (like the one in your computer) are designed to handle a variety of tasks from word processing to streaming a video, to playing music through your speakers, but that ability to handle that wide variety of tasks makes CPUs ill-suited for the millions of tiny calculations needed to make things like AI and self-driving cars work.

The point is that even though Jensen Huang predicted that Moore’s Law was dead because of the physical limitations involved when trying to place ever more transistors on the same area of silicon, his company actually accelerated the rate of growth in computing power by re-engineering the way computers work from the ground up. So even physics itself cannot stop the exponential growth of technology.

Source: NVIDIA.

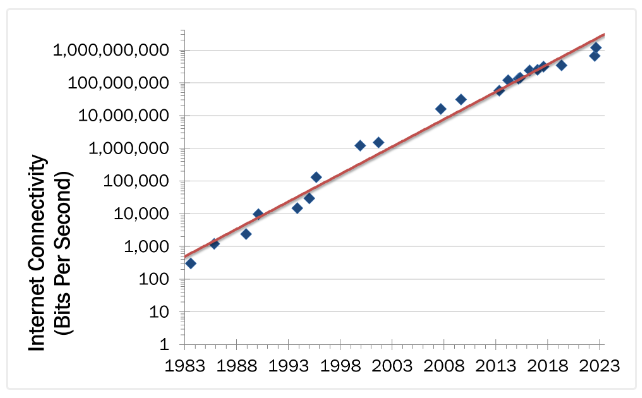

4. Internet Growth

Source: NNgroup.com (graph is logarithmic).

Another important hockey stick that has far-reaching implications is the growth of internet speeds over time. Bandwidth increases follow a similar curve as compute power, roughly doubling every two years. This rapid growth in internet bandwidth has enabled everything from The App Revolution, The Streaming Revolution, The Internet of Things (IoT) Revolution, and will soon help enable The Robotics Revolution and many more Revolutions to come. Ever cheaper and faster internet essentially lowers the cost of information itself, thereby enabling thousands of new applications and unlocking trillions of dollars of value in the process.

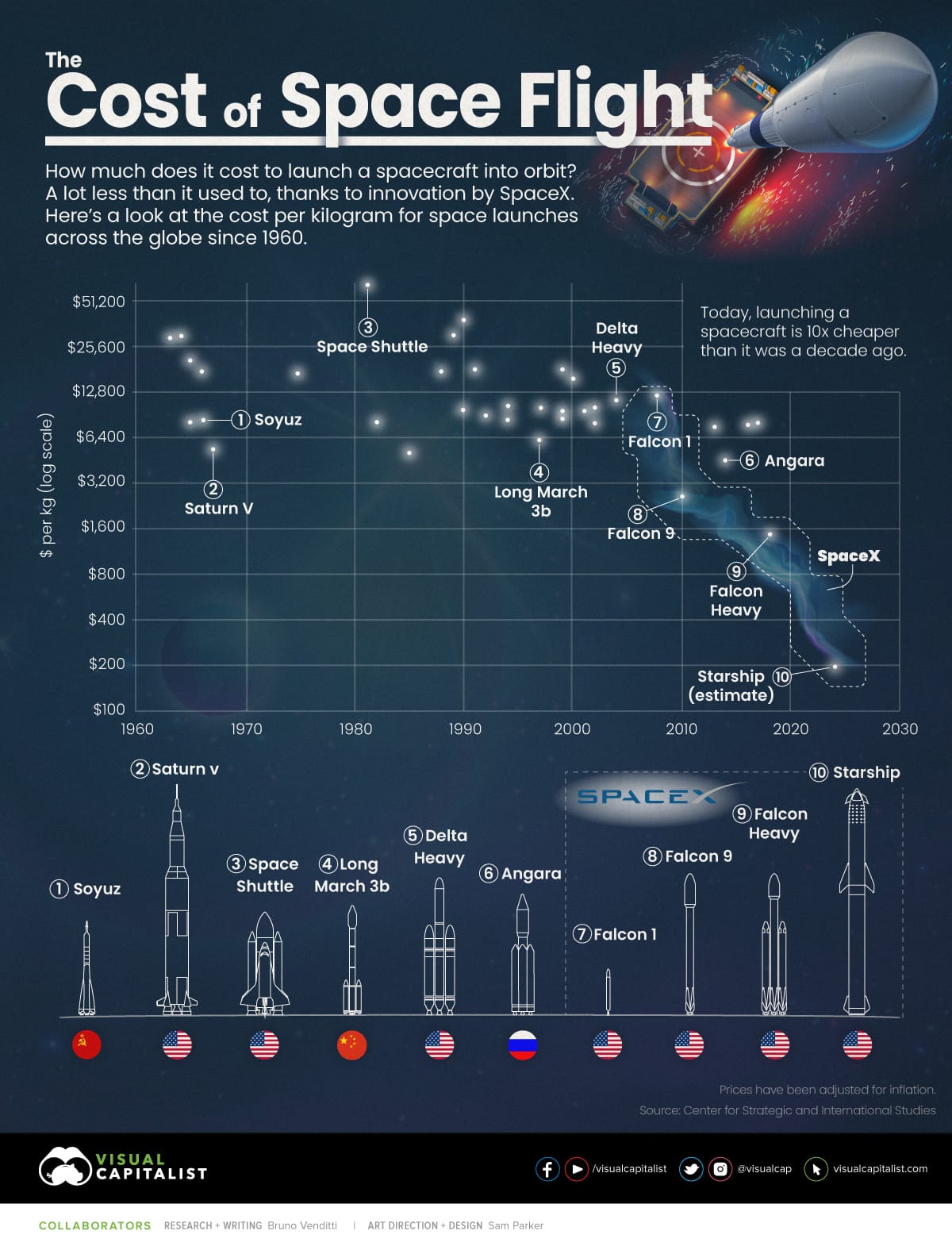

5. Launch Costs

Source: VisualCapitalist.com.

We’ve written about this one a lot, so we won’t waste too much ink here. But the declining cost of launching stuff into space, driven almost entirely by SpaceX, is opening up an entirely new market to the world. We always say that we don’t know exactly what all of the applications in space will be, but if the price of getting to space gets to be only a few hundred, or maybe even tens of dollars per kilogram, we think there are trillions of dollars worth of new ideas that people will come up with to capitalize on this astonishingly cheap access to space. We can think of space travel, tourism, manufacturing, mining, energy production, etc. to name a few of the very valuable things that people can do in space once it is dirt cheap to leave Earth’s atmosphere.

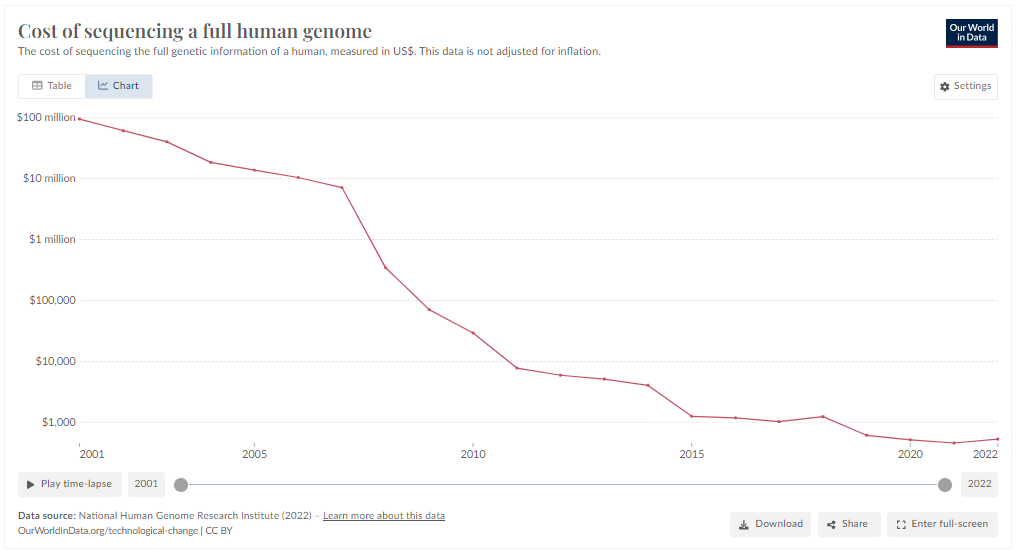

6. Genome Sequencing

Source: “Data Page: Cost of sequencing a full human genome”, part of the following publication: Max Roser, Hannah Ritchie and Edouard Mathieu (2023) – “Technological Change”. Data adapted from National Human Genome Research Institute.

This graph represents the exponential decline in the cost of sequencing the human genome. This massive cost decline has led to significant advances in medicine, genomics, and biotechnology. Obviously, this will further improve human life expectancy and accelerate human population growth (see Chart 1 above). More people living longer, healthier lives enables them to be more productive which further compounds GDP growth (see Chart 2 above).

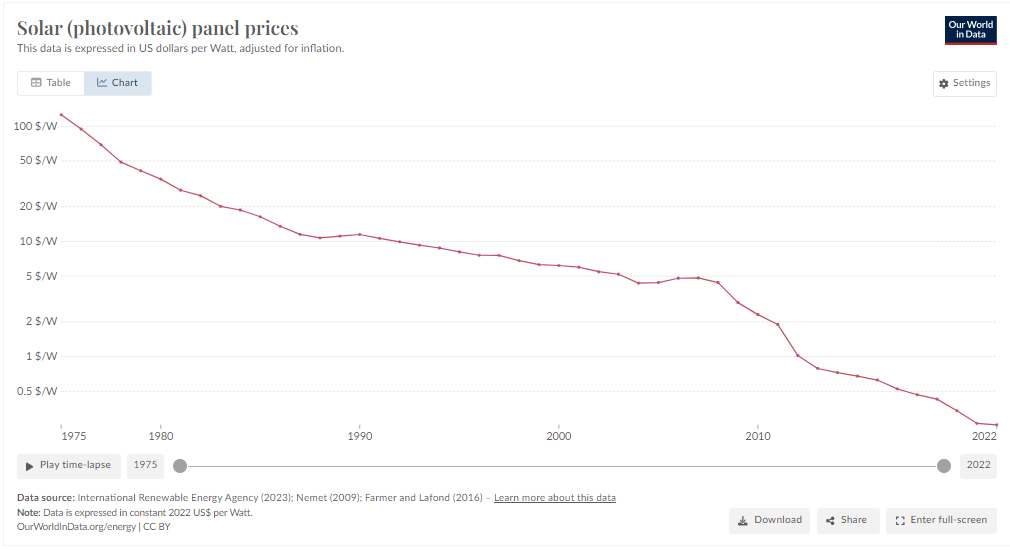

7. Solar Energy

Source: “Data Page: Solar (photovoltaic) panel prices”, part of the following publication: Hannah Ritchie, Pablo Rosado and Max Roser (2023) – “Energy”. Data adapted from International Renewable Energy Agency, Nemet, Farmer and Lafond.

Solar is in a big slump right now, but it is one of the best sources of alternative energy available to us because it helps us capture the unlimited, free, and safe energy provided by the Sun every day. Eventually, the cost of solar panels will get so cheap that we won’t have to subsidize this industry anymore (we never should have subsidized it to begin with, as that probably only slowed down the rate of technological innovation), and more of the electricity we use every day will come directly from the sun. If the cost of converting solar rays into usable electricity eventually becomes de minimus, that will open the door to even more applications and use cases that don’t make sense if electricity is really expensive (like it is right now, relatively speaking).

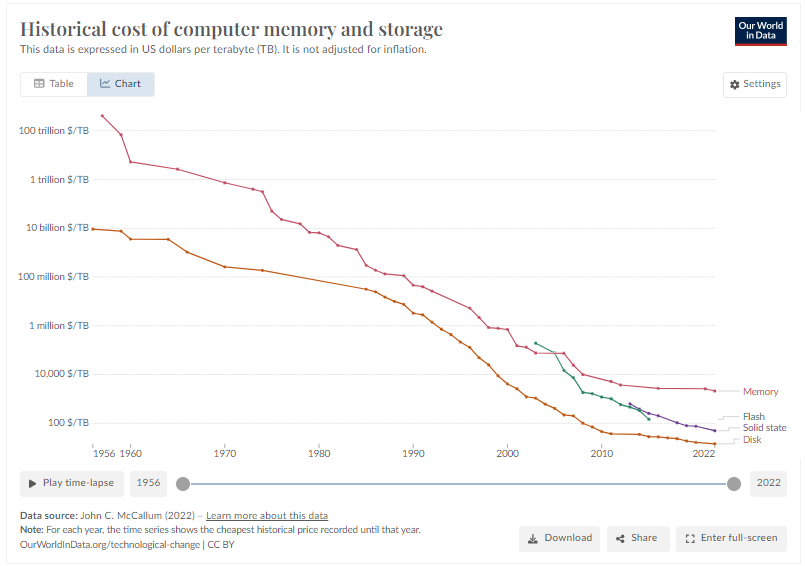

8. Digital Storage

Source: Data Page: “Historical cost of computer memory and storage,” John C. McCallum (2022) – processed by Our World in Data

Memory is another one of those fundamental constraints on technological advancement. Storage of data has become increasingly important as computers have become more advanced, and we now generate more data than ever because all of us are walking around with a very powerful computer in our pockets. Memory has essentially become a commodity as shown in the declining price graph above, and that is great for all of us because it enables us to generate ever more content (and more data-rich content like videos) without having to be worried about constantly overpaying for more cloud storage, for example. In the age of Generative AI, having cheap memory will be critical because content creation itself is being democratized and the rate of acceleration of content creation is growing rapidly.

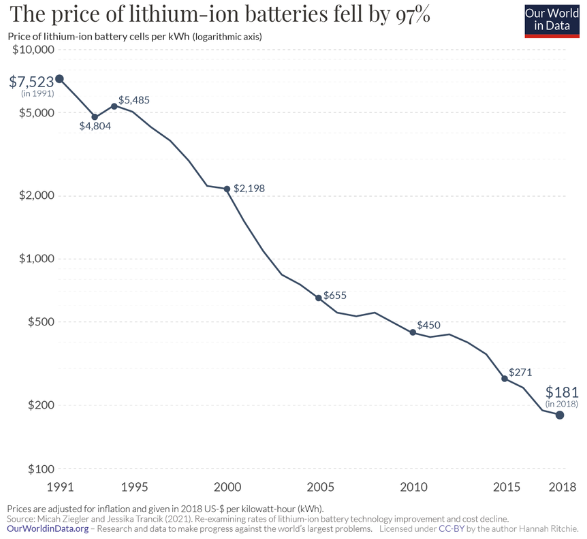

9. Energy Storage

Source: Hannah Ritchie (2021) – “The price of batteries has declined by 97% in the last three decades” Published online at OurWorldInData.org.

We need efficient ways to both create and store energy. Solar is a great solution, but it is entirely useless in the day time. Natural gas and nuclear are our most reliable forms of energy, but they both have their drawbacks as well. Remember a couple of years ago when Texas had a major winter storm that shut down most of the state’s power grid? That was mainly the result of natural gas wells in West Texas getting frozen shut and that, combined with lack of natural gas storage, led to the generators being turned off because there was no gas supply. In short, we need effective energy storage to keep the grid up and running during times when we cannot produce power. Moreover, having cheaper and more efficient batteries allows us to make much better hardware which will result in longer battery lives for phones, robots, self-driving cars, etc.

Conclusion

There are a lot of other hockey sticks that we could write about here, but it is simply amazing to us to see just how widespread the forces of exponential technological change are in our world. These are extremely powerful market forces and they will continue to drive growth and prosperity for many years to come. Obviously, there are downsides to some of this growth and it does not happen automatically. As Elon Musk often reminds us, there is no guarantee that humans will ever become a multi-planetary society if people don’t consciously choose to make that happen. Everyone has a part in advancing technology and society as a whole. But the lesson to be learned here is that history is telling us that as a species, we have the capability to drive exponential growth forever, despite facing extremely challenging circumstances.

We are more excited than ever about some of the technological Revolutions happening right now — like The AI Revolution, The Space Revolution, The Robotics Revolution, and The Self Driving Revolution. We own some of, if not the best companies, in each of these Revolutions and we want to stick with them for the next 10,000 Days. Be prepared to be amazed!