Fed Analysis

Baby, be the class clown, I’ll be the beauty queen in tears,

It’s a new art form, showin’ people how little we care (yeah),

We’re so happy, even when we’re smilin’ out of fear,

Let’s go down to the tennis court and talk it up like, yeah (yeah) — Lorde’s song called “Tennis Court”

(This article was written by Bryce Smith, analyst at the 10,000 Days Fund)

Cody and I played some pickleball last week at his house and it really is a great recreational game for friends and family to play on weekends and warm summer nights. If you don’t know about pickleball, it is basically a combination of ping-pong and tennis, and it rapidly rose in popularity during the pandemic. It now has its own professional leagues and we YouTubed some videos from those professional events. We couldn’t help but laugh a little watching this clip (no offense if any of our subs are pro pickleball players):

While we love playing the sport ourselves, we are not sure this is really the kind of professional sport that millions of spectators will tune in to on ESPN.

So what does pickleball have anything to do with the markets, and more importantly how on earth are we supposed to make money from this? Well watching that clip reminded us of the never-ending debate over what the Fed will do with interest rates. Every month for the last four or six months, the mainstream financial media goes through the same exercise. Will the Fed raise again? If so, how much will they raise? One analyst is adamant that they will only raise 25 basis points, while the other thinks it has to be 50 basis points. Oh look, the CPI only went up 6.2% on a seasonally-adjusted, adjusted, adjusted, adjusted basis versus the consensus view of 6.3%. So maybe now the Fed can start cutting to save the banks? The market behaves in about the same way, with the Dow rising 300 points during the press release, then crashing 600 points when Chairman Powell says something less than brilliant in the Q&A, then rallying into the close. This back-and-forth monthly debate over interest rates and the whipsaw action in the markets can be nauseating. And it is about as productive as those four guys wimpily hitting that pickleball back and forth to each other over the net.

The point is that so much (emphasis on the so) of what we see on TV and read in newspapers and on social media is absolutely just noise. That is not to diminish the very real things happening in the economy that potentially influence our stocks. Our job is to ignore the noise, find out what is really going on in the economy/markets, analyze how those phenomena affect our stocks, and trade accordingly.

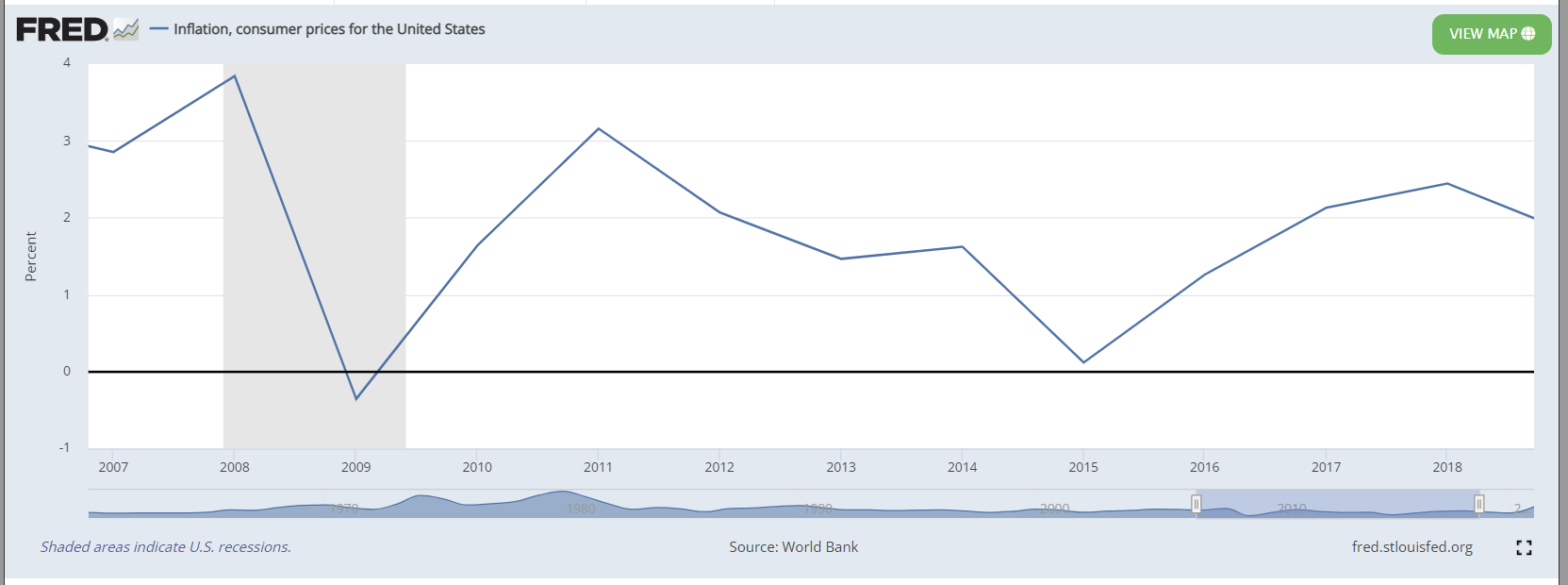

So let’s get into the meat of what is really going on with the Fed and inflation. To begin, we have to remember that there are both inflationary and deflationary forces in play in the economy at all times. Many people over-simplify the inflation analysis and look at the direction of M2 for example as the sole indicator of what inflation will do. One of the great lessons we learned post-2008 and during the over-extended QE period is that 0% interest rates and an increase in the money supply do not necessarily cause inflation to go up. Here is what the official inflation rate looked like from 2006 to 2019:

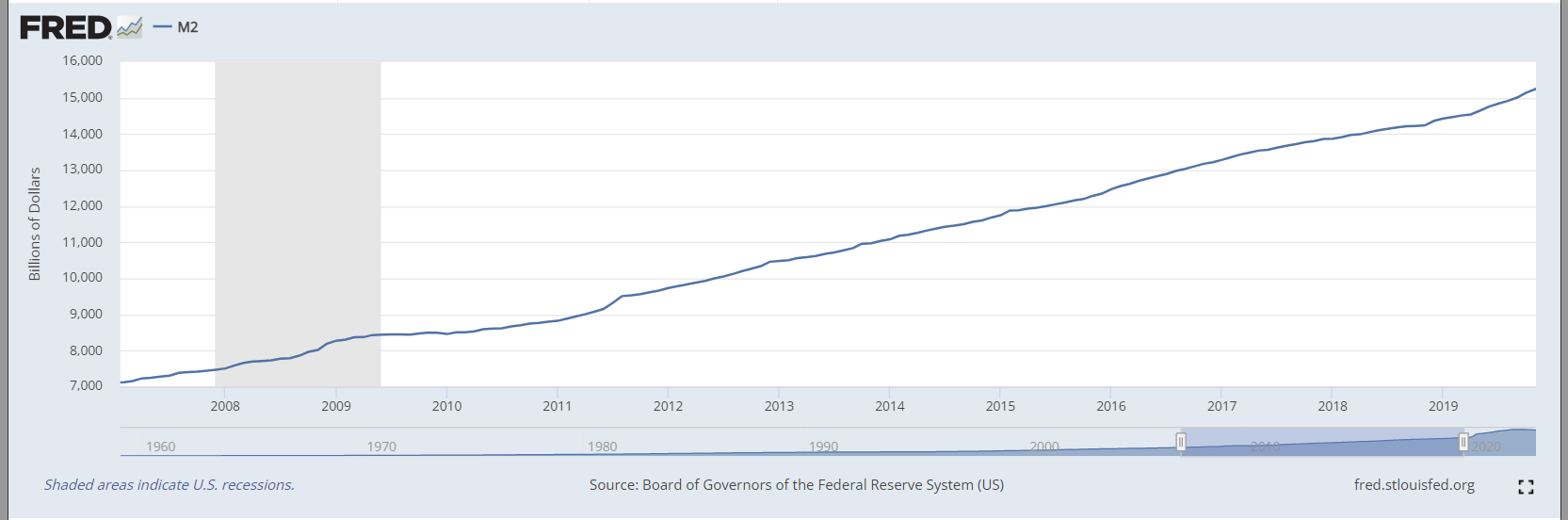

And here is M2 (the money supply) over basically the same time period:

While the money supply grew from about $7.5T in 2008 to about $14.5T in 2019, inflation remained steady at about 1-2%. So where did all of that money go? A lot of commentators thought that the Fed’s unprecedented 0% interest rates and never-ending QE would cause hyperinflation that would sink the US Economy. But that didn’t happen because most of that money was not spent on goods and services. Where did it go? Assets. The increase in the money supply combined with 0% interest rates meant people, businesses, and banks had a lot of cash that was not earning any return. So those market participants poured money into stocks, bonds, and real estate because any yield was better than earning 0% on your cash. For years I wrote about how the Fed created a bubble-blowing bull market by keeping interest rates too low for too long. While this wasn’t great for the economy, it was great for TradingWithCody readers as we were extremely well-positioned to benefit from the historic rise in stocks from about 2012 to 2020.

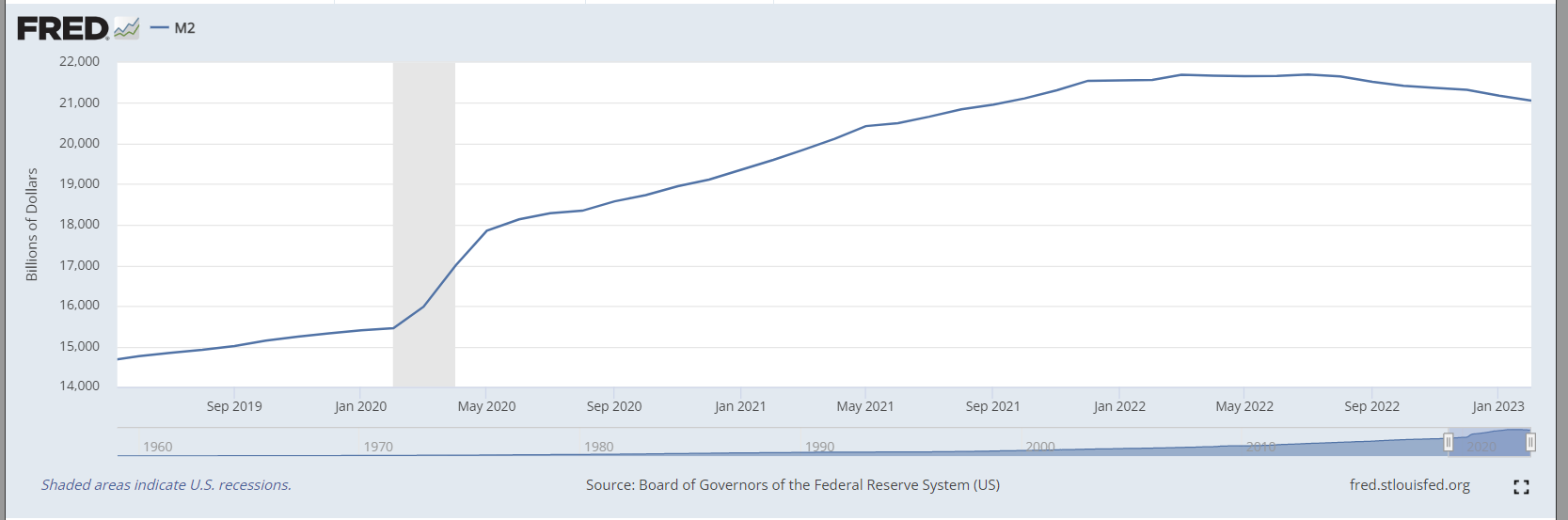

Fast forward the post-Pandemic period and now we have sticky inflation with a decreasing money supply. Look at M2 from 2020 to now:

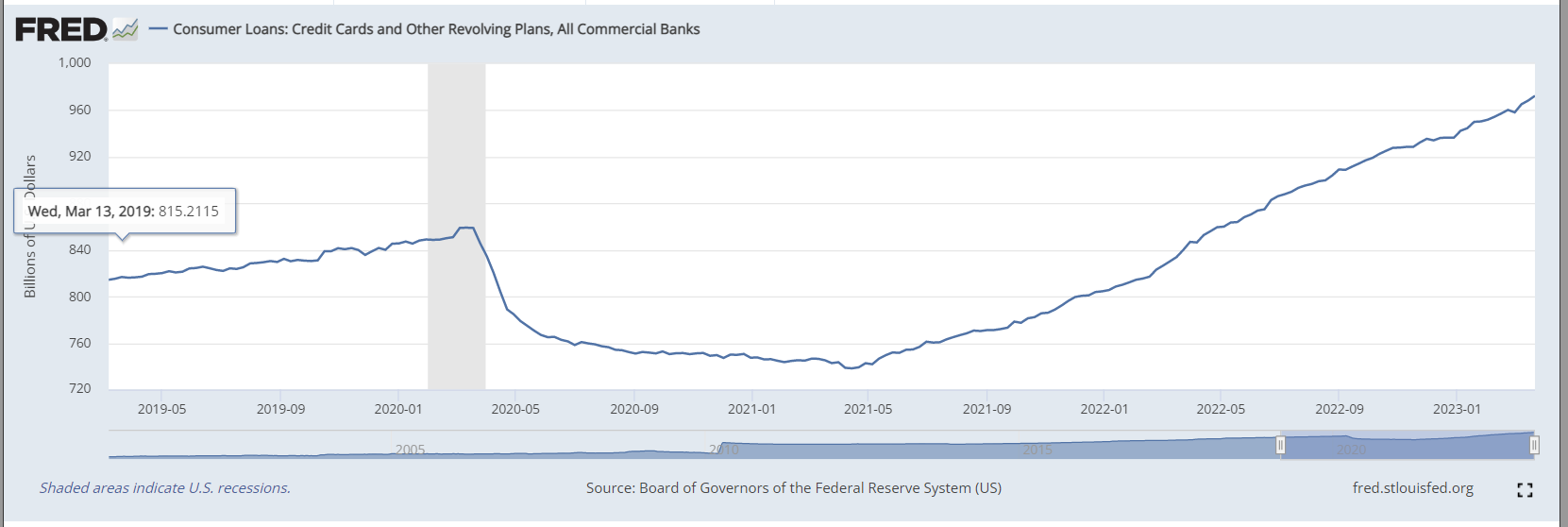

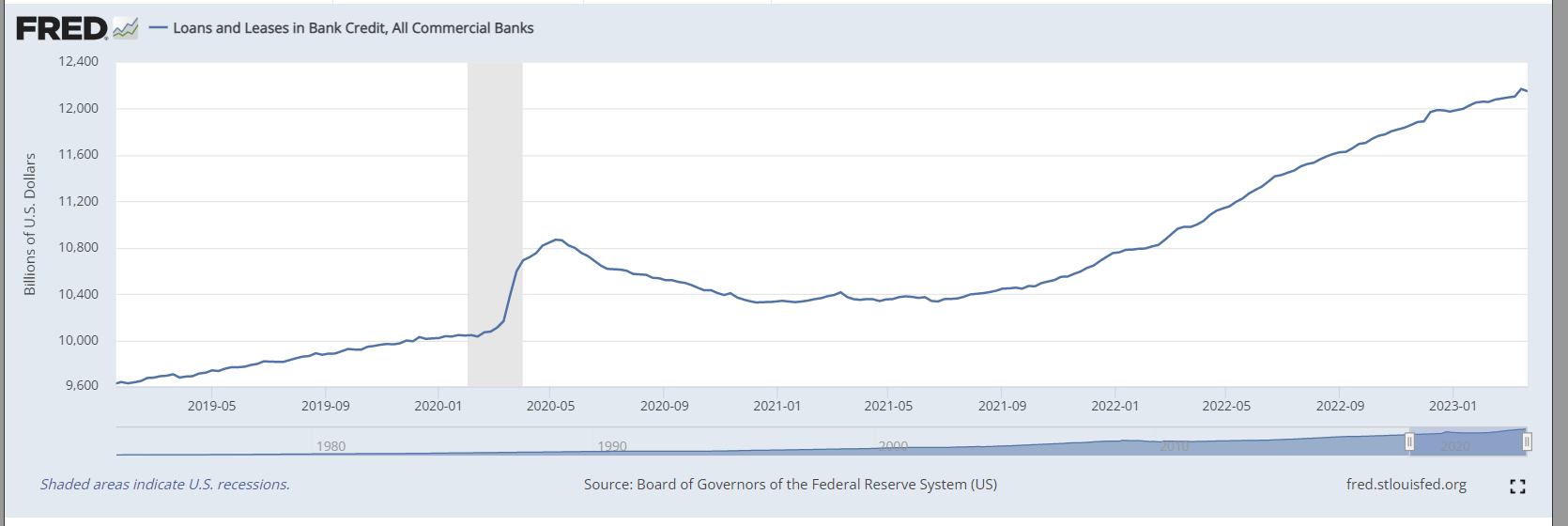

During and after the pandemic, the Fed and Treasury increased the money supply dramatically by cutting rates, stimulus checks, PPP, and numerous other bailout/welfare/stimulus programs, and yet we did not have inflation for most of 2020. With travel and most events essentially halted, people did not have places to spend. So again, people sunk money into assets and also paid off debt. Look at these next two charts which show credit card balances and total loan balances at commercial banks.

After the pandemic started, total loans and credit card balances decreased. So even though M2 increased dramatically, that additional money supply did not actually materialize in increased demand for goods and services. That was a very deflationary force that kept inflation low for most of 2020 and early 2021. But as we came out of the pandemic and people started traveling, dining, and in general spending more money again, the money supply started to find its way out of assets and into the real economy. As shown on the charts above, loan and credit card balances have increased dramatically and are still increasing. All the while, the Fed has been raising rates and trying to decrease M2.

So what does all of this mean? We think that inflation is likely to stay at elevated rates for longer than most people expect. And as long as inflation is elevated, the Fed cannot cut rates in our view. Because recession expectations are up right now, the market is pricing in rate cuts toward the end of the year and into 2024. Think back to that M2 chart we showed earlier, the Fed and Treasury pumped about $6T into the money supply (a roughly 40% increase) in 12 months. Now that money is working its way out of assets and into the real economy as loans and credit card balances continue to increase. Until that phenomenon stops, inflation will be persistent. As long as inflation is persistent, the Fed cannot cut. As long as the Fed cannot cut, don’t expect another 2012-2020esque period of bubblicious asset prices. To clear, we don’t think the Fed will continue endlessly raising rates either. Just that they will have to stop and leave rates near these current levels for a year or two or so.

This does NOT mean is that we should sell all of our stocks. Innovation is perhaps the most deflationary force of all. The goods and services produced by our companies will make products cheaper and services more efficient. Think of Moore’s law (from the late Intel co-founder Gordon Moore) which says that semiconductor efficiency doubles every two years as prices for the chips continually drop. ChatGPT and Google’s BARD will eliminate many mindless administrative tasks that bog down workflows. Tesla is making more and more cars in its Gigafactories and is cutting its prices regularly. Rockwell is making automation equipment and software for US factories that will reduce the need for employees in low value-add positions. And innovation is a force that is never-ending. Entrepreneurs, engineers, doctors, and scientists around the world will continue to develop innovative products and services because that is how we generate wealth. Accordingly, we want to continue to own these names and search for new innovative companies even as inflation remains sticky and interest rates remain elevated.

But this also doesn’t mean we should ignore inflation and elevated interest rates. With money market accounts now yielding around 4%, there is real competition for capital amongst potential investments. Verizon’s roughly 6.5% yield doesn’t look quite so attractive when you can buy a CD for 5% from your local bank. This essentially raises the opportunity cost for investing in stocks that don’t generate present earnings and is why many of the speculative names have been punished so bad. When we run discounted cash flow models on our stocks, the price we can afford to pay for future earnings drops dramatically as interest rates go up.

So while we want to continue looking for and investing in innovative companies, we must be extra diligent in our analysis and research. If companies will not be profitable for years to come, they must have good financing in place because future fundraising will not be so easy. Balance sheets and cash flow matter again, and we have to be disciplined in selecting our next investments.

This is the analytical framework that Bryce and I are working from right now. We all have to be disciplined to ignore the mainstream pickleball noise about next month’s rate hike or CPI number. We have to be disciplined in selecting growth companies that also have good fundamentals. And we have to be disciplined to protect our downside when the market gives us big swings up based on nothing news or no news at all. Investing is not easy and if we ever find that we think it is easy, we are probably being complacent.

We will have this week’s chat tomorrow (Thursday) at 3pm ET in the TWC Chat Room or just email us your question to support@tradingwithcody.com.

Happy three-day Easter weekend to all and please go play some pickleball with your friends and family if you haven’t tried it already!