The Fed, Stock Markets, The Fed, Cryptos, Christmas Songs and The Fed

What if everything you read and hear about the Federal Reserve, rate cycles and the stock market is all wrong? It probably is. It sure has been for decades. So how many money managers, hedge fund managers and home investors have told me that the stock market is in big trouble because the Fed is finally about to start raising rates. Everybody on CNBC and Fox Business and Bloomberg will tell you a litany of reasons why it’s supposed to be a Very Big Deal and Very Bearish that the Fed’s raising rates. Yet for the last 20 years or so, as you’ll see in this report, the exact opposite has been true — you would have wanted to be in stocks when the Fed was in a tightening phase in the late 1990s, while you would have wanted to be out of the markets or even short stocks when the Fed was easing again from 2000 to 2002. Likewise, you would have wanted to be in stocks when the Fed was in a tightening phase from 2003 to 2007, while you would have wanted to be out of the markets or even short stocks when the Fed was easing again from 2008 and 2009. Long-time Trading With Cody subscribers remember that, as I explained in 2012, the Fed has been cutting QE since 2012 or so which was essentially a move into another tightening phase and, once again, stocks boomed.

That’s not only part of the answer to someone’s question below, it actually comes from the opening from a 40-page booklet I published for Trading With Cody subscribers in 2017 called “How to Predict and Profit From the Fed’s Bubbles and Crashes.”

Here’s the transcript from this week’s Live Q&A Chat.

Q. Cody Which do you believe is more important to the market right now… the Fed or the Great Trade War?

A. I think everybody who wants the Fed to cut rates because they think the stock market will magically go up again if the Fed does so — well, I think all those people are on crack. Look, over my lifetime as I’ve explained many times, the stock markets go up when the Fed is raising rates. The markets typically are already in bear market mode and heading much lower when the Fed starts cutting rates. I’ll put it this way — if the Fed cuts rates, I will probably sell more of my longs and put on more shorts. I would be outright bearish about the stock market if the Fed starts cutting rates. The Great Trade War analysis is inseparable from our Fed analysis, so I don’t think we can choose one or the other in that regard. Both matter, but the Great Trade War is what is driving stocks right now because it has disrupted trillion supply chains that took decades to build.

Q. Why you think the current bubble market can keep going on for a while? Because the Fed has NOT finished the hikes? or other reasons? Thanks.

A. This is someone who’s been staying up with my writings about how we should always “fight the Fed.” I’m actually writing a whole article on the Fed and it being a factor in the market. I do think that all these people who think if the Fed will just cut rates again are completely wrong that the market will bounce back to all-time highs and get back into Bubble-Blowing Bull Market cycle with that as the catalyst. What if everything you read and hear about the Federal Reserve, rate cycles and the stock market is all wrong? It probably is. It sure has been for decades. So how many money managers, hedge fund managers and home investors have told me that the stock market is in big trouble because the Fed is finally about to start raising rates. Everybody on CNBC and Fox Business and Bloomberg will tell you a litany of reasons why it’s supposed to be a Very Big Deal and Very Bearish that the Fed’s raising rates. Yet for the last 20 years or so, as you’ll see in this report, the exact opposite has been true — you would have wanted to be in stocks when the Fed was in a tightening phase in the late 1990s, while you would have wanted to be out of the markets or even short stocks when the Fed was easing again from 2000 to 2002. Likewise, you would have wanted to be in stocks when the Fed was in a tightening phase from 2003 to 2007, while you would have wanted to be out of the markets or even short stocks when the Fed was easing again from 2008 and 2009. Long-time Trading With Cody subscribers remember that, as I explained in 2012, the Fed has been cutting QE since 2012 or so which was essentially a move into another tightening phase and, once again, stocks boomed.

Q. Shall we change our strategies in this nervous and full of over-reaction market?

A. I’m confused by the premise of your question which misses the fact that we already changed strategies over the last couple years when I went from Extremely Bullish and Aggressively Long to being Cautious and raising a bunch of cash, adding some puts and reducing the number and sizes of our longs. We did prepare for this current market a while ago, right?

Q. Cody: thoughts on Cramer calling this a bear market….

A. “Man gave names to all the animals in the beginning, long time ago. He saw an animal that liked to growl, Big furry paws and he liked to howl, Great big furry back and furry hair. ‘Ah, think I’ll call it a bear.'” — Bob Dylan. The answer though is what does it matter if Cramer’s calling this a bear market. We were already prepared for it and we are handling it as it comes anyway.

Q. Do you think DOW can go to 50K one day?

A. Yes, of course I do. Maybe not this year, but some day in the next five to twenty years it sure will I bet.

Q. Hello Cody, do you like NUGT or JNUG as gold plays too?

A. This is how I explained my take on NUGT and JNUG back in my book “Everything You Need to Know About Gold and Silver:” I’ve often advised against owning gold miner stocks because they are often high-beta versions of gold itself, meaning when gold drops 30% like it has, gold miner stocks will drop maybe twice that much, 60% or more. Indeed, take a look at this chart. That said, when the gold miner stocks are on the downside of that correlation in a down market, they can provide big leverage on any bounce in gold itself. See, if gold rallies 10-20%, or even if it just finally finds a bottom, the GDX can rally back to its recent higher lows. Meaning, the GDX can pop 30-40% when gold just finds its footing and/or actually rallies higher. In some sense then, the GDX is a good levered-up vehicle for trading gold shorter-term. Using call options for the trade makes it even more levered-up. Investing in gold miners on the downdraft is, of course, a risky trade.

Q. Cody, I may have missed something but looks like Stellar Lumens are below latest buy price?

A. It is. But those lists of “where I would look to buy more” of each position isn’t a magical “I’ll buy more here no matter what” list. It’s just a guide. And I’m not in a rush to buy more cryptos at this moment, though I can think of worse ideas than buying Stellar Lumens while Bitcoin and The Great Cryptocurrency Crash are in full bloom.

Q. Any reason why AXGN is up 6% AH”s?

A. No, it’s a small cap stock and after hours trading in a small cap stock is often misleading.

Q. Cody: Any stocks you “missed” like SQ (you said it, not me ) that might be back on radar due to market downturn?

A. I have spent a bunch of time lately creating an algorithm that uses my fundamental analysis, including balance sheet, P/E and growth rate plus a whole bunch of equations and other magic to give me some actual quantitative means of when I think a stock is a “good risk/reward setup” or not. I’ll run SQ through it right now. Hold on.

A. SQ comes out with a Risk/Reward Factor-Adjusted Annualized Upside of 19.7%. 30% or higher is the threshold for a stock I might want to buy more of. So, SQ doesn’t quite make me excited to buy here. Maybe at $50. But not yet.

Q. Good morning Cody, two weeks ago we have purchased some AAPL call options with strike prices around $200, that expire in February. How do you view this trade now, as Apple punishing seems never ending? Any near term catalysts, which you see for it?

A. I see it like you guys do now — it was a crappy trade. That said, I do think I might buy one more small tranche of AAPL call options with strike prices around $190 dated out to February or next summer.

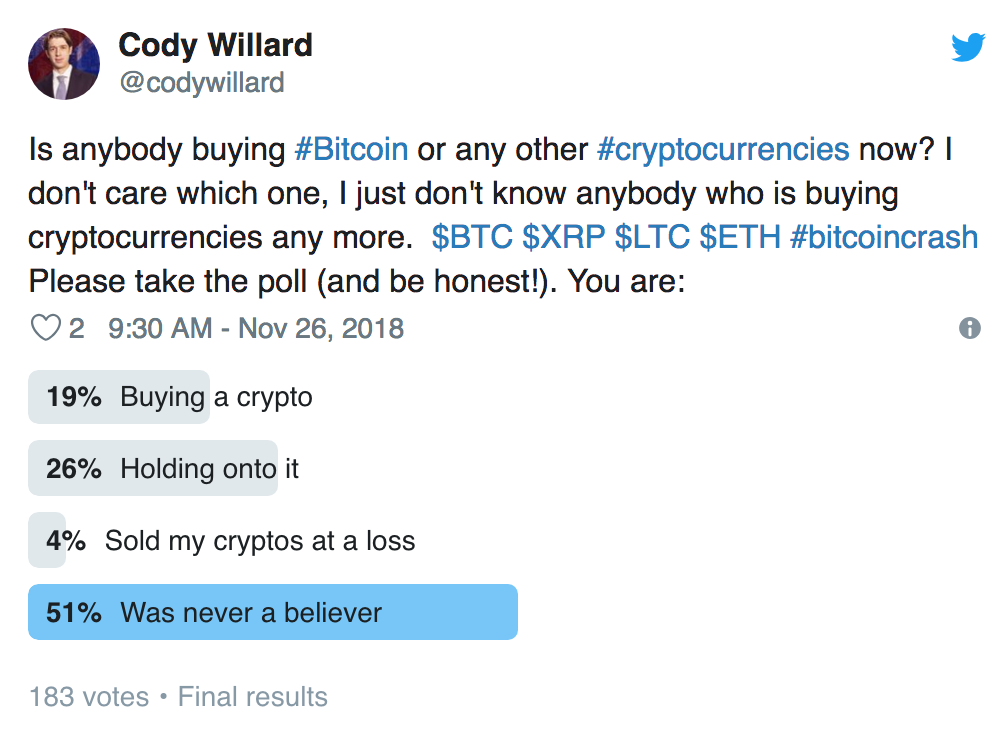

Q. Cody: Looking for a 5th option on your twitter poll – A believer, but waiting for better entry.

A. That’s a good answer, but Twitter only let me put 4 options to the poll. I wanted to put in another one or two options. Here’s the poll on Twitter that I posted yesterday by the way. Is anybody buying #Bitcoin or any other #cryptocurrencies now? I don’t care which one, I just don’t know anybody who is buying cryptocurrencies any more. $BTC $XRP $LTC $ETH #bitcoincrash Please take the poll (and be honest!). You are:

Q. Any thoughts on “Crazy Craig” Wright and his Bitcoin Cash war … and how it will affect crypto markets going forward?

A. I have never heard of Crazy Craig Wright and he is irrelevant to crypto markets long-term.

Q. How about IBM at these levels?

A. I don’t think is a level at which I would buy IBM. Maybe, like with GE, I will someday turn from IBM bear to IBM bull but I don’t think I would ever buy IBM. That said, who knows, I’m always trying to be flexible too. Q. How about IBM at these levels. A. I don’t think is a level at which I would buy IBM. Maybe, like with GE, I will someday turn from IBM bear to IBM bull but I don’t think I would ever buy IBM. That said, who knows, I’m always trying to be flexible too.

Q. I know you have an allergy to Chinese stocks, but is there any price at which BABA or TCEHY would be a buy to you?

A. The thing is that I just don’t trust the Chinese Communists in power at all. I don’t trust the Chinese accounting system or the Chinese regulatory system or anything else in the Chinese system under Communist Rule. So, I probably wouldn’t every invest long-term in BABA or TCEHY. That said, I could envision buying them for a trade, maybe with a time horizon of less than one year or so, at some point.

In your latest book, The Bitcoin Revolution and The Great Cryptocurrency Crash, I think you highlighted $OSTK as a possible revolution stock (notably, it has moved with the crypto market). With Patrick Byrne aiming to sell its retail arm and going all-in on blockchain technology, do you have any revised outlook on the stock here?

A. No, I gave OSTK a 3/10 Revolution Investing Rating in that book and I don’t think it will ever get much higher than that. I’m no fan of Patrick Byrne and he was rude to me once on air when I had one of my first CNBC appearances anyway and I still hold a grudge. Just kidding about holding the grudge part. But seriously, I was bearish on Overstock back then and still am.

Q. Is AAPL worth nibbling here?

A. Did you see my Trade Alerts about Apple a couple weeks ago and/or my comment above about AAPL? Yes, it is worth nibbling here IMHO.

Q. GBTC whats a good entry point?

A. I don’t think I’d ever trust a “Bitcoin Investment Trust.” If you want to own Bitcoin, buy Bitcoin.

Q. Any thoughts on $Z? I noticed a board member bought close to $25M worth last week. (The same guy also bought 900k shares of Netflix at $89 in 2016, so I figured why not ask…)

A. I’ve been looking at Zillow since it got crushed lately. Getting interesting here.

Q. @Cody: so you just said you are a GE bull now? should we buy?

A. No, I don’t have enough conviction about GE to actually risk my money on it. I just want to pull in my GE bear claws.

Q. I’ll second the Cramer question in calling a bear market. Having worked for Cramer, what is he trying to accomplish by this latest call?

A. Let’s get on the phone and chat sometime. Email me at cody@clwillard.com

Q. Cody If you’re into this sort of thing… your favorite 3 Christmas songs?

A. I’m dreaming of a white Christmas. Jingle Bell rock. It’s cold outside.

Q. Cody, new here though I did follow you through revolution investing. So I was not as prepared as you guys for the hit here. Nasdaq was down 16.5% at the lows a couple of days ago. I can now see you are still quite cautious. Selling here seems kind of problematic as many of the stocks seem close to a bottom in price if not in time, having suffered some big hits. I have nearly 20% in cash, How would you advise someone who is is not as hedged or in cash now?

A. The answer is somewhat relative to each person. If you don’t think you have enough cash or hedges though, then you probably should raise some cash at least and maybe add some hedges when the markets rally for a few days or something. If you’re losing sleep and worried about your positions then you’re too long. You might regret selling/trimming some at these prices if the markets happen to go straight up from here, but more likely you’ll do better long term by making sure you’re appropriately exposed in your own personal risk/reward profile.

Thanks all, that’s a wrap.