The Markets Outside Are Frightful, The Snowflake AI Is So Delightful

First off, we will do this week’s chat on Friday, September 29 at 12:00 pm ET in the TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com. As a reminder, Cody will be speaking at 12:30 pm ET on Wednesday, September 27th at the Investor Symposium hosted by the Ingenuity Venture Fund in Albuquerque, NM. He’ll be talking about all things space and specifically investing in the Space Revolution. Register with this link and use discount code “ivf vip.”

We’ve been remiss in sending out our full analysis on Snowflake (SNOW). The markets have been in pullback mode for weeks on end and most charts that you pull up have gotten quite ugly. It’s harder to buy than to sell/short right now which means it’s probably better to buy than to sell/short right now, especially good companies’ stocks. Snowflake is a good company and it’s stock is up from our initial buy price but down from its recent highs. It’s still not terribly cheap but as a prime beneficiary of The AI Revolution, it might not get terribly cheap any time soon. Without further ado, here’s our Snowflake analysis.

Snowflake Inc.

NYSE: SNOW

Share Price At Time of Analysis: $149.99

Key Metrics

- Market Cap: $49,409 mm

- Total Revenue (ttm): $2,445 mm

- Gross Margin: 66.3%

- Net Cash: $3,489 mm

- Price/Sales (ttm): 20.21

- Q2 2023 Y/Y Revenue Growth: 35.55%

Synopsis

Last week we published our analysis on Cloudflare (NET), wherein we stated that “it is clear that a handful of companies are critical pieces of infrastructure enabling the AI Revolution and are the clearest near-term winners from the AI Revolution.” Another one of those companies is Snowflake (SNOW), which we started buying in November of 2022 when the stock was just below $130/share. The stock had a nice run to the $190s before falling back to the $150 level currently. Amazingly, this stock is still down 63% from its intraday all-time high of $405 set back in November of 2021.

At the heart of the AI Revolution is data. Generative AI companies must feed immense amounts of data into high-performance computers (HPCs) to train the models that power applications like ChatGPT. Snowflake is already a leading cloud platform that allows companies to store, analyze, and manipulate their data all in one place. The company’s platform is built on top of the big three cloud service providers (CSPs), Amazon Web Services (AWS), Google Cloud, and Microsoft Azure, and thus offers nearly unlimited storage space and computing power for major organizations and AI companies. The need for ever more storage and computing power will only continue to grow as our world embraces AI and continues to generate significantly more data-rich content like videos, photos, documents, and other forms of unstructured data.

Snowflake is the best platform for managing data across the major CSPs and is positioned to win as both established enterprises and startups begin building and training AI models in the cloud. As we discussed in the Cloudflare article, the big three CSPs will handle much of the world’s AI training because they have the most computing power at their disposal. Additionally, a lot of large organizations already use Snowflake to house all of their proprietary data, and they will start to use that proprietary data to build AI models on Snowflake. For example, Snowflake recently partnered with Nvidia to enable companies to build large language models (LLMs) on the Snowflake platform, without having to move their proprietary data to another platform/provider to train the AI model.

We see Snowflake as a leading platform positioned to benefit from the AI Revolution and continued acceleration of the Cloud Revolution. The company is growing revenue at around 30-35% per year and that could be accelerated as the company continues to roll out new offerings for the AI Revolution. Trading at about 20x sales, the stock is not cheap, but given the substantial growth we expect over the next 3-5 years, we think this is a must-own at these levels. The stock is down 35% from its IPO price and down over 60% from its all-time high during the bubble.

Background

Snowflake created the “Data Cloud,” which allowed organizations to move all of their data into a unified platform where it could be securely stored and managed across the major public cloud providers. Before the advent of the cloud, all data was stored “on-premises,” which meant it was physically located on devices and servers owned by organizations and individuals themselves. The cloud allowed companies to store data remotely on servers owned by third parties like Amazon Web Services. Powered by massive data centers which each contain a multitude of HPCs, cloud computing offers more reliability, increased performance, and lower IT costs for major organizations.

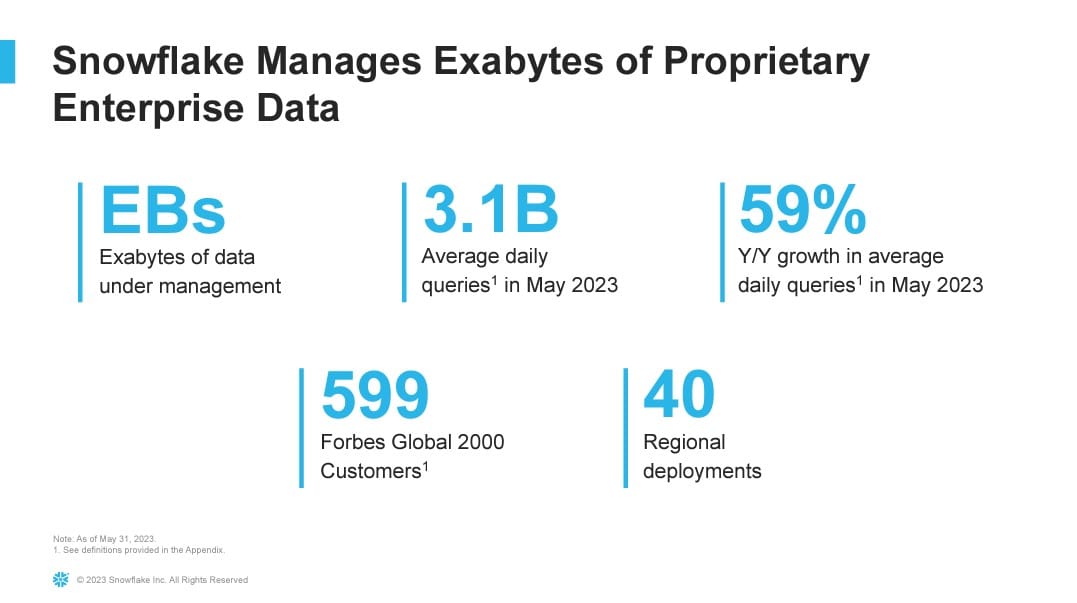

Additionally, cloud storage is widely considered to be more secure than on-premises storage, as the major public cloud companies are far more technologically sophisticated and have more resources to dedicate to cybersecurity than the average business. The public clouds also have built-in redundancy so data will most likely not be lost or compromised, even if one data center goes down or is subjected to a cyber attack. Because of the significant advantages of cloud computing and storage, today, roughly 60% of all corporate data is stored on the cloud, up from 30% in 2015. And much of that corporate data is stored on Snowflake, with 599 of the Forbes Global 2000 currently users of the platform

Snowflake came public in September 2020 at a price of $120 per share. The IPO was the biggest software IPO in history and raised $3.4 billion in cash for the company (most of which is still sitting on the company’s balance sheet by the way). Berkshire Hathaway (BRK.A) purchased about $250 million worth of SNOW stock during the IPO and still owns about 2% of the company.

The Cloud Revolution

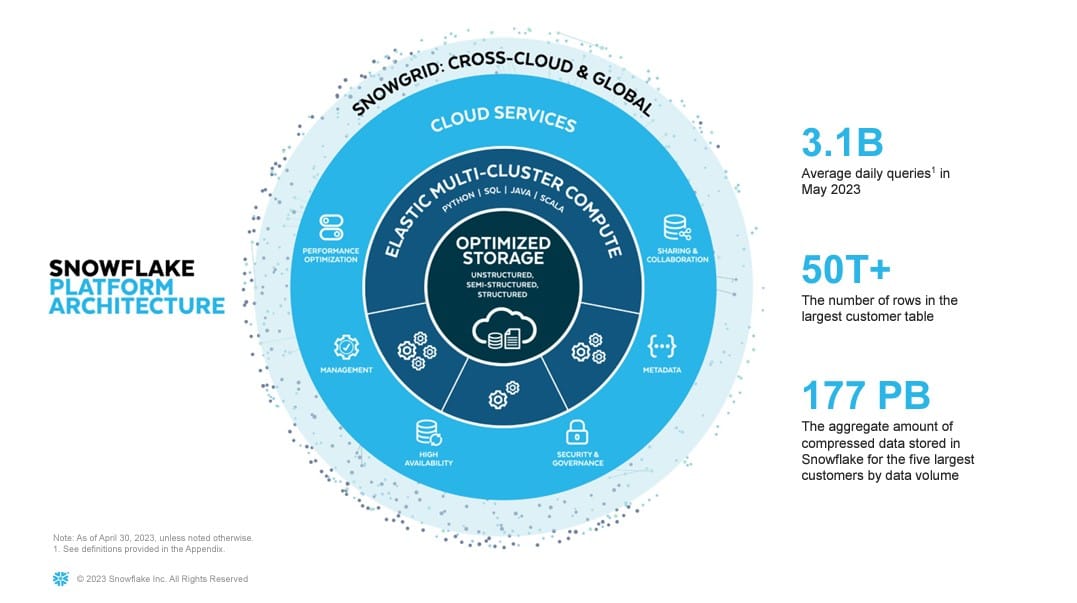

Snowflake is unique because it offers companies a single platform to store and manage data in the cloud and it is not tied to any single CSP. Snowflake describes its cloud-based platform as follows: “Our cloud-native architecture consists of three independently scalable but logically integrated layers across compute, storage, and cloud services. The compute layer provides dedicated resources to enable users to simultaneously access common data sets for many use cases with minimal latency. The storage layer ingests massive amounts and varieties of structured, semistructured, and unstructured data to create a unified data record. The cloud services layer intelligently optimizes each use case’s performance requirements with no administration. This architecture is built on three major public clouds across 38 regional deployments around the world.“

One of the Revolutionary aspects of Snowflake’s platform is what is known as “elastic compute.” Traditional cloud services or in-house solutions require businesses to estimate and contract for their computing and storage needs in advance. Snowflake’s model is fundamentally different. First, Snowflake separates storage capacity from computing power, something that is impossible with on-premises data storage. With elastic compute, customers do not have to pay for expensive computing power if they are not using it, even if they are storing a lot of data in the cloud. Elastic compute provides on-the-fly scalability, allowing businesses to adjust computing resources as demand dictates. This elasticity not only offers cost savings but ensures optimal performance across the cloud. Snowflake operates a consumption-based business model whereby it only charges its customers for the storage and computing resources that they actually used.

Even with the widespread adoption of cloud computing, a lot of data remains “siloed,” meaning that it is held in discrete locations and cannot be easily aggregated and analyzed. Snowflake’s goal is to eliminate data silos. As a public-cloud-agnostic platform, companies can use Snowflake to seamlessly analyze/utilize all of their data that is stored on the public cloud, private cloud, or locally. There is no hardware and only minimal integration required to view and use all of an organization’s data centrally through Snowflake.

Data can even be “streamed” into Snowflake in real-time from the various sources generating data in the real world. Think of a retailer’s point-of-sale (POS) system or a barcode scanner at a manufacturing plant. Developers can stream the data from these data sources into the Snowflake network seamlessly using its platfrom so that decision-makers have easy access to real-time data across their entire enterprise.

Snowflake’s model also capitalizes on substantial network effects. The network effect “refers to the concept that the value of a product or service increases when the number of people who use that product or service increases.” As more and more data is migrated to Snowflake, each Snowflake customer can extract more value out of the platform via Data Sharing.

Once example of Data Sharing is Snowflake’s Revolutionary “Data Marketplace” which allows organizations to monetize their data. There are a lot of companies that are willing to pay to get access to the data of other companies and organizations. A manufacturing company, for example, might want to know how its suppliers and distributors are doing. With the Snowflake Data Marketplace, a manufacturer can view and analyze data from its entire supply chain and distribution network in real-time.

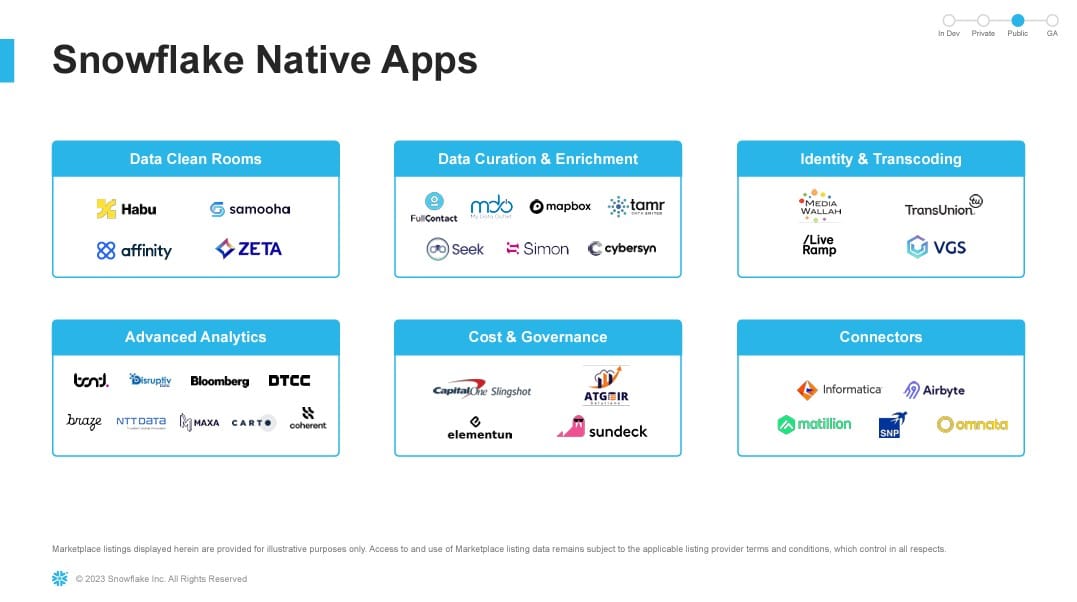

Snowflake’s Data Marketplace has also opened the door for new applications, business models, and entire companies based solely on the monetization of data through Snowflake. Snowflake’s vision is to become the de facto standard application ecosystem for the cloud, much like Apple’s iOS is the standard ecosystem for iPhone applications. Because there are already so many very large organizations that store their data on Snowflake, app developers are incentivized to build apps on Snowflake because there are many potential users already on the platform. These developers are building apps to help companies get more value out of their data, secure their data, etc. And companies want to use Snowflake-native apps so they don’t have to move data onto another platform to realize value from it. As more and more companies migrate data to Snowflake, and more and more developers build apps to manage that data on Snowflake, Snowflake’s platform becomes ever more valuable to all parties involved. Again, more network effects.

The AI Revolution

What really sets Snowflake apart is its positioning for the AI Revolution. As we have discussed, the company is already storing and managing an immense amount of proprietary data for many of the world’s largest organizations. Snowflake and Nvidia have partnered to allow companies to leverage their existing proprietary data on Snowflake to create large language models using Nvidia’s NeMo platform. As explained by ChatGPT, NeMo is “a platform designed for creating and training conversational artificial intelligence (AI) models. Its main focus is on building models for tasks such as speech recognition, natural language processing, and speech synthesis. NeMo fills a niche for developers and researchers focused on conversational AI. By providing a flexible and modular approach, combined with the power of NVIDIA’s GPU optimization, NeMo aims to make the creation of sophisticated conversational models more accessible and efficient.”

We think a lot of the long-term potential for AI will come from the cost savings and productivity gains it will bring to existing companies that are not necessarily tech companies. A lot of the AI tools and applications available today are neat products, but they do not have many commercial applications just yet. Image generators like Dall-E and Myjourney can make some amazing images, but the promise of AI is that it will make humans exponentially more productive. If AI can do in seconds what previously took a $1500/hour lawyer to do in 6 hours, then that will result in huge cost savings for companies that are used to spending millions of dollars a year on expensive lawyers doing repetitive and mundane tasks.

The Snowflake/Nvidia LLM partnership is an important first step in the direction of leveraging AI to boost profitability and cut costs for existing businesses. We think a lot of large corporations that are housing their data in Snowflake will start to build LLMs using that data that will give them insights to make their business more profitable. We expect companies like Coca-Cola, Disney, and General Electric can start to use this product together with their immense quantities of data to figure out how to generate more sales, cut inefficiencies, etc. What makes LLMs like ChatGPT so powerful is that they allow people to interface with computers and data without any technical training or skills. So for companies to be able to build custom LLMs on their own data will provide them with much more utility than they can currently get from off-the-shelf/generically trained AI products like ChatGPT.

Snowflake is also using AI to allow companies to get more out of “unstructured data” like images and videos which were previously difficult to analyze because unstructured data does not fit neatly into columns and rows which is how typical databases are managed. For example, their Document AI allows customers to use natural language to ask questions of unstructured data, things like legal contracts or invoices can now be queried and analyzed without a person physically reviewing the document and entering the data into a spreadsheet. This is another example of how Snowflake is using LLMs to generate value for its customers.

While the AI Revolution is definitely still in its early innings, we think Snowflake has the potential to be the platform where a lot of AI Workloads are taking place. As AI starts to create more and more value for companies, they will bring more and more data onto Snowflake so they can analyze it and extract value from it using AI. Because Snowflake utilizes a consumption-based business model, the more data that is stored on Snowflake and the more computing that is done generates incremental revenue for the company. We expect that AI training workloads are likely to expand exponentially over the next few years given the massive investments in AI from VCs and corporations happening right now. Companies will move more data onto Snowflake and perform significantly more computing tasks as they start training AI models on the platform.

Our Model

We model Snowflake growing revenue in line with consensus estimates for 2023 but see growth accelerating to 37% in 2024, and remaining elevated for the next 3 years as ever more data is moved on to and analyzed on Snowflake. We also model gross margins rising to the company’s long-term targets in the mid to high 70% range within the next 7 years. Lastly, we see the company hitting its operating margin target of roughly 20% by 2029, yielding a 7.7 price/profit ratio 5 years out, with the company still growing topline in the high 20% range.

| Snowflake (SNOW) Model | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenues | $2,750 | $3,768 | $5,086 | $6,765 | $8,862 | $11,431 | $14,518 |

| Y/Y Revenue Growth | 33.30% | 37.00% | 35.00% | 33.00% | 31.00% | 29.00% | 27.00% |

| Gross Margin | 66.30% | 68.00% | 70.00% | 72.00% | 74.00% | 76.00% | 78.00% |

| Gross Profit | $1,823 | $2,562 | $3,560 | $4,870 | $6,558 | $8,688 | $11,324 |

| Operating Expenses | $2,624 | $3,280 | $4,100 | $4,920 | $5,904 | $7,085 | $8,502 |

| Operating Profits | -$801 | -$718 | -$540 | -$50 | $654 | $1,603 | $2,822 |

| Operating Margin | -29.12% | -19.06% | -10.61% | -0.73% | 7.38% | 14.02% | 19.44% |

| Price/Profits | -27.37 | -30.52 | -40.61 | -442.55 | 33.54 | 13.67 | 7.77 |

Risks

Like with Cloudflare, the primary near-term risk for Snowflake is the valuation. This stock has never been cheap, and is still trading at around 20x sales even though it is down over 60% from its highs during the Bubble-Blowing Bull Market. Snowflake is still a long way from being profitable but given that the company is growing sales at around 35% per year and the rapid pace of innovation we have witnessed, it makes sense that the company has elevated operating costs currently. Additionally, the company has a nice cash balance ($3.4 billion net cash) and thus has plenty of runway to get to its long-term targets.

While Snowflake is a disruptor in the cloud and data management spaces, it faces stiff competition from both established companies and fellow startups. Oracle, for example, is a legacy data and database management company and is trying to copy Snowflake’s model of splitting storage and compute powers. Snowflake maintains an advantage in that it can be used across cloud providers, but Oracle is a giant in this area and probably will not go down easily. Snowflake’s primary competitor in the cloud-agnostic data warehousing world is privately-held Databricks. The company is one of the most valuable companies left in the private markets and recently raised $500 million at a $43 billion valuation. Databricks is more focused on data analytics rather than storage and computing, but like Snowflake, Databricks is also partnering with Nvidia to beef up its AI offerings. With any kind of early-stage company like Snowflake, there is always the risk that they lose their edge and/or fall out of style before reaching profitability. That said, given the substantial customer base of large enterprises already on Snowflake and their partnerships with the CSPs (Microsoft, Google, and Amazon), we think Snowflake has already surpassed critical mass and should continue to steadily grow enterprise customers going forward. This is further buttressed by the fact that Snowflake has one of the highest net revenue retention rates (NRR) in the software business, a stunning 142%, meaning they have an extremely low churn rate with their existing customers.

Conclusion

Snowflake is the kind of platform we like to invest in that can capitalize on secularly growing trends like the AI and Cloud Revolutions. Cody was an early investor in Apple, Meta, Google, Twitter, and many others because it was obvious that the App Revolution would result in trillions of dollars in new wealth creation. Today, we see Snowflake as the platform that will enable a new generation of cloud- and AI-based applications that will leverage the ever-increasing data created around the world to make companies more efficient and profitable. Snow is consistently rolling out new products and innovations to provide its customers ever more value for their dollar and we are excited about what comes next for Snowflake.

Don’t forget, we will do this week’s chat on Friday, September 29 at 12:00 pm ET in the TradingWithCody.com Chat Room or you can just email us at support@tradingwithcody.com.