The Grand Tesla AI Slam, Or, The AI/Robot Wedding

Now let’s get into Tesla’s AI strategy. Tesla has a unique AI strategy because it is the only Mag 7 company that is solely focused on building AI that knows how to understand, navigate, and interact with the physical world.

Please Follow us on our LinkedIn Page and Connect and Follow Cody here.

This is the final article of a series of articles breaking down and ranking the AI strategies of the Magnificent 7.

“With the Tesla Autopilot or Full Self Driving we’re effectively I think creating the most advanced, practical AI for navigating the real world. And you can almost think of Tesla as the world’s biggest robot company, or semi-sentient robot company. So we have the car as kind of a robot on four wheels, and we can probably take that same technology and put it in a humanoid robot and have that robot be useful.”

— Elon Musk

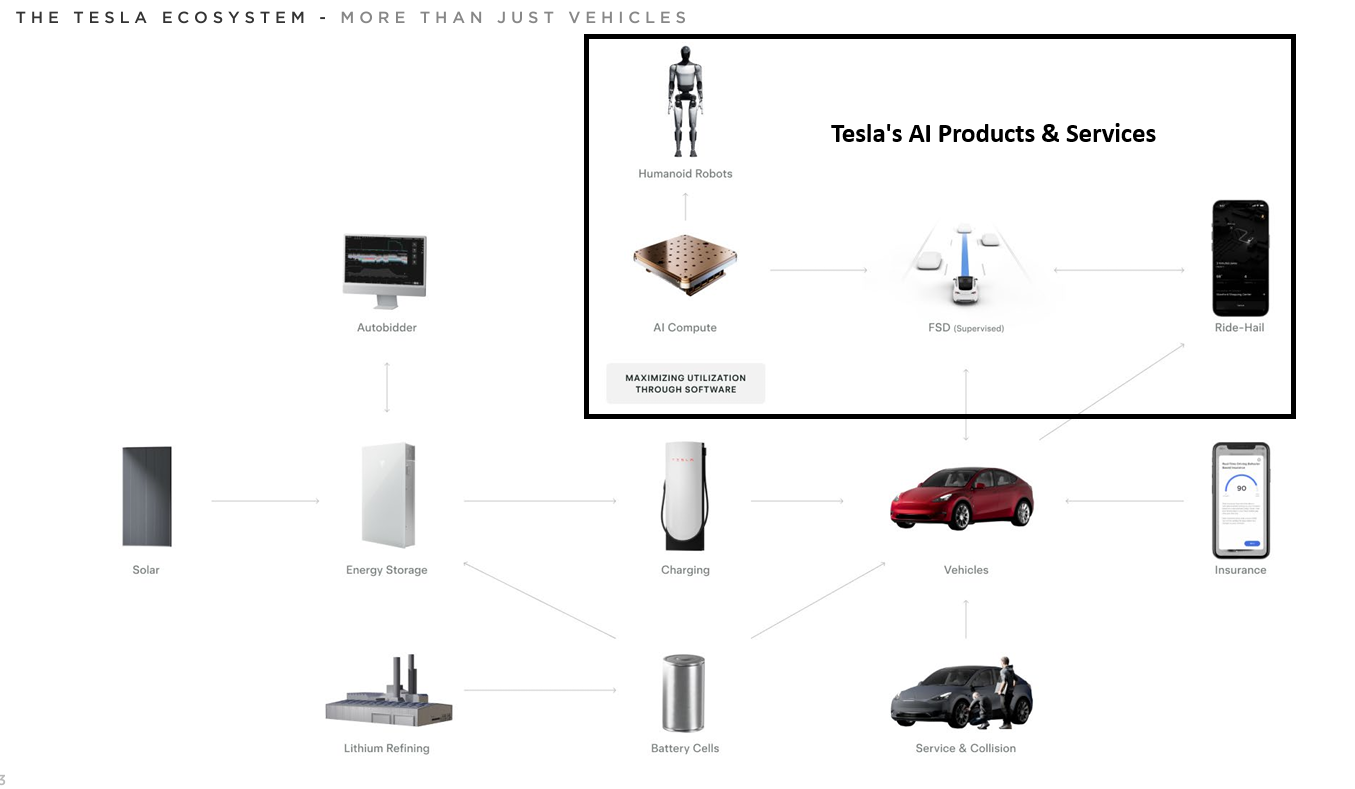

We are rounding out our series on the AI strategies of the Mag 7 with Tesla (TSLA). With every one of the other Mag 7 articles, I had to spend a lot of time thinking about how each company could use AI to develop products and services that would both (1) be useful to the public; and (2) make money for the company. However, with Tesla, it is already very clear what Tesla’s primary AI products and services will be (although you can rest assured that in the future there will be even more Tesla AI products we haven’t thought of), that they will be incredibly useful, and will make trillions of dollars for Tesla. If Tesla can marry AI with the hardware it clearly has the capability to build, it will have achieved the Grand Slam of AI and Robotics!

Between full self-driving (FSD), Robotaxi, the Optimus Robot, and Dojo, Tesla has a clear path to monetize AI. The only question for Tesla is whether the company can actually build sufficiently advanced AI, perhaps some form of artificial general intelligence (AGI), that can power those services and make them as useful and helpful as we think they can be. Therefore, in this article, we will highlight each of Tesla’s AI products, but we will also discuss the reasons why we think Tesla can actually build and scale those AI products.

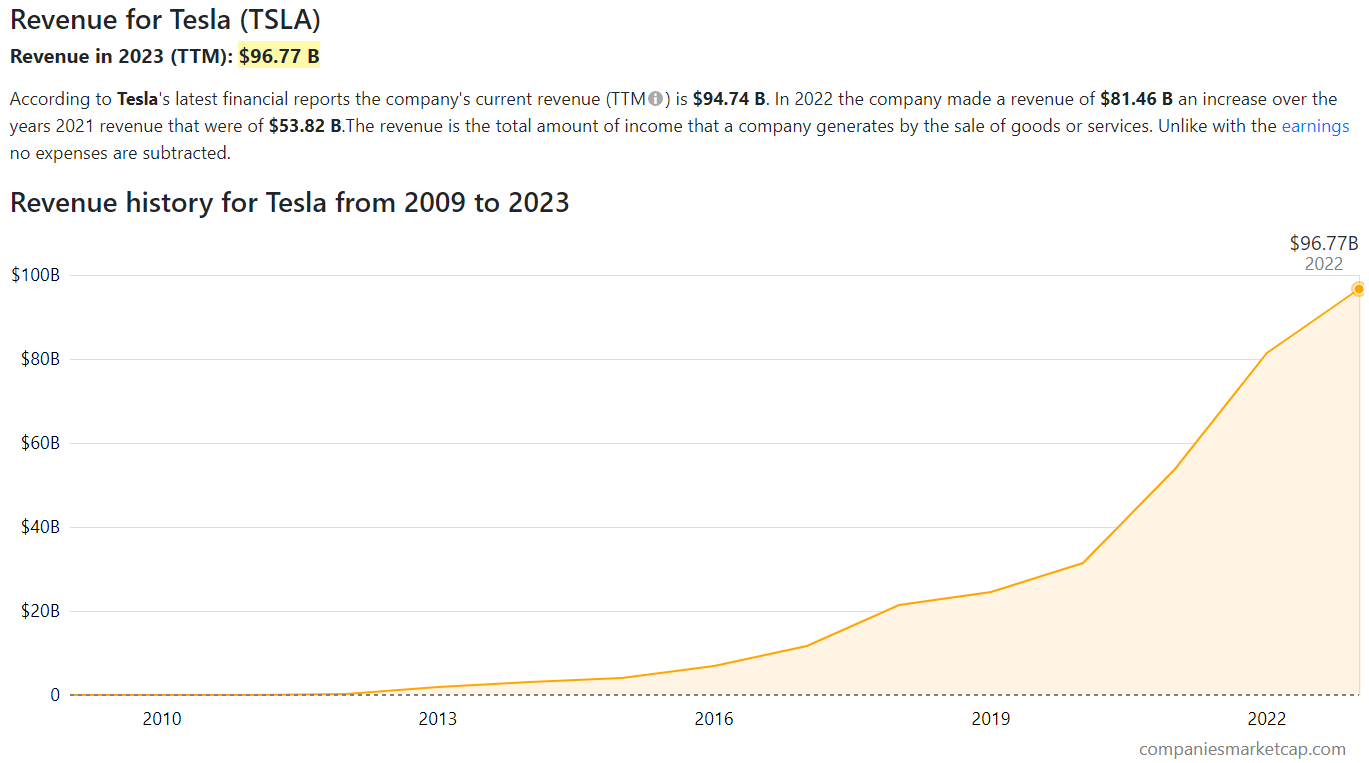

Before we get started, it’s worth taking a look at Tesla’s market cap compared to the rest of the Mag 7 for some perspective. Tesla’s current market cap of $558 billion is 53% less than the next smallest Mag 7 company (Meta), and is 82% less than the largest Mag 7 (Microsoft). Tesla’s market cap peaked at $1.23 trillion in November 2021 and is down 55% from its highs. Meanwhile, here’s what Tesla’s revenue has down over the last ten years or so:

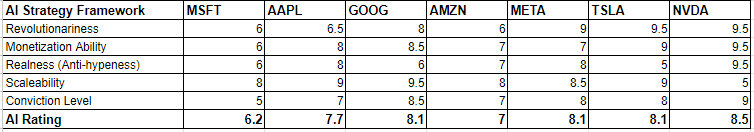

Now let’s get into Tesla’s AI strategy. Tesla has a unique AI strategy because it is the only Mag 7 company that is solely focused on building AI that knows how to understand, navigate, and interact with the physical world. Even though Tesla is tied for second in our AI Strategy Framework, we are more excited about Tesla’s AI strategy than just about any of the others in the Mag 7. The potential for each of Tesla’s current AI kickers is tremendous. The only reason that Tesla is not number one in the rankings is that the company is barely starting to monetize FSD, and the rest of these AI products/services won’t impact the company’s bottom line for another year or two (maybe sooner, but we are trying to be realistic).

We’ll look first at Tesla’s history in AI and then break down its strategy below.

Tesla’s AI History

Tesla first introduced the possibility of working on AI in 2013 when Elon Musk first discussed the Autopilot system. At that time, Musk was having conversations with Google (GOOG), which was already testing autonomous cars in three states, about utilizing some of its technology to build a self-driving car. However, Musk identified early on that Google’s system was too expensive because it relied on Lidar, rather than vision-based sensors. Since that time, Tesla has aggressively developed its autopilot and FSD programs, relying solely on cameras as the input, and today the company is very close to achieving full-scale autonomy in its vehicles. Below is a timeline of Tesla’s AI developments, generated by ChatGPT (edited by me):

Timeline of Tesla’s AI Efforts and Major Releases

2013

- May: Elon Musk first announces that Tesla is considering adding Autopilot to its cars.

2014

- September: Tesla introduces Autopilot hardware (Hardware 1), which includes a forward-facing camera, radar, and ultrasonic sensors, in its cars, utilizing technology from Mobileye (MBLY).

2015

- October: Tesla releases the first version of Autopilot software (Autopilot 1.0), enabling features like Autosteer and Traffic-Aware Cruise Control.

2016

- October: Tesla releases Autopilot 2.0, and announces the switch to Hardware 2, which includes eight cameras, improved radar, and ultrasonic sensors.

2017

- June: Andrej Karpathy joins Tesla as Director of AI, signaling a strong commitment to AI and deep learning.

- August: Tesla introduces Hardware 2.5, featuring additional computing power and redundancy for improved FSD capability.

2018

- March: Tesla releases an update to Autopilot 2.0, introducing new features and improvements.

2019

- March: Tesla unveils the Full Self-Driving Computer (Hardware 3), which is designed to enable FSD with enhanced processing power and efficiency.

2020

- October: Tesla begins rolling out the FSD beta (FSD Beta v1) to a limited group of customers, showcasing advanced capabilities in urban environments.

2021

- February: FSD Beta v2 is released, featuring improved decision-making and path planning.

- March: FSD Beta v3 is released, with enhancements in object detection and control.

- July: FSD Beta v9 is released, introducing a more refined vision-based approach.

- August: Tesla’s first AI Day is held in which the company unveils the Tesla Bot (Optimus), a bipedal humanoid robot designed to perform unsafe, repetitive, or boring tasks, Tesla announces the development of the Dojo supercomputer, designed to train AI models at unprecedented speeds and scales.

- October: FSD Beta v10 is released, further refining the vision-based system and enhancing real-world performance.

2022

- January: FSD Beta v10.9 is released to employees, featuring significant updates to perception and control algorithms.

- September: Tesla AI Day 2022 is held. The company demos Bumblebee, Tesla’s first functioning humanoid robot, which was built in less than six months. Tesla provides more details about the Dojo supercomputer, highlighting its architecture and capabilities for accelerating AI training.

- November: FSD Beta v11 is released, integrating new neural network architectures for better generalization.

2023

- March: Tesla releases an update to the FSD beta (v11.4), further improving performance and reliability in various driving scenarios, Tesla Optimus Gen 1 goes into production.

- July: Tesla turns on the Dojo Supercomputer, training models for FSD.

- October: FSD Beta v12 is announced, with an entirely new end-to-end neural network.

- September: Using an end-to-end neural network, Optimus can sort objects autonomously.

- December: Tesla Optimus Gen 2 is unveiled.

2024

- January – March: Tesla rolls out FSD v12, with its end-to-end neural network, to all FSD subscribers.

- March: All new Teslas come with a free 30-day FSD trial

- April: Tesla cuts the price of FSD subscriptions from $199/month to $99/month, and reduces the one-time purchase price to $8,000 from $12,000

- May: Rumors circulate that Tesla may be permitted to test FSD without humans in select cities in China.

Tesla’s AI Strategy

Elon Musk and Tesla are “all in on autonomy,” and that shows in Tesla’s lineup of AI products and services. In our best-selling book, The Ultimate Telsa Book (With The Ultimate Tesla Model), we discussed each of Tesla’s AI products and their potential at length. In the first part of this section, we will briefly touch again on each of Tesla’s AI products. We think it’s clear that these products will be wildly successful, but the real question for Tesla is whether the company can actually build/sell these products at scale.

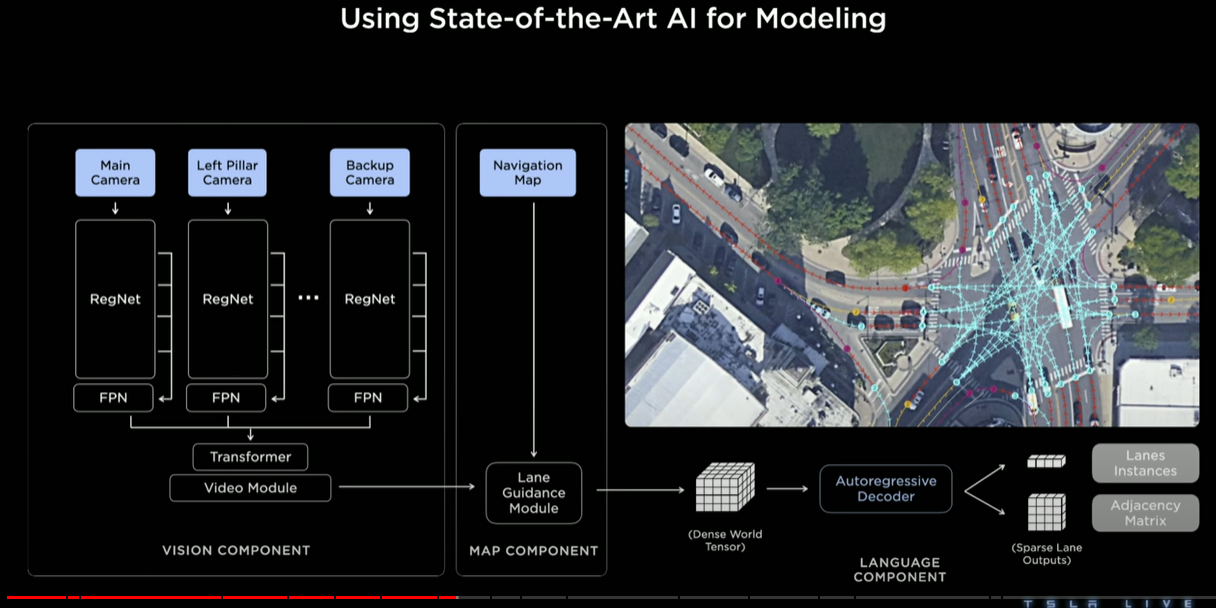

First up is Tesla’s FSD software. Version 12, which started rolling out earlier this year, is based on an end-to-end neural network that eliminated over 300,000 lines of code and countless developer hours. Now, Tesla’s software is able to learn how to drive simply by watching videos of humans driving. Because FSD is no longer manually programmed, the driving experience is much smoother and relaxed, and many people have described FSD as now driving “like a human.” Obviously, this makes sense since the new FSD learned how to drive from humans. The only manual work that Tesla has to do is to make sure that none of the bad habits from humans (like rolling through stop signs) ends up in the programming! We think FSD will steadily get better and better with each new release, and we expect that FSD penetration rates will increase concurrently. This will be a nice driver of high gross margin, recurring revenue for Tesla.

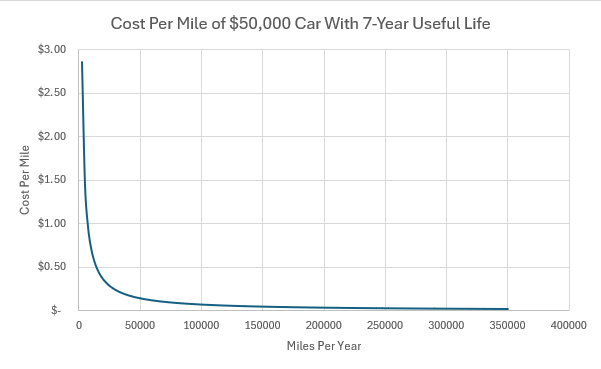

Second, solving the problem of FSD will enable Tesla to unleash the Robotaxi model. Tesla is set to unveil its Robotaxi on August 8th, but we don’t expect the cars to actually start hitting the street until the beginning of next year. Robotaxi has the potential to not only upend the ridesharing business (sorry, Uber and Lyft), but also the entire idea of non-Tesla car ownership. Cars are valuable assets that go mostly unused because they are sitting parked 90%-95% of the time. Robotaxis will be the opposite. All capital assets have opportunity costs when they are not in use, and as utilization rates go up, the cost per unit of time goes down. Robotaxis will flip the utilization chart upside down, and we expect that Robotaxis will be put to productive use 80-90% of the time, instead of sitting idle for the same amount of time like most cars do currently.

The chart above shows how the fixed cost of owning a car changes as the miles driven per year increase. The average car today is driven between 15k and 20k miles per year, which comes out to between $0.48 and $0.36 per mile. A Tesla Robotaxi driving 90% of the time would drive roughly 350,000 miles in a year (assuming an average speed of 45 mph). At that usage rate, the fixed cost of the Tesla Robotaxi would be $0.02/mile, 24x cheaper than driving the same car only 15,000 miles in a year.

Add in the fact that there is no human driver, gasoline, and very little if any maintenance, and the cost per mile of a Robotaxi will likely be significantly less than the cost per mile of owning a vehicle. For many people, it will be much cheaper on a per-mile basis to use Robotaxis exclusively and forfeit car ownership altogether. We think Robotaxis will probably roll out in select cities early next year and will be available across most of the country within the next two to three years. There will be some cities that hate Elon so much that they won’t Robotaxis until they are forced to by their residents.

Tesla’s next potential AI product is its Dojo Supercomputer. Tesla started building Dojo two years ago and it went into production in the summer of 2023. We discuss the supercomputer in more detail below because we think it is one of the keys to what gives Tesla its edge in AI. Put simply, Dojo is a super advanced computer that is purpose-built for training vision-based AI models. Elon has described neural networks as “software 2.0.” In the future, all new forms of software will almost certainly be AI-based, meaning they will use advanced neural networks to observe, predict, create, and react in ways that are radically different from the software of the past. We think that at some point Tesla will open up Dojo to third parties to use the supercomputer to train the next generation of software. This will be a model similar to that of Amazon Web Services. This could be a huge, high-margin business for Tesla. For context, AWS is at a $100 billion annual run rate right now, or roughly equal to Tesla’s total revenue over the last twelve months.

Optimus, Tesla’s humanoid robot, is really the ultimate culmination of all of Tesla’s AI efforts. All Tesla needs to do is simply go from making robots on wheels (its current cars), to building robots with legs and arms, using much of the same FSD software and hardware. Optimus will be able to do nearly anything a human can do in the physical world, and its early use cases will be in those unsafe, repetitive, and boring tasks that humans do not want to do for eight hours a day. Tesla plans to have Optimi working in its factories by the end of this year and may be ready to sell them externally by the end of 2025. The potential market for Optimus is massive (the global labor force costs about $45 trillion annually), and even if Optimus can supplement a small percentage of that, it will be huge for Tesla. Here is what Elon had to say about Optimus on the most recent earnings call:

“As I’ve said before, I think Optimus will be more valuable than everything else combined. Because if you’ve got a sentient humanoid robots that is able to navigate reality and do tasks at request, there is no meaningful limit to the size of the economy. So that’s what is going to happen. And I think Tesla is best positioned of any humanoid robot maker to be able to reach volume production with efficient inference on the robot itself.”

— Elon Musk in Tesla’s Q1’24 Earnings Conference Call.

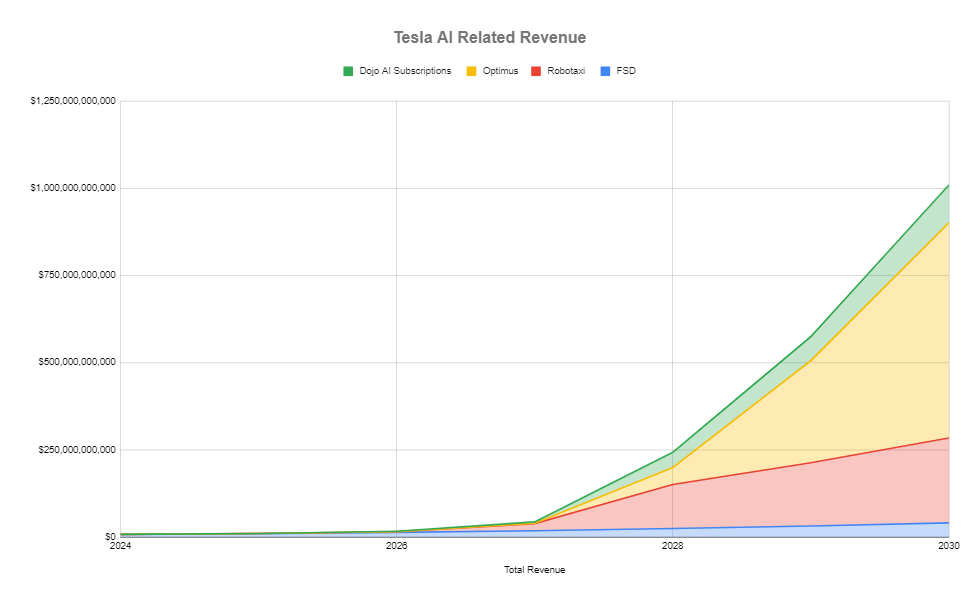

All of Tesla’s AI products have the potential to be multi-trillion dollar kickers for the company. Here is our revenue model for these four products over the next six years from the Ultimate Tesla Model:

Tesla’s Ability To Execute

Clearly, Tesla has some amazing potential to sell amazing AI products and services over the coming years. It just needs to figure out AI first. Should be a piece of cake (ha!).

Just kidding, achieving some form of AI that is powerful enough to run cars and robots autonomously is extremely difficult and costly. However, the success of each of the four products that we highlighted above turns on whether Tesla can build sufficiently powerful AI. FSD and Robotaxi only works if Tesla can eventually get to Level 5 autonomy. Companies will only want to use Dojo to train their models if it is powerful enough to build AI models that are orders of magnitude better than what other cloud providers can provide. And Optimus will only be useful to the extent it can navigate and interact with the humans and the rest of the physical world autonomously.

So what makes us confident that Tesla will be able to build AGI, or something close to it? We see the following factors as the keys to Tesla’s ability to achieve AGI: (1) The Elon Effect; (2) Vertically Integrated AI Infrastructure; (3) Data Feedback Flywheel; and (4) Capital.

The Elon Effect

First and foremost, Tesla will succeed because Elon is at the helm. As we said in the book, we are not Elon fanboys, but there is no denying his success, and his ability to Revolutionize industries and change the world. Elon has an incredible vision for his companies, but more than anything else, he knows how to execute that vision. Elon was not the first to build electric cars, or attempt commercial spaceflight, or to build an in-space broadband internet network. But Elon was the first to do all of those businesses successfully at scale. In addition to Elon’s managerial traits that make him such an excellent operator, he consistently attracts some of the most talented people in the world to come to work for him. Any time we watch a Tesla or SpaceX event, we are always extremely impressed by the apparent skill and talent of the people who work for Elon. Moreover, Elon has a long list of deep-pocketed backers (including Sergey Brin, Larry Ellison, Peter Theil, Fidelity, Sequoia, Morgan Stanely, and others) who are always willing to back his endeavors. For a more detailed discussion of The Elon Effect, check out the book here.

Vertically Integrated AI Infrastructure

With respect to AI specifically, one of the reasons we think Tesla has a huge lead in vision-based AI is its vertically integrated AI infrastructure. Everyone knows that Tesla is vertically integrated, but in doing the research, I was surprised to learn how the company has vertically integrated its AI infrastructure specifically.

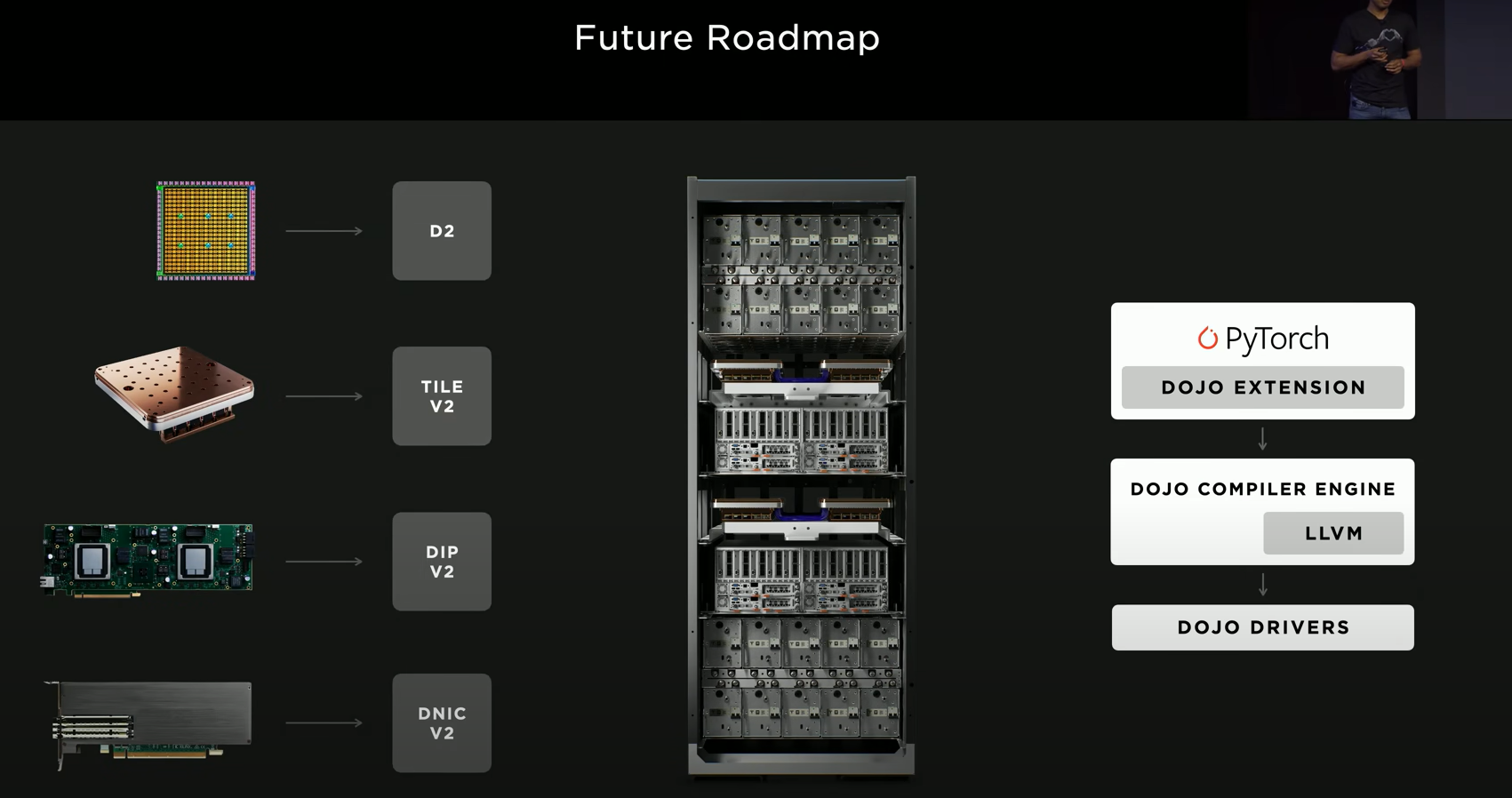

When Tesla started down the autopilot path back in 2014, it originally used sensors and systems from Mobileye. But since that time, Tesla has switched to producing nearly all of the AI hardware and software itself. This includes much of the hardware on the cars, but even more hardware in the Dojo Supercomputer is designed and built by Tesla in-house.

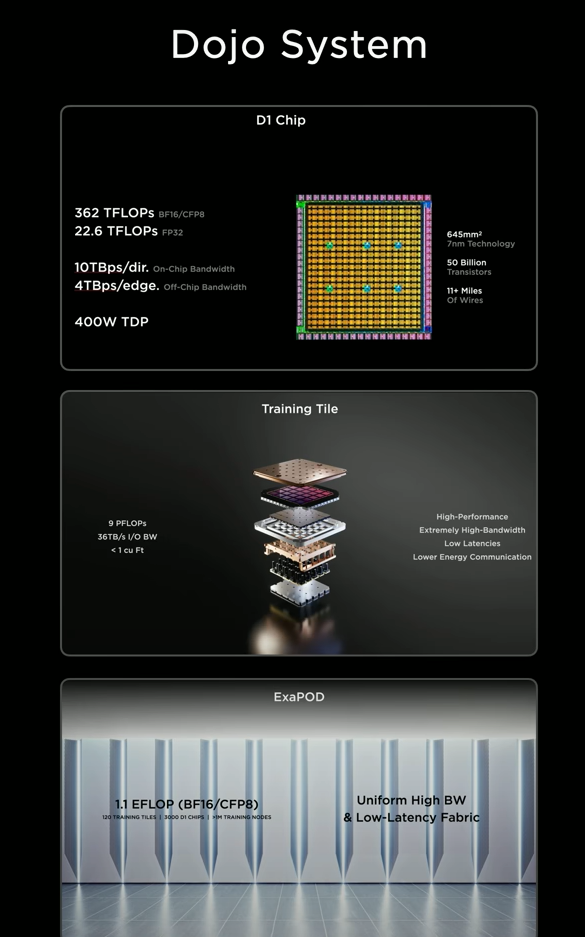

In building Dojo, Telsa didn’t just simply design its own microprocessor, but it actually built nearly the entire rack. The list of hardware designed by Tesla in the Dojo supercluster includes:

- D1 Chip (manufactured by TSMC), which includes 1.25 MB of SRAM main memory on the chip itself

- Training Tile which packages 25 D1 chips in a 5×5 array

- Dojo Interface Processor (DIP) cards which handle I.O and memory

- Tesla Transport Protocol over Ethernet (TTPOE), which is a custom communication protocol similar to NVIDIA’s Infiniband.

- The Cabinet Itself

Tesla designed the entire Dojo system to be optimized for vision-based learning, and from the beginning wanted the ability to scale the system in an unlimited fashion. Tesla made deliberate design changes from standard industry practice to optimize for high bandwidth and low latency data transfers, which is needed to process video data. For example, Tesla substituted DRAM for SRAM built right into the chip. Tesla is also one of two companies that have started using TSMC’s System on Wafer (SoW) technology, which builds a chip out of an entire 10-inch or 12-inch diameter silicon wafer rather than slicing it up into 1 square-inch pieces. These modifications allow the Dojo racks to work in unison with other racks simultaneously in a grouping called a ExaPOD. An ExaPOD is a bunch of combined cabinets that act as one AI accelerator. Tesla’s ExaPODS are able to achieve 1.1 exaflops of ML compute. For reference, NVIDIA’s latest and greatest Blackwell platform has 1.4 exaflops of AI performance.

In addition to the hardware, Tesla designed all of the software that runs the Dojo superclusters. Further, Tesla designed the FSD chip that does the inferencing part of the AI on the cars themselves, and these chips power the Optimus robots as well.

To be clear, Tesla is still investing tens of billions of dollars buying NVIDIA chips, but we think Tesla’s vertical integration with respect to its AI hardware and software is going to be a big contributor to the company’s AI strategy. As mentioned, Tesla’s Dojo supercomputer is being used by the company to train its FSD models. Dojo reportedly went into production in July 2023. FSD version 12, which is by far the best FSD version released and the first one to utilize an end-to-end neural network, was released in late 2023 and started rolling out to the public in early 2024. We think that it’s no coincidence that we have seen a massive step up in the quality of FSD following the start of Dojo production.

Data Feedback Flywheel

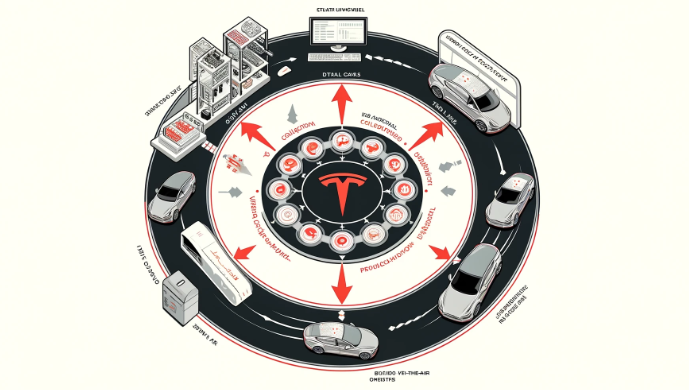

Similar to Facebook’s Data Feedback Flywheel we discussed last week, Tesla has a vision-based data feedback flywheel that constantly improves its AI models. Tesla feeds the videos from the best drivers into its computers to train FSD models. The company then sends the updated FSD models out to the cars via over-the-air (OTA) updates. Once the FSD software is downloaded to the cars, the drivers can start using it and generating more data for Tesla. Importantly, the cars send back information every time the driver has to take over when FSD is driving. Tesla then takes the data related to these interventions and feeds those into the computer so it can learn what it needs to do better next time. Once enough new data is generated, the computer can make a new FSD model and send it out via an OTA update, and the cycle continues.

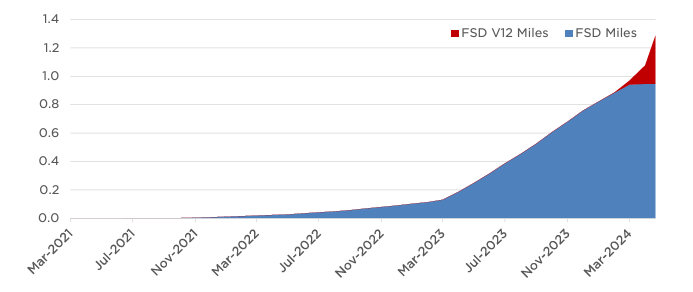

Tesla receives roughly 160 billion frames of video per day from real-life Tesla cars. As of early 2023, Tesla’s Dojo supercomputer had analyzed 10 million of those frames of video from the best drivers in order to create FSD 12. As of the first quarter of 2024, Tesla owners drove around 1.3 billion cumulative miles using FSD. That number is growing rapidly, and as adoption rates continue to grow, we think that the FSD miles driven will grow exponentially from here:

Tesla has the unique ability to feed trillions of frames of videos from its cars (and someday robots) into its computers to train AI models. Tesla’s roughly 6 million vehicles are probably the single largest sources of visual data collection in the world and all of that goes exclusively to Tesla to train AI models. The vision data from the early fleet of Optimus Robots will be used to make constant improvements to the robotics software in a similar way. And other robotics companies will be licensing this software from Tesla just like other automobile makers will license Tesla’s FSD software.

Capital

For Tesla to achieve AGI or something close to it, it needs capital. As long as Tesla has enough capital to keep expanding its AI infrastructure (by the way, Peter Beck, CEO of Rocket Lab, told us on a call with him that Elon’s superpower is his unlimited access to capital), it should be able to simply keep feeding visual data into its computers and the FSD software will keep getting better and better with time. In other words, we think there is nearly a direct correlation between compute power dedicated to AI training and the quality of the AI.

Obviously, all of the Mag 7 have plenty of capital to spend on AI servers, but Tesla is the only company dedicating all of its capital and compute resources to building vision-based AI models for its own purposes.

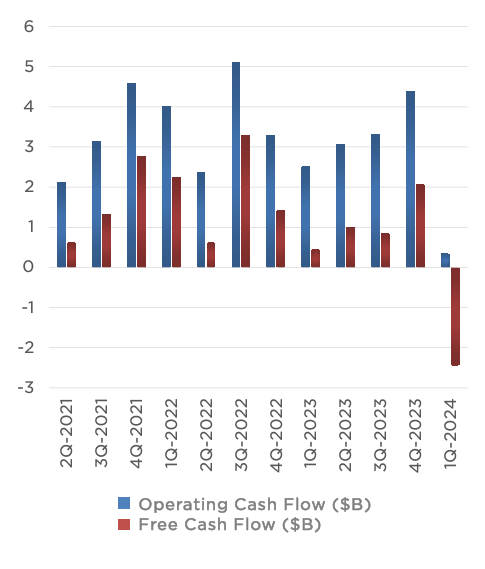

Tesla spent about $1 billion on AI infrastructure capex in the first quarter, and Elon expects that the company will end up spending nearly $10 billion this year building out its infrastructure. Tesla has roughly $27 billion in net cash and will probably generate about $3 billion in operating cash flow each quarter this year, so we think the company has plenty of runway to keep ramping up its AI spending. This is in contrast to the two-dozen or so humanoid robot startups which are supposedly nipping at Tesla’s heels.

Conclusion

Tesla has the vision and product roadmap to develop multi-trillion dollar AI products and services, and we think it has the leadership, talent, experience, infrastructure, technology, and capital to execute that vision/roadmap. Elon Musk has an incredible track record of accomplishing the impossible, and we think this time is no different. The massive improvements we have already seen in FSD give us a lot of confidence in Tesla’s ability to achieve full autonomy and some form of AGI in the near future. Once it does, hold on because the demand for what Tesla will be selling will be nearly limitless. But because nearly all of this is in the future (or pie in the sky if you will), we knocked Tesla slightly in our AI Strategy Framework.

Tesla gets an 8.1 out of 10 from us, and its our favorite long right now.